Australia Biomass Market Size, Share, Trends and Forecast by Feedstock, Application, and Region, 2025-2033

Australia Biomass Market Overview:

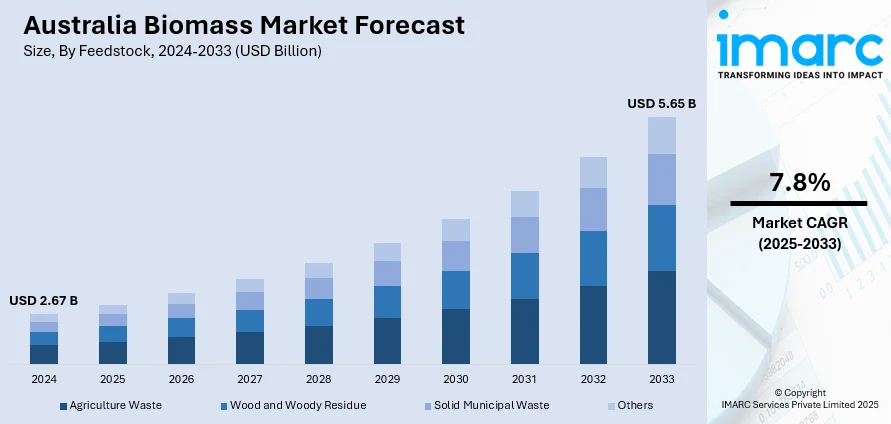

The Australia biomass market size reached USD 2.67 Billion in 2024. Looking forward, the market is expected to reach USD 5.65 Billion by 2033, exhibiting a growth rate (CAGR) of 7.8% during 2025-2033. Renewable energy, government incentives for clean energy, environmental sustainability goals, and the agricultural sector's biomass waste are some of the factors contributing to Australia biomass market share. Additionally, technological advancements in biomass conversion and the rising cost of fossil fuels contribute to the market's growth.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.67 Billion |

| Market Forecast in 2033 | USD 5.65 Billion |

| Market Growth Rate 2025-2033 | 7.8% |

Key Trends of Australia Biomass Market:

Renewable Biomass Power Investment

The Australia biomass market is witnessing significant investments in renewable power generation, particularly in sawmills and industrial sectors. This focus on biomass is driving the installation of advanced technologies such as steam turbines and boilers, designed to generate large quantities of renewable electricity. These projects aim to meet increasing energy demands while achieving substantial environmental benefits, including significant reductions in greenhouse gas emissions. Biomass power generation not only supports renewable energy goals but also promotes carbon neutrality in industrial operations. As such initiatives continue to develop, they are expected to contribute to Australia's growing commitment to sustainable energy and climate change mitigation, with large-scale projects anticipated to play a key role in shaping the future energy landscape. These factors are intensifying the Australia biomass market growth. For example, in October 2024, OneFortyOne committed approximately USD 30 Million in a renewable biomass power generation project at its Jubilee Sawmill in Mount Gambier, Australia. The project includes installing a new boiler and steam turbine, generating 43,800 MWh of renewable electricity annually. Expected to be completed by 2026, it will reduce emissions by over 70%, cut combined scope 1 and 2 emissions by over 50%, and avoid 9,000 tCO2e emissions compared to 2021 levels.

To get more information on this market, Request Sample

Advancements in Biomass Oil for Biofuel Production

The market in Australia is benefiting from innovations aimed at enhancing biofuel production, including sustainable aviation fuel. New technologies are increasing plant oil yields by expanding oil production from traditional seeds to the entire plant biomass, including leaves and stems. This shift is opening new opportunities in biofuel production by utilizing underexploited parts of plants, improving overall yield efficiency. Research partnerships are actively advancing these technologies, positioning Australia as a key player in the sustainable biofuels sector. The focus on biomass oil not only supports the nation’s renewable energy goals but also fosters economic growth by creating new pathways for agricultural products to contribute to global biofuel demand. This innovation is expected to play a pivotal role in the future of sustainable energy. For instance, in November 2024, Australia's CSIRO developed a breakthrough technology to increase plant oil yield, enhancing biofuel production, including sustainable aviation fuel. The technology, acquired by Nufarm, extends oil production from seeds to plant biomass, such as leaves and stems. Nufarm has since led a global research partnership to further advance this innovation, contributing significantly to Australia's biomass market and biofuel sustainability, as part of the Biomass Oil Project.

Growth Drivers of Australia Biomass Market:

Plentiful Agricultural and Forestry Wastes as Easily Accessible Feedstock

Australia's expansive agricultural and forestry industries are a rich and untapped source of biomass feedstock that supports the growth opportunity in the market. In regions such as New South Wales, Queensland, and Victoria, intensive farming and logging activities produce large amounts of organic waste materials such as wheat straw, sugarcane bagasse, forest thinning, and sawdust. Typically utilized as waste or low-value by-products, these materials are now more and more being valued for their energy-producing potential. Local feedstock use also minimizes the requirement for long-distance transport, decreasing the cost of logistics and facilitating the expansion of localized bioenergy solutions. Specifically, areas with significant sugarcane or forestry industries have started looking at cogeneration power plants employing biomass residues as fuel to generate electricity and heat while facilitating circular economy operations in the industry. This increasing appreciation of waste-to-energy opportunities, along with increased green conscience, is driving both public and private investments toward biomass conversion and processing technologies in Australia's varied resource-endowed landscapes.

Policy Support and Renewable Energy Transition Initiatives

Government policy and regulation backing cleaner energy sources contribute significantly toward promoting the Australia biomass market demand. State and federal governments are pledging to lower greenhouse emissions, and biomass is being seen as a promising renewable energy source that fits these objectives. Some regional governments, such as those of South Australia and Tasmania, have established incentives, grants, and pilot schemes to encourage the uptake of bioenergy in off-grid and rural communities. Additionally, Australia's Renewable Energy Target (RET) promotes the use of renewable energy for power generation, and biomass is eligible under this scheme if it is obtained sustainably. Its ability to be integrated into current infrastructure where retrofitting existing coal-fired power plants with biomass technology, for example, is also gaining traction. This policy action reduces the cost risk for early adopters and also renders the investment climate more stable. In Australia's continued overarching energy transition, biomass is being looked at as a complementary option, especially for industrial heat, combined heat and power, and rural electrification.

Rural and Remote Area Decentralized Energy Demand

Australia's distinctive geographical spread with several communities scattered throughout remote and rural regions, makes a compelling argument for decentralized biomass energy systems. While solar and wind energy are weather-dependent and tend to require costly storage options, biomass provides a reliable and controllable energy source. This makes it more appealing for isolated or off-grid communities in places like Northern Territory, Western Australia, and rural Queensland. These regions tend to have expensive electricity and supply issues because of their remoteness from the central power distribution networks. Using locally accessible biomass resources such as agricultural waste, weed species, or animal dung, mini bioenergy systems can supply inexpensive, efficient, and renewable energy. These solutions enhance energy security while also driving local economies through employment in biomass gathering, processing, and system upkeep. The increasing need for robust, community-driven power solutions, particularly against the backdrop of extreme weather conditions and climate variability, is placing biomass as a viable and scalable energy source in Australia's rural regions.

Opportunities of Australia Biomass Market:

Exporting Prospects to Asia-Pacific Markets

Australia possesses substantial potential to emerge as a major exporter of biomass fuel and bioenergy products to regional Asia-Pacific nations, several of which are looking for sustainable energy options aggressively. Countries such as Japan and South Korea are moving away from coal and have ambitious renewable energy goals, propelling high demand for imported biomass pellets and biofuels. Australia's geographic proximity to these countries and rich resources of agricultural and forest residues make it a strategic regional supplier. Queensland and New South Wales already host major ports of large-scale commodity export, and the same transport networks could be configured to accommodate bulk biomass volumes. And Australia's fame for stringent environmental regulation and product quality may win over offshore buyers emphasizing sustainability and traceability. By setting up biomass processing centers close to major ports and investing in pellet manufacturing plants, Australia can access long-term supply arrangements with local energy utilities, driving its bioenergy industry through international trade.

Industrial Decarbonization and Circular Economy Programs

According to the Australia biomass market analysis, the industry can greatly gain from increasing efforts toward the decarbonization of industries like manufacturing, mining, and agriculture. Mass industrial activities in regions such as Western Australia and South Australia are aggressively looking for fossil fuel alternatives to cut on emissions and internal sustainability targets. Biomass offers the perfect solution to produce thermal energy where there is a need for constant temperature levels, as seen in cement manufacturing, food processing, and mining activities. There is also a significant potential to develop closed-loop systems wherein agricultural or industrial wastage is turned into energy on-site, cutting down on waste management costs and minimizing carbon footprints. This also feeds into the larger circular economy drive that is catching on in Australia, especially in eco-friendly industries such as viticulture and grain farming. Businesses that adopt biomass into their operations also have the potential to gain from carbon credits and renewable energy schemes. These prospects are hence economically feasible and also consistent with Australia's national plan for a low-emissions future.

Advanced Biofuels and Biochemicals Innovation

Another promising prospect for Australia's biomass industry involves the production of advanced biofuels and bio-based chemicals. With a robust agricultural science and biotechnology industry, Australia can position itself as a center of bio-innovation, converting biomass into high-value outputs beyond energy. Universities and research centers in such states as Victoria and New South Wales already participate in pilot projects to transform agricultural waste into bioethanol, biodiesel, and even bioplastics. Such developments create new industries and new markets for exports, particularly as international demand for sustainable aviation fuel (SAF) and clean chemicals keeps growing. The capacity to generate next-generation biofuels from non-food biomass feedstocks provides Australia with a competitive advantage while sidelining competition with food production. Investment in this sector can result in regional bio-refineries that generate employment and stimulate local economic growth. Focusing on value-added products, Australia's biomass industry can diversify its products, recruit global partnerships, and contribute more to the world bioeconomy.

Challenges of Australia Biomass Market:

Fragmented Regulatory Environment and Absence of Specific Policy Support

Among the greatest challenges currently confronting the Australian biomass market is the lack of a coherent national policy or regulatory environment specifically for bioenergy. In contrast with solar and wind, which enjoy well-established national incentives and transparent long-term goals, biomass development too often operates in a regulatory limbo. This uncertainty complicates it for developers and investors to invest in large-scale projects. Every Australian state has a different approach to renewable energy, and not all have biomass as part of their energy policy explicitly. For example, although some places back bioenergy at the small scale in rural areas, others do not have the infrastructure or incentives necessary to encourage its use more broadly. Furthermore, the present regulatory framework for clearing bioenergy projects is cumbersome and variable, which deters innovation and postpones commercialization. Without robust, centralized policy directives, Australia could lose out to other countries that are aggressively scaling up biomass as part of their energy portfolio.

Rural Area Cost Constraints and Infrastructure Shortages

Even with the high potential for biomass growth in Australia's rural and farming areas, infrastructure constraints and initial high capital outlays are significant hindrances. Taking massive feedstock materials such as forestry waste or farm waste, to processing or power plants from distant farms is technically challenging and costly. A majority of the rural areas do not have the required roads, transport networks, or proximity to energy transmission networks to ensure biomass projects are economically feasible without heavy investment. In areas like northern Queensland or inner Western Australia, where there is abundant resource supply, the absence of proximate biomass processing plants or vertically integrated supply chains regularly causes projects not to make it out of the conceptual phases. Furthermore, small towns and villages lack the initial capital or technical skills to establish decentralized biomass energy schemes by themselves. Without allocated funding, public-private partnerships, or backing for local infrastructure development, most potential regional biomass opportunities in Australia go untapped or are commercially unviable.

Public Perception and Competition with Other Renewables

Biomass is also hindered by issues of public perception, especially in a nation like Australia where solar and wind energy dominate the renewable debate. Many of the Australians remain unaware of biomass being a clean energy source and some even have the negative perception of deforestation or greenhouse gas emission when managed poorly. Informing stakeholders of the carbon neutrality and sustainability of well-managed biomass systems is a major challenge. In addition, biomass must fight for funding, policy attention, and grid space with more established technologies such as solar PV and onshore wind, which are both highly deployed and becoming ever cheaper. Consequently, biomass tends to be viewed as a second-choice or bridge technology, not a central part of Australia's energy future. This makes it harder to muster political will and investor appetite to expand biomass operations. To overcome them, there will need to be targeted outreach, transparency in feedstock sourcing, and more explicit demonstration of biomass's environmental and economic merits.

Australia Biomass Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on feedstock and application.

Feedstock Insights:

- Agriculture Waste

- Wood and Woody Residue

- Solid Municipal Waste

- Others

The report has provided a detailed breakup and analysis of the market based on the feedstock. This includes agriculture waste, wood and woody residue, solid municipal waste, and others.

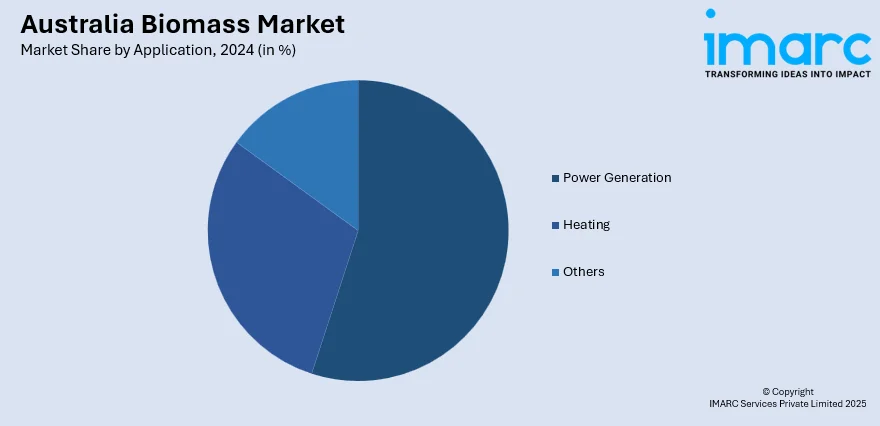

Application Insights:

- Power Generation

- Heating

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes power generation, heating, and others.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Biomass Market News:

- In March 2025, the Albanese government announced plans to invest USD 250 Million to accelerate Australia’s Low Carbon Liquid Fuels (LCLF) industry, part of the USD 1.7 Billion Future Made in Australia Innovation Fund. LCLFs, produced sustainably from biomass and waste, would focus on sustainable aviation fuel and renewable diesel. This investment supports regional economic growth, diversifies agriculture, and creates jobs, contributing up to USD12 Billion annually.

Australia Biomass Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Feedstocks Covered | Agriculture Waste, Wood and Woody Residue, Solid Municipal Waste, Others |

| Applications Covered | Power Generation, Heating, Others |

| Regions Covered | Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia biomass market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia biomass market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia biomass industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia biomass market was valued at USD 2.67 Billion in 2024.

The Australia biomass market is projected to exhibit a CAGR of 7.8% during 2025-2033.

The Australia biomass market is expected to reach a value of USD 5.65 Billion by 2033.

Key trends in Australia biomass market include increased investment in bioenergy projects, rising use of agricultural waste and forestry residues, and integration of biomass with existing power infrastructure. There is also growing interest in advanced biofuels, decentralized energy systems, and export potential, particularly to Asian markets seeking sustainable energy alternatives, which further contribute to the market share.

The Australia biomass market is driven by growing demand for renewable energy, government support for carbon reduction, and the shift away from fossil fuels. Abundant agricultural and forestry residues offer strong feedstock potential, while rural energy needs and industrial decarbonization goals further encourage investment in biomass-based power generation and bioenergy solutions.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)