Australia Biopharmaceutical Packaging Market Size, Share, Trends and Forecast by Material, Packaging Type, Application, and Region, 2025-2033

Australia Biopharmaceutical Packaging Market Overview:

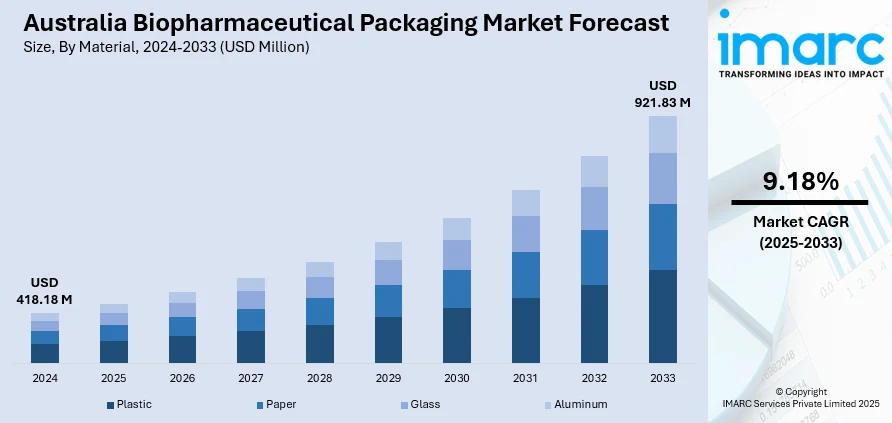

The Australia biopharmaceutical packaging market size reached USD 418.18 Million in 2024. Looking forward, the market is projected to reach USD 921.83 Million by 2033, exhibiting a growth rate (CAGR) of 9.18% during 2025-2033. The market is progressing with trends such as sustainable packaging materials, intelligent technologies, and advanced therapy packaging. Green plastics, RFID labels, and cryogenic-compatible forms are improving drug safety, supply chain clarity, and patient results. Developments in vials, syringes, and ampoules address the increasing need for precision and sterility. These advances are pushing regulatory compliance and efficiency throughout the industry, adding to the growth of the Australia biopharmaceutical packaging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 418.18 Million |

| Market Forecast in 2033 | USD 921.83 Million |

| Market Growth Rate 2025-2033 | 9.18% |

Key Trends of Australia Biopharmaceutical Packaging Market:

Increasing Use of Sustainable Packaging Materials

Over the last several years, the Australia biopharmaceutical industry has witnessed a significant turn toward sustainable packaging practice. This is primarily fueled by concerns for the environment and changing stakeholder expectations for green practices. As per the reports, in December 2023, EMBALL'ISO opened its subsidiary, EMBALL'ISO Australia, as full operational launch in Australia and New Zealand. This move increases regional supply of environmentally friendly, temperature-controlled packaging for pharmaceutical and medical products in the Asia-Pacific region. Moreover, recyclable plastics, biodegradable polymers, and glass packaging materials are being widely used throughout the value chain to minimize carbon footprints. Paper-based products are also in increasing demand for secondary and tertiary packaging requirements. These developments do not only achieve regulatory standards but also follow global green packaging philosophies. Research and development (R&D) investments from local manufacturers include the development of lightweight, rigid, and environmentally friendly materials with product safety ensured without sacrificing ecological goals. Australian biopharmaceutical packaging development is heavily complemented by such sustainability-driven initiatives, which shall shape future standards in packaging. As the sector continues to develop, green material demand will become a key basis of packaging development policies.

To get more information on this market, Request Sample

Technological Incorporation in Packaging Forms

The biopharmaceutical packaging industry in Australia is being revolutionized by technological developments that improve product integrity and patient safety. Smart packaging technologies such as, tamper-evident sealants, radio frequency identification labels (RFID) labels, and temperature-sensing labels are increasingly finding prominence for sensitive products such as cell and gene therapies. These technologies support improved monitoring along the distribution cycle to ensure efficacy at the time of delivery of critical biologics. For example, in July 2024, CSafe introduced the Silverpod MAX RE reusable pallet shipper for pharma companies, enhancing cost-effectiveness and sustainability. It provides 120+ hours of thermal protection, real-time tracking, and a rental option. Furthermore, digital traceability systems built into packaging are also making supply chain transparency and compliance possible. Automation in fill-finish and precision dosing innovations are additionally enhancing the usability of packaging forms like syringes, vials, and cartridges. Australia biopharmaceutical packaging market growth is being supported by the adoption of such technologies, which not only simplify operations but also strengthen consumer confidence in drug safety. With increasing personalization of treatment, the function of smart and tech-enabled packaging is likely to grow significantly across the industry.

Growth of Specialized Packaging for Advanced Therapies

With the rising use of advanced therapies like, monoclonal antibodies, gene therapies, and cell-based therapies—comes the demand for specialized biopharmaceutical packaging solutions in Australia. These treatments tend to call for strict temperature regulation, sterility, and dose precision, which are met by advanced primary packaging systems such as ampoules, syringes, and tailored vials. Flexible packaging forms are being invested in by the industry for accommodating both large-volume manufacturing and personalized medicine delivery. Innovations such as moisture-resistant barriers, cryogenic storage compatibility, and precision-sealed closures are driving Australia biopharmaceutical packaging growth. This packaging design innovation guarantees that sophisticated biologics are well-protected from production to administration. Australia biopharmaceutical packaging growth is being driven by the amplified demand for such high-performance packaging, which specifically addresses the functional requirements of next-generation biologics. As regulatory requirements develop to support innovative therapies, the packaging sector should respond spontaneously with strong, compliant, and effective solutions.

Growth Drivers of Australia Biopharmaceutical Packaging Market:

Rising Biopharmaceutical Production

The growth of biopharmaceutical research and manufacturing in Australia is a significant factor driving the need for advanced packaging solutions. As more biologics, vaccines, and cell-based therapies become available in the market, manufacturers are looking for packaging that guarantees safety, sterility, and prolonged shelf life. Packaging is increasingly recognized not just as a passive element but as a crucial component that preserves product stability throughout storage and distribution. The rise of local biotech companies and partnerships with international pharmaceutical firms further enhance this trend. Consequently, the demand for innovative packaging formats is on the rise, directly influencing Australia biopharmaceutical packaging market demand.

Cold Chain Expansion

The growing dependence on temperature-sensitive biologics, such as vaccines, monoclonal antibodies, and gene therapies, underscores the necessity for effective cold chain packaging in Australia. These advanced treatments require accurate temperature regulation to maintain their stability and efficacy during distribution. Breakthroughs in insulated containers, phase-change materials, and active cooling systems are providing greater dependability and adherence to stringent regulations. With healthcare professionals and pharmaceutical companies emphasizing product safety, specialized cold chain packaging has become essential. This increasing reliance on biologics ensures a consistent need for packaging solutions capable of overcoming logistical challenges while maintaining the integrity of sensitive medications.

Innovation in Drug Delivery

Progress in drug delivery methods is transforming the demand for biopharmaceutical packaging in Australia. Injectable therapies, pre-filled syringes, and auto-injectors necessitate precisely engineered packaging that guarantees sterility and patient safety while enhancing convenience for users. This transition from conventional packaging formats to user-friendly, ready-to-use solutions represents the changing expectations of healthcare providers and patients alike. Biopharmaceutical companies are investing in packaging that preserves product integrity and improves treatment adherence. As therapies become more sophisticated, the significance of customized, high-performance packaging continues to escalate. According to Australia biopharmaceutical packaging market analysis, innovation in drug delivery is a vital force shaping future growth.

Government Regulations for Australia Biopharmaceutical Packaging Market:

Strict Quality Compliance

In the Australian biopharmaceutical packaging sector, strict quality compliance serves as the cornerstone of regulatory supervision. Packaging must be crafted to protect the integrity of biologics, vaccines, and advanced therapies by maintaining sterility and reducing contamination risks. Regulations mandate tamper-evident features, robust seals, and protective barriers to ensure drug stability throughout storage and distribution phases. Compliance also encompasses ongoing testing and validation of packaging processes to verify consistency and safety. By enforcing these standards, regulatory bodies guarantee that patients receive safe, effective, and uncompromised therapies, which in turn fosters trust within the healthcare system and enhances market accountability.

Labeling and Transparency Rules

Labeling regulations are essential in the biopharmaceutical packaging arena. Every package must prominently display dosage instructions, storage conditions, expiration dates, and traceability information to promote patient safety and effective use. Moreover, packaging frequently incorporates barcodes or digital tracking systems to enhance supply chain visibility and mitigate the risks of mismanagement or counterfeiting. Transparency in labeling also assists healthcare providers in properly handling sensitive biologics while enabling patients to adhere to prescribed treatments. Regulatory authorities enforce these practices to minimize errors, fortify monitoring, and ensure that all stakeholders can confidently depend on packaged products for quality and safety.

Material Safety Standards

In Australia, regulators require that packaging materials utilized for biopharmaceuticals must be completely safe for direct drug contact. These materials must be non-toxic, non-reactive, and compatible with sensitive biologics to maintain their stability and efficacy. This requirement applies to vials, syringes, closures, and secondary packaging components. Additionally, packaging materials must undergo stringent approval and testing processes to ensure that no harmful substances can leach into the drug during storage or transport. These standards are particularly crucial for biologics, as they can be extremely sensitive to external factors. By enforcing material safety regulations, authorities ensure that patients receive medications in their intended, unaltered state.

Australia Biopharmaceutical Packaging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on material, packaging type, and application.

Material Insights:

- Plastic

- Paper

- Glass

- Aluminum

The report has provided a detailed breakup and analysis of the market based on the material. This includes plastic, paper, glass, and aluminum.

Packaging Type Insights:

- Vials

- Bottles

- Ampoules

- Syringes

- Cartridges

A detailed breakup and analysis of the market based on the packaging type have also been provided in the report. This includes vials, bottles, ampoules, syringes, and cartridges.

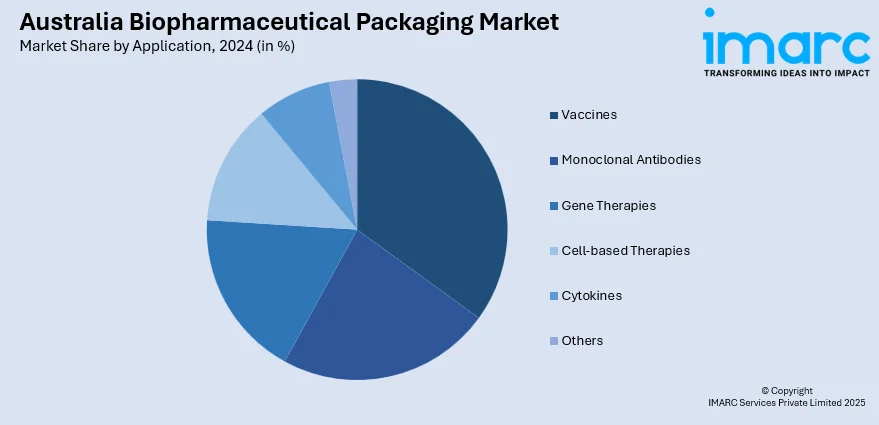

Application Insights:

- Vaccines

- Monoclonal Antibodies

- Gene Therapies

- Cell-based Therapies

- Cytokines

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes vaccines, monoclonal antibodies, gene therapies, cell-based therapies, cytokines, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Biopharmaceutical Packaging Market News:

- In February 2024, PCI Pharma Services completed its acquisition of Pharmaceutical Packaging Professionals in Melbourne. The acquisition adds clinical trial manufacturing, packaging, and cold chain capacity for PCI in Australia, making Melbourne its Asia Pacific headquarters and increasing support for early-phase drug development throughout the region.

Australia Biopharmaceutical Packaging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Materials Covered | Plastic, Paper, Glass, Aluminum |

| Packaging Types Covered | Vials, Bottles, Ampoules, Syringes, Cartridges |

| Applications Covered | Vaccines, Monoclonal Antibodies, Gene Therapies, Cell-based Therapies, Cytokines, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia biopharmaceutical packaging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia biopharmaceutical packaging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia biopharmaceutical packaging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The biopharmaceutical packaging market in Australia was valued at USD 418.18 Million in 2024.

The Australia biopharmaceutical packaging market is projected to exhibit a compound annual growth rate (CAGR) of 9.18% during 2025-2033.

The Australia biopharmaceutical packaging market is expected to reach a value of USD 921.83 Million by 2033.

The major key trends include rising adoption of smart packaging technologies, integration of digital tracking for supply chain security, and growth in sustainable packaging materials. Increasing demand for user-friendly designs, such as pre-filled syringes and single-dose packs, is further shaping packaging innovation and consumer preferences.

Expansion of clinical trials, rising demand for advanced therapies, and growing collaborations between biotech firms and packaging innovators are fueling market growth. Increased focus on patient-centric packaging, alongside investments in automation and precision manufacturing, is also accelerating the adoption of high-quality packaging solutions across the biopharmaceutical sector.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)