Australia Bioplastics Market Size, Share, Trends and Forecast by Product, Application, Distribution Channel, and Region, 2025-2033

Australia Bioplastics Market Size and Growth:

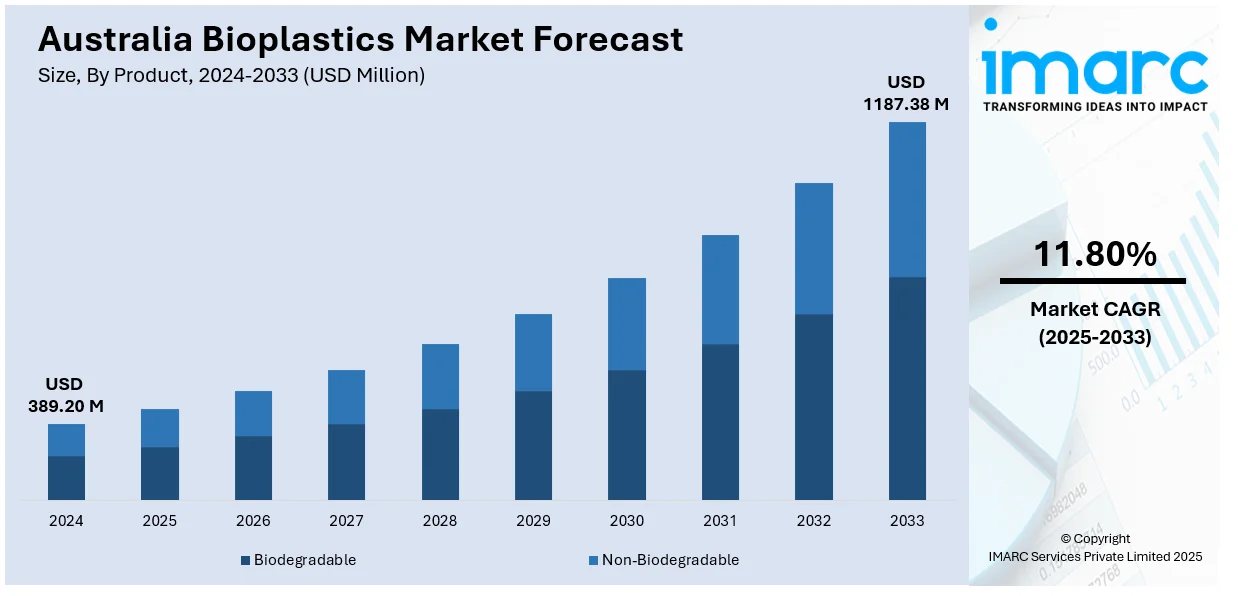

The Australia bioplastics market size reached USD 389.20 Million in 2024. Looking forward, the market is projected to reach USD 1187.38 Million by 2033, exhibiting a growth rate (CAGR) of 11.80% during 2025-2033. The market is driven by government regulations and sustainable packaging policies. Also, technological advancements and diversification of applications are fueling the product adoption. Additionally, consumer awareness and corporate sustainability initiatives are increasing bioplastics usage. In tandem with this, the implementation of regulatory mandates, industry innovation, and environmental consciousness are further expanding the Australia bioplastics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 389.20 Million |

| Market Forecast in 2033 | USD 1187.38 Million |

| Market Growth Rate 2025-2033 | 11.80% |

Key Trends of Australia Bioplastics Market:

Government Regulations and Sustainable Packaging Policies

Australia's federal and state governments have implemented stringent policies to reduce plastic waste, including bans on single-use plastics and mandates for sustainable packaging. These regulations are compelling industries to transition toward biodegradable and compostable alternatives. For instance, several states have prohibited single-use plastic bags, prompting retailers to adopt bioplastic options. Additionally, initiatives like the National Plastics Plan encourage the use of recyclable and biodegradable materials in packaging. These policy measures are fostering a favorable environment for the adoption of bioplastics across various sectors, including food packaging, retail, and agriculture. Such regulatory frameworks are instrumental in advancing Australia bioplastics market growth, particularly as demand shifts toward sustainable and compliant materials.

To get more information on this market, Request Sample

On 5 December 2024, a recent industry report confirmed that the rising demand for sustainable alternatives as global plastic production reaches 460 million tonnes. It highlighted the potential of bioplastics like polylactic acid (PLA) and polyhydroxyalkanoates (PHA) for applications in packaging, agriculture, and biomedicine, with PLA already widely used in Australia. Corporate commitments to reduce carbon footprints and enhance brand image are driving investments in bioplastics research and development. These initiatives are not only meeting consumer demand but also positioning companies as leaders in sustainability. As corporate and consumer priorities align toward environmental responsibility, the integration of bioplastics into various products is expected to accelerate, contributing to the market's expansion.

Technological Advancements and Diversification of Applications

Innovations in bioplastic production technologies are expanding their applicability across various industries in Australia. Advancements in polymer science have led to the development of bioplastics with enhanced properties, such as increased durability and thermal resistance, making them suitable for automotive parts, electronics casings, and agricultural films. Rising environmental consciousness among consumers in Australia is influencing purchasing behaviors, leading to increased demand for products made from sustainable materials. This shift is prompting companies to integrate bioplastics into their product lines to meet consumer expectations and corporate sustainability targets. Retailers are offering biodegradable packaging options, while consumer goods manufacturers are developing bioplastic-based products to appeal to environmentally conscious buyers. The automotive sector, for instance, is incorporating bioplastics into interior components to reduce vehicle weight and improve fuel efficiency. In agriculture, biodegradable mulch films are being used to enhance soil health and reduce plastic waste. These technological strides not only broaden the scope of bioplastics applications but also improve their competitiveness against conventional plastics.

On 2 September 2024, the Australian Government launched the Bioplastics Innovation Hub in Perth, backed by an AUD 8 Million investment (USD 5.2 Million), aiming to accelerate the development of 100% compostable bioplastics. The initiative, a collaboration between CSIRO and Murdoch University, supports national goals to reduce per capita waste by 10% by 2030 and addresses a market where bioplastics currently account for only 1%. Industry involvement includes WA-based Ecopha Biotechnology and technology partners Spiegare Consulting and BioRa, focusing on replacing conventional chemical additives with bio-based alternatives to enhance commercial uptake. As industries seek sustainable materials that meet performance requirements, the adoption of advanced bioplastics is poised to increase, reinforcing their role in Australia's industrial landscape.

Rising Demand for Sustainable Packaging

In Australia, the growing demand for sustainable packaging is significantly driving the expansion of the bioplastics market. As environmental awareness continues to grow, both consumers and businesses are actively pursuing alternatives to traditional plastics. Biodegradable and compostable packaging options are becoming increasingly favored, especially in sectors such as food, retail, and e-commerce, where there is a movement away from single-use plastics. Brands are adopting bioplastics to comply with regulations and also to align with their sustainability objectives and enhance their brand image. This shift is further bolstered by government initiatives aimed at reducing plastic usage and improving waste management. With more companies embracing eco-friendly packaging to cater to environmentally aware consumers, the market for bioplastics is projected to experience consistent and sustained growth, driving overall Australia bioplastics market demand.

Growth Drivers of Australia Bioplastics Market:

Expansion of Food and Beverage Sector

The increasing focus on sustainability within Australia’s food and beverage sector is fueling the demand for eco-friendly packaging solutions. Bioplastics, which are compostable, biodegradable, and derived from renewable materials, are becoming more favored over traditional plastics, especially in the context of ready-to-eat meals, beverages, and takeaway items. Leading food chains and producers are transitioning to bioplastic trays, wraps, and containers to align with changing consumer expectations and regulatory requirements. As considerations of food safety, shelf-life extension, and environmental responsibility converge, bioplastics offer a practical yet sustainable packaging choice. Furthermore, collaborations between packaging manufacturers and food brands are driving innovation in compostable and bio-based solutions designed to meet industry needs. This transition addresses environmental issues and aids food businesses in enhancing their brand reputation and market distinctiveness.

Retail and E-commerce Growth

The swift growth of the retail and e-commerce sectors in Australia is providing significant opportunities for the adoption of bioplastics in sustainable packaging. With the rise in online shopping comes an increased need for secure and eco-friendly packaging materials. Bioplastics are becoming a favored option due to their minimal environmental footprint, adaptability, and capacity to satisfy new consumer demands for green logistics. E-commerce platforms and retailers are progressively replacing standard plastic mailers, wraps, and inserts with biodegradable and compostable alternatives. Additionally, Australia’s regulatory initiatives aimed at reducing plastic waste are in line with this market transformation. According to Australia bioplastics market analysis, this changing packaging environment offers a strong opportunity for bioplastic manufacturers to extend their reach across various retail channels and delivery methods.

Corporate Sustainability Goals

Organizations across numerous sectors in Australia are aligning their practices with sustainability objectives, which is leading to the increased incorporation of bioplastics in packaging and product development. From consumer goods and FMCG to logistics and agriculture, companies are emphasizing bio-based materials to fulfill their Environmental, Social, and Governance (ESG) responsibilities. Bioplastics provide a strategic benefit by lowering carbon emissions and reducing landfill waste, supporting long-term sustainability reporting for companies. Additionally, investors and stakeholders are placing greater importance on green initiatives, prompting businesses to reconsider their use of traditional plastics. This shift is also fostered by public demand and objectives for brand differentiation, making bioplastics an essential component of responsible sourcing and environmental stewardship within Australian supply chains.

Opportunities of Australia Bioplastics Market:

Growth in Agricultural Applications

Australia’s agriculture sector offers exciting possibilities for bioplastics, particularly through biodegradable mulch films, crop covers, and seedling trays. These products contribute to minimizing plastic waste on farms while enhancing soil health and boosting operational efficiency. With increasing pressure on farmers to embrace environmentally-friendly practices, the need for compostable alternatives is anticipated to rise steadily. Bioplastics utilized in agriculture naturally decompose, removing the necessity for expensive retrieval and disposal. Moreover, initiatives supported by regional programs and government aimed at promoting sustainable farming further facilitate their adoption. As interest in eco-friendly cultivation continues to rise, bioplastics are well-positioned to provide practical, scalable solutions for rural markets throughout Australia.

Innovation in Biopolymer Blends

Recent advancements in biopolymer technology are paving the way for the creation of durable, high-performance bioplastics that can meet more demanding applications. By combining natural materials with engineered bio-resins, manufacturers are producing composites that offer enhanced strength, heat resistance, and flexibility. These innovations are broadening the applications of bioplastics into areas such as automotive interiors, consumer electronics, and home appliances. As businesses strive to lower their carbon emissions without compromising on functionality, biopolymer blends serve as a viable substitute for petroleum-based plastics. This trend is also encouraging product innovation, allowing for the creation of tailored solutions that meet specific industry requirements. The ongoing development of bio-based materials is expected to play a crucial role in expanding the market presence of bioplastics in Australia.

Public Procurement of Green Products

There is a growing inclination in government procurement policies toward environmentally sustainable materials, which is opening up new institutional opportunities for the bioplastics sector in Australia. The public sector's demand for eco-friendly packaging, office supplies, catering disposables, and construction materials is on the rise, driven by green purchasing frameworks and objectives for waste reduction. By incorporating bioplastics into their supply chains, government agencies can showcase their commitment to sustainability and promote local green innovation. This transition also creates consistent, large-scale demand that can assist bioplastics manufacturers in scaling up production and achieving cost efficiency. As federal, state, and local agencies increasingly emphasize climate-conscious purchasing, public procurement is likely to remain a significant avenue for accelerating adoption and market expansion.

Challenges of Australia Bioplastics Market:

High Production Costs

One of the major obstacles confronting the bioplastics market in Australia is the high cost of production. Bioplastics are generally made from renewable resources like corn starch, sugarcane, or cellulose, and their extraction and processing methods tend to be more complicated and resource-consuming than those for petroleum-based plastics. Furthermore, the absence of economies of scale in the production of bioplastics leads to elevated prices. These increased costs hinder competitiveness in price-sensitive markets and hamper widespread adoption across various industries. For small and medium-sized enterprises, the initial investment required to transition to bioplastics including sourcing and manufacturing changes can be a significant barrier, limiting their market reach. Reducing production costs is crucial for enhancing the commercial feasibility of bioplastics in Australia.

Limited Industrial Composting Infrastructure

The success of bioplastics heavily relies on the presence of suitable disposal and treatment systems. In Australia, industrial composting facilities that can handle biodegradable plastics are currently scarce and unevenly spread across different states and territories. Consequently, bioplastics frequently find their way into general waste streams, where they fail to decompose properly and may contribute to landfill accumulation. Many compostable bioplastics necessitate specific environmental conditions such as elevated heat and moisture to degrade effectively, conditions that aren’t present in standard backyard or municipal compost systems. This disconnects between product design and actual waste management capabilities undermines environmental advantages and erodes consumer trust. Expanding the capacity for industrial composting is vital to promoting bioplastics adoption on a national scale.

Performance Limitations

In spite of their environmental benefits, bioplastics face various technical and functional limitations. Often, they do not achieve the same mechanical properties as conventional petroleum-based plastics. Performance issues such as reduced durability, lower thermal stability, and shorter shelf life restrict their application in areas that require long-lasting performance or exposure to elevated temperatures. For example, sectors such as packaging, automotive, or electronics may encounter significant hurdles due to these performance gaps. Additionally, certain grades of bioplastics may have increased moisture sensitivity and reduced impact resistance, limiting their use in challenging environments. Addressing these technical issues through enhanced material engineering and research and development is essential for the greater acceptance and sustainable growth of the bioplastics market in Australia.

Australia Bioplastics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, application, and distribution channel.

Product Insights:

- Biodegradable

- Polylactic Acid

- Starch Blends

- Polybutylene Adipate Terephthalate (PBAT)

- Polybutylene Succinate (PBS)

- Others

- Non-Biodegradable

- Polyethylene

- Polyethylene Terephthalate

- Polyamide

- Polytrimethylene Terephthalate

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes biodegradable (polylactic acid, starch blends, polybutylene adipate terephthalate (PBAT), polybutylene succinate (PBS), and others) and non-biodegradable (polyethylene, polyethylene terephthalate, polyamide, polytrimethylene terephthalate, and others).

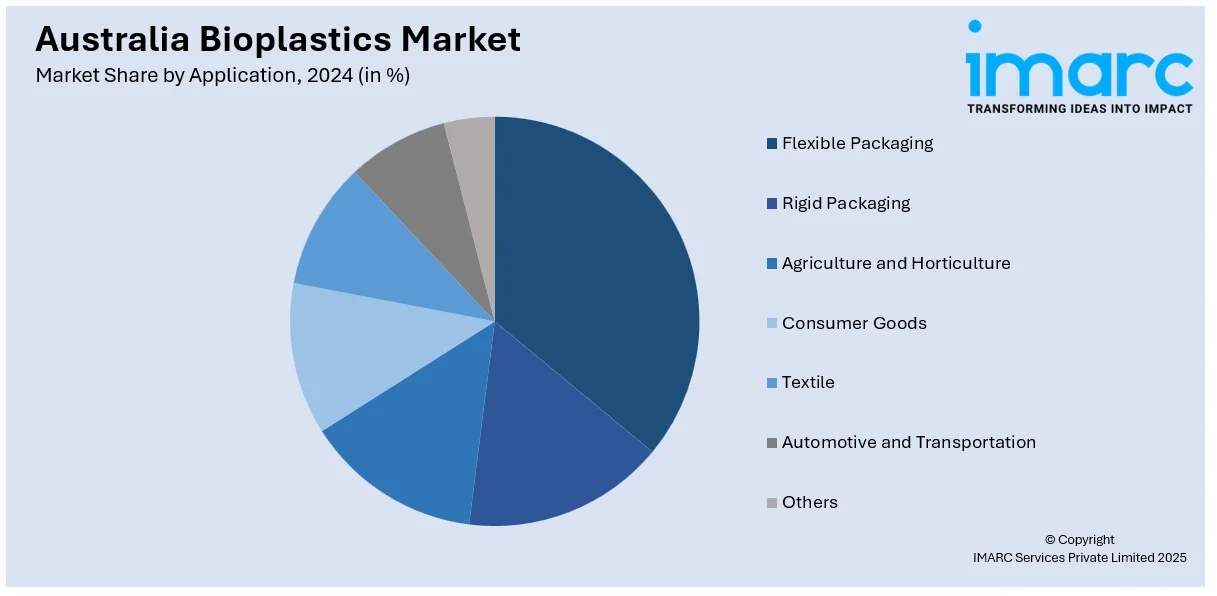

Application Insights:

- Flexible Packaging

- Rigid Packaging

- Agriculture and Horticulture

- Consumer Goods

- Textile

- Automotive and Transportation

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes flexible packaging, rigid packaging, agriculture and horticulture, consumer goods, textile, automotive and transportation, and others.

Distribution Channel Insights:

- Online

- Offline

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online and offline.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has provided a comprehensive analysis of all major regional markets, including demand trends by product, application, and distribution channel. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Bioplastics Market News:

- On 5 September 2024, CSIRO and Murdoch University officially launched the Bioplastics Innovation Hub in Perth, backed by a co-investment of AUD 8 Million (USD 5.4 Million), with a mission to advance 100% compostable, bio-derived plastics that degrade in compost, land, or water. The Hub brings together researchers in microbiology, genetics, and manufacturing to accelerate industrial-scale bioplastic production, aligning with CSIRO’s goal of reducing plastic waste in Australia by 80% by 2030.

Australia Bioplastics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Applications Covered | Flexible Packaging, Rigid Packaging, Agriculture and Horticulture, Consumer Goods, Textile, Automotive and Transportation, Others |

| Distribution Channels Covered | Online, Offline |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia bioplastics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia bioplastics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia bioplastics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The bioplastics market in Australia was valued at USD 389.20 Million in 2024.

The Australia bioplastics market is projected to exhibit a compound annual growth rate (CAGR) of 11.80% during 2025-2033.

The Australia bioplastics market is expected to reach a value of USD 1187.38 Million by 2033.

The Australia bioplastics market is witnessing trends such as growing use of biopolymer blends for enhanced material performance, increased adoption in agriculture and electronics, and rising interest in compostable films. Businesses are also exploring advanced bio-based packaging for premium branding and environmental differentiation.

Key growth drivers include rising demand for sustainable packaging across food and retail sectors, expanding corporate ESG initiatives, and growing consumer awareness of environmental impacts. Additionally, supportive government policies and increased availability of plant-based feedstocks are encouraging manufacturers to scale bioplastics production in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)