Australia Blenders and Mixers Market Size, Share, Trends and Forecast by Product Type, Capacity, Speed Settings, Features, and Region, 2026-2034

Australia Blenders and Mixers Market Summary:

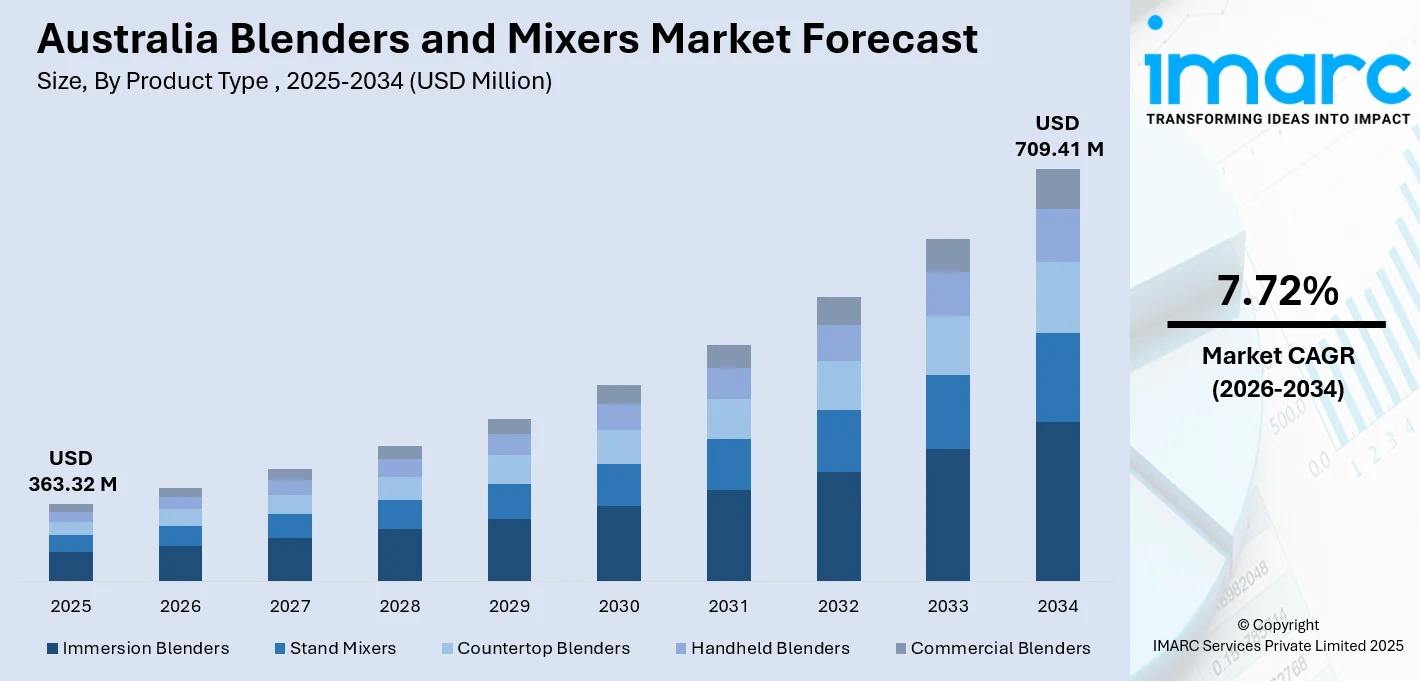

The Australia blenders and mixers market size was valued at USD 363.32 Million in 2025 and is projected to reach USD 709.41 Million by 2034, growing at a compound annual growth rate of 7.72% from 2026-2034.

The market is experiencing robust growth, driven by the nationwide shift toward health-conscious lifestyles and home cooking. Consumers are increasingly investing in high-performance kitchen appliances that support nutritious meal preparation, from smoothies and protein shakes to homemade nut butters and soups. The proliferation of multi-functional blenders and stand mixers that consolidate several kitchen tasks into a single appliance is accelerating adoption across urban and suburban households. Rising disposable incomes, diversification of e-commerce channels, and growing consumer preference for premium, aesthetically pleasing kitchen equipment are further expanding the Australia blenders and mixers market share.

Key Takeaways and Insights:

- By Product Type: Countertop blenders dominate the market with a share of 37.09% in 2025, driven by their versatility in preparing smoothies, soups, and sauces combined with powerful motors that handle tough ingredients efficiently.

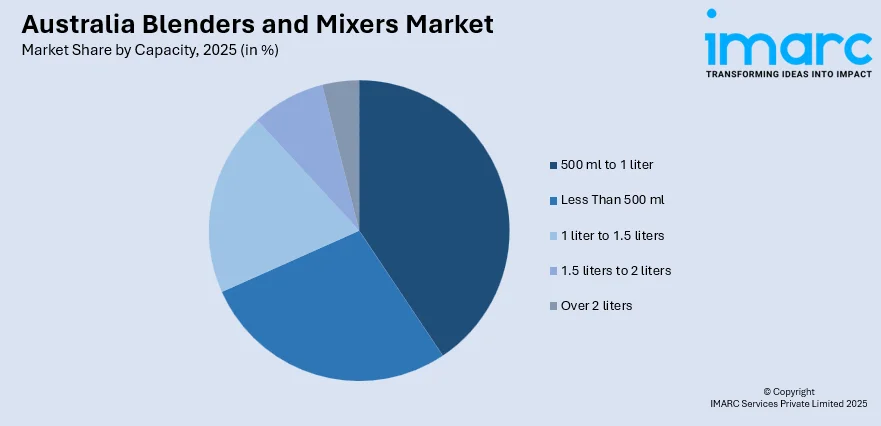

- By Capacity: 500 ml to 1 liter leads the market with a share of 41.03% in 2025, owing to its suitability for individual and small family servings while maintaining compact countertop footprints.

- By Speed Settings: 2-5 speeds represent the largest segment with 48.07% share in 2025, reflecting consumer preference for versatile yet user-friendly controls that balance simplicity with adequate blending options.

- By Features: Pulse function leads the market with a share of 43.03% in 2025, as this feature provides precision control for achieving desired textures without over-processing ingredients.

- By Region: Australia Capital Territory & New South Wales represent the largest segment with a market share of 28.6% in 2025, supported by high population density, elevated disposable incomes, and concentration of premium retail outlets in Sydney and surrounding metropolitan areas.

- Key Players: The Australia blenders and mixers market exhibits moderate-to-high competitive intensity, with established global brands competing alongside regional manufacturers across premium, mid-range, and budget segments.

To get more information on this market Request Sample

The Australian market benefits from strong consumer interest in healthy eating and home-based food preparation, creating sustained demand for quality blending and mixing appliances. According to Food Standards Australia, approximately 73% of Australians are actively putting more effort into maintaining healthy diets, directly driving demand for appliances that facilitate nutritious meal preparation including smoothies, soups, and plant-based alternatives. The persistent home cooking trend is increasing the demand for small kitchen appliances as consumers invest in enhancing their culinary capabilities. The market is characterized by product premiumization, with consumers increasingly willing to invest in high-performance blenders featuring advanced motor technology, noise reduction capabilities, and smart connectivity features that integrate with modern kitchen ecosystems. Distribution channels continue evolving, with electronic stores accounting for majority of household appliance sales while e-commerce platforms gain significant traction among tech-savvy consumers seeking convenience and competitive pricing.

Australia Blenders and Mixers Market Trends:

Rising Health Consciousness and Smoothie Culture

Australian consumers are increasingly prioritizing nutrient-dense meals and beverages, driving demand for high-performance blenders capable of processing whole foods, leafy greens, and frozen fruits. The smoothie bowl phenomenon has gained significant momentum, with the acai bowl shop industry projected to reach new heights by 2025. In 2025, Oakberry launched a new bowl inspired by the brand’s ambassador, current Australian Open champion Aryna Sabalenka. The bowl, named the Sabalenka Power Serve, will feature Oakbery acai as its foundation. It includes chia pudding, a scoop of whey protein, peanut butter, fresh blueberries, and cacao nibs. This health-first behaviour encourages households to invest in powerful blenders that can reliably extract nutrients from superfoods, seeds, and vegetables, creating smooth and palatable beverages.

Integration of Smart Technology and IoT Features

Smart kitchen appliances are transforming the Australian culinary landscape, with blenders and mixers incorporating Wi-Fi connectivity, mobile app control, and voice assistant compatibility. The global smart kitchen appliances market is experiencing growth, with smaller countertop appliances representing the fastest-growing segment. Australian consumers are embracing connected cooking devices that offer automated blending programs, recipe downloads, and real-time monitoring through smartphone applications. Companies are also launching efficient smart kitchen appliances to fulfil these needs. For instance, in 2025, the next-generation Thermomix TM7 has been introduced in Australia and New Zealand, representing the initial launch of the new model beyond Europe. The TM7 includes a bigger 10-inch multi-touch screen, a stronger motor, and a quieter, insulated mixing bowl.

Growing Demand for Compact and Portable Blenders

The shift toward compact, portable blending solutions is accelerating as urban dwellers and busy professionals seek convenient on-the-go nutrition options. Personal blenders with rechargeable batteries and travel-friendly designs are gaining popularity among fitness enthusiasts and commuters. Gym goers are purchasing portable blenders to make smoothies and healthy mixes for gaining optimum nutrition from food products. In 2025, Kmart introduced a 25-dollar portable blender featuring 400 ml capacity and USB charging capability, demonstrating the market's expansion into accessible, entry-level portable options that meet growing consumer demand for convenience.

Market Outlook 2026-2034:

The Australia blenders and mixers market is positioned for sustained expansion throughout the forecast period, supported by evolving consumer lifestyles, technological innovation, and strengthening health-consciousness across demographic segments. The market generated a revenue of USD 363.32 Million in 2025 and is projected to reach a revenue of USD 709.41 Million by 2034, growing at a compound annual growth rate of 7.72% from 2026-2034. Product innovation focusing on energy efficiency, noise reduction technology, and multi-functionality will continue driving premiumization across all segments. The expanding e-commerce infrastructure and rising penetration of specialty kitchen stores will enhance product accessibility nationwide. The growing influence of social media platforms and cooking content creators will further stimulate consumer interest in premium kitchen appliances.

Australia Blenders and Mixers Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Countertop Blenders |

37.09% |

|

Capacity |

500 ml to 1 liter |

41.03% |

|

Speed Settings |

2-5 Speeds |

48.07% |

|

Features |

Pulse Function |

43.03% |

|

Region |

Australia Capital Territory & New South Wales |

28.6% |

Product Type Insights:

- Immersion Blenders

- Stand Mixers

- Countertop Blenders

- Handheld Blenders

- Commercial Blenders

Countertop blenders dominate with a market share of 37.09% of the total Australia blenders and mixers market in 2025.

Countertop blenders have established themselves as essential kitchen appliances in Australian households due to their exceptional versatility and powerful blending capabilities. These appliances efficiently handle a wide range of tasks including smoothie preparation, soup blending, ice crushing, and food processing, making them indispensable for health-conscious consumers. The segment benefits from continuous product innovation with manufacturers introducing models featuring advanced motor technology, vacuum blending capabilities, and premium materials that enhance durability and performance.

The demand for countertop blenders is further strengthened by the growing popularity of plant-based diets and homemade food preparation among Australian consumers. Local brands and international market players have cultivated strong market presence through their reputation for quality and reliability. The segment continues to attract investment in research and development, with manufacturers focusing on noise reduction technology, energy efficiency improvements, and smart connectivity features that appeal to modern Australian households seeking premium kitchen experiences.

Capacity Insights:

Access the comprehensive market breakdown Request Sample

- Less Than 500 ml

- 500 ml to 1 liter

- 1 liter to 1.5 liters

- 1.5 liters to 2 liters

- Over 2 liters

500 ml to 1 liter leads with a share of 41.03% of the total Australia blenders and mixers market in 2025.

In the Australia blenders and mixers industry, the capacity segment ranging from 500 ml to 1 liter holds the largest share. This size offers a versatile balance between convenience and efficiency, catering to consumers who seek appliances suitable for daily use without taking up too much counter space. With its optimal capacity, this segment appeals to individuals and families who want to prepare smoothies, shakes, or sauces in moderate quantities, making it a practical choice for most households.

Consumers are increasingly prioritizing compact yet efficient appliances that can meet their everyday needs. The 500 ml to 1 liter range addresses this demand, becoming the go-to option in the market. As trends in health and wellness continue to grow, these blenders and mixers provide an accessible solution for quick meal prep and nutritious drinks, further driving the segment's popularity. The convenience factor of this size, combined with competitive pricing, has positioned it as a dominant force in the market.

Speed Settings Insights:

- Single Speed

- 2-5 Speeds

- 6-10 Speeds

- 10+ Speeds

2-5 speeds exhibit a clear dominance with a 48.07% share of the total Australia blenders and mixers market in 2025.

The 2-5 speed segment is the largest, offering consumers an ideal balance of control and versatility. With multiple speed options, these blenders and mixers allow users to adjust settings based on the task at hand, whether it’s blending smoothies, crushing ice, or mixing dough. This range is particularly popular among households that require flexibility without the complexity of too many speed settings, making it a practical choice for everyday kitchen tasks.

The 2-5 speed segment’s popularity is driven by its ease of use and affordability. Consumers find it more than sufficient for a variety of blending and mixing needs, while not being overwhelmed by excessive features. With its ability to handle both basic and moderately complex tasks, this segment appeals to a wide range of consumers seeking reliable, functional kitchen appliances. As home cooking and meal preparation trends rise, the demand for these versatile blenders and mixers continues to grow in Australia.

Features Insights:

- Digital Display

- Pulse Function

- Ice Crushing

- Self-Cleaning

Pulse function leads with a share of 43.03% of the total Australia blenders and mixers market in 2025.

Pulse functionality has emerged as the most valued feature among Australian consumers due to its ability to provide precise control over blending texture and consistency. This feature enables users to achieve desired results without over-processing ingredients, preserving texture in applications such as chunky salsas, coarse nut butters, and partially crushed ice. The pulse function appeals to both amateur and experienced cooks who appreciate the ability to fine-tune their culinary creations with precision bursts of power.

Apart from this, the demand for pulse-equipped appliances reflects broader consumer expectations for versatile kitchen tools that can adapt to diverse recipe requirements. This feature has become a standard inclusion across most blender categories from entry-level to premium models, demonstrating its universal appeal. Moreover, manufacturers continue to refine pulse mechanisms to deliver consistent and responsive performance, reinforcing consumer confidence in appliances that offer this essential functionality. They are also investing in research and development (R&D) to come up with innovation and high-end pulse functionalities.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales exhibits a clear dominance with a 28.6% share of the total Australia blenders and mixers market in 2025.

The Australia Capital Territory and New South Wales region commands the largest market share, driven by the concentration of Australia's most populous metropolitan area in Sydney and surrounding urban centres. This region benefits from higher average disposable incomes, greater density of premium retail outlets, and a well-established culture of health-conscious consumption. The concentration of professional households and urban millennials who prioritize kitchen modernization and healthy lifestyles supports strong demand for quality blenders and mixers.

The region's market leadership is reinforced by robust e-commerce infrastructure, extensive specialty appliance store networks, and proximity to major distribution hubs that ensure product availability and competitive pricing. Health food cafes, smoothie bars, and juice establishments prevalent throughout Sydney and Canberra also contribute to consumer awareness and adoption of blending appliances for home use. The region's trendsetting influence on consumer preferences further solidifies its position as the primary market for premium kitchen appliances in Australia.

Market Dynamics:

Growth Drivers:

Why is the Australia Blenders and Mixers Market Growing?

Escalating Health and Wellness Awareness

The growing emphasis on health and wellness among Australian consumers serves as a primary catalyst for blender and mixer market expansion. Australians are increasingly incorporating nutrient-dense smoothies, protein shakes, and homemade healthy beverages into their daily routines, necessitating reliable blending appliances. The Australian Dietary Guidelines are currently under review by the National Health and Medical Research Council (NHMRC). The revised guidelines are set to be issued in 2026. The rising popularity of plant-based diets, functional foods, and clean eating philosophies further amplifies consumer interest in appliances that facilitate nutritious meal preparation at home.

Growing Preference for Multi-Functional Kitchen Appliances

Australian households increasingly favor versatile kitchen appliances that consolidate multiple functions into single devices, driving demand for advanced blenders and mixers. Modern consumers seek appliances capable of blending, food processing, ice crushing, and even heating soups within unified systems that maximize kitchen efficiency. This preference is particularly pronounced among urban residents with limited counter space who value appliances that deliver comprehensive functionality without requiring multiple separate devices. Manufacturers have responded by developing innovative multi-purpose systems that combine blending with food processing, grinding, and mixing capabilities, appealing to consumers seeking streamlined kitchen solutions. As per IMARC Group’s predictions, Australia kitchen appliances market is projected to attain USD 3.50 Million by 2033.

Expansion of E-commerce and Online Retail Channels

The rapid growth of e-commerce platforms and online retail channels has significantly enhanced market accessibility and consumer reach for blender and mixer products. Australian consumers increasingly prefer the convenience of online shopping, benefiting from detailed product comparisons, customer reviews, and competitive pricing that facilitate informed purchasing decisions. Australians recorded a historic A$20.7bn (US$13.4bn) in online shopping during the July-September 2025 quarter, as stated in Australia Post’s most recent Quarterly eCommerce Report. Major retailers have expanded their online kitchen appliance offerings, while direct-to-consumer brand websites provide additional purchasing pathways that support market growth.

Market Restraints:

What Challenges the Australia Blenders and Mixers Market is Facing?

High Prices of Premium Smart Appliances

Premium blenders and mixers featuring advanced technology, smart connectivity, and superior build quality command significant price premiums that limit accessibility for price-sensitive consumers. High-end models from leading brands can exceed several hundred dollars, creating affordability barriers for budget-conscious households. This pricing challenge is compounded by economic pressures including inflation and cost-of-living concerns that influence consumer spending priorities on discretionary kitchen appliances.

Competition from Low-Cost Imported Products

The Australian market faces intense competition from low-cost imported blenders and mixers that attract price-conscious consumers despite potential quality compromises. These budget alternatives pressure established brands to compete on pricing while maintaining quality standards. The proliferation of inexpensive options through discount retailers and online marketplaces creates market fragmentation that challenges brand differentiation and premium positioning strategies.

Consumer Resistance to Technology Adoption

Despite growing smart appliance availability, certain consumer segments demonstrate reluctance toward adopting technologically advanced blenders and mixers. Traditional consumers may perceive smart features as unnecessary complexity rather than valuable functionality. Concerns regarding data privacy, connectivity requirements, and learning curves associated with app-controlled appliances contribute to hesitation among consumers who prefer straightforward mechanical operation.

Competitive Landscape:

The Australia blenders and mixers market exhibits a moderately consolidated competitive structure characterized by the presence of established global brands and regional manufacturers competing across diverse price segments. Leading international players leverage strong brand recognition, extensive distribution networks, and continuous product innovation to maintain market leadership. Competition intensifies around product differentiation through technological advancement, design aesthetics, and performance capabilities. Companies employ strategies including new product launches, strategic partnerships with retail chains, and targeted marketing campaigns to capture consumer attention and expand market share. The market also witnesses growing participation from direct-to-consumer brands that challenge traditional distribution models through digital engagement and competitive pricing strategies.

Australia Blenders and Mixers Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Immersion Blenders, Stand Mixers, Countertop Blenders, Handheld Blenders, Commercial Blenders |

| Capacities Covered | Less Than 500 ml, 500 ml to 1 liter, 1 liter to 1.5 liters, 1.5 liters to 2 liters, Over 2 liters |

| Speed Settings Covered | Single Speed, 2-5 Speeds, 6-10 Speeds, 10+ Speeds |

| Features Covered | Digital Display, Pulse Function, Ice Crushing, Self-Cleaning |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia blenders and mixers market size was valued at USD 363.32 Million in 2025.

The Australia blenders and mixers market is expected to grow at a compound annual growth rate of 7.72% from 2026-2034 to reach USD 709.41 Million by 2034.

Countertop blenders dominated the market with a 37.09% share in 2025, driven by their versatility, powerful performance, and ability to handle diverse blending tasks from smoothies to soups.

Key factors driving the Australia blenders and mixers market include rising health consciousness among consumers, growing demand for multi-functional kitchen appliances, expansion of e-commerce channels, and increasing preference for premium products.

Major challenges include high prices of premium smart appliances limiting mass market accessibility and intense competition from low-cost imported products. Apart from this, consumer resistance to adopting technologically advanced features is creating resistance in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)