Australia Board Games Market Size, Share, Trends and Forecast by Product Type, Game Type, Age Group, Distribution Channel, and Region, 2025-2033

Australia Board Games Market Overview:

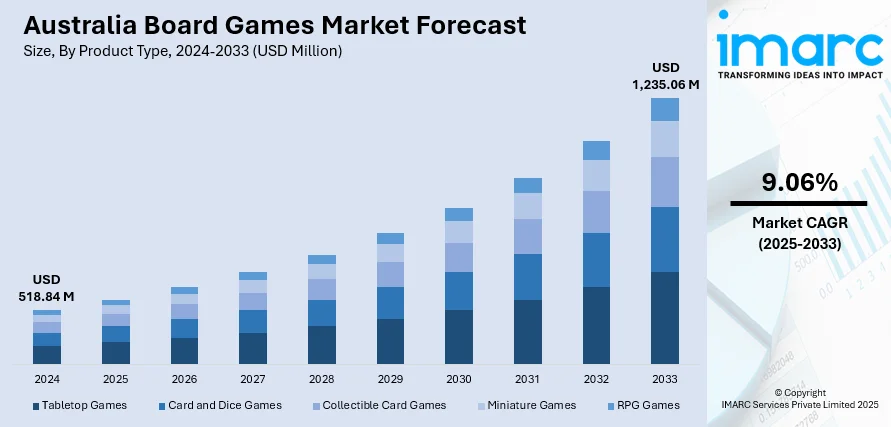

The Australia board games market size reached USD 518.84 Million in 2024. Looking forward, the market is expected to reach USD 1,235.06 Million by 2033, exhibiting a growth rate (CAGR) of 9.06% during 2025-2033. At present, people are becoming more interested in social and family entertainment activities. Moreover, entrepreneurs are opening stand-alone establishments where enthusiasts can go, play a vast array of games, and meet other like-minded people, thereby creating a strong sense of community. Apart from this, the heightened availability of diverse and fresh game titles is expanding the Australia board games market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 518.84 Million |

| Market Forecast in 2033 | USD 1,235.06 Million |

| Market Growth Rate 2025-2033 | 9.06% |

Key Trends of Australia Board Games Market:

Increased Popularity of Family and Social Entertainment

The board games market in Australia is growing steadily because people are becoming more interested in social and family entertainment activities. People are becoming more interested in interactive and engaging means of spending quality time with friends and family as people experience digital fatigue. Families are finding board games as a way to disconnect from screens and reconnect through face-to-face interaction. This is also complemented by the invention of newer board games with sophisticated stories, rich gameplay, and cooperative modes of play, both for old and new markets. The growing aspect of social bonding and family integration is propelling homes to spend on assorted boards, from old favorites to innovative indie titles. This shift in culture is strengthening board gaming as a social activity that cuts across age differences, thus increasing the customer base and invoking repeat purchases, which is contributing to the market growth. In 2024, BIRDS, a lively game of sabotage, strategy, and luck, was launched in Australia. The board game honored Australian avian life with all Tasmanian endemics included among 70 magnificent species.

To get more information on this market, Request Sample

Increasing Popularity of Board Game Cafés and Community Events

Australia's board games market is experiencing growth through the increasing popularity of board game cafes and community-based gaming events. Entrepreneurs are opening stand-alone establishments where enthusiasts can go, play a vast array of games, and meet other like-minded people, thereby creating a strong sense of community. These coffee shops are exposing new customers to contemporary board games they might not otherwise buy for themselves, thus generating future retail pull. At the same time, gaming conventions, tournaments, and grassroots meetups are providing platforms for publishers to expose new titles, collect player feedback, and establish brand loyalty. By creating accessible places for social exploration and play, these projects are turning board gaming from a solitary home-based activity into a dynamic, communal experience. This community-centered ecosystem is creating a culture of repeat use and word-of-mouth, and this is increasing awareness and driving stable growth within both urban and country markets in Australia. Moreover, the heightened number of cafes and food joints opening in Australia is contributing to the Australia board games market growth. The IMARC Group predicts that the Australia food service market is projected to attain USD 129.9 Billion by 2033.

Expanding Availability of Diverse and Fresh Game Titles

The Australia market for board games is growing as publishers are continually releasing a wide variety of new game titles that meet changing tastes. Game designers and developers are trying new themes, mechanics, and cooperative gameplay styles, which are appealing to experienced hobbyists and casual gamers alike. Domestic and overseas publishers are using crowdfunding sites and direct-to-consumer (D2C) channels to release niche titles that otherwise might not have been profitable via standard retail channels, thereby increasing the diversity of offerings in the marketplace. This influx of new titles is causing enthusiasts and collectors to replenish their collections regularly, driving repeat purchases and further broadening marketplace reach. In addition, retailers are expanding their board game shelf space both in physical stores and on online platforms, which makes it convenient for customers to consume the new titles.

Growth Drivers of Australia Board Games Market:

Rising Interest in Offline Social Entertainment

The increasing demand for screen-free leisure activities is significantly influencing the Australia board games market demand. In a time predominantly filled with digital entertainment, numerous Australian families, friends, and hobby groups are once again appreciating the importance of in-person connections through analog games. Board games offer a hands-on and captivating substitute for solitary screen usage, encouraging face-to-face interaction, communication, and strategic thought. With the rising focus on mental health and mindful socialization, board games are becoming popular tools for relaxation, reconnection, and strengthening interpersonal relationships. This movement is particularly noticeable among millennials and Gen Z, who are at the forefront of reviving traditional forms of leisure. The communal aspect of board gaming perfectly meets the increasing desire for meaningful, interactive group experiences.

Increased Retail and Specialty Store Presence

The physical availability of board games is growing through specialty shops, hobby retailers, and themed board game cafés throughout Australia. These venues present carefully curated product assortments and also offer customers chances to try games before buying. This experiential retail approach fosters brand loyalty and community involvement through events, tournaments, and game nights. Such immersive shopping environments are fueling industry growth by enhancing discoverability, stimulating impulse buys, and creating social communities around gameplay. As these interactive spaces expand, they are driving market growth by providing consumers with a tangible and social alternative to online shopping.

Educational and Therapeutic Use

Board games are increasingly recognized in Australia’s educational and healthcare sectors for their ability to promote learning and wellness. Schools are integrating strategic and collaborative games into classrooms to enhance problem-solving, communication, and critical thinking skills. Concurrently, therapists and rehabilitation facilities utilize them to boost cognitive function, social skills, and emotional regulation in both children and adults. These structured, interactive activities present a non-invasive approach to therapy and development, particularly for individuals with special needs or those experiencing age-related cognitive decline. This evolving use of board games beyond leisure is generating new institutional demand streams, according to Australia board games market analysis, significantly contributing to its overall growth.

Opportunities of Australia Board Games Market:

Crowdfunding and Independent Publishing

Australia's board game industry is experiencing a surge of interest from independent creators who utilize crowdfunding platforms like Kickstarter to bring their innovative concepts to fruition. This approach allows designers to bypass the limitations of traditional publishing and connect directly with a worldwide audience. Crowdfunding encourages niche creativity, enabling games with unique mechanics, localized themes, or specific demographic targets to garner support. With lower barriers to entry and a direct-to-consumer approach, financial risks are minimized, promoting creative liberty. As Australian creators gain visibility in global communities, this movement is enhancing the country’s role in the international board game landscape. Insights from the Australian board games market suggest that independent publishing is becoming a significant factor in driving innovation and diversification.

Personalization and Custom Games

The appetite for personalized board games is steadily increasing in Australia, influenced by consumer preferences and trends in corporate gifting. Companies are more frequently commissioning branded games for marketing initiatives, team-building activities, or client interactions, while individuals desire customized editions for celebrations like birthdays, weddings, or anniversaries. This niche market is attractive due to its emotional and experiential connections, offering unique gameplay that reflects specific themes or personal narratives. Progress in printing technology and digital design has made customization more attainable and cost-effective. As consumers seek meaningful, tailored experiences, this trend represents a lucrative opportunity in the premium segment of the Australian board games market.

Export Potential for Australian-Themed Games

Board games with Australian themes present a distinctive opportunity for export by highlighting local culture, wildlife, geography, and indigenous narratives to a global audience. International players are attracted to new stories and striking visuals that differentiate themselves in a competitive market. Games that feature elements like the Great Barrier Reef, Aboriginal art, or outback adventures serve as entertainment and as a means of promoting cultural understanding. With a rising demand for diverse content, Australian developers are well-positioned to explore global markets, particularly in areas looking for educational or travel-themed gameplay. Insights from the Australian board games market indicate that this cultural uniqueness can help local publishers stand out and enhance export opportunities.

Challenges of Australia Board Games Market:

Retail Space Competition

In the Australian board games market, physical stores encounter space limitations that greatly impact product visibility and sales. Due to limited shelf space, retailers often focus on established, high-volume mainstream titles that guarantee steady turnover. This situation restricts the chances for independent or niche games to gain visibility, making it difficult for new entrants to compete fairly. Furthermore, premium or larger-format games may be entirely omitted due to logistical issues, despite strong demand from hobbyists. These limitations also hinder retailers' ability to provide a varied catalog, diminishing consumer access to innovative and lesser-known games. To tackle this issue, closer collaboration between publishers and retailers, along with increased support for specialty stores and gaming cafés, is essential to highlight diverse offerings.

High Production and Import Costs

The Australian board games market is significantly influenced by the elevated costs linked to both domestic production and international imports. Manufacturing games locally incurs high expenses associated with labor, raw materials, and compliance regulations, making it difficult to stay competitive on price. Conversely, importing from overseas suppliers, particularly from regions like Europe or North America, adds more challenges such as high shipping fees, import taxes, and fluctuating currency exchange rates. These extra expenses are usually transferred to consumers, leading to increased retail prices and restricting market access. Consequently, smaller publishers and retailers operate on narrow margins, while consumers face a decrease in affordable options. Improving supply chain management and fostering localized production could alleviate these financial pressures in the long run.

Limited Domestic Manufacturing Infrastructure

Australia’s board games sector is limited by an underdeveloped domestic manufacturing infrastructure that lacks the capacity for large-scale production. Most local designers and publishers are compelled to depend on overseas manufacturers, particularly in Asia, for printing, packaging, and component creation. This reliance raises costs, and lead times and also constrains the ability to swiftly respond to market demands or adapt designs. Managing smaller print runs can be especially challenging due to minimum order quantities set by international suppliers. Additionally, shipping delays or global disruptions, such as supply chain bottlenecks, can significantly impact launch schedules. Establishing localized, scalable game production capabilities would enhance innovation, flexibility, and resilience within the Australian board games industry.

Australia Board Games Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, game type, age group, and distribution channel.

Product Type Insights:

- Tabletop Games

- Card and Dice Games

- Collectible Card Games

- Miniature Games

- RPG Games

The report has provided a detailed breakup and analysis of the market based on the product type. This includes tabletop games, card and dice games, collectible card games, miniature games, and RPG games.

Game Type Insights:

- Strategy and War Games

- Educational Games

- Fantasy Games

- Sport Games

- Others

The report has provided a detailed breakup and analysis of the market based on the game type. This includes strategy and war games, educational games, fantasy games, sport games, and others.

Age Group Insights:

- 0-2 Years

- 2-5 Years

- 5-12 Years

- Above 12 Years

The report has provided a detailed breakup and analysis of the market based on the age group. This includes 0-2 years, 2-5 years, 5-12 years, and above 12 years.

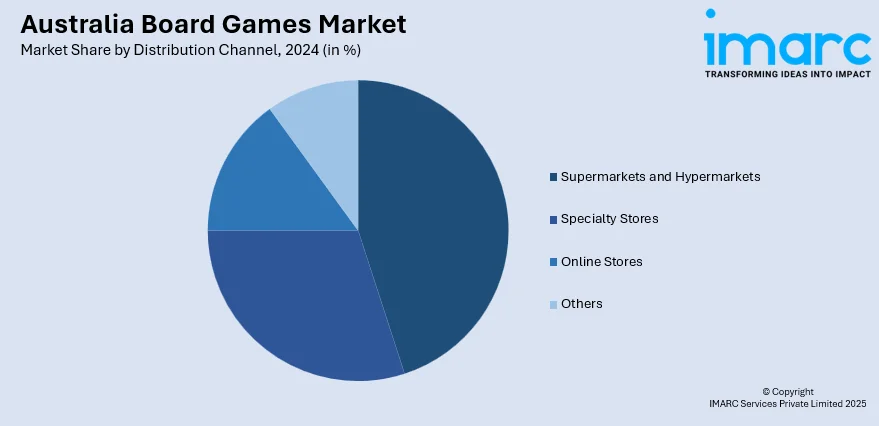

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Board Games Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Tabletop Games, Card and Dice Games, Collectible Card Games, Miniature Games, RPG Games |

| Game Types Covered | Strategy and War Games, Educational Games, Fantasy Games, Sport Games, Others |

| Age Groups Covered | 0-2 Years, 2-5 Years, 5-12 Years, Above 12 Years |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia board games market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia board games market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia board games industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The board games market in Australia was valued at USD 518.84 Million in 2024.

The Australia board games market is projected to exhibit a compound annual growth rate (CAGR) of 9.06% during 2025-2033.

The Australia board games market is expected to reach a value of USD 1,235.06 Million by 2033.

The major trends of the Australia board games market include a surge in demand for thematic and strategy-driven titles, hybrid physical-digital games, and locally designed content. Community-driven gaming events, eco-conscious packaging, and collaborations with pop culture franchises are further shaping product innovation and consumer engagement.

Key drivers impacting the market include growing family-oriented leisure activities, educational adoption in classrooms, and increased distribution via specialty stores and online platforms. Additionally, expanding tabletop gaming cafés and rising disposable incomes are encouraging more frequent purchases, while cultural nostalgia continues to boost demand for classic and modern board games alike.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)