Australia Boiler Market Size, Share, Trends and Forecast by Boiler Type, End User, and Region, 2025-2033

Australia Boiler Market Overview:

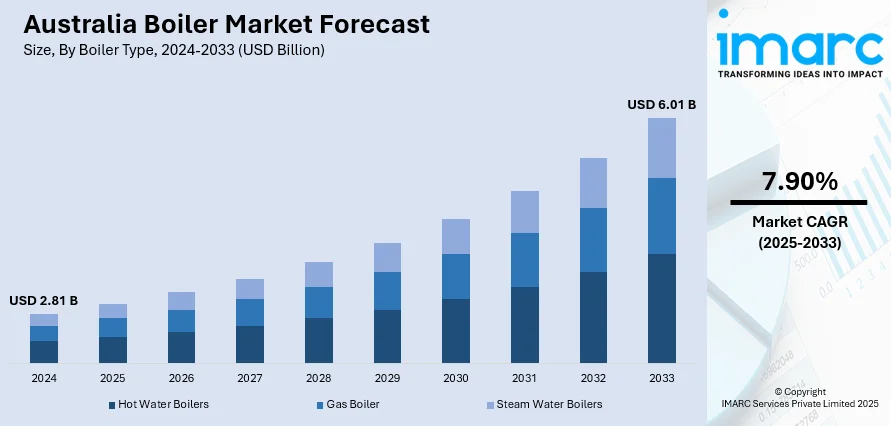

The Australia boiler market size reached USD 2.81 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 6.01 Billion by 2033, exhibiting a growth rate (CAGR) of 7.90% during 2025-2033. The market is supported by drivers such as growing need for energy-efficient heating solutions, strict environmental legislation, and developing boiler technology. The growth in the use of smart home systems and the connection of renewable power sources such as solar and hydrogen also support the growth of the market. Besides, government policy and incentives to support sustainable heating technologies significantly shape the Australia boiler market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2.81 Billion |

| Market Forecast in 2033 | USD 6.01 Billion |

| Market Growth Rate 2025-2033 | 7.90% |

Australia Boiler Market Trends:

Integration of Renewable Energy Sources

The integration of renewable energy sources into boiler systems is a prominent trend in the Australia boiler market. Hybrid systems that combine traditional boilers with renewable technologies, such as solar thermal panels and heat pumps, are gaining popularity. These systems not only enhance energy efficiency but also reduce carbon footprints, aligning with Australia's commitment to sustainability. Government incentives and subsidies are further encouraging the adoption of these eco-friendly solutions. As a result, manufacturers are focusing on developing boilers compatible with renewable energy sources, driving innovation and expanding the market. This trend is expected to continue, contributing significantly to the Australia boiler market growth. For instance, in May 2025, New Zealand dairy giant Fonterra commissioned three renewable-powered electrode boilers at its Edendale plant, replacing coal-fired systems. This move, backed by NZ$70 million in investment and co-funded by the EECA, will cut CO₂e emissions by 72,800 tonnes annually from 2027, equivalent to 4% of Fonterra’s 2030 emissions target. The initiative is part of a broader shift from coal, following previous conversions that reduced emissions by over 200,000 tonnes per year. Fonterra continues sourcing biomass and renewables to meet its goals.

To get more information on this market, Request Sample

Regulatory Support for Energy Efficiency

Regulatory frameworks in Australia are increasingly supporting energy efficiency in heating systems, significantly influencing the boiler market. Programs like the Energy Efficiency Opportunities (EEO) and the Renewable Energy Target (RET) mandate the adoption of high-efficiency boilers and encourage the use of renewable energy sources. These regulations are compelling businesses and homeowners to invest in energy-efficient heating solutions. Compliance with these standards not only reduces operational costs but also aligns with national sustainability goals. Consequently, the regulatory environment is a critical driver of innovation and growth in the Australia boiler market. For instance, Jericho Energy Ventures and LINE Hydrogen recently partnered to introduce the hydrogen-powered DCC Boiler to Australia. This advanced boiler technology supports commercial and industrial applications while significantly cutting emissions, each unit can eliminate around 4,400 tons of CO₂ annually. The initiative aligns with Australia’s net zero goals and includes plans to use LINE Hydrogen’s green hydrogen from its George Town plant.

Australia Boiler Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on boiler type and end user.

Boiler Type Insights:

- Hot Water Boilers

- Gas Boiler

- Steam Water Boilers

The report has provided a detailed breakup and analysis of the market based on the boiler type. This includes hot water boilers, gas boiler, and steam water boilers.

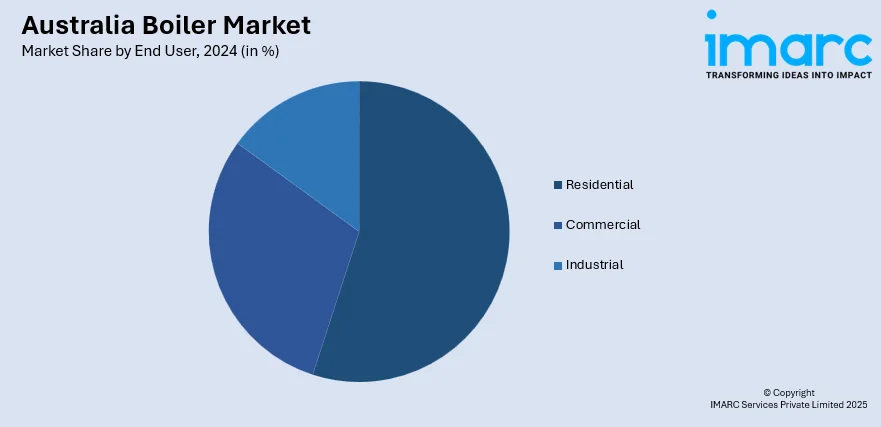

End User Insights:

- Residential

- Commercial

- Industrial

The report has provided a detailed breakup and analysis of the market based on the end user. This includes residential, commercial, and industrial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Boiler Market News:

- In May 2025, Automatic Heating Global acquired Simons Boilers to expand its product portfolio, manufacturing capacity, and export potential. The acquisition aligns with its strategy to strengthen market presence, especially in New South Wales and across Australia. Simons Boilers will continue to operate under its brand, focusing on electric and gas steam boilers and hot water heaters.

- In March 2025, the Environmental Group acquired Advanced Boilers & Combustion for $5.5 million to strengthen its industrial boiler capabilities. The deal expands EGL’s fabrication, fit-out, and control panel expertise, while integrating Advanced’s strong service revenues and market presence. Post-acquisition, the former owners will remain in leadership roles. Advanced is Australia’s second-largest boiler supplier, holding approximately 8% of the Australia boiler market share and boosting EGL’s competitive edge.

Australia Boiler Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Boiler Types Covered | Hot Water Boilers, Gas Boiler, Steam Water Boilers |

| End Users Covered | Residential, Commercial, Industrial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia boiler market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia boiler market on the basis of boiler type?

- What is the breakup of the Australia boiler market on the basis of end user?

- What is the breakup of the Australia boiler market on the basis of region?

- What are the various stages in the value chain of the Australia boiler market?

- What are the key driving factors and challenges in the Australia boiler market?

- What is the structure of the Australia boiler market and who are the key players?

- What is the degree of competition in the Australia boiler market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia boiler market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia boiler market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia boiler industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)