Australia BOPP Films Market Size, Share, Trends and Forecast by Type, Thickness, Production Process, Application, and Region, 2025-2033

Australia BOPP Films Market Overview:

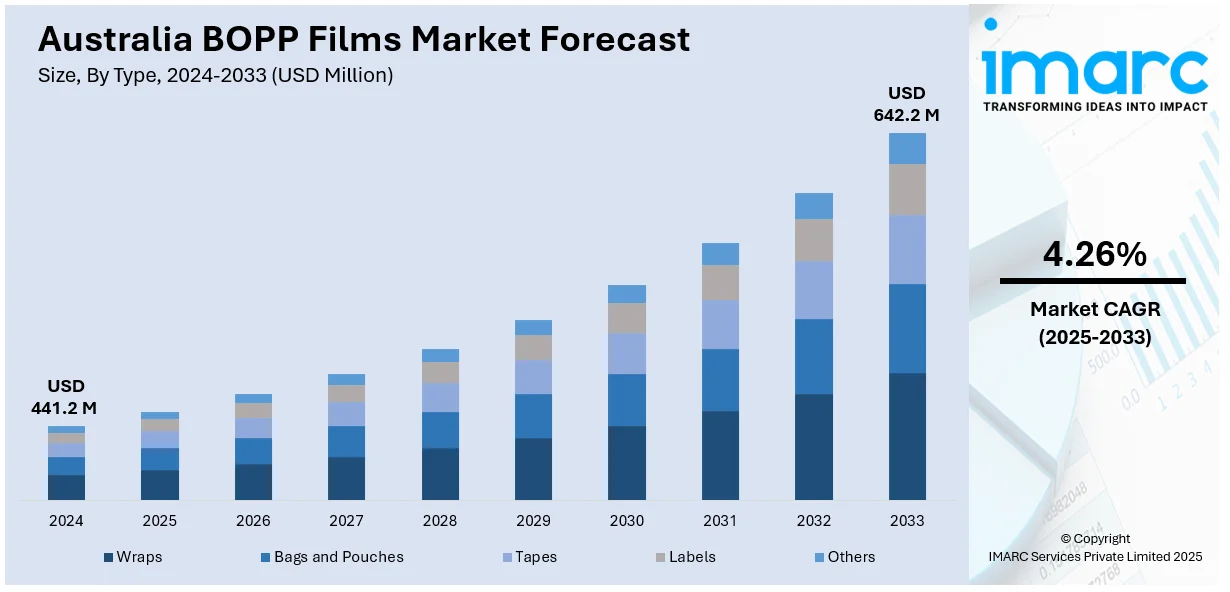

The Australia BOPP films market size reached USD 441.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 642.2 Million by 2033, exhibiting a growth rate (CAGR) of 4.26% during 2025-2033. The rising demand for flexible packaging in food, pharmaceuticals, and consumer goods, growth in e-commerce, advancements in film technology, increasing sustainability focus, government initiatives promoting plastic recycling, and expanding applications in labeling and industrial sectors are the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 441.2 Million |

| Market Forecast in 2033 | USD 642.2 Million |

| Market Growth Rate 2025-2033 | 4.26% |

Australia BOPP Films Market Trends:

Sustainable Shift in Currency-Grade Film Applications

Australia’s legacy in polymer banknote adoption is driving broader interest in recyclable and lower-impact film technologies. The integration of chemically recycled BOPP film into currency manufacturing signals growing efforts to merge durability with environmental responsibility. With regulatory and market pressures encouraging alternatives to virgin plastics, the use of ISCC Plus-certified recycled polymers in security-grade applications reflects rising priorities in resource efficiency. Australian institutions are well-positioned to pilot such materials, reinforcing their role in shaping environmentally conscious packaging and specialty film usage. As global suppliers push to replace traditional substrates, polymer films designed for circularity are expected to find broader adoption in both niche and mainstream segments, including labels, packaging, and financial-grade materials, where recyclability and compliance are increasingly prioritized. For example, in April 2024, Toray Plastics America developed a chemically recycled BOPP film for polymer banknotes using ExxonMobil's ISCC Plus-certified recycled polymers. This marks the first use of mass balance plastics in polymer banknotes. Australia, the pioneer in adopting polymer banknotes in 1988, continues to influence global trends in sustainable currency production.

To get more information on this market, Request Sample

Growing Preference for Recycled Content BOPP Films

The use of recycled-content BOPP films is gaining steady acceptance in Australia’s packaging industry. Manufacturers are introducing materials with improved environmental credentials, including higher percentages of post-consumer recycled content, without sacrificing clarity, strength, or barrier properties. These films are designed to integrate easily into current printing and converting lines, making them a practical alternative to traditional options. As sustainability commitments tighten across the supply chain, businesses are seeking packaging materials that align with recycling targets and reduce dependency on virgin plastics. The shift reflects an evolving approach to packaging, where functionality and eco-conscious design are expected to go hand in hand, encouraging broader adoption of responsible film materials across both food and non-food applications. For instance, in July 2024, Jet Technologies introduced its Encore range of recycled content BOPP films in Australasia, aligning with APCO 2025 sustainability targets. These films, containing at least 30% recycled content, offer comparable quality and performance to traditional films. Australian converters Impact Labels and Ultra Labels have adopted Encore films, citing their environmental benefits and seamless integration into existing production processes.

Australia BOPP Films Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, thickness, production process, and application.

Type Insights:

- Wraps

- Bags and Pouches

- Tapes

- Labels

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes wraps, bags and pouches, tapes, labels, and others.

Thickness Insights:

- Below 15 Microns

- 15-30 Microns

- 30-45 Microns

- More than 45 Microns

A detailed breakup and analysis of the market based on the thickness have also been provided in the report. This includes below 15 microns, 15-30 microns, 30-45 microns, and more than 45 microns.

Production Process Insights:

- Tenter

- Tubular

The report has provided a detailed breakup and analysis of the market based on the production process. This includes tenter and tubular.

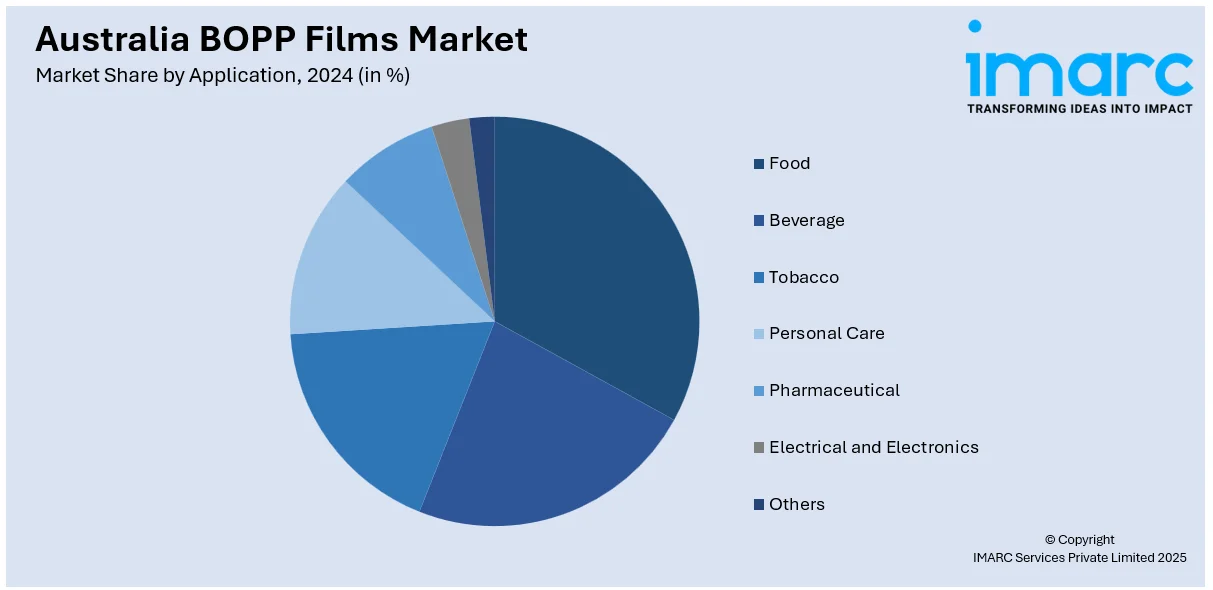

Application Insights:

- Food

- Beverage

- Tobacco

- Personal Care

- Pharmaceutical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes food, beverage, tobacco, personal care, pharmaceutical, electrical and electronics, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia BOPP Films Market News:

- In March 2024, TOPPAN, in collaboration with TOPPAN Speciality Films, developed GL-SP, a BOPP-based barrier film aimed at enhancing sustainable packaging in the Asia-Pacific region. This innovation facilitates the creation of monomaterial structures for dry product packaging, improving recyclability. The initiative reflects the growing demand for eco-friendly packaging solutions across the Asia-Pacific market.

Australia BOPP Films Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Type Covered | Wraps, Bags and Pouches, Tapes, Labels, Others |

| Thickness Covered | Below 15 Microns, 15-30 Microns, 30-45 Microns, More than 45 Microns |

| Production Process Covered | Tenter, Tubular |

| Application Covered | Food, Beverage, Tobacco, Personal Care, Pharmaceutical, Electrical and Electronics, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia BOPP films market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia BOPP films market on the basis of type?

- What is the breakup of the Australia BOPP films market on the basis of thickness?

- What is the breakup of the Australia BOPP films market on the basis of production process?

- What is the breakup of the Australia BOPP films market on the basis of application?

- What are the various stages in the value chain of the Australia BOPP films market?

- What are the key driving factors and challenges in the Australia BOPP films market?

- What is the structure of the Australia BOPP films market and who are the key players?

- What is the degree of competition in the Australia BOPP films market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia BOPP films market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia BOPP films market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia BOPP films industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)