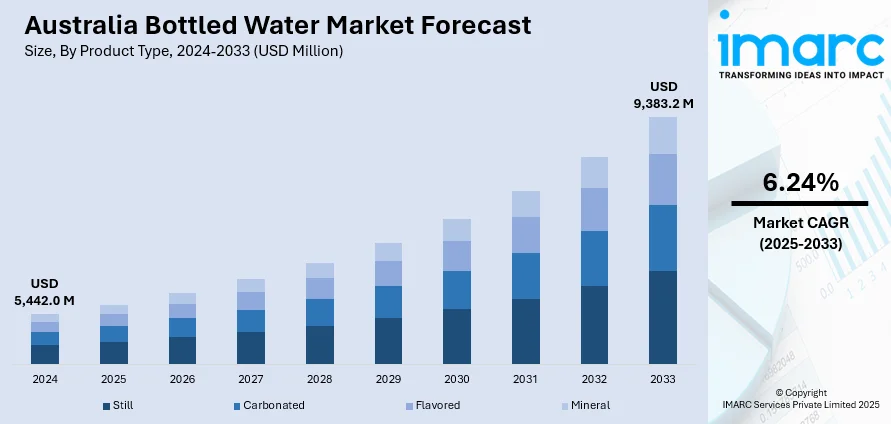

Australia Bottled Water Market Report by Product Type (Still, Carbonated, Flavored, Mineral), Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, and Others), and Region 2025-2033

Australia Bottled Water Market Size and Share:

Australia bottled water market size reached USD 5,442.0 Million in 2024. Looking forward, the market is expected to reach USD 9,383.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.24% during 2025-2033. The development of product variants with advanced hydration solutions, such as isotonic and pH-balanced water, is primarily driving the market growth across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 5,442.0 Million |

|

Market Forecast in 2033

|

USD 9,383.2 Million |

| Market Growth Rate 2025-2033 | 6.24% |

Bottled water is derived from diverse sources, including natural springs, wells, municipal water supplies, etc., and undergoes strict purification procedures. Through rigorous filtration processes, it is rid of contaminants like bacteria, chemicals, and pollutants, ensuring its purity. Bottled water proves convenient for on-the-go hydration, easily accessible in diverse environments, such as offices, gyms, outdoor activities, etc. It is packaged in containers crafted from plastic, glass, and aluminum for both commercial distribution and consumer consumption, maintaining its quality and meeting varying preferences.

To get more information on this market, Request Sample

Key Trends of Australia Bottled Water Market:

Health-and-Wellness Focus Steering Consumer Choices

Australian shoppers' increasing focus on overall wellbeing has among the most potent impacts redefining the bottled water category. Tap water substitutes are eschewed for bottled versions seen as cleaner, purer, and sugar-free or artificial additive-free. For wellness-focused millennials and Generation Z, bottled water is now a lifestyles declaration congruent with exercise regimens, outdoor activity, and mental health. Peculiar to Australia, the market has stretched from plain spring or purified water to added variants—such as alkaline water, mineral-sourced spring origins, and electrolyte-doped variants. Brands tout their origins in pristine parts of the country such as Tasmanian bush or remote Outback springs, leaning on the nation's reputation for environmental purity. This prioritization of natural-source bottling differentiates the market from other global markets that tend to prioritize price over origin. With consumers ever more vigilant about ingredient panels and manufacturing processes, transparency related to botanical profiling, filtering practices, and spring origin has become an important brand differentiator in Brisbane to Broome retail establishments and foodservice outlets, which further contributes to the increasing Australia bottled water market share.

Sustainability and Packaging Innovation Fueling Transformation

Environmental responsibility has become a core market trend in Australia's bottled water market, with plastic pollution and carbon footprint concerns driving producers and consumers alike. Regulatory frameworks such as APCO's 2025 recycling goals and container deposit initiatives in states like New South Wales and South Australia have driven the use of recycled PET and refill systems. Locally driven projects, such as businesses teaming up with Tetra Pak for locally sourced plant‑based cartons from Victorian springs, illustrate this drive. Queensland, where the tropical climate also creates high demand, sees its bottled water brands frequently develop regionally focused sustainability programs to coincide with coastal clean‑ups and messaging around coral reef preservation. Refillable water points are being introduced in cafes and community facilities—mirroring a wider cultural shift towards minimizing single-use plastics. Combining green packaging with premium positioning is not merely environmental virtue-signaling—it appeals to Australian consumers who want both convenience and responsibility, and who might shift to brands that openly show corporate environmental commitment.

Product Differentiation through Flavors, Functionality, and Premium Positioning

According to the Australia bottled water market analysis, product type diversification is becoming an influential trend in the sector, mirroring educated consumer needs. Although water continues to be the base, high-end categories are performing well with sparkling, flavored, alkaline, and functional waters delivering more than simple hydration. Novel Australian developments involve vitamin-enriched varieties and electrolyte-infused formulas formulated for active lifestyles—a trend mirrored in international wellness categories. Local brands boost their popularity by showcasing indigenous botanicals like Kakadu plum-infused sparkling water or bush salt–balanced electrolyte drinks, producing goods that are uniquely Australian and rich in story. Heritage spring brands from places like the Blue Mountains or Tasmanian highlands focus on purity and taste distinction, appealing to premium shoppers in cafés, hotels, and foodservice establishments throughout key cities and tourist destinations. Dependence on powerful stories surrounding native ingredients, local sourcing, and clean-label advantages allows businesses to establish brand loyalty and support premium prices, creating a fertile ground for product development and marketing differentiation.

Growth Drivers of Australia Bottled Water Market:

Increased Health Awareness and Clean Hydration Demand

One of the major growth drivers for Australia's bottled water industry is increasing health awareness among the population and its greater inclination toward healthier lifestyle options. With increasing awareness of the adverse health impacts of sugary beverages, more Australians are turning to water as an alternative major drink for everyday hydration. This is supplemented by the popularity of fitness, yoga, outdoor activities, and health programs throughout the country. The warm climate in Australia, especially in states such as Queensland and Western Australia, also contributes to regular consumption of water, adding additional momentum to bottled water sales. Consumers are expressing a resounding preference for products that support their wellness objectives, opting for bottled water not only for convenience but also for perceived purity and health advantages. Australian brands typically promote the natural origin of their water—whether from Victorian alpine springs or Tasmanian protected catchments—something that appeals to health-conscious buyers who desire certainty of safety, cleanliness, and minimal processing.

Urbanization and On-the-Go Lifestyles

Australia's increasingly urban population, particularly urban centers like Sydney, Melbourne, and Brisbane, plays a major role in the expansion of the bottled water industry. City residents tend to adopt active, mobile lifestyles that call for easy hydration. Bottled water represents a convenient, portable option over the use of public fountains or indoor tap water, particularly in city centers, on the go, or at fitness and leisure centers. This is especially true among young working people and students who spend much of their time away from home. Moreover, the convenience store and food delivery boom has also facilitated consumers to buy bottled water in bulk or as an accompaniment to meal packs. The popularity of Australian café culture and takeaway food also enhances bottled water sales since consumers often add bottled beverages to take-out orders. Such convenience-driven consumption behavior is particularly supported by the geography and infrastructure of Australia, with vast distances between urban and rural communities that frequently restrict access to stable, high-quality tap water in outback areas.

Tourism, Events, and Premium Positioning

The region’s vibrant tourism industry and regular outdoor events also represent some of the prominent factors of growth contributing to the Australia bottled water market demand. The nation's image as a tourist destination for nature, beach recreation, and cultural celebrations results in a perpetual flow of local and foreign travelers who use bottled water for convenience when out and about. Areas such as the Gold Coast, Great Barrier Reef, and Uluru have high volumes of tourist traffic, especially in the summer, adding to the demand for readily accessible water sources. Secondly, mass events—like sports matches, music festivals, and open-air markets—still increase the demand for packaged drinks, especially in a controlled setting where external beverages might be prohibited. Most brands of bottled water capitalize on this by presenting themselves as premium, green alternatives through emphasis on distinctive aspects like spring sourcing, First Nations partnerships, or green packaging. These qualities not only appeal to tourists but also support the brand image in locals, driving continuous market expansion.

Opportunities of Australia Bottled Water Market:

Functional and Enhanced Water Segment Expansion

The most promising avenue of growth for the Australian bottled water industry is expansion into functional and enhanced water segments. As health-conscious consumers become more sophisticated, the demand increases for bottled water that provides more than mere hydration. Examples include vitamins, minerals, electrolyte, antioxidant, and even natural energy-boosting infusions. Australian businesses are in an ideal position to leverage this trend through using the nation's clean, natural reputation and availability of native ingredients. For example, functional water with Australian botanicals such as lemon myrtle or Kakadu plum provides both a health benefit and a high level of local authenticity. Additionally, the active lifestyle adopted in cities such as Brisbane, Perth, and coastal areas promotes hydration solutions dedicated to sport and recovery. By creating a wider portfolio of preimmunized waters, Australian brands can position themselves to appeal to both health-oriented consumers and wellness-oriented niche segments and gain a unique positioning in an expanding category.

Sustainability-Driven Packaging and Circular Economy Models

Environmental sustainability in Australia provides a significant market opportunity for innovation in environmentally friendly bottled water packaging. With the highest level of public consciousness about plastic waste and country-level objectives to decrease single-use plastics, consumers are increasingly attracted towards brands that showcase transparent environmental stewardship. Bottled water firms can stand out by investing in compostable, biodegradable, or 100% recycled packaging materials. In markets like South Australia and New South Wales, state-backed container deposit schemes have already been proving effective in enhancing recycling rates, prompting brands to align themselves with local sustainability initiatives. There is also growing interest in refillable bottled water platforms and closed-loop supply systems, especially in densely populated urban areas. Brands that collaborate with local councils, retailers, or hospitality outlets to provide water refill points can establish themselves as circular economy leaders. Highlighting the sustainable aspects not only reinforces brand credibility but also caters to increasing consumer demands for responsible and environmentally friendly options.

Growth in Regional and Export Markets

Outside of domestic market consumption, Australian bottled water brands stand to capitalize significantly on regional and international markets in which demand for premium, naturally sourced, and clean water is on the rise. Australia's image of having high food safety standards and immaculate natural environments means that its bottled water is extremely desirable for consumption in Asia-Pacific and the Middle East. The exclusive charm of water from regions such as Tasmania, the Victorian Alps, or Western Australia's unspoiled wilderness brings a premium factor that echoes with international consumers looking for high-end imports. Moreover, a growing population and urbanization in proximate Southeast Asian countries provide a fertile ground for Australian exports, particularly in markets where local water systems could be inadequate or where there is strong faith in imported products. Locally, there is also potential for expansion in regional and remote regions where the availability of consistent, high-quality tap water is restricted, leading to bottled water being an even more essential commodity. With the right distribution and marketing, these opportunities can contribute dramatically to brand visibility and revenue.

Challenges of Australia Bottled Water Market:

Environmental Issues and Consumer Resistance

One of the biggest challenges for the Australian bottled water industry is ongoing public pressure over its impact on the environment, specifically plastic pollution. Being a nation with a strong cultural heritage based on natural environments and outdoor lifestyles, Australians are waking up to the environmental toll that single-use plastics take. Environmental campaigns and acts of activism by conservation groups have picked up steam, focusing on waste produced by bottled water and promoting increased use of tap water and refillable containers. States such as Victoria and South Australia are implementing policies that reduce plastic use, including bans on specific packaging and more stringent recycling requirements, forcing bottled water companies to examine their materials and supply chains. This ecological examination is even more intense in areas popular with tourists like the Great Barrier Reef and national parks, where plastic waste is a visibly threatening presence to ecosystems. As consumer attitudes change, brands face reputational harm unless they make concerted efforts to invest in sustainable strategies and openness about environmental practice.

Competition from Tap Water and Public Infrastructure

Australia's availability of good quality tap water poses another major threat to the bottled water business, especially in cities where municipal water is not just safe but also highly marketed. Large cities such as Sydney, Melbourne, and Canberra have renowned dependable water treatment systems, and therefore tap water is an affordable and environmentally sound option for most residents. Local governments and councils have also stepped up installing public water fountains and refill points, particularly in schools, parks, and transport centers, to prompt people to use reusable containers. Such advances place a competitive environment where bottled water will need to stand out not only in terms of convenience, but in terms of value added—like greater nutrition, distinction in the source, or environmental credentials. In addition, initiatives like "Choose Tap," initiated by local water authorities, have managed to change the tide of public opinion by actively marketing tap water as just as safe and significantly less wasteful. This complicates the ability of bottled water companies to maintain their price tag and environmental cost, particularly for frugal or environmentally conscious consumers.

Logistical Challenges and Geographic Distribution

Australia’s vast geography and uneven population distribution pose logistical and operational challenges for bottled water companies, particularly those attempting to service remote or regional areas. Unlike densely populated countries with centralized distribution hubs, Australia’s consumers are spread across urban centers, coastal towns, and remote inland communities. Ensuring consistent supply and freshness of bottled water across these areas requires substantial investment in transportation, refrigeration, and storage infrastructure. This is particularly challenging in regions prone to extreme heat or weather conditions, like the Northern Territory or Western Queensland, where quality of the product may prove tricky to ensure. Transportation costs are also higher due to sheer distance involved, and bottled water becomes pricier and less effective in certain areas. Seasonal fluctuations, bushfire danger, and flood closures on roads can also impede distribution chains. For smaller or standalone bottled water companies, such issues can hold back market coverage and scalability, whereas bigger players must keep adjusting their logistics to stay profitable and meet service expectations.

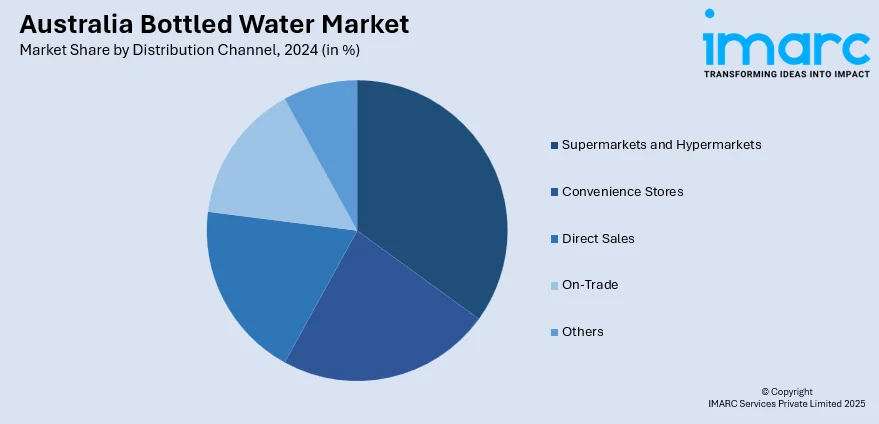

Australia Bottled Water Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type and distribution channel.

Product Type Insights:

- Still

- Carbonated

- Flavored

- Mineral

The report has provided a detailed breakup and analysis of the market based on the product type. This includes still, carbonated, flavored, and mineral.

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Direct Sales

- On-Trade

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, direct sales, on-trade, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Bottled Water Market News:

- In December 2024, a community in regional New South Wales received free bottled water following the detection of hazardous levels of “forever chemicals” in a bore water supply. Test results from NSW Health indicated that the elevated PFAS levels in a supply at Warialda, New England, surpass current Australian drinking water standards. The township, located around 200 kilometers north of Tamworth, has a population of roughly 1,400 residents. Following the July investigation, regional water suppliers were provided with tests after PFAS was detected at a water filtration facility servicing at least 41,000 residences in the upper Blue Mountains.

- In September 2024, Billy, an Australia-based packaged water brand, elevated its sustainability efforts by introducing aluminum cans containing 100% pure spring water. Using recyclable and sustainable materials like aluminum, the new Australian spring water brand, which comes from the clean springs of Mount Buninyong in Victoria, seeks to eradicate plastic.

- In August 2023, Australian startup The Boxed Beverage Company collaborated with the global packaging firm Tetra Pak to introduce Waterbox, which it characterizes as sustainably packaged alkaline water sourced straight from Cottonwood Springs in Victoria. The packaging is Tetra Top carton bottle made from plant-based materials by Tetra Pak, and the company claims that Waterbox has up to eight times lesser effect on climate change than conventional PET bottled water throughout its entire lifecycle in Australia and New Zealand.

Australia Bottled Water Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Still, Carbonated, Flavored, Mineral |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Direct Sales, On-Trade, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia bottled water market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia bottled water market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia bottled water industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia bottled water market was valued at USD 5,442.0 Million in 2024.

The Australia bottled water market is projected to exhibit a CAGR of 6.24% during 2025-2033.

The Australia bottled water market is expected to reach a value of USD 9,383.2 Million by 2033.

Principal drivers for Australia's bottled water industry include expanding health consciousness, hectic urban lifestyles, and rising tourism. Consumers demand convenient, sugar-free, and healthy hydration solutions, while the nation's clean, natural reputation facilitates high levels of trust in locally produced water. Rising wellness trends and premium positioning further drive demand in domestic and export markets.

Australia's bottled water industry is influenced by increasing health awareness, desire for sustainable packaging, and premium and functional water segments' expansion. Consumers increasingly favor green and local choices, while innovation in enhanced and flavored water continues to appeal to wellness-oriented and on-the-go lifestyles in urban areas.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)