Australia Botulinum Toxin Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2025-2033

Australia Botulinum Toxin Market Overview:

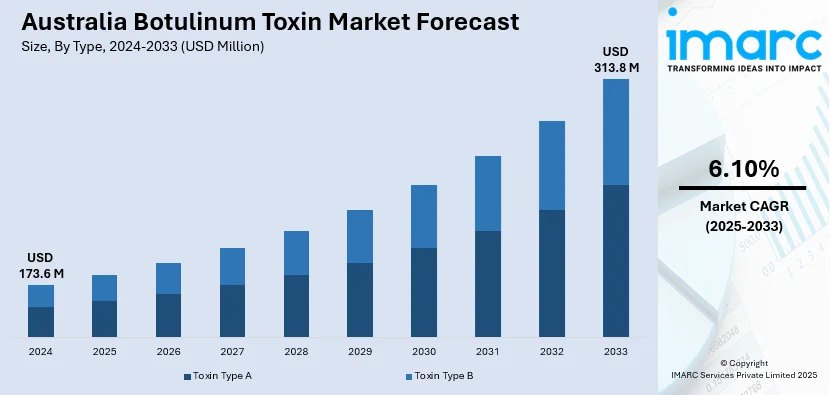

The Australia botulinum toxin market size reached USD 173.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 313.8 Million by 2033, exhibiting a growth rate (CAGR) of 6.10% during 2025-2033. The growing demand for cosmetic procedures, increasing aesthetic consciousness, rising disposable income, expanding aging population, and broader therapeutic applications such as chronic migraine and muscle disorders are key drivers of the market. Supportive regulatory approvals and medical tourism also contribute to market expansion.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 173.6 Million |

| Market Forecast in 2033 | USD 313.8 Million |

| Market Growth Rate 2025-2033 | 6.10% |

Australia Botulinum Toxin Market Trends:

Strengthening Regulatory Oversight for Cosmetic Injectables

Australia is witnessing stricter oversight of cosmetic injectables with updated regulatory directives focused on product legitimacy and patient safety. Authorities now require all injectable substances, including botulinum toxin products, to be approved and listed on the Australian Register of Therapeutic Goods (ARTG) prior to supply or administration. This shift reflects growing scrutiny toward unapproved imports and off-label use, reinforcing accountability among importers, suppliers, and practitioners. Clinics and aesthetic providers are being held to higher standards, with increased documentation and compliance obligations. These regulatory refinements are also expected to reshape procurement practices, as practitioners prioritize products with formal ARTG listings. The evolving compliance environment is creating a more structured market, particularly in therapeutic and cosmetic applications of botulinum toxin. For example, in May 2024, the TGA published guidelines on the import and supply of cosmetic injectables, including botulinum toxin products, emphasizing that such substances must be approved and listed on the Australian Register of Therapeutic Goods (ARTG). These updates aim to ensure that only regulated and authorized products are used in cosmetic procedures, enhancing patient safety and compliance among providers.

To get more information on this market, Request Sample

Enhancing Clinical Oversight in Cosmetic Procedures

Australia is moving toward stronger clinical governance for non-surgical aesthetic treatments involving botulinum toxin. Health regulators are refining professional standards for nurses who administer these procedures, focusing on safety, competence, and appropriate supervision. Proposed updates emphasize stricter credentialing, clearer consent protocols, and defined responsibilities between prescribing doctors and administering nurses. This adjustment is set to raise the clinical threshold for providers, limiting unauthorized practices and reinforcing patient protection. It also underscores the growing importance of formal training and adherence to established practice guidelines. As oversight increases, providers in the cosmetic injectable space are expected to reassess operational models and workforce qualifications to remain compliant. This shift is reshaping how cosmetic treatments are delivered, particularly in high-demand urban and suburban clinics. For instance, in September 2023, the Medical Board of Australia announced plans to strengthen guidelines for nurses performing non-surgical cosmetic procedures, including the administration of botulinum toxin.

Australia Botulinum Toxin Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Toxin Type A

- Toxin Type B

The report has provided a detailed breakup and analysis of the market based on the type. This includes toxin type A and toxin type B.

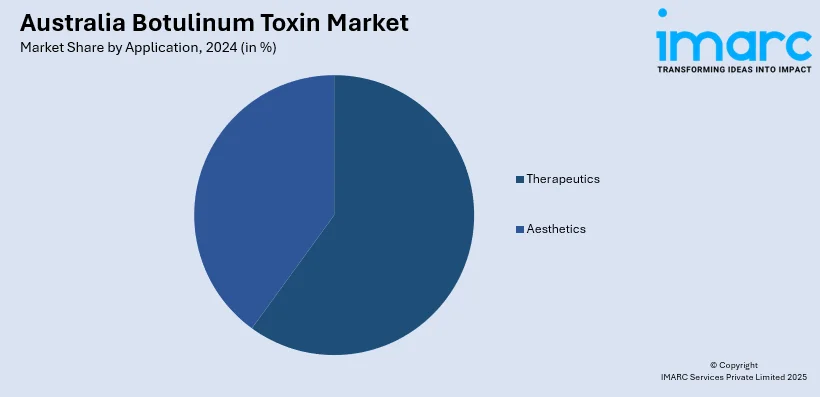

Application Insights:

- Therapeutics

- Aesthetics

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes therapeutics and aesthetics.

End User Insights:

- Hospitals and Clinics

- Dermatology Clinics

- Spas and Cosmetic Centers

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, dermatology clinics, and spas and cosmetic centers.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Botulinum Toxin Market News:

- In July 2024, Evolus, Inc. commenced operations in Australia with the launch of Nuceiva (prabotulinumtoxinA), a botulinum toxin type A product, marking a significant expansion of their global presence. The company’s entry into the Australian market introduces a new therapeutic option within the aesthetic botulinum toxin segment, aiming to support physicians and clinics through localized operations.

- In July 2024, the Therapeutic Goods Administration (TGA) approved Relfydess (relabotulinumtoxinA), a purified botulinum toxin type A product, for therapeutic use in Australia. The approval followed the evaluation of six clinical studies targeting glabellar and lateral canthal lines. Relfydess works by inhibiting acetylcholine release, reducing muscle activity, and smoothing facial wrinkles.

Australia Botulinum Toxin Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Toxin Type A, Toxin Type B |

| Applications Covered | Therapeutics, Aesthetics |

| End Users Covered | Hospitals and Clinics, Dermatology Clinics, Spas and Cosmetic Centers |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia botulinum toxin market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia botulinum toxin market on the basis of type?

- What is the breakup of the Australia botulinum toxin market on the basis of application?

- What is the breakup of the Australia botulinum toxin market on the basis of end user?

- What are the various stages in the value chain of the Australia botulinum toxin market?

- What are the key driving factors and challenges in the Australia botulinum toxin market?

- What is the structure of the Australia botulinum toxin market and who are the key players?

- What is the degree of competition in the Australia botulinum toxin market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia botulinum toxin market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia botulinum toxin market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia botulinum toxin industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)