Australia Breakfast Cereal Market Size, Share, Trends and Forecast by Type, Nature, Distribution Channel, and Region, 2025-2033

Australia Breakfast Cereal Market Overview:

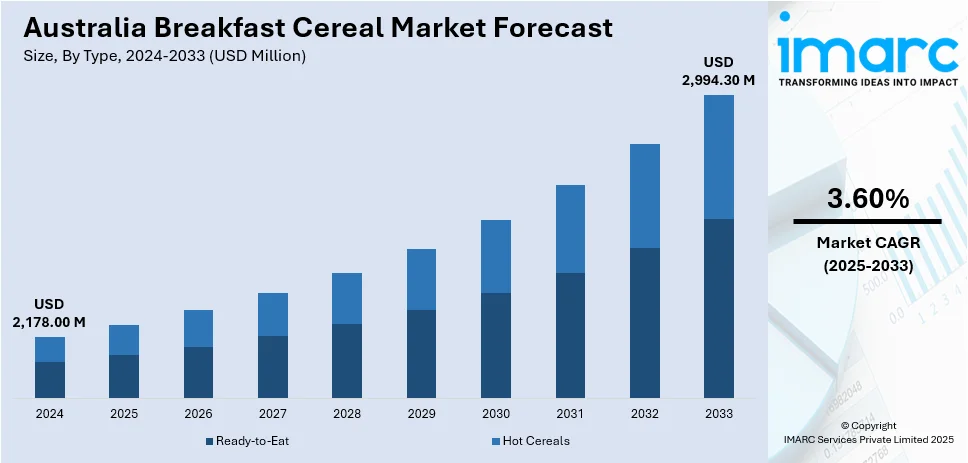

The Australia breakfast cereal market size reached USD 2,178.00 Million in 2024. Looking forward, the market is expected to reach USD 2,994.30 Million by 2033, exhibiting a growth rate (CAGR) of 3.60% during 2025-2033. The market is driven by the rising health awareness among consumers, leading to increased demand for high-fiber, low-sugar, and nutrient-dense options. Increased consumption of gluten-free and organic diets also drives product innovation and segmentation, while busy lifestyles are making convenient, ready-to-eat cereals and single-serve packaging more appealing. Retail expansion, especially through e-commerce, also contributes to the Australia breakfast cereal market share by enhancing accessibility and enabling brands to address specific consumer segments with targeted products and healthier options.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,178.00 Million |

| Market Forecast in 2033 | USD 2,994.30 Million |

| Market Growth Rate 2025-2033 | 3.60% |

Key Trends of Australia Breakfast Cereal Market:

Health-Conscious Consumer Trends

An increasing number of health-conscious Australians are exerting a significant influence on the breakfast cereal industry. Consumers are demanding cereals that are low in sugar, high in fiber, and loaded with essential nutrients. Thus, various options such as granola and muesli are gaining more popularity as they are perceived as healthier alternatives to conventional sugary cereals. The manufacturers are responding by reformulating their existing products with lower sugar content and have also begun developing new ranges specifically targeting health-conscious consumers. This is aligned with the trend where consumers today are actively seeking food options that support digestive health, energy, and overall well-being.

To get more information on this market, Request Sample

Gluten-Free and Organic Growth

The breakfast cereal market in Australia is experiencing an increase in the demand for organic and gluten-free options. This is driven by an increasing number of consumers adopting gluten-free diets due to health reasons or personal choice. Companies are responding to this demand by expanding their product lines to include gluten-free and organic cereals, focusing on this niche yet expanding market. For instance, major companies like Arnott's have significantly invested in gluten-free production facilities, showcasing the importance of this market sector. This diversification caters to consumer demands while also making brands more inclusive and health-focused, enhancing their appeal in a competitive market.

Convenience and On-the-Go Consumption

The busy lifestyle of most Australians is fueling the demand for easy-to-consume and portable breakfasts. Consumers increasingly desire to be able to prepare and consume cereals easily, for instance, through single-serving packs and ready-to-eat ones. This transition is encouraging producers to innovate through the provision of products that combine convenience with nutrition. Hence, cereal products such as pre-packaged granola bars and single-serve muesli cups, are increasingly found on the shelves of supermarkets. These offerings appeal to busy consumers who do not wish to sacrifice health despite time limitations, thus fueling the Australia breakfast cereal market growth.

Growth Drivers of Australia Breakfast Cereal Market:

Expansion of E-commerce and Digital Retail

The rapid growth of e-commerce is significantly influencing the breakfast cereal market in Australia. Online platforms offer consumers the convenience of browsing a wide variety of products, comparing nutritional values, and accessing promotional offers, all from home. Digital retail also enables brands to interact directly with customers, gather feedback, and offer personalized recommendations. This channel is especially beneficial for niche or emerging cereal brands, allowing them to bypass traditional retail barriers and reach broader, more diverse audiences. Seasonal promotions, subscription models, and flash sales further drive engagement and recurring purchases. As internet penetration and digital literacy rise across Australia, e-commerce is becoming an essential driver for product visibility, consumer loyalty, and sales growth in the breakfast cereal category.

Rising Demand Among Children and Teens

Breakfast cereals continue to gain popularity among children and teenagers, driven by engaging advertising, bright packaging, and exciting flavor options. Brands are tailoring offerings to suit younger palates by introducing chocolate, honey, fruit-flavored, or character-branded variants. According to the Australia breakfast cereal market analysis, these products appeal to kids while satisfying parents' preferences for convenience and added nutrition, with many cereals fortified with essential vitamins and minerals. School mornings, sports routines, and snack occasions further boost consumption among this age group. Marketers are also leveraging social media, influencer partnerships, and mobile apps to connect with teens directly, increasing product engagement and brand loyalty. This targeted focus on younger demographics is helping to shape long-term consumer habits and fuel sustained market growth.

Product Innovation and Flavor Diversification

Continuous innovation in ingredients, formats, and flavors is playing a vital role in driving interest in breakfast cereals across various consumer segments. Companies are expanding beyond traditional wheat- or corn-based options to include superfoods, quinoa, seeds, and high-protein alternatives. Flavor diversification—ranging from tropical fruits and chocolate-nut mixes to seasonal spices and yogurt clusters, keeps product lines fresh and appealing. This experimentation caters to evolving consumer preferences for both health and indulgence. Brands are also introducing limited-edition offerings, regional flavors, and snack-sized formats to attract impulse buyers and younger shoppers. Such innovation enhances product visibility, encourages trial, and strengthens brand identity in a competitive market where novelty and variety often influence purchasing decisions.

Opportunities of Australia Breakfast Cereal Market:

Targeting Niche Demographics and Age Groups

The Australia breakfast cereal market presents significant opportunities in targeting under-served consumer segments such as children, older adults, and active individuals. For instance, brands can introduce cereals enriched with calcium, fiber, or protein specifically designed to support senior nutrition. Similarly, fun, low-sugar, or character-themed cereals appeal to children while reassuring parents about health and quality. Athletes and fitness-focused consumers increasingly seek high-protein, high-energy options suited for performance and recovery. Customization based on lifestyle, age, and dietary needs creates stronger brand relevance and encourages long-term consumer loyalty. By diversifying product offerings to meet the unique expectations of these niche demographics, companies can unlock new revenue streams and broaden their consumer base in a competitive, health-conscious market.

Sustainability and Ethical Sourcing Trends

Environmental responsibility is becoming a key factor influencing consumer purchasing decisions in Australia’s breakfast cereal market. More Australians are choosing brands that commit to ethical sourcing, eco-friendly farming, and sustainable packaging solutions. This includes the use of recyclable or compostable materials, carbon-neutral manufacturing, and transparent supply chain practices, which are driving the Australia breakfast cereal market demand. As demand grows for responsible consumption, cereal companies that prioritize environmental and social impact can strengthen their brand image and stand out in a crowded market. Consumers, particularly younger generations, are drawn to companies that reflect their values. Embracing sustainability not only supports global environmental goals but also builds brand trust and loyalty, offering companies a strategic advantage in capturing and retaining an ethically minded customer segment.

Collaboration with Foodservice and Hospitality Sectors

Expanding into foodservice and hospitality presents a valuable opportunity for breakfast cereal brands to increase market presence and drive volume sales. Collaborations with hotels, cafes, gyms, schools, and airline caterers allow companies to introduce cereals in high-traffic, everyday settings. Offering single-serve packs, customizable blends, or private-label solutions tailored for bulk consumption can meet institutional needs while simultaneously promoting brand recognition among new consumers. These partnerships also support seasonal promotions and corporate wellness programs, positioning cereals as convenient, healthy options beyond the home. Such strategies enable brands to diversify their distribution channels, reduce reliance on traditional retail, and tap into steady, recurring business demand from the foodservice ecosystem across urban and regional Australia.

Australia Breakfast Cereal Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, nature, and distribution channel.

Type Insights:

- Ready-to-Eat

- Hot Cereals

The report has provided a detailed breakup and analysis of the market based on the type. This includes ready-to-eat and hot cereals.

Nature Insights:

- Conventional

- Organic

The report has provided a detailed breakup and analysis of the market based on the nature. This includes conventional and organic.

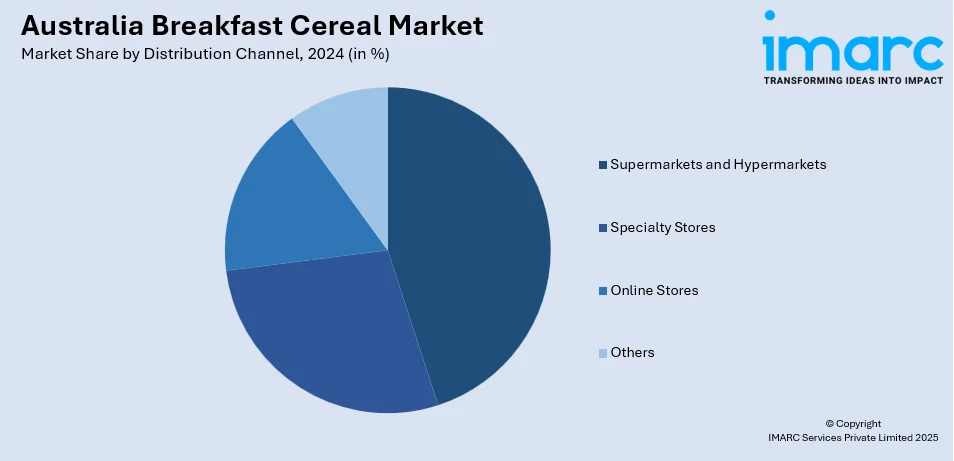

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Specialty Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes supermarkets and hypermarkets, specialty stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- ALDI Stores Australia

- Brookfarm

- Good Food Partners

- Honest to Goodness

- Kellanova Group

- Nestle S.A

- Sanitarium

- The Muesli Company Pty Limited

Australia Breakfast Cereal Market News:

- In March 2025, Kellogg's unveiled a fresh television spot under its 'For Real' campaign, which premiered during an episode of Gogglebox Australia. The collaboration of Gogglebox Australia and Kellogg’s provides makes this campaign a reality by highlighting the genuine nutrition in breakfast cereals, such as the 12.7g of protein in Nutri-Grain High Protein Crunch or the 25% less sugar in Coco Pops Chocos.

- In August 2024, Cereal Partners Worldwide revealed the introduction of KitKat Cereal, a tasty new breakfast choice that brings the beloved KitKat brand to cereal bowls in Australia. Developed in collaboration with the KitKat team, this tasty new cereal feature whole grain and provides a chocolate flavor along with a wafer-like consistency.

- In October 2023, Kellogg's, the Australian cereal brand known for Sultana Brown, Coco Pops, and Corn Flakes, revealed that it is changing its name, although consumers will see no difference on supermarket shelves. The major breakfast food company Kellogg's will be rebranded as Kellanova as part of an initiative to expand into the snack market and offer more portable products in Australia.

Australia Breakfast Cereal Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ready-to-Eat, Hot Cereals |

| Natures Covered | Conventional, Organic |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Specialty Stores, Online Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | ALDI Stores Australia, Brookfarm, Good Food Partners, Honest to Goodness, Kellanova Group, Nestle S.A, Sanitarium, The Muesli Company Pty Limited, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia breakfast cereal market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia breakfast cereal market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia breakfast cereal industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The breakfast cereal market in Australia was valued at USD 2,178.00 Million in 2024.

The Australia breakfast cereal market is projected to exhibit a CAGR of 3.60% during 2025-2033.

The Australia breakfast cereal market is projected to reach a value of USD 2,994.30 Million by 2033.

The major key trend of the market is the innovation in functional ingredients, such as protein, probiotics, and whole grains. Consumers are favoring artisanal blends, clean labels, and reduced sugar content. Eco-conscious packaging and transparent sourcing are trending, while digital engagement through influencers and online campaigns is redefining brand–consumer relationships.

The rising demand for quick, nutritious breakfasts due to busy lifestyles is driving cereal consumption. Expanding retail and e-commerce channels improve product accessibility. Increasing awareness of fortified cereals for children and seniors, along with marketing focused on convenience, nutrition, and variety, continues to boost market growth across demographics.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)