Australia Breakfast Foods Market Size, Share, Trends and Forecast by Source, Packaging Type, Distribution Channel, and Region, 2026-2034

Australia Breakfast Foods Market Summary:

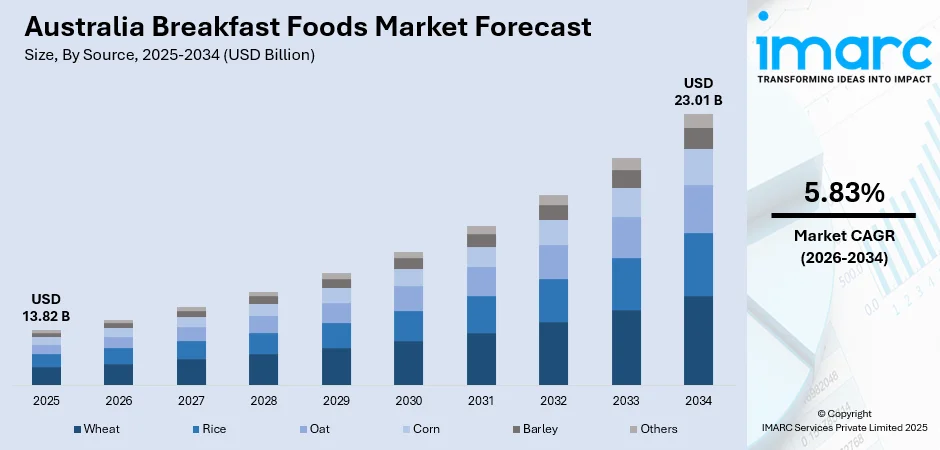

The Australia breakfast foods market size was valued at USD 13.82 Billion in 2025 and is projected to reach USD 23.01 Billion by 2034, growing at a compound annual growth rate of 5.83% from 2026-2034.

This expansion is propelled by evolving consumer preferences toward nutritious morning meal options, expanding product portfolios addressing dietary requirements including gluten-free and plant-based formulations, and accelerating digital retail channels enhancing accessibility. Demographic trends favoring convenience-oriented lifestyles alongside heightened awareness about functional nutrition continue reshaping purchase decisions across urban and regional markets, establishing breakfast foods as a dynamic segment within the broader packaged food industry that reflects both traditional consumption patterns and contemporary health imperatives expanding the Australia breakfast foods market share.

Key Takeaways and Insights:

- By Source: Wheat dominates the market with a share of 35% in 2025, driven by their versatility in creating diverse breakfast offerings from traditional flakes to contemporary granola formulations.

- By Packaging Type: Boxes lead the market with a share of 60% in 2025, reflecting consumer preference for stackable storage solutions, extensive branding opportunities enabling visual differentiation.

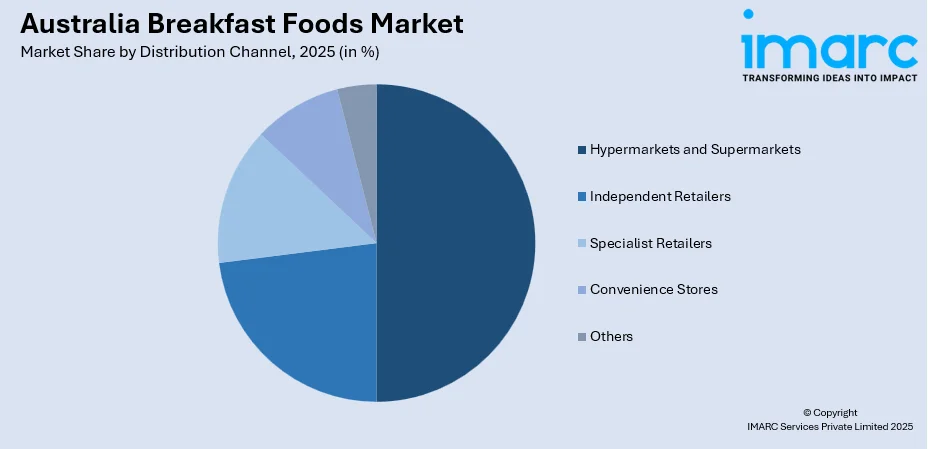

- By Distribution Channel: Hypermarkets and supermarkets represent the largest segment with a market share of 50% in 2025, benefiting from comprehensive product assortments accommodating varied consumer preferences, strategic promotional activities driving trial and repeat purchases.

- Key Players: The Australia breakfast foods market exhibits moderate competitive intensity, with multinational food corporations competing alongside regional manufacturers across price segments. Market participants leverage brand heritage, product innovation capabilities, distribution networks, and marketing investments to maintain market positioning.

To get more information on this market, Request Sample

The market demonstrates robust momentum driven by converging factors including demographic shifts toward dual-income households prioritizing convenience, nutritional awareness prompting reformulation toward reduced sugar and enhanced functional ingredients, and retail modernization expanding accessibility through both physical and digital channels. Recent industry developments illustrate ongoing innovation, with 2024 witnessing Cereal Partners Worldwide's introduction of KitKat Cereal featuring whole grain composition. The KitKat Cereal features cocoa obtained via the Nestlé Cocoa Plan, an initiative designed to enhance the livelihoods of cocoa farmers and ensure sustainable cocoa sourcing, certified by the Rainforest Alliance. These initiatives exemplify manufacturers' responsiveness to consumer demands for both indulgent flavors and nutritional credentials, positioning breakfast foods as a category balancing tradition with contemporary health priorities across diverse demographic segments and consumption occasions throughout Australian households.

Australia Breakfast Foods Market Trends:

Health-Conscious Product Reformulation Accelerating

Manufacturers are systematically reducing sugar content while enhancing nutritional profiles through fiber enrichment and protein fortification, responding to consumer scrutiny of ingredient labels and dietary recommendations emphasizing whole grains and functional nutrition. This reformulation wave encompasses both established brands and emerging products, with companies investing in research and development to maintain taste profiles while improving nutritional density. In 2025, Australia’s beloved Kellogg’s cereals have received a protein-fortified revamp through one of the most thrilling partnerships the health food industry has ever witnessed. Kellanova, the global cereal giant, has teamed up with Macro Mike in a partnership facilitated by brand extension agency Asembl to introduce a limited-edition range of protein powders inspired by three iconic breakfast cereals including Coco Pops®, Nutri-Grain®, and Froot Loops® for Australia and New Zealand.

Expansion of Dietary Specialization Options

The market witnesses significant growth in gluten-free and organic product lines addressing diverse dietary preferences and health considerations ranging from celiac disease to lifestyle choices prioritizing natural ingredients and sustainable agriculture. Manufacturers respond by developing dedicated production facilities ensuring ingredient integrity and certification compliance, with specialized offerings transitioning from niche segments to mainstream availability across major retail channels. This expansion encompasses gluten-free variants along with organic certifications, plant-based formulations, and allergen-free options, collectively broadening market accessibility and enabling personalized nutrition approaches that align with individual health goals and ethical considerations. IMARC Group predicts that the Australia gluten free food market is projected to attain USD 1,007.27 Million by 2033.

Digital Commerce Integration and Direct-to-Consumer Models

E-commerce penetration accelerates as breakfast foods brands enhance online presence through subscription services, personalized marketing strategies, and seamless digital shopping experiences catering to convenience-oriented consumers and enabling targeted product recommendations. According to Australia Post's most recent Quarterly eCommerce Report, Australians invested a record A$20.7bn (US$13.4bn) in online shopping during the July-September 2025 period. Online platforms provide manufacturers direct consumer relationships facilitating feedback loops and data-driven product development while offering consumers greater accessibility particularly in regional areas with limited retail diversity. Moreover, e-commerce platform integration advanced with breakfast cereal brands enhancing online presence and subscription services improving product accessibility and customer engagement through personalized shopping experiences. This digital transformation extends beyond transactional convenience to encompass content marketing and community building, establishing digital channels as integral components of brand strategy.

Market Outlook 2026-2034:

The Australia breakfast foods market is poised for sustained expansion over the forecast period, with revenue trajectories reflecting continued consumer prioritization of convenient, nutritious morning meal solutions despite competitive pressures from alternative breakfast formats and evolving dietary patterns. The market generated a revenue of USD 13.82 Billion in 2025 and is projected to reach a revenue of USD 23.01 Billion by 2034, growing at a compound annual growth rate of 5.83% from 2026-2034. The convergence of health awareness establishes favorable conditions for market development.

Australia Breakfast Foods Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Source | Wheat | 35% |

| Packaging Type | Boxes | 60% |

| Distribution Channel | Hypermarkets and Supermarkets | 50% |

Source Insights:

- Wheat

- Rice

- Oat

- Corn

- Barley

- Others

Wheat dominates with a market share of 35% of the total Australia breakfast foods market in 2025.

Wheat-based breakfast foods maintain market leadership through multiple reinforcing advantages including established agricultural infrastructure supporting consistent domestic supply, nutritional fortification potential enabling vitamin and mineral enrichment addressing public health priorities, and processing versatility accommodating diverse product formats from extruded cereals to baked granolas. The ingredient's neutral flavor profile facilitates both simple preparations and complex flavor combinations, while its structural properties support various textures appealing to different consumer segments.

The wheat segment benefits from ongoing innovation in variety selection and processing techniques, with manufacturers exploring heritage wheat varieties, sprouted grain processing, and whole grain retention maximizing nutritional content while maintaining palatability. In 2025, following two decades of international research and development by CSIRO in collaboration with Limagrain and GRDC, along with breeding efforts from Australian Grain Technologies (AGT), Wise Wheat flour has been created. Alleged to produce six times the fiber of standard wheat flour without sacrificing flavor or texture*, the high-fiber wheat component is cultivated throughout New South Wales and Victoria’s wheat regions.

Packaging Type Insights:

- Boxes

- Pouches

- Others

Boxes lead with a share of 60% of the total Australia breakfast foods market in 2025.

Box packaging maintains substantial market dominance through functional advantages including structural stability protecting product integrity during transportation and storage, stackable geometry optimizing shelf space utilization both at retail and in household pantries, and extensive surface area providing comprehensive branding, nutritional information, and promotional messaging. The format's established supply chain infrastructure enables cost-effective production and distribution, while inner liner technology ensures product freshness through moisture and oxygen barriers.

Consumer familiarity with box format reduces purchase friction, particularly among traditional cereal categories where box packaging represents category convention and quality signal. The format accommodates promotional tactics including on-pack premiums, recipe suggestions, and family engagement activities that extend brand interaction beyond product consumption. Recent innovations explore sustainable material alternatives and reduced packaging weight while maintaining protective properties, addressing both environmental impact concerns and logistics cost optimization. Distribution efficiency benefits from standardized dimensions facilitating palletization and shelf allocation, while retail presentation advantages include vertical display capability.

Distribution Channel Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Hypermarkets and Supermarkets

- Independent Retailers

- Specialist Retailers

- Convenience Stores

- Others

Hypermarkets and supermarkets exhibit a clear dominance with a 50% share of the total Australia breakfast foods market in 2025.

Hypermarkets and supermarkets maintain distribution dominance through unparalleled product breadth spanning value, mainstream, and premium segments within consolidated shopping environments serving diverse household needs. Major retail chains leverage sophisticated category management practices, promotional calendars, and loyalty programs that drive breakfast foods visibility and purchase frequency. These retailers' negotiating power with manufacturers yields competitive pricing accessible to price-conscious consumers while maintaining profitability through efficient supply chain operations and private label offerings.

The channel's strength derives from integrated retail experiences combining physical browsing with digital enhancement through mobile applications, online ordering, and click-and-collect services catering to evolving shopping preferences. Retailers invest in category education through shelf communication, sampling programs, and health-focused merchandising that influence purchase decisions at critical moments. In 2025, Prime Minister has called on Emirati 'hypermarket' chain LuLu Group to rival Coles and Woolworths for market presence as Australia and the United Arab Emirates work on a free-trade agreement. LuLu Hypermarket ranks among the largest retail chains in the Middle East, boasting over 250 locations throughout the Gulf region and beyond.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

ACT & New South Wales have the largest and most mature market for breakfast foods, driven by densely populated urban centers such as Sydney, Canberra, Newcastle, and Wollongong. Supermarkets are the largest outlets for cereals, bread, spreads, and dairy products, but a very strong café culture underpins demand for high-end baked goods, granola, yogurt, and barista-style drinks. Busy professionals and students favor ready-to-eat cereals, bars that can be consumed on the go, and single-serve yogurts.

Victoria, with Melbourne at its forefront, has emerged as a vital location for the development and uptake of innovative breakfast products. Consumers have great openness to organic cereals, plant-based milks, and functional foods. Additionally, the strong culture of coffee in the country bolsters demand for fresh pastries, artisan breads, and grab-and-go items in cafés and convenience stores. Meanwhile, home breakfast occasions remain quite dependent on packaged cereals, toast, and spreads, but shoppers are increasingly trading up to premium muesli, granola, and specialty nut butters.

Queensland's breakfast foods market is reflective of the state's warm climate and tourism orientation. Chilled products, such as yogurt, smoothies, and fresh fruit-based options, are popular along with traditional cereals and toast. Brisbane and the Gold Coast record strong demand for convenient, on-the-go formats targeting commuters and tourists, including breakfast bars, ready-to-drink coffee, and single-serve bakery packs.

Northern Territory & South Australia are smaller but still distinct breakfast foods opportunities. Adelaide anchors South Australia, a high-penetrated market with strong price sensitivity among shoppers; however, there is a steady interest in healthier choices, such as wholegrain cereals and reduced-sugar spreads. The vast distances and remote communities in the Northern Territory make long-life products.

Western Australia Western Australia's market is shaped by Perth's urban demand and the state's significant mining and resources workforce. Modern retail channels drive the sales of branded cereals, artisan bread, premium coffee, plant-based milk, and gourmet spreads in Perth. Consumers are showing an increasing interest in high-protein, high-fiber, and low-sugar breakfast options, especially young professionals and families.

Market Dynamics:

Growth Drivers:

Why is the Australia Breakfast Foods Market Growing?

Convenience-Oriented Lifestyle Evolution

The accelerating pace of Australian lifestyles characterized by dual-income households, extended work commitments, and time-compressed morning routines establishes convenience as a paramount purchase criterion, positioning breakfast foods as optimal solutions delivering nutrition with minimal preparation requirements. Consumer research indicates declining time allocation for morning meal preparation, with breakfast foods offering immediate consumption readiness or rapid preparation pathways that accommodate rushed mornings without sacrificing nutritional intake. Moreover, schools in the country are providing comprehensive breakfast to students, which is again allowing parents to save time. In 2024, Over 52,000 school breakfasts were provided to an additional 2,000 students statewide who participated in the school breakfast program during terms 1 to 3 of last year, thanks to enhanced funding for the initiative.

Nutritional Awareness and Functional Food Demand

Heightened consumer consciousness regarding dietary composition's health implications drives demand for breakfast foods offering clear nutritional benefits, with particular emphasis on fiber content supporting digestive health, protein levels promoting satiety and muscle maintenance, and micronutrient fortification addressing nutritional gaps prevalent in modern diets. Public health campaigns emphasizing breakfast's importance in daily nutrition, combined with medical research linking morning meal consumption to metabolic health and cognitive performance, reinforce breakfast foods' value proposition beyond mere convenience. In 2024, the Outdoor Media Association revealed that the 2024 Healthy Eating campaign ‘Fresh veg, deliciously affordable’ aimed to motivate Australians to choose healthy options while taking into account cost-of-living challenges. Working alongside Health and Wellbeing Queensland and Nutrition Australia, the ‘Fresh Veg, Deliciously Affordable’ initiative achieved remarkable success. A historic $12.3 million in advertising value contributed by OMA members was displayed on more than 18,250 signs throughout all states and territories in Australia during the four-week timeframe from 28 January to 24 February 2024.

Sustainability and Environmental Consciousness

Growing environmental awareness among Australian consumers elevates sustainability considerations in purchase decisions, with breakfast foods manufacturers responding through eco-friendly packaging solutions, responsible sourcing practices, and carbon footprint reduction initiatives that resonate with environmentally conscious demographics. Packaging innovation prioritizes recyclable materials, reduced plastic content, and compostable alternatives addressing consumer concerns about packaging waste and environmental impact. The Australian government's establishment of the 2025 National Packaging Targets promoting 100% reusable, compostable, or recyclable packaging drives industry transformation toward sustainable practices, with manufacturers investing in packaging redesign and supply chain optimization reducing environmental footprints while maintaining product protection and shelf appeal.

Market Restraints:

What Challenges the Australia Breakfast Foods Market is Facing?

Perception of Ultra-Processed Food Products

Growing consumer skepticism toward packaged food products perceived as ultra-processed creates headwinds for breakfast foods categories traditionally associated with manufacturing intensity and ingredient additives. Health-conscious consumers increasingly favor whole food alternatives including fresh fruit, eggs, and artisanal bakery items over packaged cereals, driven by dietary philosophies emphasizing minimally processed ingredients and skepticism toward food technology. Media coverage highlighting sugar content in traditional breakfast cereals, combined with nutritional guidance questioning processed food consumption, reinforces negative perceptions challenging category growth despite reformulation efforts improving nutritional profiles.

Competition from Alternative Breakfast Options

Market growth faces constraints from expanding alternative breakfast choices including protein-based options, smoothie bowls, and international cuisine adoptions that compete for morning meal occasions and household pantry space. Foodservice innovation in quick-service restaurants and cafés offering convenient breakfast menus with perceived freshness advantages draws consumers away from home breakfast preparation, while delivery platforms enhance accessibility to diverse morning meal alternatives. The proliferation of breakfast bar formats, meal replacement beverages, and portable protein options provides convenience competition within grab-and-go segments, fragmenting traditional breakfast foods market share across expanding category boundaries.

Commodity Price Volatility and Input Cost Pressures

Breakfast foods manufacturing confronts significant input cost variability stemming from agricultural commodity price fluctuations affecting primary ingredients including wheat, corn, and oats subject to weather patterns, global supply dynamics, and trade policy impacts. Energy costs associated with manufacturing operations including grain processing, extrusion cooking, and packaging production create additional cost pressures, while transportation expenses affect distribution economics particularly for regional market service. Ingredient cost increases create profitability challenges as manufacturers balance pricing adjustments against consumer price sensitivity and competitive dynamics, with promotional intensity limiting pricing flexibility.

Competitive Landscape:

The Australia breakfast foods market demonstrates moderate competitive intensity characterized by established multinational corporations maintaining significant market positions alongside regional manufacturers and private label offerings from major retail chains. Market structure reflects concentration among leading participants leveraging brand heritage, distribution advantages, and marketing investments, while accommodating niche players addressing specialized dietary segments and premium positioning opportunities. Marketing expenditure levels vary by participant, with major brands investing substantially in advertising across traditional and digital media building brand awareness and preference, while smaller players focus resources on targeted segments and alternative communication channels including social media and influencer partnerships. Price competition exists primarily in value segments where private label presence exerts pressure, though brand differentiation through quality perception and nutritional positioning enables premium pricing sustainability.

Recent Developments:

- In November 2025, Arada has allocated AED60 million to Brooki Bakehouse, the Australian bakery known for its popular presence on social media. The deal executed by Arada’s hospitality and entertainment division marks Brooki Bakehouse’s initial significant external investment, allowing the brand to grow internationally, starting in the United Arab Emirates this year and subsequently entering additional markets in 2026.

- In July 2025, Wieden+Kennedy Sydney’s new work for Macca is launched, titles as 'Brekkie Comes First'. The campaign honors Macca’s breakfast menu as the highlight of a brekkie enthusiast’s day.

Australia Breakfast Foods Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Sources Covered | Wheat, Rice, Oat, Corn, Barley, Others |

| Packaging Types Covered | Boxes, Pouches, Others |

| Distribution Channels Covered | Hypermarkets and Supermarkets, Independent Retailers, Specialist Retailers, Convenience Stores, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia breakfast foods market size was valued at USD 13.82 Billion in 2025.

The Australia breakfast foods market is expected to grow at a compound annual growth rate of 5.83% from 2026-2034 to reach USD 23.01 Billion by 2034.

Wheat-based products dominate the source segment with approximately 35% market share, driven by versatility in product applications, established consumer familiarity, nutritional fortification potential, and cost-effectiveness supporting competitive pricing across retail segments

Key factors driving the Australia breakfast foods market include convenience-oriented lifestyle evolution emphasizing time-efficient morning meal solutions, nutritional awareness promoting functional food demand with enhanced fiber and protein content, sustainability consciousness driving eco-friendly packaging adoption, and ongoing product innovation addressing diverse dietary preferences including gluten-free and organic formulations.

Major challenges include perception of ultra-processed food products prompting consumer preference shifts toward whole food alternatives, competition from expanding breakfast options including foodservice innovations and meal replacement formats, and evolving regulatory requirements around nutritional claims and packaging sustainability standards requiring ongoing compliance investments.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)