Australia Bridge Construction and Maintenance Market Size, Share, Trends and Forecast by Bridge Type, Material Used, Construction Type, Application, Maintenance Activity, and Region, 2025-2033

Australia Bridge Construction and Maintenance Market Overview:

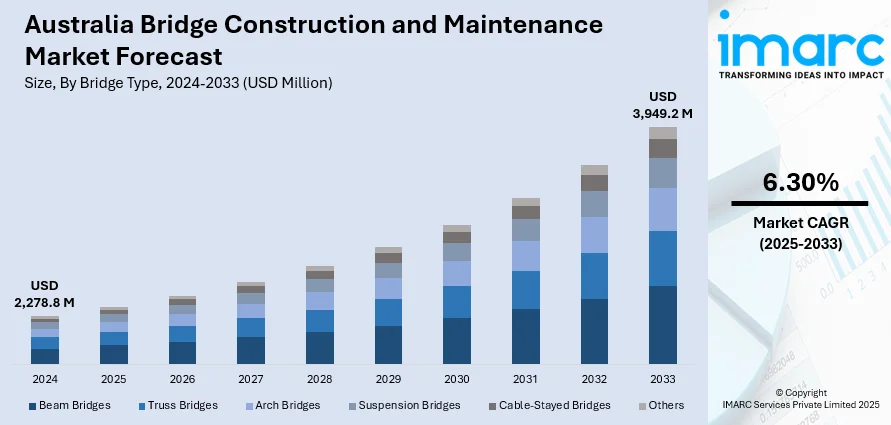

The Australia bridge construction and maintenance market size reached USD 2,278.8 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 3,949.2 Million by 2033, exhibiting a growth rate (CAGR) of 6.30% during 2025-2033. The market is majorly driven by the considerable increase in infrastructure development, with government focus on enhancing transportation networks across urban and rural areas. Technological innovations in construction, such as automation and smart technologies, are improving efficiency and safety in both building and maintaining bridges, thereby propelling the market. Government policies and funding initiatives continue to support large-scale infrastructure projects, further augmenting the Australia bridge construction and maintenance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 2,278.8 Million |

|

Market Forecast in 2033

|

USD 3,949.2 Million |

| Market Growth Rate 2025-2033 | 6.30% |

Australia Bridge Construction and Maintenance Market Trends:

Technological Advancements in Construction

Technological innovations in construction have been at the forefront in driving the market. The use of advanced materials, including high-performance concrete and composite materials, and advanced construction methods like prefabrication and automation has resulted in enhanced efficiency in the construction of bridges and their repair. These innovations not only shorten construction timelines but also improve the durability and safety of bridges, reducing the frequency of necessary repairs. The integration of smart technologies, such as sensors and automated monitoring systems, has become crucial in predictive maintenance, allowing for more precise and timely interventions. On April 22, 2025, the Seymour-Avenel Road bridge in Victoria was opened as part of Australia's Inland Rail infrastructure improvements, enhancing freight movement across the region. The new bridge, rising 3.2 meters higher and spanning 35 meters, replaces an older structure to allow double-stacked freight trains to pass safely beneath. The project, part of the broader Inland Rail initiative, utilized 170,000 tons of locally sourced material and is expected to significantly improve freight speed and regional connectivity. These advancements have transformed the practice of maintenance from reactive to proactive, significantly improving the general efficiency of bridge maintenance. These technologies will become crucial in coordinating the increasing requirements of Australia's bridge infrastructure, further propelling the market in the future. The use of advanced tools and techniques has changed the manner in which bridge building and maintenance is conducted, giving the industry immense growth opportunities.

To get more information on this market, Request Sample

Government Policies and Funding Initiatives

Government policies and funding initiatives have significantly impacted the market. Public-private partnerships (PPP), coupled with federal and state funding, have made large-scale infrastructure projects more feasible and sustainable. In recent years, the Australian government has committed to substantial investments in infrastructure to enhance transportation networks, particularly to address congestion in major metropolitan areas and improve connectivity in rural regions. Additionally, regulations governing safety standards and environmental impacts have led to an increase in bridge repair and maintenance activities to ensure compliance with these evolving requirements. Financial incentives, subsidies, and grants aimed at improving infrastructure, combined with long-term plans for urban development, have provided a stable environment for Australia bridge construction and maintenance market growth. On February 4, 2025, the Australian and NSW Governments awarded a contract for the Sheahan Bridge Upgrade project on the Hume Highway at Gundagai, with a joint funding of AUD 20 Million (USD 13.2 Million). The project aims to improve the bridge's capacity for heavy vehicles, addressing limitations due to the age and structure of the current northbound bridge, built in 1977. WSP Australia Pty Ltd will provide the concept design and environmental assessment for potential upgrade or replacement options, with a preferred solution expected to be identified by mid-2026. These governmental efforts not only support the construction of new bridges but also ensure the longevity and safety of existing structures through continuous maintenance. As these policies continue to shape the market, they create a favorable climate for industry expansion and innovation.

Australia Bridge Construction and Maintenance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on bridge type, material used, construction type, application, and maintenance activity.

Bridge Type Insights:

- Beam Bridges

- Truss Bridges

- Arch Bridges

- Suspension Bridges

- Cable-Stayed Bridges

- Others

The report has provided a detailed breakup and analysis of the market based on the bridge type. This includes beam bridges, truss bridges, arch bridges, suspension bridges, cable-stayed bridges, and others.

Material Used Insights:

- Concrete

- Steel

- Composite Materials

- Pre-Stressed Structures

The report has provided a detailed breakup and analysis of the market based on the material used. This includes concrete, steel, composite materials, and pre-stressed structures.

Construction Type Insights:

- New Bridge Construction

- Bridge Rehabilitation and Retrofitting

The report has provided a detailed breakup and analysis of the market based on the construction type. This includes new bridge construction and bridge rehabilitation and retrofitting.

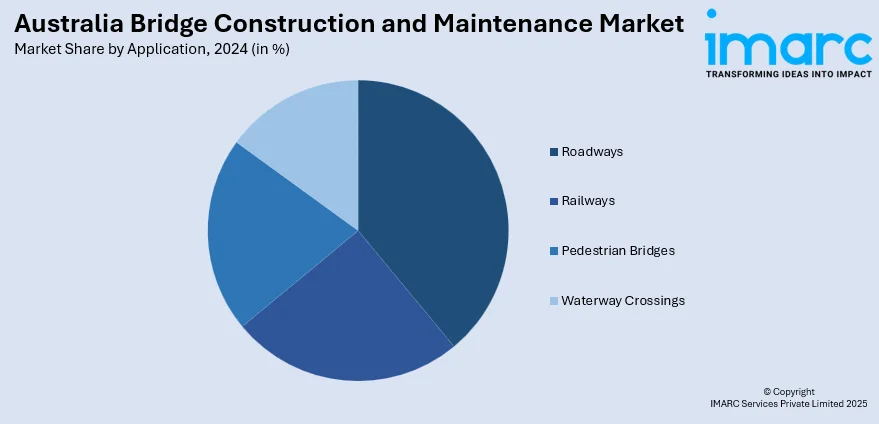

Application Insights:

- Roadways

- Railways

- Pedestrian Bridges

- Waterway Crossings

The report has provided a detailed breakup and analysis of the market based on the application. This includes roadways, railways, pedestrian bridges, and waterway crossings.

Maintenance Activity Insights:

- Structural Repairs

- Resurfacing and Coating

- Safety Enhancements

- Load Capacity Upgrades

The report has provided a detailed breakup and analysis of the market based on the maintenance activity. This includes structural repairs, resurfacing and coating, safety enhancements, and load capacity upgrades.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Bridge Construction and Maintenance Market News:

- On May 7, 2025, the Toowoomba Regional Council announced the completion of the Perseverance Hall Road bridge construction at Ravensbourne, marking the end of contractor Georgiou Group’s work for the 2022 Flood Recovery Program. The new bridge replaces a culvert damaged in the 2022 floods, improving resilience against future events, enhancing traffic flow, and reducing environmental impacts. The broader recovery program has repaired over 1,500 roads and replaced more than 100 culverts across the region, supported by the Australian and Queensland Governments' Disaster Recovery Funding Arrangements.

Australia Bridge Construction and Maintenance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Bridge Types Covered | Beam Bridges, Truss Bridges, Arch Bridges, Suspension Bridges, Cable-Stayed Bridges, Others |

| Materials Covered | Concrete, Steel, Composite Materials, Pre-Stressed Structures |

| Construction Types Covered | New Bridge Construction, Bridge Rehabilitation and Retrofitting |

| Applications Covered | Roadways, Railways, Pedestrian Bridges, Waterway Crossings |

| Maintenance Activities Covered | Structural Repairs, Resurfacing and Coating, Safety Enhancements, Load Capacity Upgrades |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia bridge construction and maintenance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia bridge construction and maintenance market on the basis of bridge type?

- What is the breakup of the Australia bridge construction and maintenance market on the basis of material used?

- What is the breakup of the Australia bridge construction and maintenance market on the basis of construction type?

- What is the breakup of the Australia bridge construction and maintenance market on the basis of application?

- What is the breakup of the Australia bridge construction and maintenance market on the basis of maintenance activity?

- What is the breakup of the Australia bridge construction and maintenance market on the basis of region?

- What are the various stages in the value chain of the Australia bridge construction and maintenance market?

- What are the key driving factors and challenges in the Australia bridge construction and maintenance market?

- What is the structure of the Australia bridge construction and maintenance market and who are the key players?

- What is the degree of competition in the Australia bridge construction and maintenance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia bridge construction and maintenance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia bridge construction and maintenance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia bridge construction and maintenance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)