Australia Bridge Construction Market Size, Share, Trends and Forecast by Type, Material, Application, and Region, 2025-2033

Australia Bridge Construction Market Overview:

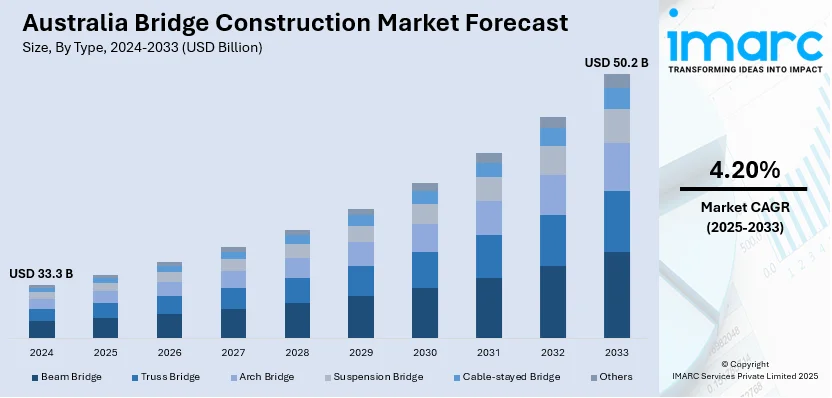

The Australia bridge construction market size reached USD 33.3 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 50.2 Billion by 2033, exhibiting a growth rate (CAGR) of 4.20% during 2025-2033. The market is driven by government infrastructure spending, urbanization, and population growth, which increase demand for transport networks. Private investment through PPPs accelerates project delivery, while aging bridges require upgrades. Technological advancements, such as modular construction and digital tools, enhance efficiency, sustainability, and cost-effectiveness, further expanding the Australia bridge construction market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 33.3 Billion |

| Market Forecast in 2033 | USD 50.2 Billion |

| Market Growth Rate 2025-2033 | 4.20% |

Australia Bridge Construction Market Trends:

Increasing Investment in Infrastructure Projects

The significant growth due to increased government and private investment in infrastructure is majorly driving the Australia bridge construction market growth. Australia's New Dubbo Bridge project worth $ 263.2 Million is under construction, wherein one-third of the 660-meter concrete deck has already been completed. The project is scheduled to be completed by late 2026. It is funded by $ 210.6 Million from the federal government and $ 52.6 Million from the New South Wales government. Adopting P2478CB, this bridge will enhance flood resilience and enable the construction of 5,500 new homes. It will also generate 1,500 jobs and connect critical roads over the Macquarie River, deeming it one of Western New South Wales’s largest-ever infrastructure projects. With urbanization and population growth driving demand for better transport networks, federal and state governments are prioritizing bridge projects to improve connectivity and reduce congestion. Initiatives including the Infrastructure Australia Priority List highlight key projects, including the Melbourne Metro Tunnel and Sydney’s Western Harbour Tunnel, which involve major bridge constructions. Additionally, the Bridges Renewal Program allocates funding to upgrade aging bridges, enhancing safety and capacity. Private sector participation through Public-Private Partnerships (PPPs) is also rising, accelerating project delivery. This trend is expected to continue as Australia focuses on resilient and sustainable infrastructure to support economic growth, creating opportunities for construction firms, engineers, and material suppliers.

To get more information on this market, Request Sample

Increasing Use of Alternative Financing Models for Large-Scale Projects

With traditional funding methods under strain, Australia’s bridge construction sector is embracing innovative financing solutions to deliver critical infrastructure. Value capture mechanisms—where beneficiaries such as developers contribute to project costs—are gaining traction, particularly for urban bridges that enhance property values. Green bonds and sustainability-linked loans are also being utilized to fund eco-friendly designs, attracting ESG-focused investors. On 2nd December’2024, IFC issued a 10-year AUD 700 Million Green Kangaroo Bond with a coupon of 4.90%. This is the largest 10-year supranational transaction for biodiversity in the emerging world since 2010. Demand reached 800 Million AUD and net proceeds will be allocated to ecosystem restoration projects in accordance with IFC’s updated Green Bond Framework. As green finance continues to grow in Australia, these financial instruments may also facilitate the development of nature-positive infrastructure, such as sustainable bridge construction throughout the region. In addition, the federal government is exploring availability payment models, where private consortia finance construction in exchange for long-term operational reimbursements. This shift helps mitigate budget constraints while accelerating project timelines. Additionally, state governments are increasingly bundling multiple bridges into single contracts to improve economies of scale, creating a positive Australia bridge construction market outlook.

Australia Bridge Construction Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, material, and application.

Type Insights:

- Beam Bridge

- Truss Bridge

- Arch Bridge

- Suspension Bridge

- Cable-stayed Bridge

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes beam bridge, truss bridge, arch bridge, suspension bridge, cable-stayed bridge, and others.

Material Insights:

- Steel

- Concrete

- Composite Materials

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes steel, concrete, and composite materials.

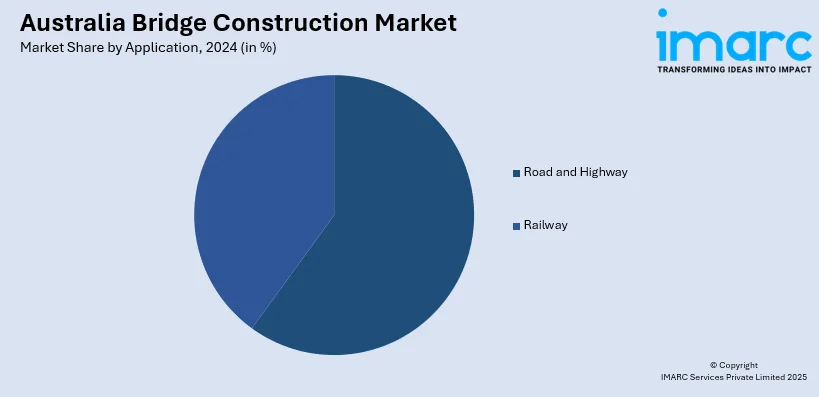

Application Insights:

- Road and Highway

- Railway

The report has provided a detailed breakup and analysis of the market based on the application. This includes road and highway and railway.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Bridge Construction Market News:

- November 27, 2024: European construction group STRABAG plans to expand to Australia by acquiring Georgiou Group, a specialist in road and infrastructure construction with approximately 875 employees and an annual revenue of AUD 1.3 Billion.

Australia Bridge Construction Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Beam Bridge, Truss Bridge, Arch Bridge, Suspension Bridge, Cable-stayed Bridge, Others |

| Materials Covered | Steel, Concrete, Composite Materials |

| Applications Covered | Road and Highway, Railway |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia bridge construction market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia bridge construction market on the basis of type?

- What is the breakup of the Australia bridge construction market on the basis of material?

- What is the breakup of the Australia bridge construction market on the basis of application?

- What is the breakup of the Australia bridge construction market on the basis of region?

- What are the various stages in the value chain of the Australia bridge construction market?

- What are the key driving factors and challenges in the Australia bridge construction market?

- What is the structure of the Australia bridge construction market and who are the key players?

- What is the degree of competition in the Australia bridge construction market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia bridge construction market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia bridge construction market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia bridge construction industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)