Australia Building Energy Efficiency Systems Market Size, Share, Trends and Forecast by System Type, Building Type, Deployment, Technology Type, and Region, 2026-2034

Australia Building Energy Efficiency Systems Market Overview:

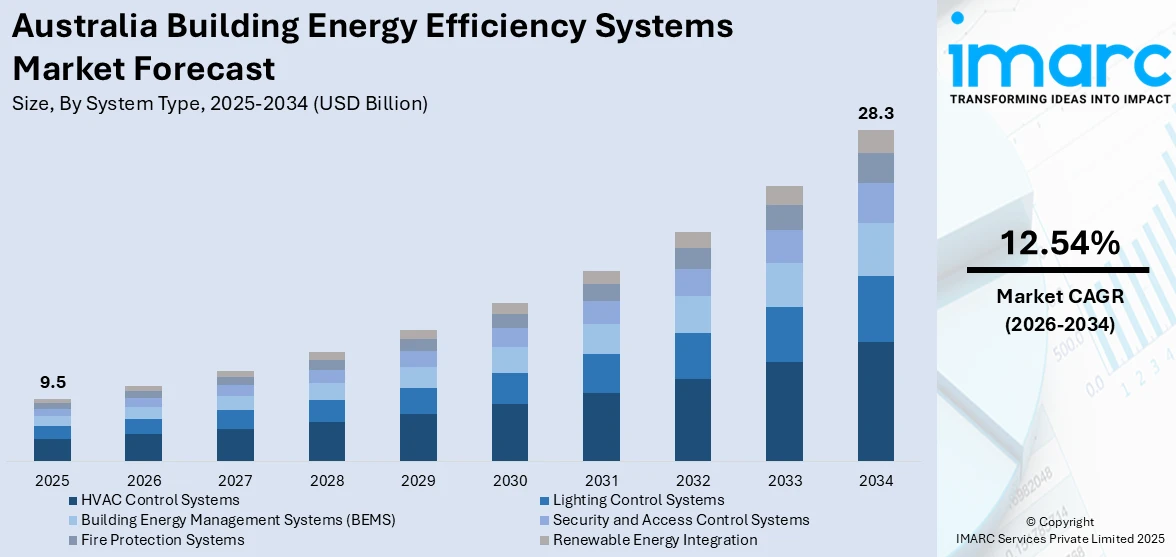

The Australia building energy efficiency systems market size reached USD 9.5 Billion in 2025. Looking forward, the market is expected to reach USD 28.3 Billion by 2034, exhibiting a growth rate (CAGR) of 12.54% during 2026-2034. The market is driven by the adoption of smart technologies, integration of renewable energy, and retrofitting of older infrastructure. These trends enhance sustainability, lower energy consumption, and support long-term cost savings across residential, commercial, and institutional sectors. Propelled by national goals for reduced emissions and environmental responsibility, the market continues to gain momentum as stakeholders prioritize efficiency in new and existing structures. Further, Australia building energy efficiency systems share reflected its growing role in the global market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 9.5 Billion |

| Market Forecast in 2034 | USD 28.3 Billion |

| Market Growth Rate (2026-2034) | 12.54% |

Key Trends of Australia Building Energy Efficiency Systems Market:

Smart Technologies Integration for Energy Optimization

The progressive move toward digital infrastructure has further intensified the integration of smart technologies in building energy efficiency systems in Australia. Advanced systems like automated heating, ventilation, and air conditioning controls, adaptive lighting, and occupancy-based energy use monitoring are being increasingly integrated into commercial, residential, and institutional buildings. These smart elements facilitate real-time data gathering and analysis, enabling dynamic energy management and predictive maintenance. As buildings become intensely integrated via the Internet of Things (IoT), energy consumption is optimized according to usage habits, time-of-day demand, and seasonal changes. This change minimizes total consumption and contributes to national sustainability objectives. Australia's building energy efficiency systems development is being predominantly fueled by this technological progress, supporting a shift toward smarter infrastructure that reduces waste and maximizes operational performance while maintaining environmental stewardship.

To get more information on this market Request Sample

Growing Use of Renewable Energy Integration

The Australia market is observing a growing trend for integrating renewable energy sources into building energy systems. Solar photovoltaic (PV) panels, wind microturbines, and energy storage systems are becoming an integral part of new construction as well as retrofitting initiatives. Such renewable systems tend to be integrated with sophisticated energy management platforms that focus on green energy utilization with optimal grid interaction. This change is a manifestation of both environmental responsibility and economic considerations, as buildings cut down on their reliance on fossil fuels and save on electricity bills. Grid-interactive efficient buildings (GEBs) are now becoming the model of choice, where demand response is balanced with renewable inputs. On-site renewables integration increases self-reliance and meets national energy policy directives aimed at decarbonization. Australia building energy efficiency systems market growth is further boosted by this trend, with sustainability frameworks encouraging decentralized, cleaner power in accordance with carbon neutrality goals.

Retrofitting and Building Upgrades

One of the major trends in Australia is retrofitting buildings to current energy efficiency standards. Instead of depending entirely on new builds, there is a strategic effort to improve the energy performance of existing infrastructure through retrofits like insulation upgrades, energy-efficient windows, light emitting diode (LED) lighting systems, and upgraded heating, ventilation, and air conditioning (HVAC) installations. This decrease energy consumption, and prolongs the life and usability of older buildings. Financial incentives, performance-based benchmarking, and changing regulatory requirements are motivating owners of property and facilities managers to invest in retrofits. Such projects frequently include thorough audits and phased rollouts to maximize returns on investment. The upshot is a substantial improvement in Australia's overall efficiency of the built environment. Australia's building energy efficiency systems development is inextricably linked to this emphasis on modernization, narrowing the gap between aging infrastructure and the demands of a modern energy management needs while enhancing a more sustainable city environment.

Growth Drivers of Australia Building Energy Efficiency Systems Market:

Government Regulations and Policies

Government initiatives are crucial in driving the adoption of energy-efficient solutions within Australia's building sector. Stringent building codes, minimum energy performance standards, and mandatory certifications have prompted property developers and facility managers to incorporate advanced energy management systems into both new and existing buildings. These regulations are designed to decrease national energy consumption and align with wider sustainability and climate objectives. Incentives, rebates, and tax benefits also assist businesses and households in upgrading to more efficient technologies. With governments prioritizing greener urban infrastructure, compliance has become essential. This regulatory momentum fosters a conducive environment for innovation, investment, and large-scale implementation, ultimately stimulating Australia building energy efficiency systems market growth.

Rising Energy Costs

Energy prices in Australia continue to rise, creating financial strain on households, commercial properties, and industrial facilities. Consequently, both businesses and homeowners are seeking cost-effective approaches to manage their energy usage. Energy efficiency systems, including smart HVAC, lighting controls, and automated energy management platforms, deliver measurable savings by minimizing waste and optimizing usage patterns. Increased energy costs also enhance the attractiveness of investing in efficiency technologies, encouraging quicker adoption. Additionally, unpredictable variations in electricity and fuel markets underscore the significance of energy independence and efficiency. By reducing operational costs while supporting sustainability goals, these solutions are being more widely embraced across residential, commercial, and industrial sectors. This growing reliance on efficient systems is significantly boosting Australia building energy efficiency systems market demand.

Corporate ESG Commitments

Corporate responsibility and sustainability initiatives are increasingly central to business strategies in Australia. Organizations are focusing on energy-efficient infrastructure to fulfill environmental, social, and governance (ESG) goals, demonstrating their commitment to reducing carbon footprints and enhancing operational efficiency. Beyond adhering to regulations, companies are willingly investing in smart building systems, renewable integration, and advanced automation to enhance brand reputation and attract environmentally conscious investors. Energy efficiency is regarded as a competitive advantage, helping businesses lower long-term costs while exhibiting leadership in sustainability. With ESG reporting becoming more linked to investment decisions, firms adopting these technologies are boosting their market credibility. This heightened corporate emphasis on sustainability directly contributes to the growth of Australia building energy efficiency systems market share.

Government Initiatives for Australia Building Energy Efficiency Systems Market:

National Construction Code (NCC) Updates

The National Construction Code (NCC) is fundamental to building regulations in Australia, establishing required standards for safety, sustainability, and energy efficiency. Recent updates have established more stringent energy efficiency standards, requiring new buildings to incorporate advanced insulation, lighting, HVAC systems, and materials that lower energy usage. These initiatives are designed to minimize the overall carbon footprint of construction while also offering long-term cost savings for property owners. Adhering to NCC standards has become essential for architects, builders, and developers, affecting design choices and material selections. By enforcing stringent benchmarks, the NCC guarantees that energy efficiency is considered in the building design process from the beginning, fostering sustainable urban development and encouraging the widespread adoption of energy-efficient systems in both commercial and residential projects throughout Australia.

Minimum Energy Performance Standards (MEPS)

Minimum Energy Performance Standards (MEPS) aim to govern appliances, lighting, and building equipment to ensure a consistent level of energy efficiency across the industry. By establishing baseline efficiency standards, MEPS helps reduce energy waste and motivates manufacturers to innovate toward more sustainable technologies. Compliance is compulsory, and products that do not meet these standards are prohibited from entering the market, promoting higher-quality, energy-efficient options. Additional incentives and audits help reinforce compliance and encourage adoption. According to Australia building energy efficiency systems market analysis, MEPS has emerged as a crucial factor for both product development and building renovations, as businesses and homeowners place a growing emphasis on energy savings, sustainability, and long-term cost reductions. This framework is instrumental in shaping demand for advanced energy management and building efficiency solutions across the nation.

Green Star and NABERS Programs

The Green Star and NABERS programs are voluntary rating systems designed to advocate for sustainable building practices in Australia. Green Star evaluates both new and existing buildings for their energy efficiency, water consumption, indoor environmental quality, and overall sustainability. Meanwhile, NABERS provides a framework for measuring the operational performance in areas such as energy, water, waste, and indoor environmental quality. These programs incentivize building owners and developers to implement innovative energy-saving solutions and monitor measurable improvements over time. Obtaining high ratings enhances a brand’s reputation, draws in tenants or buyers, and may yield financial benefits through lower operational costs. By providing transparent performance metrics, these programs stimulate competition, promote the adoption of energy-efficient technologies, and align with national objectives to lower emissions and maximize energy consumption efficiency in commercial and residential buildings.

Australia Building Energy Efficiency Systems Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on system type, building type, deployment, and technology type.

System Type Insights:

- HVAC Control Systems

- Lighting Control Systems

- Building Energy Management Systems (BEMS)

- Security and Access Control Systems

- Fire Protection Systems

- Renewable Energy Integration

The report has provided a detailed breakup and analysis of the market based on the system type. This includes HVAC control systems, lighting control systems, building energy management systems (BEMS), security and access control systems, fire protection systems, and renewable energy integration.

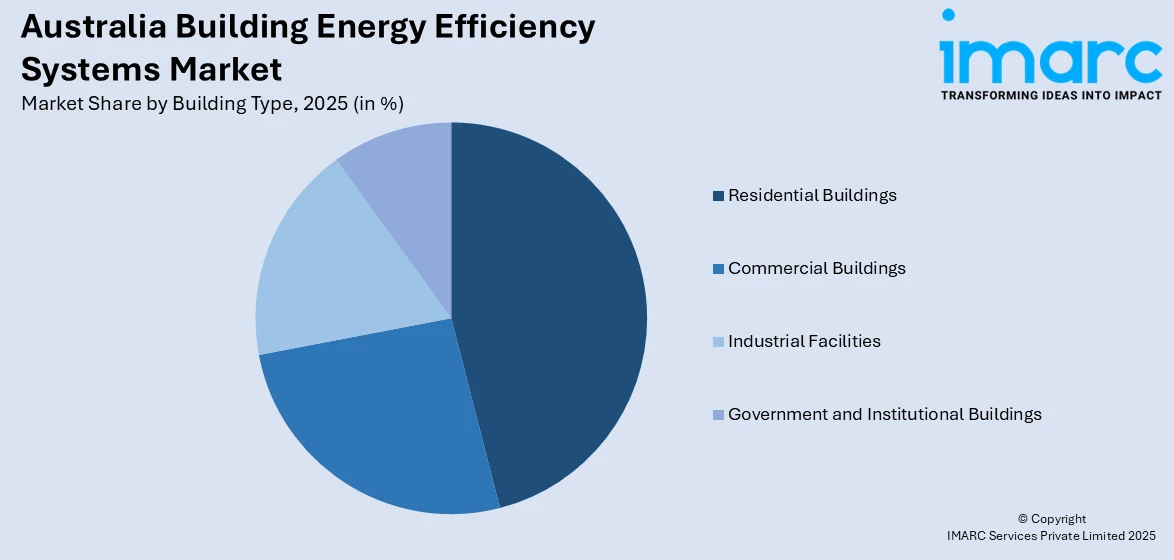

Building Type Insights:

Access the comprehensive market breakdown Request Sample

- Residential Buildings

- Commercial Buildings

- Industrial Facilities

- Government and Institutional Buildings

A detailed breakup and analysis of the market based on the building type have also been provided in the report. This includes residential buildings, commercial buildings, industrial facilities, and government and institutional buildings.

Deployment Mode Insights:

- On-Premises

- Cloud-Based

The report has provided a detailed breakup and analysis of the market based on the deployment mode. This includes on-premises and cloud-based.

Technology Type Insights:

- Wired Systems

- Wireless Systems

A detailed breakup and analysis of the market based on the technology type have also been provided in the report. This includes wired systems and wireless systems.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Building Energy Efficiency Systems Market News:

- In June 2024, CoreLogic and CSIRO unveiled RapidRate, an artificial intelligence-based platform to approximate the energy efficiency of Australia's 11 million residential homes. By marrying four decades of property information with sophisticated machine learning under the Nationwide House Energy Rating Scheme (NatHERS), the platform equips banks and lenders with enhanced sustainability knowledge to meet climate transition objectives and emissions reporting requirements for the housing market.

Australia Building Energy Efficiency Systems Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| System Types Covered | HVAC Control Systems, Lighting Control Systems, Building Energy Management Systems (BEMS), Security and Access Control Systems, Fire Protection Systems, Renewable Energy Integration |

| Building Types Covered | Residential Buildings, Commercial Buildings, Industrial Facilities, Government and Institutional Buildings |

| Deployment Modes Covered | On-Premises, Cloud-Based |

| Technology Types Covered | Wired Systems, Wireless Systems |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia building energy efficiency systems market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia building energy efficiency systems market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia building energy efficiency systems industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The building energy efficiency systems market in Australia was valued at USD 9.5 Billion in 2025.

The Australia building energy efficiency systems market is projected to exhibit a compound annual growth rate (CAGR) of 12.54% during 2026-2034.

The Australia building energy efficiency systems market is expected to reach a value of USD 28.3 Billion by 2034.

The market is witnessing increased adoption of smart building technologies, including IoT-enabled sensors and AI-driven energy management systems. Growing integration of renewable energy, focus on retrofitting existing buildings, and adoption of green certification programs are also shaping trends, alongside demand for predictive maintenance and real-time energy monitoring solutions.

Rising energy costs and government regulations promoting sustainability are key growth drivers. Urbanization, expansion of commercial and residential infrastructure, corporate ESG initiatives, and growing awareness about lifecycle cost savings from energy-efficient buildings further stimulate adoption, driving long-term demand for advanced energy management and efficiency solutions in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)