Australia Business Process Management Market Size, Share, Trends and Forecast by Deployment Type, Component, Business Function, Organization Size, Vertical, and Region, 2025-2033

Australia Business Process Management Market Size and Share:

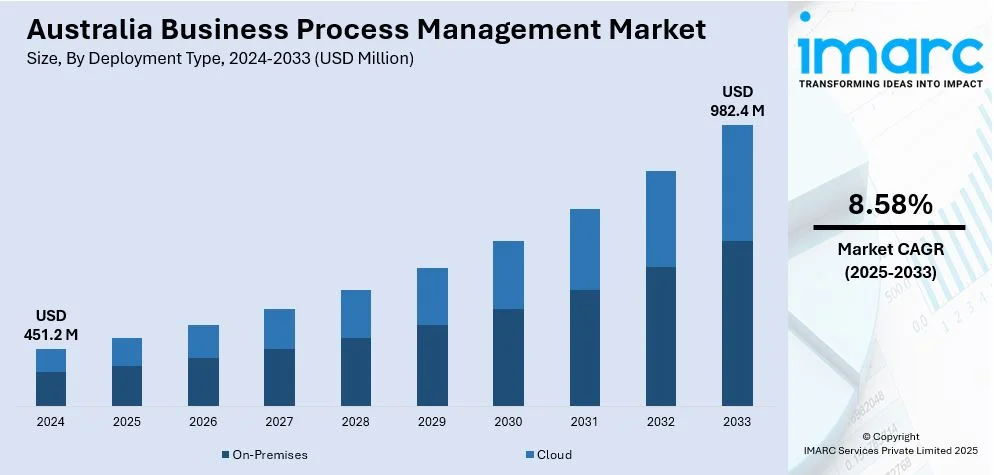

The Australia business process management market size reached USD 451.2 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 982.4 Million by 2033, exhibiting a growth rate (CAGR) of 8.58% during 2025-2033. Increased automation adoption, digital transformation initiatives, demand for operational efficiency, rising use of cloud-based BPM solutions, regulatory compliance requirements, and the growing need to enhance customer experience and streamline business operations across various industry sectors are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 451.2 Million |

| Market Forecast in 2033 | USD 982.4 Million |

| Market Growth Rate 2025-2033 | 8.58% |

Australia Business Process Management Market Trends:

Rising Investment in Automation-Driven Operations

Australia is seeing growing interest in automation and low-code platforms as organizations push to modernize their operations and streamline service delivery. Financial institutions, law firms, and large enterprises are adopting business process tools that enable rapid deployment of digital workflows without overhauling legacy systems. This shift is driving increased demand for scalable solutions that support both compliance and operational agility. As more companies recognize the value of faster decision-making and improved customer experience, technology providers are expanding their local presence and strengthening ties with enterprise clients. The focus is on solutions that integrate easily, reduce manual effort, and support continuous improvement across departments. This pattern signals a broader shift toward operational resilience, with organizations prioritizing flexibility and speed in how they manage internal processes and external interactions. For example, in May 2024, Appian Corporation opened a new office in Melbourne's central business district to support its growing team and enhance engagement with clients and partners. This expansion reflects Appian's commitment to the Australian market, serving organizations like Bendigo and Adelaide Bank, MinterEllison, and Westpac.

To get more information on this market, Request Sample

Technology Adoption Becoming a Strategic Priority for SMEs

Amid rising operational costs, Australian small and medium-sized enterprises are shifting focus toward technology to improve efficiency and protect margins. A significant number are planning investments in digital tools that help reduce expenses and unlock new revenue streams. This growing interest in process automation and workflow optimization signals a broader move toward smarter resource management. Businesses are exploring platforms that streamline repetitive tasks, improve data handling, and support faster decision-making. The focus is not only on cost control but also on building resilience and competitiveness in a tightening economic environment. With economic pressure accelerating change, companies are becoming more intentional about upgrading internal processes. This proactive mindset is reshaping how smaller firms approach business operations, favoring scalable, tech-driven solutions that offer clear value in managing day-to-day complexity while positioning them for sustainable growth. For instance, the National Australia Bank's SME Business Insights report, published in January 2025, indicated that three in four Australian small and medium-sized enterprises expect further increases in the cost of doing business in 2025. Many SMEs plan to focus on technology adoption to aid cost reduction and revenue generation, reflecting a proactive approach to business process management.

Australia Business Process Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on deployment type, component, business function, organization size, and vertical.

Deployment Type Insights:

- On-Premises

- Cloud

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes on-premises and cloud.

Component Insights:

- IT Solution

- Process Improvement

- Automation

- Content and Document Management

- Integration

- Monitoring and Optimization

- IT Service

- System Integration

- Consulting

- Training and Education

A detailed breakup and analysis of the market based on the component have also been provided in the report. This includes IT solution (process improvement, automation, content and document management, integration, and monitoring and optimization) and IT service (system integration, consulting, and training and education).

Business Function Insights:

- Human Resource

- Accounting and Finance

- Sales and Marketing

- Manufacturing

- Supply Chain Management

- Operation and Support

- Others

The report has provided a detailed breakup and analysis of the market based on the business function. This includes human resource, accounting and finance, sales and marketing, manufacturing, supply chain management, operation and support, and others.

Organization Size Insights:

- SMEs

- Large Enterprises

A detailed breakup and analysis of the market based on the organization size have also been provided in the report. This includes SMEs and large enterprises.

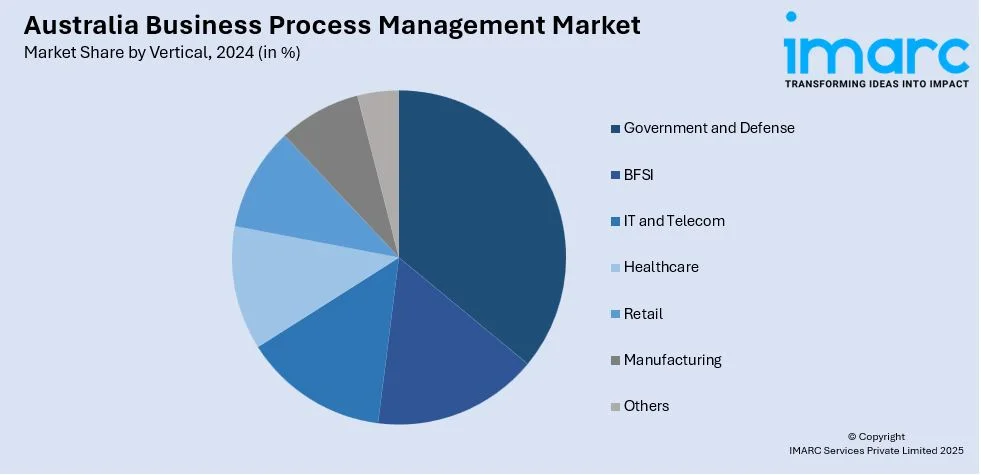

Vertical Insights:

- Government and Defense

- BFSI

- IT and Telecom

- Healthcare

- Retail

- Manufacturing

- Others

A detailed breakup and analysis of the market based on the vertical have also been provided in the report. This includes government and defense, BFSI, IT and telecom, healthcare, retail, manufacturing, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Business Process Management Market News:

- In March 2025, Accenture Ventures invested in Aaru, an AI prediction engine developer that simulates consumer behavior. Accenture Song plans to integrate Aaru's flagship model, Lumen, into its AI offerings to enhance product development, marketing, customer strategy, and service. This collaboration aims to improve customer experiences and accelerate time-to-market, potentially influencing business process management practices in Australia.

- In December 2024, Endeavour Group, the parent company of BWS and Dan Murphy's, partnered with AI-enabled production agency Plus Also Studio to streamline content creation and enhance customer engagement. This collaboration aims to leverage artificial intelligence for efficient advertising content production, reinvesting savings into strategic and creative initiatives.

Australia Business Process Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Deployment Types Covered | On-Premises, Cloud |

| Components Covered |

|

| Business Functions Covered | Human Resource, Accounting and Finance, Sales and Marketing, Manufacturing, Supply Chain Management, Operation and Support, Others |

| Organization Sizes Covered | SMEs, Large Enterprises |

| Verticals Covered | Government and Defense, BFSI, IT and Telecom, Healthcare, Retail, Manufacturing, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia business process management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia business process management market on the basis of deployment type?

- What is the breakup of the Australia business process management market on the basis of component?

- What is the breakup of the Australia business process management market on the basis of business function?

- What is the breakup of the Australia business process management market on the basis of organization size?

- What is the breakup of the Australia business process management market on the basis of vertical?

- What are the various stages in the value chain of the Australia business process management market?

- What are the key driving factors and challenges in the Australia business process management market?

- What is the structure of the Australia business process management market and who are the key players?

- What is the degree of competition in the Australia business process management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia business process management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia business process management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia business process management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)