Australia C4 Raffinate Market Size, Share, Trends and Forecast by Type, Application, and Region, 2025-2033

Australia C4 Raffinate Market Overview:

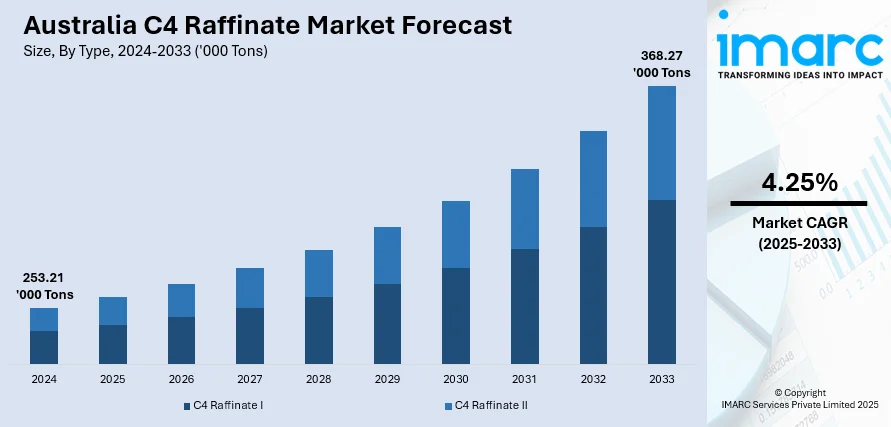

The Australia C4 raffinate market size reached 253.21 Thousand Metric Tons in 2024. Looking forward, IMARC Group expects the market to reach 368.27 Thousand Metric Tons by 2033, exhibiting a growth rate (CAGR) of 4.25% during 2025-2033. The market is driven by rising demand for butadiene in synthetic rubber production, growth in the automotive and construction industries, and expanding petrochemical manufacturing. Moreover, technological advancements in extraction and refining processes that enhance product quality and yield, along with the increasing investments in infrastructure projects and focus on domestic chemical production, are contributing to the Australia C4 raffinate market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 253.21 Thousand Metric Tons |

| Market Forecast in 2033 | 368.27 Thousand Metric Tons |

| Market Growth Rate 2025-2033 | 4.25% |

Australia C4 Raffinate Market Trends:

Rising Demand for Synthetic Rubber in Automotive and Industrial Sectors

Australia’s growing automotive sector, alongside increased industrial activities, is significantly boosting demand for synthetic rubber. C4 raffinate, primarily containing butadiene, serves as a key raw material for producing synthetic rubbers like styrene-butadiene rubber (SBR) and polybutadiene rubber (PBR). These materials are essential for tire manufacturing, belts, hoses, and other automotive components. Additionally, Australia's construction boom drives the need for rubber-based products used in insulation, sealing, and waterproofing applications. As domestic manufacturing expands and regional trade intensifies, synthetic rubber consumption rises, directly fueling C4 raffinate demand. Furthermore, advancements in material technologies, such as more durable rubber compounds, increase the usage of specialty synthetic rubbers, further pushing up the market for high-purity C4 raffinate in Australia.

To get more information on this market, Request Sample

Expansion of Petrochemical and Refining Industries

Australia’s petrochemical and refining industries are undergoing expansion, driven by strategic investments, modernization efforts, and rising domestic demand for petrochemical derivatives. C4 raffinate, a critical by-product from steam cracking and catalytic cracking processes, finds significant usage as a feedstock in producing butadiene, isobutylene, and other specialty chemicals. New refinery projects and capacity upgrades enhance C4 raffinate recovery rates, increasing market supply and encouraging downstream investment. Moreover, Australia’s strategic positioning as an exporter to Asia-Pacific markets strengthens local production initiatives. The combination of technological upgrades in refining facilities and government incentives for industrial development contributes heavily to the growing availability and commercial importance of C4 raffinate, supporting robust market growth across multiple sectors.

Technological Advancements in Refining Processes

Continuous innovations in refining technologies represent the major factor catalyzing the Australia C4 raffinate market growth. The adoption of advanced cracking techniques, such as selective hydrogenation and high-precision separation units, improves the purity and yield of C4 raffinate streams. Refiners increasingly deploy digital automation, machine learning, and process optimization tools to enhance operational efficiency, minimize emissions, and reduce production costs. These upgrades not only ensure higher profitability but also cater to stricter environmental regulations. Enhanced refining capabilities enable better extraction of valuable compounds like butadiene and isobutylene from raffinate streams, making C4 raffinate more commercially viable. As the industry shifts toward cleaner, smarter, and more sustainable operations, the reliance on technologically advanced processes significantly boosts C4 raffinate’s strategic market importance.

Australia C4 Raffinate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type and application.

Type Insights:

- C4 Raffinate I

- C4 Raffinate II

The report has provided a detailed breakup and analysis of the market based on the type. This includes C4 raffinate I and C4 raffinate II.

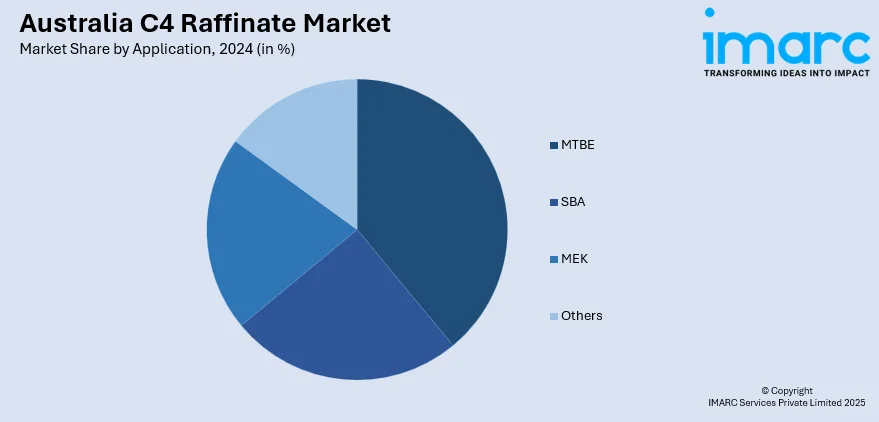

Application Insights:

- MTBE

- SBA

- MEK

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes MTBE, SBA, MEK, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia C4 Raffinate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Metric Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | C4 Raffinate I, C4 Raffinate II |

| Applications Covered | MTBE, SBA, MEK, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia C4 raffinate market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia C4 raffinate market on the basis of type?

- What is the breakup of the Australia C4 raffinate market on the basis of application?

- What is the breakup of the Australia C4 raffinate market on the basis of region?

- What are the various stages in the value chain of the Australia C4 raffinate market?

- What are the key driving factors and challenges in the Australia C4 raffinate market?

- What is the structure of the Australia C4 raffinate market and who are the key players?

- What is the degree of competition in the Australia C4 raffinate market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia C4 raffinate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia C4 raffinate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia C4 raffinate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)