Australia Cable Management Market Size, Share, Trends and Forecast by Product, Material, End User, and Region, 2025-2033

Australia Cable Management Market Overview:

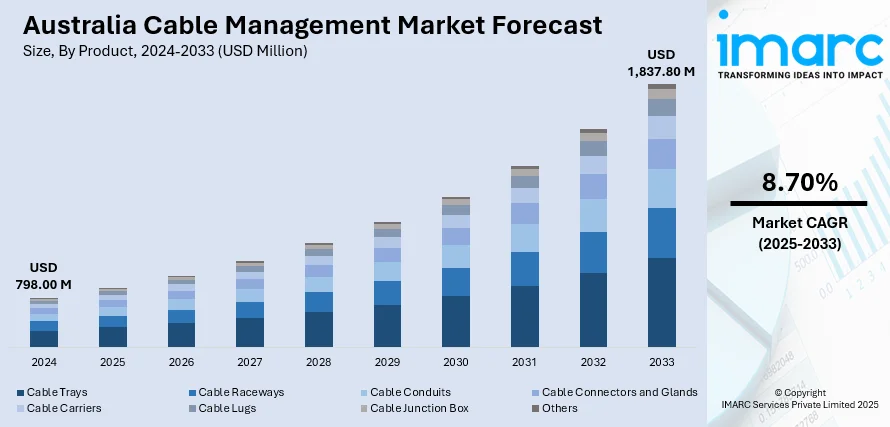

The Australia Cable Management Market size reached USD 798.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,837.80 Million by 2033, exhibiting a growth rate (CAGR) of 8.70% during 2025-2033. The market is driven by growing infrastructure development, increased demand for high-speed connectivity, and the rapid expansion of data centers and commercial buildings. The rise in smart building technologies and energy-efficient systems has also heightened the need for organized, scalable cable management. Additionally, government regulations promoting safety and sustainability are encouraging the adoption of eco-friendly and compliant cable systems. These factors collectively surge the Australia cable management market share, especially across sectors like information technology (IT), construction, manufacturing, and renewable energy.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 798.00 Million |

| Market Forecast in 2033 | USD 1,837.80 Million |

| Market Growth Rate 2025-2033 | 8.70% |

Australia Cable Management Market Trends:

Smart Technology Adoption

Australia's cable management market is changing with more industries embracing smart technology solutions. Smart systems enable the monitoring of cable conditions in real time such as temperature, pressure, and system performance. With more businesses aiming to minimize downtime and enhance operational efficiency, smart cable management has become crucial particularly in data centers and communication hubs. These smart systems can signal technicians to looming problems before they arise, facilitating preventative maintenance. In commercial structures, these systems also enhance safety by detecting overheating or overloading in the early stages. This trend towards smarter infrastructure mirrors a larger national shift towards automation and digital optimization. As firms in all sectors upgrade their networks, the requirement for cable systems that can interoperate with established digital infrastructure gains greater importance. Overall, the move towards smart cable management is a pragmatic reaction to Australia's drive towards smarter and more sustainable infrastructure systems.

To get more information on this market, Request Sample

Sustainable and Eco-Friendly Practices

Sustainability is becoming central to Australia’s cable management industry, with companies adopting greener materials and energy-efficient designs. As construction projects face increasing environmental scrutiny, new cable systems prioritize recyclability, reduced energy consumption, and the use of materials like corrosion-resistant metals and recyclable plastics. These innovations align with clients’ growing demand for sustainable building practices. More than a regulatory trend, this shift reflects Australia’s broader cultural and policy push toward green infrastructure. National targets also include a 10% reduction in material footprint, a 30% boost in material productivity, and an 80% resource recovery rate. In line with these goals, the Australian government approved SunCable's A$20 billion Australia-Asia PowerLink project in 2024, which plans to export solar-generated electricity from a vast solar farm in Northern Australia to Singapore via a 4,300 km undersea cable, highlighting the country's commitment to renewable energy infrastructure. As a result, eco-friendly cable management systems are quickly becoming standard in both new and retrofit developments across the country.

Modular and Flexible System Designs

Australian businesses are finding more and more that modular and adaptable cable management systems are necessary to suit changing infrastructure requirements. Such systems are particularly favored in applications like data centers, manufacturing, and commercial building, where configurations and technology needs shift frequently. In contrast to old fixed systems, modular cable trays, ducts, and support structures are designed to be replanned or increased quickly without extensive overhauls. This flexibility also makes it easier to install and maintain, saving time and labor in the long run. It also provides for future expansion, which is important in tech-intensive environments where growth is continuous and fast. Modular systems are convenient and flexible according to contractors and facility managers, particularly when undertaking large or complex projects. The increasing focus on long-term value and adaptability of infrastructure is assisting in fueling the Australia cable management market growth and making flexible cable management a convenient and increasingly sought-after solution across Australia's contemporary building and manufacturing industries.

Australia Cable Management Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, material, and end user.

Product Insights:

- Cable Trays

- Cable Raceways

- Cable Conduits

- Cable Connectors and Glands

- Cable Carriers

- Cable Lugs

- Cable Junction Box

- Others

The report has provided a detailed breakup and analysis of the market based on the product. This includes cable trays, cable raceways, cable conduits, cable connectors and glands, cable carriers, cable lugs, cable junction box, and others.

Material Insights:

- Metallic

- Non-Metallic

A detailed breakup and analysis of the market based on the material have also been provided in the report. This includes metallic, and non-metallic.

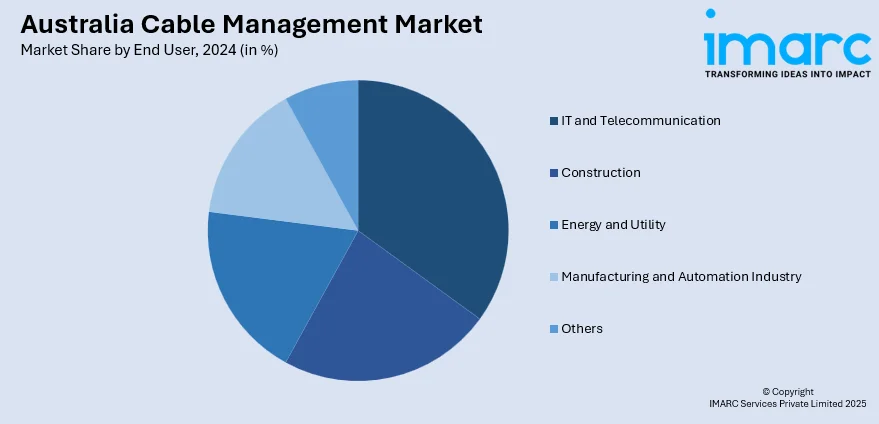

End User Insights:

- IT and Telecommunication

- Construction

- Energy and Utility

- Manufacturing and Automation Industry

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes IT and telecommunication, construction, energy and utility, manufacturing and automation industry, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cable Management Market News:

- In July 2024, Australia is investing $18 million to establish a digital cable connectivity and resilience centre aimed at strengthening undersea cable networks across the Indo-Pacific. The centre will offer technical training, regulatory support, and facilitate government-industry collaboration to enhance digital infrastructure. Staffed by Australian public servants, it reflects efforts to bolster regional connectivity while countering China’s growing influence in the area. The initiative supports secure, reliable data flow vital to the digital economy.

- In June 2024, MOBIWAY BOOST, a next-gen cable spool management system, launched in Australia and New Zealand. Designed by and for electricians, it enhances mobility, safety, and efficiency on job sites. Featuring an ergonomic handle, stackable design, and eco-friendly materials, it simplifies transport, setup, and multi-cable tasks. With secure unspooling and space-saving features, MOBIWAY BOOST streamlines workflows while supporting sustainability in the electrical and cable management industry.

Australia Cable Management Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Cable Trays, Cable Raceways, Cable Conduits, Cable Connectors and Glands, Cable Carriers, Cable Lugs, Cable Junction Box, Others |

| Materials Covered | Metallic, Non-Metallic |

| End Users Covered | IT and Telecommunication, Construction, Energy and Utility, Manufacturing and Automation Industry, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cable management market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cable management market on the basis of product?

- What is the breakup of the Australia cable management market on the basis of material?

- What is the breakup of the Australia cable management market on the basis of end user?

- What is the breakup of the Australia cable management market on the basis of region?

- What are the various stages in the value chain of the Australia cable management market?

- What are the key driving factors and challenges in the Australia cable management market?

- What is the structure of the Australia cable management market and who are the key players?

- What is the degree of competition in the Australia cable management market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cable management market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cable management market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cable management industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)