Australia Cakes and Pastries Market Size, Share, Trends and Forecast by Product, Type, Sector, Distribution Channel, and Region, 2025-2033

Australia Cakes and Pastries Market Overview:

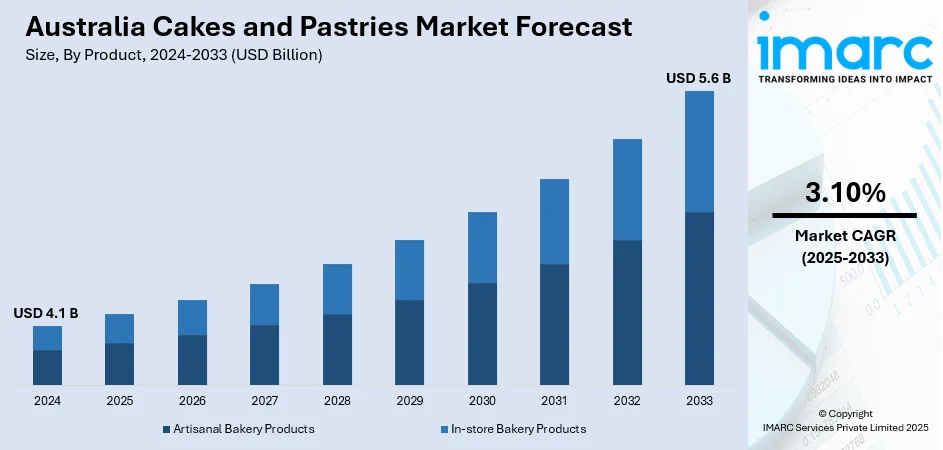

The Australia cakes and pastries market size reached USD 4.1 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 5.6 Billion by 2033, exhibiting a growth rate (CAGR) of 3.10% during 2025-2033. The market is driven by increasing demand for premium, artisanal products, rising health-consciousness prompting gluten-free and vegan options, and the growing influence of multicultural flavors. Additionally, expanding online sales channels and convenience-driven consumption are boosting product accessibility, while innovation helps brands remain competitive in a saturated market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 4.1 Billion |

| Market Forecast in 2033 | USD 5.6 Billion |

| Market Growth Rate 2025-2033 | 3.10% |

Australia Cakes and Pastries Market Trends:

Health-Conscious and Specialty Offerings

Australian shoppers are increasingly health-conscious and mindful of dietary requirements, which has resulted in strong demand for specialty cakes and pastries like gluten-free, sugar-free, and vegan options. This is due to increasing consciousness of lifestyle disorders, food intolerance, and a desire for clean-label ingredients. Large supermarket chains and artisan bakeries alike are adding to their product ranges nutrient-rich, low-calorie, and allergen-free offerings. Plant-based baking technologies are also becoming popular, and dairy and eggs are being replaced to produce the classic treats but with a healthful spin. This is based on consumer focus on wellness, ethical eating, and sustainability that is making the manufacturers redesign original recipes that comply with contemporary nutrition standards while staying indulgent and palatable.

To get more information on this market, Request Sample

E-commerce and Digital Convenience

Online platforms are increasingly transforming how Australians purchase cakes and pastries, with e-commerce becoming a popular channel for both everyday treats and special occasion desserts. Approximately 54% of Australian consumers prefer using third-party apps for online food ordering, with 76% of users ordering at least twice per month. This trend, which gained momentum during the pandemic, continues to thrive due to the convenience and time-saving nature of online shopping. Bakeries are responding by offering online menus, custom cake orders, and contactless delivery services. Their digital presence not only enhances customer experience but also enables real-time promotions and seasonal offers. As a result, both small and large bakeries are investing in user-friendly interfaces and mobile optimization to meet consumers' growing demand for speed, accessibility, and seamless ordering experiences.

Artisanal and Premium Product Demand

The demand among Australian consumers for high-quality, handmade pastries and cakes is experiencing significant growth. This trend is driven by a growing preference for uniqueness, superior taste, and an exceptional overall experience. Consumers are increasingly favoring products that prioritize quality over quantity, particularly those produced in small batches, using traditional techniques, and incorporating meticulously sourced ingredients. These are products like artisan hand-crafted croissants, customized celebratory cakes, and sourdough pastries being most popular among urban consumers with disposable incomes and refined palates. The appeal is not just taste but also the story behind each product, often associated with heritage recipes or neighborhood sourcing. Boutique bakeries succeed by positioning themselves as high-end, experience-driven brands. The shift from mass production to artisanal goods is an emerging consumer preference for craft, personalization, and sensory pleasure in baked goods.

Australia Cakes and Pastries Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on product, type, sector, and distribution channel.

Product Insights:

- Artisanal Bakery Products

- In-store Bakery Products

The report has provided a detailed breakup and analysis of the market based on the product. This includes artisanal bakery products, and in-store bakery products.

Type Insights:

- Cakes

- Frozen Cakes and Pastries

- Pastries

- Sweet Pies

A detailed breakup and analysis of the market based on the type have also been provided in the report. This includes cakes, frozen cakes and pastries, pastries, and sweet pies.

Sector Insights:

- Food Service

- Retail

The report has provided a detailed breakup and analysis of the market based on the sector. This includes food service, and retail.

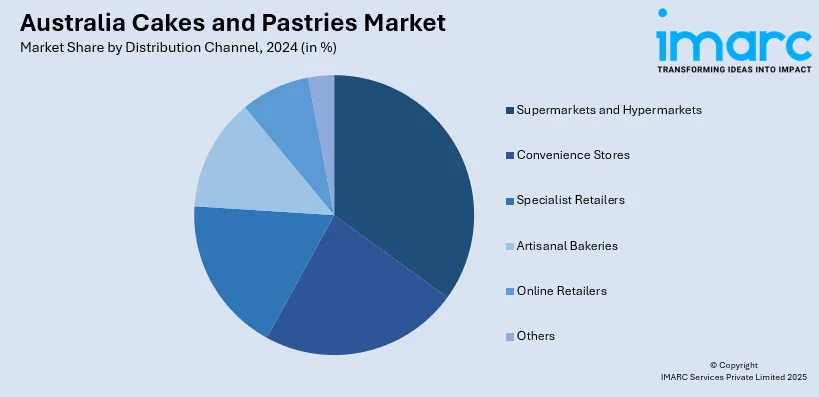

Distribution Channel Insights:

- Supermarkets and Hypermarkets

- Convenience Stores

- Specialist Retailers

- Artisanal Bakeries

- Online Retailers

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes supermarkets and hypermarkets, convenience stores, specialist retailers, artisanal bakeries, online retailers, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cakes and Pastries Market News:

- In April 2025, Sprout Artisan Bakery is set to expand with a new production facility and retail store opening later this year at Craft’d Grounds in Albion. Founded in 2014 by Lutz Richter and Rebecca Foley, Sprout has grown steadily from markets to a James Street staple. This new industrial-inspired space will serve Brisbane’s northside, meeting increasing demand for its acclaimed pastries and artisanal breads while continuing its commitment to quality and thoughtful growth.

- In March 2025, Green's, the maker of bestselling baking mix in Australia, introduced new lamingtons and cakes to its bakery line that are now available in Coles stores across the country. These include Swirly Cakes with bright colors, Deluxe White Choc Lamingtons, and a Jam & Cream Lamington Roll. These indulgent treats cater to busy consumers seeking high-quality, nostalgic, and convenient options for family gatherings, afternoon teas, and special events. Green’s continues to innovate with these exciting new offerings.

Australia Cakes and Pastries Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Artisanal Bakery Products, In-store Bakery Products |

| Types Covered | Cakes, Frozen Cakes and Pastries, Pastries, Sweet Pies |

| Sectors Covered | Food Service, Retail |

| Distribution Channels Covered | Supermarkets and Hypermarkets, Convenience Stores, Specialist Retailers, Artisanal Bakeries, Online Retailers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cakes and pastries market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cakes and pastries market on the basis of product?

- What is the breakup of the Australia cakes and pastries market on the basis of type?

- What is the breakup of the Australia cakes and pastries market on the basis of sector?

- What is the breakup of the Australia cakes and pastries market on the basis of distribution channel?

- What is the breakup of the Australia cakes and pastries market on the basis of region?

- What are the various stages in the value chain of the Australia cakes and pastries market?

- What are the key driving factors and challenges in the Australia cakes and pastries market?

- What is the structure of the Australia cakes and pastries market and who are the key players?

- What is the degree of competition in the Australia cakes and pastries market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cakes and pastries market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cakes and pastries market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cakes and pastries industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)