Australia Calcium Chloride Market Size, Share, Trends and Forecast by Product Type, Application, Raw Material, Grade, and Region, 2026-2034

Australia Calcium Chloride Market Summary:

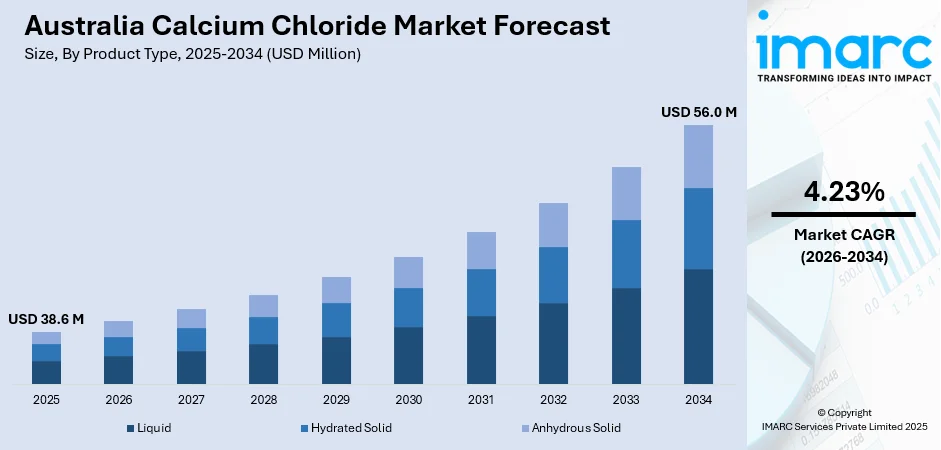

The Australia calcium chloride market size was valued at USD 38.6 Million in 2025 and is projected to reach USD 56.0 Million by 2034, growing at a compound annual growth rate of 4.23% from 2026-2034.

The robust market growth reflects escalating demand driven by accelerating infrastructure development across multiple Australian states, expanding mining operations requiring effective dust suppression solutions, and intensifying oil and gas exploration activities offshore. The integration of calcium chloride in concrete acceleration processes, coupled with growing adoption in industrial manufacturing and food processing applications, continues to expand the Australia calcium chloride market share.

Key Takeaways and Insights:

-

By Product Type: Liquid dominates the market with a share of 50% in 2025, driven by superior application efficiency, uniform distribution capabilities enabling consistent dust control performance, and ease of integration with existing spray equipment across mining and construction sites.

-

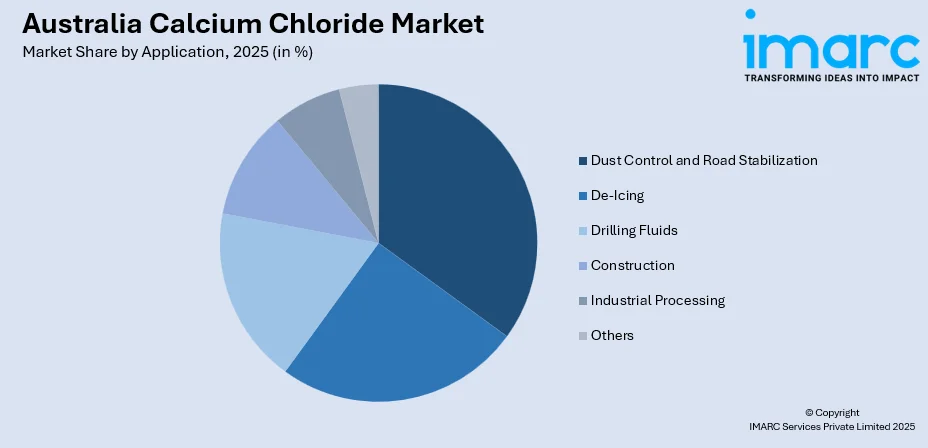

By Application: Dust control and road stabilization lead the market with a share of 35% in 2025, owing to extensive unpaved road networks across regional mining corridors, increasing regulatory focus on airborne particulate management, and proven cost-effectiveness compared to frequent water-only applications.

-

By Raw Material: Natural brine represents the largest segment with a market share of 55% in 2025, attributed to abundant underground brine deposits facilitating economical extraction processes, lower production costs relative to synthetic alternatives, and established supply chain infrastructure supporting continuous industrial demand.

-

By Grade: Industrial grade leads the market with a share of 82% in 2025 propelled by widespread utilization across construction, mining, oil and gas drilling operations, and manufacturing processes requiring high-volume applications without pharmaceutical-grade purity specifications.

-

Key Players: The Australia calcium chloride market exhibits moderate competitive intensity, with established international chemical corporations competing alongside specialized regional distributors across industrial and food-grade segments, focusing on supply reliability and technical application support.

To get more information on this market Request Sample

Australia's calcium chloride market is experiencing sustained momentum as the nation advances major infrastructure projects valued at over 120 billion dollars through 2030, including transportation networks, renewable energy installations, and urban development initiatives. The West Gate Tunnel project completion and Sydney Metro West's multi-billion dollar investment generating 10,000 direct construction jobs exemplify infrastructure drivers. In April 2025, a regional council in New South Wales approved a dust-control program for rural roads, directly increasing procurement of calcium chloride for long-route stabilization to reduce dust-related traffic hazards. Mining sector expansion continues with approximately 88 percent of petroleum production derived from offshore fields requiring calcium chloride-based drilling fluids, while Santos' Barossa gas project completion underscores ongoing drilling operations. The construction sector's adoption of smart moisture-optimization systems integrating calcium chloride additives with artificial intelligence-powered curing sensors, as observed in Victoria contractors, demonstrates technological advancement enhancing application efficiency.

Australia Calcium Chloride Market Trends:

Infrastructure-Driven Demand Acceleration Across Construction and Transportation Sectors

Australia's unprecedented infrastructure investment pipeline is fundamentally reshaping calcium chloride consumption patterns as construction timelines accelerate nationwide. The Melbourne Metro Tunnel project advancing toward late 2025 completion requires continuous concrete acceleration in cooler months, driving demand for industrial-grade calcium chloride to maintain construction schedules. Federal and state governments allocated 17.1 billion dollars for road and rail in the 2025-2026 cycle. More than $2.3 billion allocated for essential infrastructure improvements in the expanding Western Sydney area, comprising $1 billion to maintain the corridor for the South West Sydney Rail Extension and $500 million for enhancements to Fifteenth Avenue. Moreover, infrastructure spending increased, driven by utilities portfolio expansion including water treatment facilities and transmission projects where calcium chloride serves critical roles in process optimization.

Advanced Application Technologies Enhancing Efficiency and Environmental Performance

Technological integration is revolutionizing calcium chloride application methodologies across Australian industrial operations, improving cost-effectiveness while addressing environmental considerations. Infrastructure contractors in the country began deploying smart moisture-optimization systems for concrete works, integrating calcium chloride additives with artificial intelligence-powered curing sensors to improve construction speed and reliability during cooler months. By utilizing an advanced system of sensors, satellites, and AI-driven analytics, farmers can now observe and handle their crops with unmatched precision, right down to the square meter. This technology-based method has enabled Australian farmers to decrease water consumption by as much as 30% and lower fertilizer expenses by 25%, all while boosting crop production by an average of 20%. Mining and road-maintenance operators increasingly adopt scheduling tools determining optimal dosing times for calcium chloride, balancing dust control effectiveness with environmental compliance and minimizing product waste. Automated monitoring systems and energy-efficient evaporation technologies in production facilities support consistent supply quality while reducing operational costs, stabilizing price indices despite fluctuating energy tariffs and raw material costs. Liquid calcium chloride application via precision spray systems enables uniform surface coverage at calibrated concentrations, reducing over-application risks and extending treatment duration between reapplications across mining haul roads.

Sustainability Focus and Environmental Management Driving Product Innovation

Environmental stewardship considerations are increasingly influencing calcium chloride selection and application practices across Australian industries, spurring innovation in sustainable product formulations and usage protocols. According to the 2024 ISG Provider Lens Sustainability and ESG report for Australia, firms in the country are increasing investments in technology to enhance their environmental and sustainability efforts. Operators recognize calcium chloride's advantages over traditional sodium chloride for dust control applications, as calcium ions improve soil quality and strengthen plant cell walls while effective chloride management minimizes groundwater contamination risks through proper dosing. Nordic countries' successful implementation of strict calcium chloride usage standards and monitoring systems demonstrates effective environmental management models, inspiring Australian regulatory frameworks emphasizing responsible application rates protecting surface waters and soil ecosystems. Chemical producers adopt advanced waste treatment and recycling technologies converting production byproducts into useful compounds, reducing emissions and resource consumption while maintaining competitive pricing.

Market Outlook 2026-2034:

The Australia calcium chloride market is positioned for sustained expansion through 2033, supported by persistent infrastructure development momentum, advancing offshore energy projects, and evolving industrial manufacturing requirements. The market generated a revenue of USD 38.6 Million in 2025 and is projected to reach a revenue of USD 56.0 Million by 2034, growing at a compound annual growth rate of 4.23% from 2026-2034. Food processing industry expansion, particularly in dairy product manufacturing and beverage production, will gradually increase food-grade calcium chloride demand as domestic cheese-making operations grow and craft brewing industries emphasize water chemistry optimization for distinctive flavor profiles.

Australia Calcium Chloride Market Report Segmentation:

|

Segment Category |

Leading Segment |

Market Share |

|

Product Type |

Liquid |

50% |

|

Application |

Dust Control and Road Stabilization |

35% |

|

Raw Material |

Natural Brine |

55% |

|

Grade |

Industrial Grade |

82% |

Product Type Insights:

- Liquid

- Hydrated Solid

- Anhydrous Solid

Liquid dominates with a market share of 50% of the total Australia calcium chloride market in 2025.

Liquid calcium chloride solutions command market leadership through operational advantages addressing Australia's demanding industrial environments. Pre-mixed calcium chloride brine formulations at 35-38 percent concentration enable immediate application via spray equipment commonly deployed across mining operations and road maintenance programs, eliminating preparation time associated with solid forms requiring dissolution before use. Hygroscopic properties inherent to calcium chloride solution form facilitate continuous moisture attraction from atmospheric conditions, maintaining road surface dampness even during prolonged dry periods characteristic of Australia's interior regions where dust suppression challenges intensify during summer months. Distribution infrastructure supporting liquid calcium chloride delivery via tanker trucks ensures efficient large-volume supply to remote mining sites and construction projects across Queensland's resource corridors and Western Australia's offshore support facilities.

The versatility of liquid calcium chloride extends beyond dust control into specialized industrial applications requiring precise dosing capabilities. Manufacturing facilities utilize liquid formulations in dehumidification systems maintaining optimal humidity levels protecting equipment and inventory from moisture damage. Construction operations benefit from liquid calcium chloride integration into concrete admixture systems, enabling automated dispensing during batching processes that ensure consistent mixture proportions accelerating setting times during cooler weather construction windows. Food processing industries prefer pharmaceutical-grade liquid calcium chloride for cheese production and brewing applications, as liquid form facilitates accurate measurement and thorough mixing into milk or brewing water compared to solid alternatives requiring complete dissolution verification before process continuation.

Application Insights:

Access the comprehensive market breakdown Request Sample

- De-Icing

- Dust Control and Road Stabilization

- Drilling Fluids

- Construction

- Industrial Processing

- Others

Dust control and road stabilization leads with a share of 35% of the total Australia calcium chloride market in 2025.

Dust control and road stabilization applications constitute the largest calcium chloride consumption segment across Australia, addressing critical operational and environmental challenges inherent to resource extraction and remote area transportation networks. Mining companies operating across Queensland, Western Australia, and Northern Territory deploy calcium chloride extensively on haul roads where heavy vehicle traffic on unpaved surfaces generates substantial airborne particulate matter threatening worker health, equipment longevity, and community relations with nearby residential areas. Cost-effectiveness considerations favor calcium chloride over conventional water-only approaches, as hygroscopic properties enable longer intervals between reapplications compared to water requiring multiple daily applications during hot, dry conditions typical of Australian mining regions. In 2025, Dalwallinu in the Central Wheatbelt of the state recorded 40.9 degrees, whereas Morawa to the southeast of Geraldton reached 42.6 degrees. This high temperature situations are further driving the need for calcium chloride.

Regulatory drivers increasingly mandate effective dust suppression protocols as environmental protection agencies strengthen airborne particulate standards protecting community health and ecosystems adjacent to industrial operations. Road stabilization benefits extend beyond dust suppression to structural improvements, as calcium chloride penetrates several inches into road base materials coating fine particles and binding aggregates together, creating denser, more compact surfaces resisting traffic-induced deterioration and minimizing costly maintenance interventions requiring equipment mobilization to remote locations.

Raw Material Insights:

- Natural Brine

- Solvay Process (by-Product)

- Limestone and HCL

- Others

Natural brine exhibits a clear dominance with a 55% share of the total Australia calcium chloride market in 2025.

Natural brine extraction dominates Australia's calcium chloride supply chain through inherent economic advantages and established production infrastructure supporting industrial demand volumes. Underground brine deposits accessible across specific geological formations enable straightforward extraction methodologies involving pumping saline solutions to surface processing facilities where evaporation concentrates calcium chloride to commercial specifications. Production cost advantages relative to synthetic manufacturing routes utilizing limestone and hydrochloric acid reactions position natural brine-sourced calcium chloride competitively for price-sensitive industrial applications including dust control, road stabilization, and drilling fluids where pharmaceutical-grade purity specifications remain unnecessary.

Established supply relationships between brine producers and major industrial consumers across mining, construction, and oil and gas sectors ensure reliable product availability supporting operational continuity critical for project timelines and production targets. Natural brine sources typically contain multiple valuable minerals including bromine, magnesium, and lithium that are recovered during processing operations, improving overall economic viability of extraction facilities through diversified revenue streams enabling competitive calcium chloride pricing. Quality consistency achievable through modern evaporation and purification technologies applied to natural brine feedstocks meets industrial specifications without requiring extensive additional processing steps, streamlining supply chain logistics and reducing delivery lead times for bulk industrial customers.

Grade Insights:

- Food Grade

- Industrial Grade

Industrial grade leads with a share of 82% of the total Australia calcium chloride market in 2025.

Industrial-grade calcium chloride commands overwhelming market dominance reflecting its ubiquitous utilization across Australia's resource extraction, infrastructure development, and manufacturing sectors requiring high-volume applications without pharmaceutical-grade purity mandates. Construction projects consuming substantial calcium chloride quantities for concrete acceleration benefit from industrial-grade specifications providing necessary performance characteristics at price points supporting project budgets, particularly for large-scale infrastructure developments where material costs directly impact overall project economics. Mining operations deploy industrial-grade calcium chloride extensively across haul road dust suppression and equipment washing applications where technical effectiveness takes precedence over ultra-high purity, enabling cost-efficient procurement of bulk quantities required for continuous operations across expansive mine sites generating hundreds of vehicle movements daily.

In 2024, the Australian Prime Minister announced the introduction of a Future Made in Australia Act, gesturing the explicit implementation of a new industrial policy for Australia. These reforms are further enhancing industrial innovation activities and driving the need for chemicals like industrial grade calcium chloride. Industrial manufacturing applications including dehumidification systems, refrigeration processes, and wastewater treatment facilities utilize industrial-grade calcium chloride addressing operational requirements cost-effectively while meeting environmental discharge standards applicable to industrial operations. Industrial-grade specifications standardized through industry associations enable procurement efficiency as buyers specify products meeting established performance criteria without extensive custom testing protocols, streamlining supply chain management for distributors serving diverse industrial customer bases across Australia's geographically dispersed industrial operations.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The calcium chloride market in the Australian Capital Territory and New South Wales is supported by construction, road maintenance, and industrial activity. NSW’s large urban base drives steady demand for dust suppression, concrete acceleration, and winter road safety in elevated areas. Water treatment plants and food processing units also use calcium chloride for moisture control and brining. Infrastructure upgrades around Sydney and regional transport corridors contribute to regular consumption. Distribution is efficient due to strong logistics networks and proximity to ports, making imports and bulk supply more cost-effective. Demand remains stable, led by public works and manufacturing users.

Victoria represents a consistent market for calcium chloride due to its strong construction sector, cold storage facilities, and industrial processing base. The product is commonly used in concrete works, food preservation, and humidity control across warehouses. Tasmania adds seasonal demand, particularly in agriculture, food processing, and dust control on unsealed roads. Port access in Melbourne supports smooth supply chains, while Tasmania relies more on inter-state shipments. Environmental regulations influence application methods, especially in sensitive regions. Overall consumption is moderate but reliable, supported by infrastructure activity and steady industrial output across both states.

Queensland’s calcium chloride market is driven by mining, infrastructure development, and road dust control. Large mining operations use calcium chloride to manage haul road dust and improve safety. Construction activity in Brisbane and regional centers supports demand for concrete setting applications. The product is also used in water treatment and food processing, particularly in coastal and agricultural zones. Warmer climate conditions limit winter de-icing use, but industrial consumption offsets this gap. Supply is supported through major ports and regional distributors, with demand closely linked to mining output and public infrastructure spending.

In the Northern Territory and South Australia, calcium chloride demand is tied to mining, oil and gas support services, and road maintenance in remote areas. Dust suppression on unpaved roads is a key application, especially in arid zones. South Australia also shows usage in food processing, refrigeration, and concrete works, supported by manufacturing clusters around Adelaide. Seasonal construction activity influences short-term demand. Logistics costs can be higher due to long transport distances, but local distributors help maintain supply continuity. Consumption volumes are smaller compared to eastern states but remain application-specific and steady.

Western Australia is a major consumer of calcium chloride due to its extensive mining sector. The compound is widely used for dust control on mine sites, port roads, and transport routes. Construction activity in Perth supports additional demand for concrete acceleration and moisture control. Water treatment and industrial processing also contribute to usage. Supply chains rely heavily on bulk imports through ports, supported by regional storage facilities. Demand patterns closely follow mining investment cycles and infrastructure expansion. Overall, Western Australia represents one of the more industrially driven markets for calcium chloride in the country.

Market Dynamics:

Growth Drivers:

Why is the Australia Calcium Chloride Market Growing?

Accelerating Infrastructure Development and Urbanization Driving Construction Material Demand

Australia's unprecedented infrastructure investment surge is fundamentally transforming calcium chloride consumption patterns as government commitments to transportation modernization, renewable energy installations, and urban development projects create sustained demand for construction-grade applications. Federal and state governments allocated 17.1 billion dollars for road and rail in the 2025-2026 budget cycle, anchoring a 120 billion dollar rolling infrastructure pipeline emphasizing proactive capacity creation across transport corridors requiring concrete acceleration and dust control solutions. Apart from this, infrastructure contractors in the country began deploying smart moisture-optimization systems for concrete works, integrating calcium chloride additives with artificial intelligence-powered curing sensors to improve construction speed and reliability during cooler months, demonstrating technological advancement enhancing application efficiency and driving premium product demand.

Expanding Oil and Gas Exploration Activities Offshore and Onshore Basins

Australia's offshore petroleum sector intensification is generating robust calcium chloride demand as drilling operations expand across established basins and exploratory activities target new hydrocarbon reserves supporting domestic energy security and export commitments. Approximately 88 percent of Australia's petroleum production originates from offshore fields primarily in the North West Shelf and Gippsland Basin, requiring calcium chloride-based drilling fluids maintaining wellbore stability during subsea operations where formation pressures and temperatures challenge conventional water-based systems. Cooper Energy submitted environment plans in September 2025 for Annie-2 development drilling in the Otway Basin approximately 25-40 kilometers off Peterborough coast, proposing drilling campaign including survey, inspection, and maintenance activities alongside well construction utilizing calcium chloride completion fluids for formation stabilization.

Growing Industrial Processing Applications and Manufacturing Sector Expansion

Australia's manufacturing sector diversification and industrial processing capacity expansion create incremental calcium chloride demand across dehumidification, refrigeration, and chemical processing applications supporting operational efficiency and product quality maintenance. Food processing industry growth, particularly dairy manufacturing operations across Victoria and South Australia regions, sustains increasing food-grade calcium chloride consumption supporting cheese production where calcium chloride compensates for calcium loss during milk pasteurization, improving curd formation and cheese yield critical for commercial dairy processor profitability. Brewing industry expansion across Australia's craft beer sector drives food-grade calcium chloride demand as brewers recognize water chemistry optimization's importance for flavor profile development, with calcium chloride additions adjusting mineral content and pH levels enhancing enzyme activity during mashing and improving beer clarity through protein flocculation. IMARC Group predicts that the Australia craft beer market is projected to attain USD 6.1 Billion by 2033.

Market Restraints:

What Challenges the Australia Calcium Chloride Market is Facing?

Environmental Concerns and Regulatory Compliance Requirements

Environmental impact considerations increasingly constrain calcium chloride application practices as regulatory frameworks emphasize ecological protection and stakeholders demand sustainable chemical usage across industrial operations. Calcium chloride runoff from road applications infiltrates surface water and groundwater systems, potentially elevating chloride concentrations above aquatic life tolerance thresholds established by environmental protection agencies monitoring freshwater ecosystem health. Research demonstrates calcium chloride releases more chloride ions per mole than sodium chloride, creating vegetation damage risks when over-application or improper dosing occurs near sensitive plant species, as chloride accumulation in soil inhibits nutrient absorption and causes leaf scorching observed in roadside vegetation adjacent to treated surfaces.

Corrosion Impact on Infrastructure and Equipment

Calcium chloride's corrosive properties present significant challenges for infrastructure durability and equipment longevity, generating maintenance costs and replacement requirements that influence procurement decisions across price-sensitive applications. Calcium chloride accelerates metal corrosion on vehicles, guardrails, bridge components, and construction equipment exposed to treated surfaces, with corrosion rates exceeding sodium chloride in certain environmental conditions creating higher maintenance expenses for transport authorities and industrial operators managing vehicle fleets. Concrete degradation concerns arise from repeated calcium chloride exposure creating freeze-thaw cycles that stress pavement surfaces, causing chipping and scaling reducing structural integrity and requiring accelerated resurfacing schedules increasing total infrastructure ownership costs.

Raw Material Price Volatility and Supply Chain Uncertainties

Calcium chloride pricing experiences fluctuations driven by energy cost variations, raw material availability, and freight charges impacting producer margins and customer procurement budgets across price-sensitive industrial applications. Natural brine extraction operations require substantial energy inputs for pumping and evaporation processes, with energy tariff increases directly translating to production cost escalations passed through to customers unless producers absorb margin compression maintaining competitive positioning. International trade dynamics influence Australian calcium chloride markets as import duties and shipping costs affect landed prices for imported products competing with domestic production, with 2025 introduction of trade tariffs in certain jurisdictions reshaping sourcing strategies and procurement planning for chemical distributors serving industrial customers.

Competitive Landscape:

The Australia calcium chloride market exhibits moderate competitive intensity characterized by established international chemical corporations competing alongside specialized regional distributors across industrial and food-grade segments. Major global producers leverage vertically integrated production capabilities spanning brine extraction, refining operations, and distribution networks supplying bulk industrial customers including mining companies, construction contractors, and oil and gas operators requiring consistent quality and reliable delivery supporting operational continuity. Regional distributors differentiate through technical application support, customized packaging configurations, and responsive customer service addressing specific requirements of food processing facilities, pharmaceutical manufacturers, and smaller industrial operations preferring localized supply relationships and flexible order quantities. Competition focuses primarily on supply reliability, product quality consistency, and technical expertise rather than aggressive price competition, as industrial customers prioritize operational risk mitigation over marginal cost savings when selecting calcium chloride suppliers supporting critical production processes.

Australia Calcium Chloride Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Liquid, Hydrated Solid, Anhydrous Solid |

| Applications Covered | De-Icing, Dust Control and Road Stabilization, Drilling Fluids, Construction, Industrial Processing, Others |

| Raw Materials Covered | Natural Brine, Solvay Process (by-Product), Limestone and HCL, Others |

| Grades Covered | Food Grade, Industrial Grade |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia calcium chloride market size was valued at USD 38.6 Million in 2025.

The Australia calcium chloride market is expected to grow at a compound annual growth rate of 4.23% from 2026-2034 to reach USD 56.0 Million by 2034.

Liquid dominated the market with 50% share, driven by superior application efficiency, uniform distribution capabilities enabling consistent dust control performance, and ease of integration with existing spray equipment across mining and construction sites throughout Australian industrial operations.

Key factors driving the Australia calcium chloride market include accelerating infrastructure development with government commitments creating sustained construction-grade demand, expanding offshore oil and gas exploration activities with major drilling projects consuming completion fluids, and growing industrial processing applications across manufacturing sectors requiring dehumidification and food processing solutions supporting operational efficiency and product quality maintenance.

Major challenges include environmental concerns regarding chloride runoff impacts on aquatic ecosystems and vegetation requiring regulatory compliance and monitoring systems, corrosion effects on infrastructure and equipment accelerating maintenance requirements and replacement cycles, and raw material price volatility driven by energy cost fluctuations and supply chain uncertainties affecting procurement budgets across price-sensitive industrial applications.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)