Australia Calibration Services Market Size, Share, Trends and Forecast by Service Type, Calibration Type, End Use Industry, and Region, 2025-2033

Australia Calibration Services Market Overview:

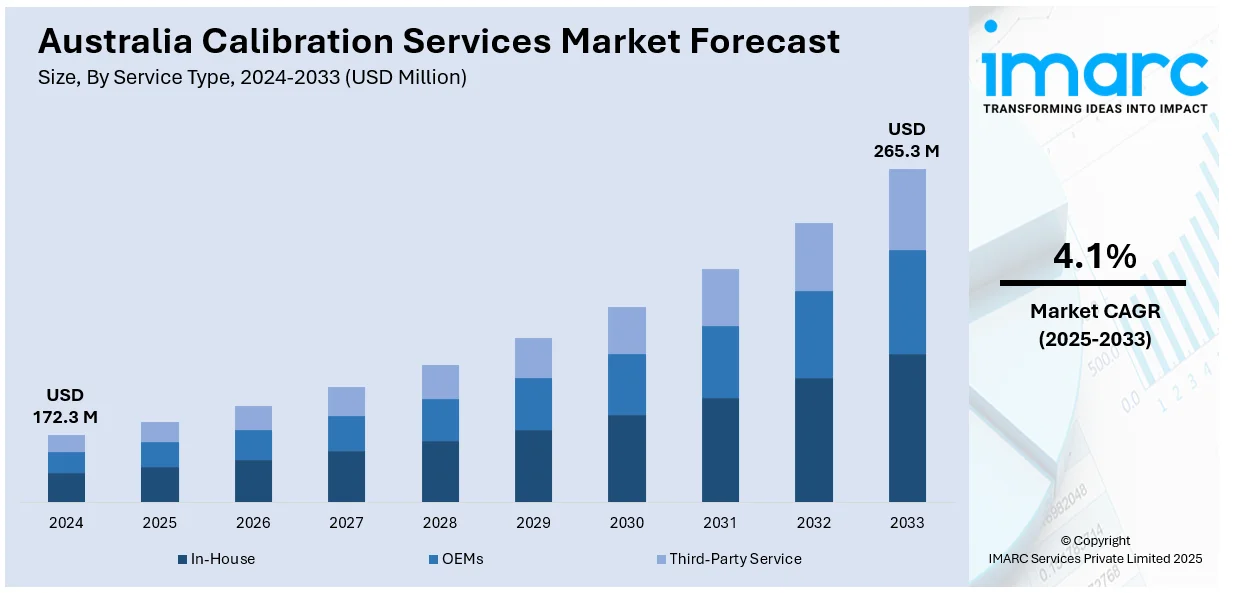

The Australia calibration services market size reached USD 172.3 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 265.3 Million by 2033, exhibiting a growth rate (CAGR) of 4.1% during 2025-2033. The increasing industrial automation, stringent regulatory standards, technological advancements in precision equipment, growth in manufacturing sectors, and rising demand for equipment maintenance and performance optimization across industries like automotive, aerospace, and healthcare are some of the factors propelling the growth of the market.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 172.3 Million |

| Market Forecast in 2033 | USD 265.3 Million |

| Market Growth Rate 2025-2033 | 4.1% |

Australia Calibration Services Market Trends:

Rising Demand for Accurate Calibration Services

The need for high-precision calibration services throughout Australia is increasing, owing to the requirement for high accuracy in measurement across sectors. Laboratories in major cities with accreditation provide services in calibration of mass, length, and volume with high precision to ensure that the instruments are up to high standards. This is vital for facilitating just trade practices, improving consumer protection, and ensuring high standards in the industry. Through the provision of calibration on a broad scale across instruments ranging from small masses to large volumes, these services become more crucial to industries like manufacturing, healthcare, and trade. With the urgency for dependable measurements growing, the role of NATA-accredited calibration laboratories in ensuring measurement integrity becomes ever more important in Australia's competitive business environment. For example, the National Measurement Institute (NMI) offers comprehensive calibration services through its measurement standards unit (MSU) across Australia. Their NATA-accredited laboratories in Brisbane, Adelaide, and Perth provide precise calibration for mass standards (1 mg to 5,000 kg), length measures (1 mm to 3,000 mm), and volume measures (1 mL to 5,000 L). These services ensure measurement accuracy, supporting fair trade and consumer protection.

To get more information on this market, Request Sample

Expansion of Single-Source Calibration Solutions

The calibration services market in Australia is growing with the development of comprehensive single-source offerings. This process presents a cost-saving, time-effective means through which industries are able to achieve access to calibration services, facilitating higher measurement precision and regulatory standards. By using one-stop means of satisfying calibration requirements, firms can enhance operational effectiveness and assure high standards for businesses like manufacturing, aerospace, and healthcare. The greater availability of these services is particularly useful in the facilitation of quality assurance programs and compliance with industry regulations. As industries continue to focus on precision and compliance, this move toward centralized calibration services is increasingly becoming a part of ensuring competitiveness and operational integrity throughout the region. For instance, in April 2022, Trescal launched its single-source calibration solution across Australia and New Zealand. This initiative aims to provide comprehensive calibration services to various industries, enhancing measurement accuracy and compliance.

Australia Calibration Services Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on service type, calibration type, and end use industry.

Service Type Insights:

- In-House

- OEMs

- Third-Party Service

The report has provided a detailed breakup and analysis of the market based on the service type. This includes in-house, OEMs, and third-party service.

Calibration Type Insights:

- Electrical

- Mechanical

- Thermodynamic

- Physical/Dimensional

- Others

A detailed breakup and analysis of the market based on the calibration type have also been provided in the report. This includes electrical, mechanical, thermodynamic, physical/dimensional, and others.

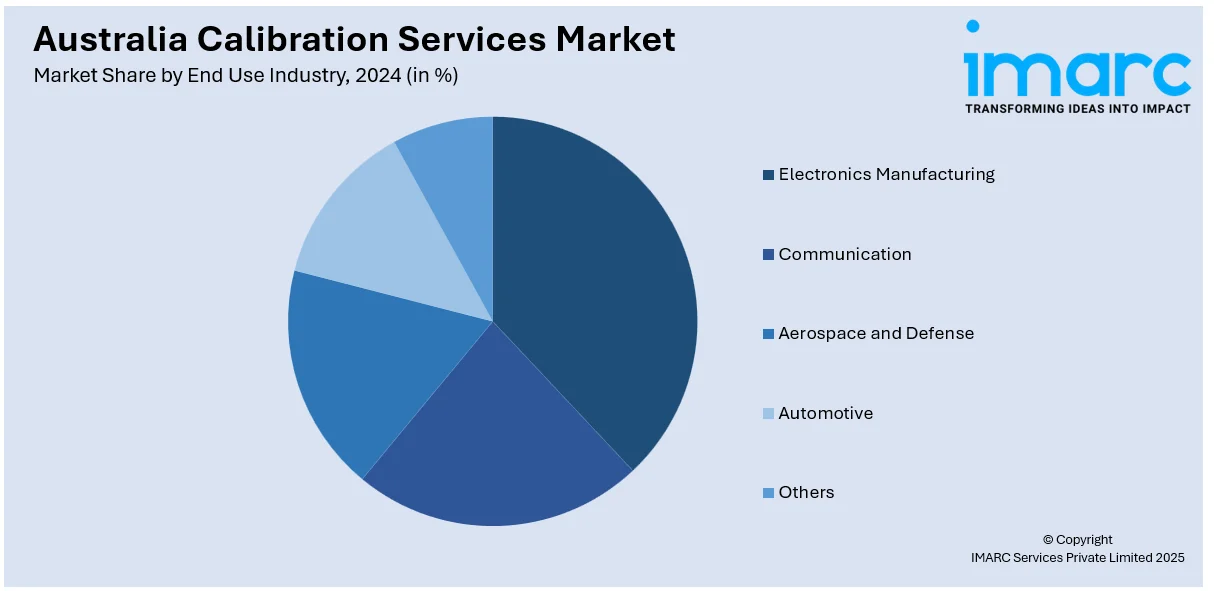

End Use Industry Insights:

- Electronics Manufacturing

- Communication

- Aerospace and Defense

- Automotive

- Others

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes electronics manufacturing, communication, aerospace and defense, automotive, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Calibration Services Market News:

- In December 2024, the National Measurement Institute (NMI) published the legal metrology priorities for 2024–25, focusing on enhancing calibration services to ensure accurate and reliable measuring instruments for trade. Key actions include verifying and calibrating instruments across industries, supporting calibration service providers, and upholding high standards to maintain measurement integrity. These services are crucial for ensuring fair trade and consumer protection in sectors reliant on precise measurement, such as manufacturing and healthcare.

Australia Calibration Services Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Service Types Covered | In-House, OEMs, Third-Party Service |

| Calibration Types Covered | Electrical, Mechanical, Thermodynamic, Physical/Dimensional, Others |

| End Use Industries Covered | Electronics Manufacturing, Communication, Aerospace and Defense, Automotive, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia calibration services market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia calibration services market on the basis of service type?

- What is the breakup of the Australia calibration services market on the basis of calibration type?

- What is the breakup of the Australia calibration services market on the basis of end use industry?

- What are the various stages in the value chain of the Australia calibration services market?

- What are the key driving factors and challenges in the Australia calibration services market?

- What is the structure of the Australia calibration services market and who are the key players?

- What is the degree of competition in the Australia calibration services market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia calibration services market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia calibration services market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia calibration services industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)