Australia Cancer Diagnostics Market Size, Share, Trends and Forecast by Product, Technology, Application, End User, and Region, 2025-2033

Australia Cancer Diagnostics Market Overview:

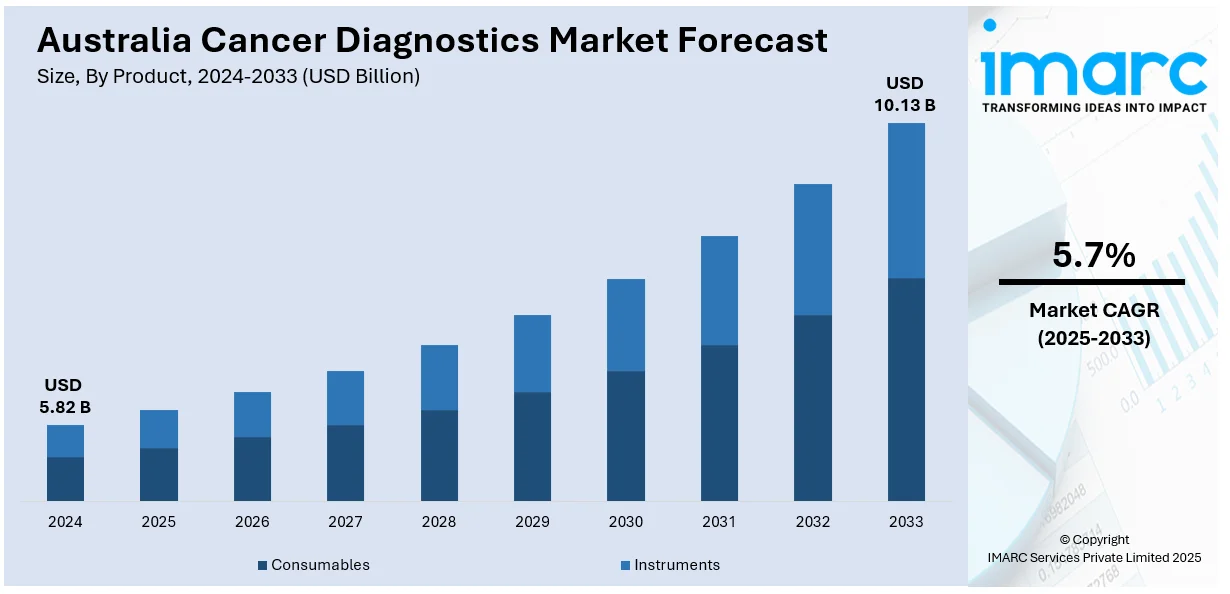

The Australia cancer diagnostics market size reached USD 5.82 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 10.13 Billion by 2033, exhibiting a growth rate (CAGR) of 5.7% during 2025-2033. Rising cancer incidence, technological advancements in diagnostic tools, increasing government support for healthcare innovation, growing awareness of early detection, and the demand for personalized medicine and non-invasive diagnostic methods to improve patient outcomes are some of the factors contributing to Australia cancer diagnostics market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5.82 Billion |

| Market Forecast in 2033 | USD 10.13 Billion |

| Market Growth Rate 2025-2033 | 5.7% |

Australia Cancer Diagnostics Market Trends:

Growing Focus on Cancer Care Leadership

Australia's healthcare landscape is shifting toward improved cancer care, owing to the establishment of a new strategic organization devoted to leading and enhancing cancer detection and treatment. This step demonstrates a commitment to pooling resources and expertise among cancer care providers, encouraging collaboration, and assuring the delivery of high-quality, accessible healthcare services. This project, which focuses on developing a single framework for research, treatment standards, and patient outcomes, is anticipated to boost cancer diagnostic innovation by incorporating cutting-edge technology and supporting a more coordinated approach. This approach is anticipated to accelerate advances in early identification, tailored treatment regimens, and integrated care pathways, benefiting both medical professionals and patients. The focus on leadership and excellence could position Australia as a global leader in cancer diagnostic advancements. These factors are intensifying the Australia cancer diagnostics market growth. For example, in May 2024, the Australian government announced the establishment of the Australian Comprehensive Cancer Network (ACCN) to provide strategic leadership and drive excellence in cancer care across the sector.

To get more information on this market, Request Sample

Expansion of Precision Oncology Initiatives

Australia is strengthening its commitment to precision oncology by making considerable investments in cancer detection and treatment. A new effort aims to extend a platform that provides full genetic analysis for individuals with advanced malignancies. This program will help integrate cutting-edge genetic technology to better detect cancer subtypes and enhance treatment methods. The platform's goal is to personalize cancer care by offering access to precision medicine and personalized therapeutics based on individual genetic profiles, hence improving patient outcomes. The proliferation of such services is anticipated to hasten the adoption of modern diagnostic techniques and clinical trials, boosting innovation in cancer therapy. With increased investment in this area, Australia is positioning itself to lead in the adoption of precision medicine, providing hope for more effective, targeted cancer care and improving the quality of life for patients. For instance, in March 2025, the Australian government announced a USD 30.8 Million investment to extend the precision oncology screening platform, enabling clinical trials (PrOSPeCT), providing comprehensive genomic profiling to patients with advanced cancers.

Australia Cancer Diagnostics Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, technology, application, and end user.

Product Insights:

- Consumables

- Antibodies

- Kits and Reagents

- Probes

- Others

- Instruments

- Pathology-based Instruments

- Imaging Instruments

- Biopsy Instruments

The report has provided a detailed breakup and analysis of the market based on the product. This includes consumables (antibodies, kits and reagents, probes, and others) and instruments (pathology-based instruments, imaging instruments, and biopsy instruments).

Technology Insights:

- IVD Testing

- Polymerase Chain Reaction (PCR)

- In Situ Hybridization (ISH)

- Immunohistochemistry (IHC)

- Next-generation Sequencing (NGS)

- Microarrays

- Flow Cytometry

- Immunoassays

- Others

- Imaging

- Magnetic Resonance Imaging (MRI)

- Computed Tomography (CT)

- Positron Emission Tomography (PET)

- Mammography

- Ultrasound

- Biopsy Technique

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes IVD testing (polymerase chain reaction (PCR), in situ hybridization (ISH), immunohistochemistry (IHC), next-generation sequencing (NGS), microarrays, flow cytometry, immunoassays, and others), imaging (magnetic resonance imaging (MRI), computed tomography (CT), positron emission tomography (PET), mammography, and ultrasound), and biopsy technique.

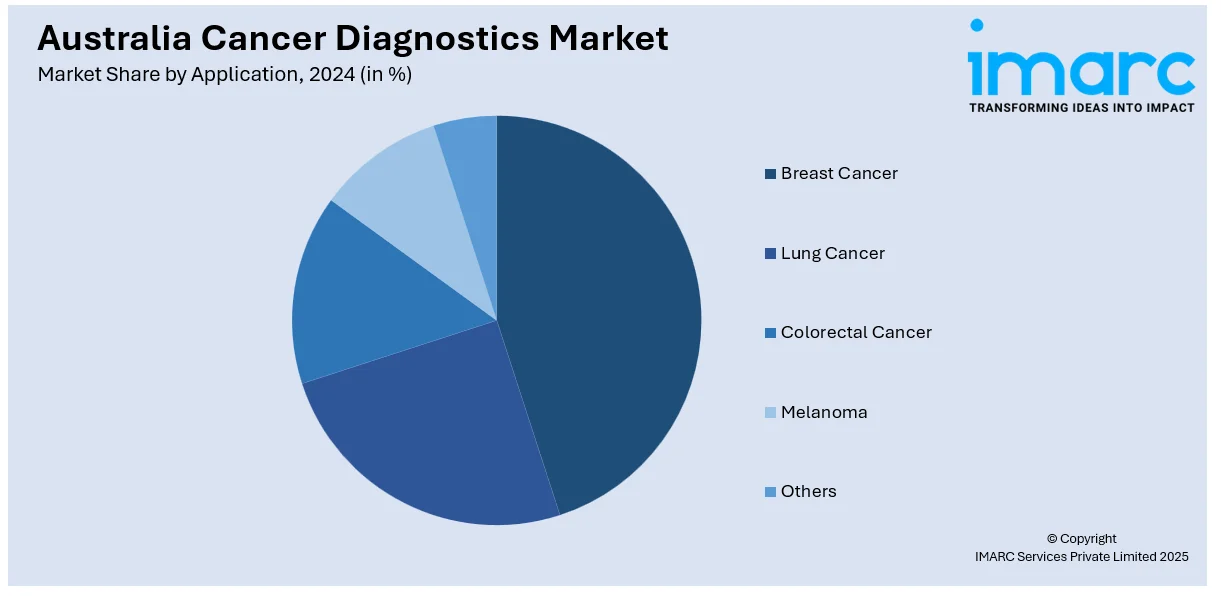

Application Insights:

- Breast Cancer

- Lung Cancer

- Colorectal Cancer

- Melanoma

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes breast cancer, lung cancer, colorectal cancer, melanoma, and others.

End User Insights:

- Hospitals and Clinics

- Diagnostic Laboratories

- Others

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes hospitals and clinics, diagnostic laboratories, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cancer Diagnostics Market News:

- In April 2025, the Australian government announced the introduction of the National Lung Cancer Screening Program, the first new national cancer screening program in nearly 20 years, set to begin in July 2025.

- In March 2025, the Australian government announced a USD 21 Million investment to extend the ZERO Childhood Cancer program to support young Australians aged 19-25 with cancers typically seen in childhood.

Australia Cancer Diagnostics Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered |

|

| Technologies Covered |

|

| Applications Covered | Breast Cancer, Lung Cancer, Colorectal Cancer, Melanoma, Others |

| End Users Covered | Hospitals and Clinics, Diagnostic Laboratories, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cancer diagnostics market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cancer diagnostics market on the basis of product?

- What is the breakup of the Australia cancer diagnostics market on the basis of technology?

- What is the breakup of the Australia cancer diagnostics market on the basis of application?

- What is the breakup of the Australia cancer diagnostics market on the basis of end user?

- What is the breakup of the Australia cancer diagnostics market on the basis of region?

- What are the various stages in the value chain of the Australia cancer diagnostics market?

- What are the key driving factors and challenges in the Australia cancer diagnostics market?

- What is the structure of the Australia cancer diagnostics market and who are the key players?

- What is the degree of competition in the Australia cancer diagnostics market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cancer diagnostics market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cancer diagnostics market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cancer diagnostics industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)