Australia Car Audio Market Size, Share, Trends and Forecast by Component Type, Vehicle Type, Sound Management, Sales Channel, and Region, 2025-2033

Australia Car Audio Market Overview:

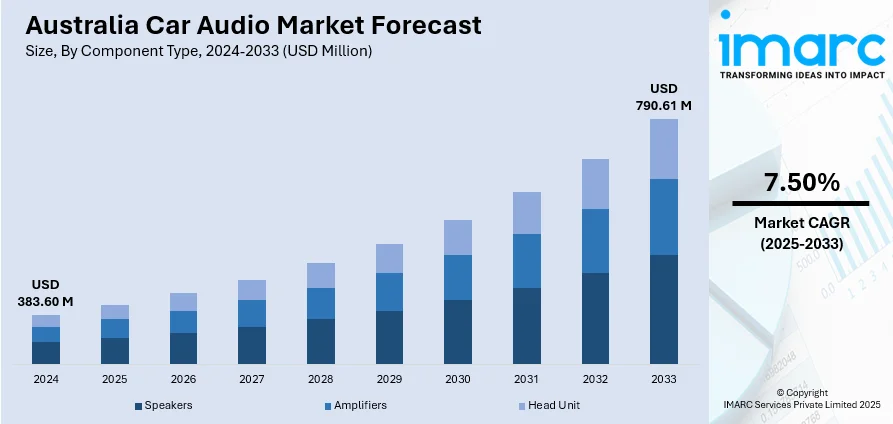

The Australia Car Audio Market size reached USD 383.60 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 790.61 Million by 2033, exhibiting a growth rate (CAGR) of 7.50% during 2025-2033. The trend is fueled by increasing consumer need for connected and personalized in-car entertainment, electric vehicle (EV) adoption, and audio technology innovations. As motorists pursue seamless smartphone connectivity and immersive entertainment, manufacturers are putting together smarter systems with voice control and AI-powered features. The transition to quieter EV cabins also increases demand for high-fidelity sound systems. Besides this, the Australia car audio market share is fueled by the growth lifestyle trends like increased commuting distances and digital audio streaming are continuing to solidify audio quality as a major auto buying consideration.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 383.60 Million |

| Market Forecast in 2033 | USD 790.61 Million |

| Market Growth Rate 2025-2033 | 7.50% |

Australia Car Audio Market Trends:

Rise of Smart and AI-Powered Car Audio Systems

Australia car audio systems are transforming from basic entertainment devices to smart, connected platforms. Drivers now demand seamless connectivity with smartphones and voice assistants, enabling hands-free operation of music, navigation, and calls. AI-enabled systems learn listening patterns and adjust sound settings accordingly. These capabilities make driving safer by minimizing distractions and enhance the driving experience overall. Intrinsic apps and cloud connectivity facilitate access to streaming media and real-time information. The move towards more intelligent, intuitive audio systems is indicative of a larger movement in automotive technology, where convenience, customization, and connectivity are the focus. As vehicles become digital centers, audio systems are no longer about sound they're about designing a personalized, immersive experience that meets the driver's lifestyle and daily habits.

To get more information on this market, Request Sample

Influence of Electric Vehicles on Car Audio Design

In 2024, electric vehicles (EVs) accounted for 9.5% of new car sales in Australia, with around 114,000 units sold a 150% increase in market share since 2022. This rapid adoption is reshaping car audio design to suit EVs’ quieter cabins, which allow for cleaner, more immersive sound. Automakers are rethinking speaker placement, acoustic insulation, and bass response, while also integrating external pedestrian warning systems. This dual focus on interior entertainment and external safety is driving innovation in both functionality and design. Premium audio systems are now being developed with luxury-grade sound, AI enhancements, and smart connectivity tailored to the EV experience. As demand for EVs rises, the need for advanced, purpose-built audio systems is becoming a key differentiator. This shift is further boosting the Australia car audio market growth, as manufacturers and brands compete to deliver superior in-car sound experiences.

Growing Demand for Premium, Immersive Audio

Australian drivers are showing a strong preference for premium, immersive car audio experiences. This trend is shaping how manufacturers and aftermarket brands design and market their systems. Consumers want more than just loud sound they’re looking for clarity, depth, and surround-like audio that makes every drive feel like a private concert. Features such as surround sound, customizable sound zones, and enhanced equalizer controls are becoming standard in higher-end vehicles. People are also drawn to systems co-developed with renowned audio brands, bringing studio-quality sound into everyday commuting. As music, podcasts, and audiobooks become central to travel, the quality of in-car audio is increasingly seen as a reflection of lifestyle and taste. This desire for richer experiences is transforming car interiors into carefully tuned sound environments, with buyers willing to invest more for the best auditory experience on the road.

Australia Car Audio Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component type, vehicle type, sound management, and sales channel.

Component Type Insights:

- Speakers

- Amplifiers

- Head Unit

The report has provided a detailed breakup and analysis of the market based on the component type. This includes speakers, amplifiers, and head unit.

Vehicle Type Insights:

- Hatchback

- Sedan

- Sports Utility Vehicles (SUVs)

- Multi-Purpose Vehicles (MPVs)

A detailed breakup and analysis of the market based on the vehicle type have also been provided in the report. This includes hatchback, sedan, sports utility vehicles (SUVs), and multi-purpose vehicles (MPVs).

Sound Management Insights:

- Voice Recognition

- Manual

The report has provided a detailed breakup and analysis of the market based on the sound management. This includes voice recognition and manual.

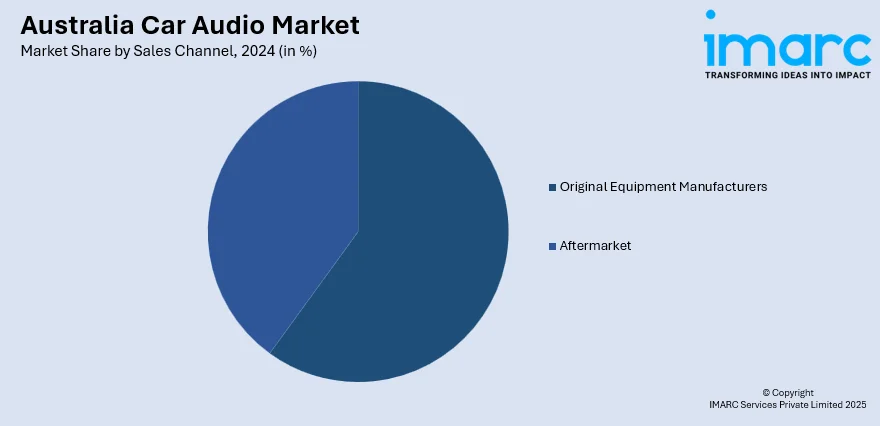

Sales Channel Insights:

- Original Equipment Manufacturers

- Aftermarket

A detailed breakup and analysis of the market based on the sales channel have also been provided in the report. This includes original equipment manufacturers and aftermarket.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Car Audio Market News:

- In May 2025, Samsung’s Harman acquired Masimo’s Sound United audio division for $350 million, strengthening its position in automotive sound and connected tech. The deal adds premium brands like Bowers & Wilkins to Harman’s portfolio, reinforcing its leadership in car audio. This marks Samsung’s biggest acquisition since buying Harman in 2017, underlining its commitment to expanding its influence in both in-vehicle electronics and premium consumer audio markets.

- In April 2025, Mahindra is set to launch the XUV 3XO in Australia at the 2025 Melbourne Motor Show, scheduled for April 5–6. While pricing hasn’t been confirmed, it’s expected to start around AUD 25,000. The sub-compact SUV will compete with rivals like the Chery Omoda 5, GWM Haval Jolion, and MG ZS. Originally launched in India in 2024, the XUV 3XO is positioned as a value-packed contender in its segment.

Australia Car Audio Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered | Speakers, Amplifiers, Head Unit |

| Vehicle Types Covered | Hatchback, Sedan, Sports Utility Vehicles (Suvs), Multi-Purpose Vehicles (MPVs) |

| Sound Managements Covered | Voice Recognition, Manual |

| Sales Channels Covered | Original Equipment Manufacturers, Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia car audio market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia car audio market on the basis of component type?

- What is the breakup of the Australia car audio market on the basis of vehicle type?

- What is the breakup of the Australia car audio market on the basis of sound management?

- What is the breakup of the Australia car audio market on the basis of sales channel?

- What is the breakup of the Australia car audio market on the basis of region?

- What are the various stages in the value chain of the Australia car audio market?

- What are the key driving factors and challenges in the Australia car audio market?

- What is the structure of the Australia car audio market and who are the key players?

- What is the degree of competition in the Australia car audio market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia car audio market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia car audio market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia car audio industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)