Australia Car Leasing Market Size, Share, Trends and Forecast by Type, Lease Type, Service Provider Type, Tenure, and Region, 2025-2033

Australia Car Leasing Market Overview:

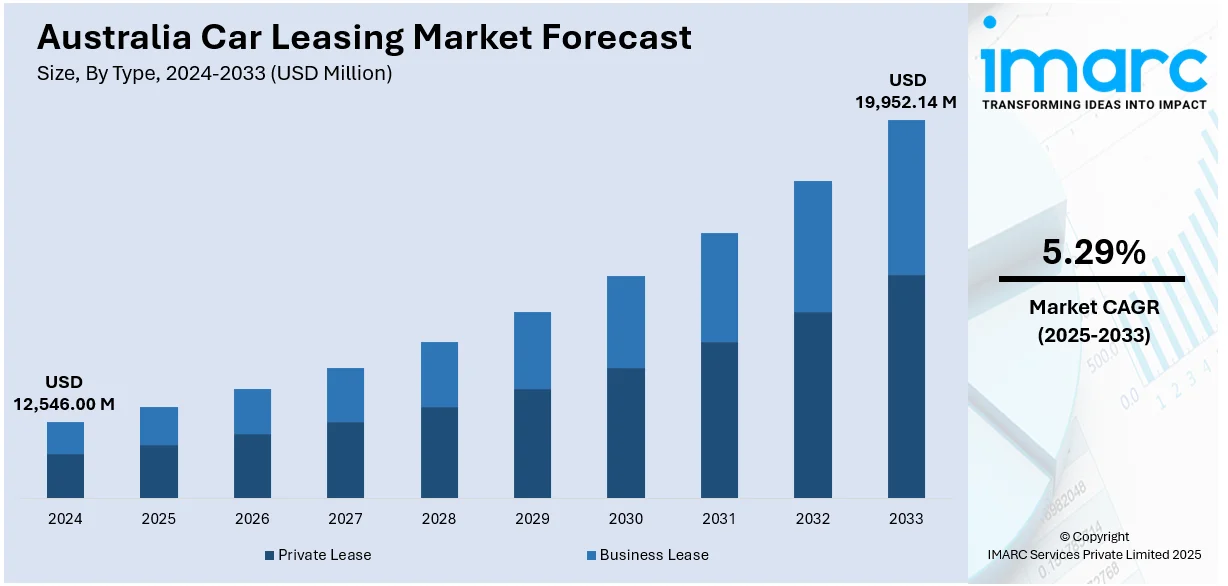

The Australia car leasing market size reached USD 12,546.00 Million in 2024. Looking forward, the market is projected to reach USD 19,952.14 Million by 2033, exhibiting a growth rate (CAGR) of 5.29% during 2025-2033. The increasing need for flexible mobility solutions, increased initial expenses, depreciation problems, and utilization of fleet leasing by companies are motivating the market growth. Tax benefits, preference for newer vehicle models, environmental consciousness, the increase in electric vehicle leasing, urbanization and traffic congestion, and convenience provided by internet websites are also motivating the market growth. Apart from this, remote work models reducing fleet needs and the development of long-term leasing options for individuals and businesses are fostering the Australian car leasing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12,546.00 Million |

| Market Forecast in 2033 | USD 19,952.14 Million |

| Market Growth Rate 2025-2033 | 5.29% |

Key Trends of Australia Car Leasing Market:

Increased Demand for Flexible Mobility Solutions

Among the most important drivers of the expansion of the Australian car leasing market is the increasing demand for flexible mobility solutions. There has been a revolutionary shift in the way Australians view transportation over the last few years, with increasing numbers of people abandoning car ownership in favor of alternatives. This change is caused by a growing demand for convenience and flexibility services such as car leasing, where the customer can access a car without the long-term cost of car ownership. Urbanization, long commute times, and a value for shorter use of cars make leasing a popular option. Furthermore, with the rise of mobility as a service (MaaS), Australians are increasingly embracing the concept of paying to use a vehicle when they need one, without committing entirely to ownership. This trend is also reflected in the growing demand for subscription-based car services, which allow users to swap vehicles depending on their needs.

To get more information on this market, Request Sample

High Upfront Costs and Depreciation Concerns

High initial expenses and depreciation issues are persuading many Australians to consider car leasing as a more financially attractive alternative. When buying a car outright, the initial financial outlay can be high, with new car prices continuing to increase. Added to that, cars depreciate over time, with most cars depreciating by as much as 20% in the first year alone. This rapid depreciation can be particularly disconcerting to people and businesses who would rather not bear the cost of owning a depreciating asset. Car leasing serves this purpose by offering lower payments than car loans and allowing people to use new or nearly new cars without worrying about their resale value. For businesses, fleet leasing also lessens depreciation risks by enabling them to change cars frequently without shouldering the full ownership cost.

Businesses Leveraging Fleet Leasing for Cost Management

Businesses in Australia are increasingly leveraging fleet leasing to manage their operational costs more effectively, which is contributing to the growth of the car leasing market. In 2024, Hyundai and Oly came together to roll out novated leasing to hundreds of Hyundai dealerships across the country, facilitating customers to avail flexible leasing plans with ease. Fleet leasing provides companies with the flexibility to maintain a fleet of vehicles without committing large amounts of capital to purchasing the vehicles outright. This arrangement allows businesses to avoid the hefty upfront costs, as well as the ongoing maintenance and depreciation concerns associated with owning a fleet. Leasing provides companies with predictable expenses through fixed monthly payments, which helps in budgeting and cash flow management. Additionally, it often includes maintenance and insurance, further reducing the administrative burden on businesses, which is further driving the Australian car leasing market growth.

Growth Drivers of Australia Car Leasing Market:

Cost Efficiency

Car leasing is becoming increasingly popular in Australia due to its significant cost benefits when compared to traditional vehicle ownership. Leasing reduces the impact of hefty initial costs, allowing both individuals and businesses to enjoy access to vehicles through consistent monthly payments. This financial structure enables customers to manage their budgets adeptly without concerns about depreciation or the resale market. For businesses, it allows for the preservation of capital, which can be allocated to essential operations instead of being immobilized in vehicle purchases. For individuals, leasing provides an affordable and convenient option, particularly for those seeking short-term commitments. According to Australia car leasing market analysis, cost efficiency remains one of the most compelling reasons driving adoption, making leasing a practical choice in today’s dynamic economic environment.

Corporate Fleet Expansion

The corporate interest in car leasing within Australia continues to rise as businesses prioritize efficient fleet management. Leasing offers companies predictable operational expenses, access to modern and fuel-efficient vehicles, and diminished maintenance obligations. It also enables businesses to scale their fleets up or down as needed, enhancing operational flexibility. By incorporating leasing models, organizations can optimize their resources while minimizing capital expenditure, which leads to improved cash flow management. Moreover, fleet leasing supports sustainability objectives by allowing companies to integrate hybrid and electric vehicles more affordably. This trend is significantly boosting Australia car leasing market demand, with corporate clients emerging as one of the most critical growth drivers of the industry.

Preference for Newer Models

The growing preference for newer vehicle models is a crucial element propelling the uptake of leasing in Australia. Consumers are increasingly drawn to cars that feature the latest technology, better safety enhancements, and improved fuel efficiency. Leasing gives drivers the opportunity to upgrade their vehicles every few years, eliminating the complications associated with resale or depreciation. This adaptability is especially appealing to tech-oriented individuals and younger audiences who value convenience and modernity. The chance to frequently access advanced models also resonates with environmentally aware consumers interested in hybrid or electric options. By facilitating affordable upgrades, leasing aligns with changing lifestyle trends and enhances the attractiveness of contemporary mobility solutions in the market.

Australia Car Leasing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional and country levels for 2025-2033. Our report has categorized the market based on type, lease type, service provider type, and tenure.

Type Insights:

- Private Lease

- Business Lease

The report has provided a detailed breakup and analysis of the market based on the type. This includes private lease and business lease.

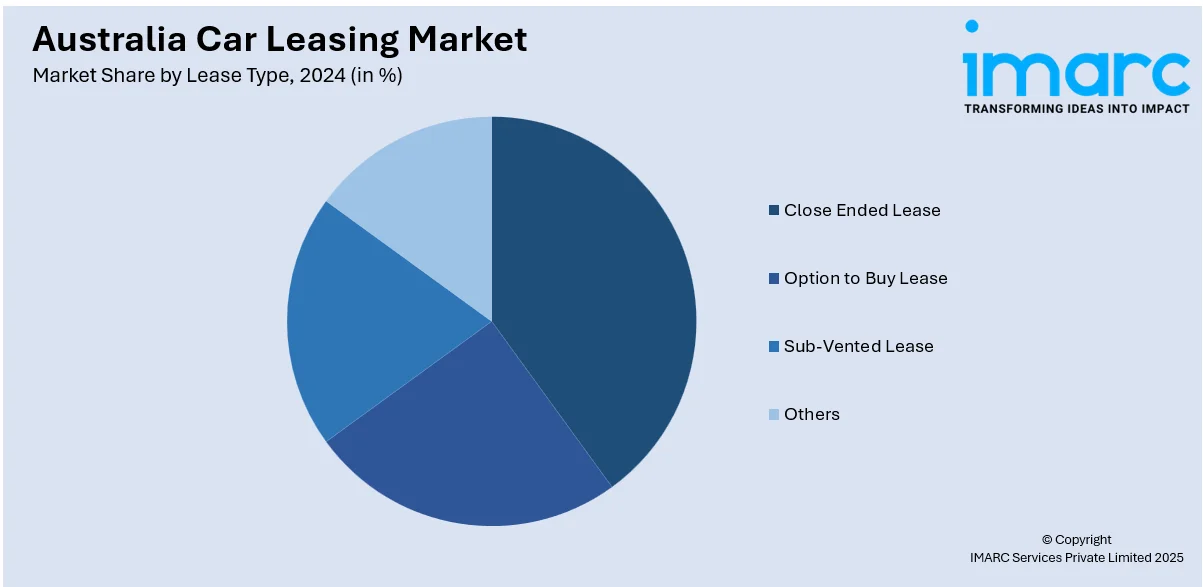

Lease Type Insights:

- Close Ended Lease

- Option to Buy Lease

- Sub-Vented Lease

- Others

A detailed breakup and analysis of the market based on the lease type have also been provided in the report. This includes close ended lease, option to buy lease, sub-vented lease, and others.

Service Provider Type Insights:

- Original Equipment Manufacturer (OEM)

- Bank Affiliated

- Nonbank Financial Companies (NBFCs)

The report has provided a detailed breakup and analysis of the market based on the service provider type. This includes original equipment manufacturer (OEM), bank affiliated, and nonbank financial companies (NBFCs).

Tenure Insights:

- Short-Term

- Long-Term

A detailed breakup and analysis of the market based on the tenure have also been provided in the report. This includes short-term and long-term.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Avis Australia

- Budget Rent a Car Australia Pty Ltd

- Custom Fleet

- Leaselab

- Novated Lease Australia

- ORIX Australia Corporation Limited

- SG Fleet

- Summit Fleet Leasing and Management

- The Hertz Corporation

- Toyota Fleet Management Australia

Australia Car Leasing Market News:

- In 2024, SG Fleet opened its books to Pacific Equity Partners following a USD 1.2 billion takeover bid. The offer represented a 31% premium on SG Fleet's last closing price of USD 2.67.

- In April 2024, Macquarie announced the cessation of new car lending through its direct, broker, and novated leasing channels, signaling a strategic shift in its operations.

Australia Car Leasing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Private Lease, Business Lease |

| Lease Types Covered | Close Ended Lease, Option to Buy Lease, Sub-Vented Lease, Others |

| Services Provider Type Covered | Original Equipment Manufacturer (OEM), Bank Affiliated, Nonbank Financial Companies (NBFCs) |

| Tenures Covered | Short-Term, Long-Term |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Avis Australia, Budget Rent a Car Australia Pty Ltd, Custom Fleet, Leaselab, Novated Lease Australia, ORIX Australia Corporation Limited, SG Fleet, Summit Fleet Leasing and Management, The Hertz Corporation, Toyota Fleet Management Australia, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia car leasing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia car leasing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia car leasing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The car leasing market in Australia was valued at USD 12,546.00 Million in 2024.

The Australia car leasing market is projected to exhibit a compound annual growth rate (CAGR) of 5.29% during 2025-2033.

The Australia car leasing market is expected to reach a value of USD 19,952.14 Million by 2033.

The Australia car leasing market is shaped by rising adoption of electric vehicle leasing, growing popularity of subscription-based mobility services, and increasing use of digital platforms for lease management. Enhanced customer preference for flexible contracts and sustainability-driven choices is also influencing leasing patterns across urban markets.

The market is driven by rising urbanization, increasing preference for hassle-free vehicle access, and greater financial awareness among consumers. Expanding corporate mobility needs and supportive government policies promoting cleaner transport options further fuel leasing adoption. Additionally, changing consumer lifestyles and reduced interest in long-term ownership strengthen market expansion prospects.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)