Australia Car Rental Market Size, Share, Trends and Forecast by Booking Type, Rental Length, Vehicle Type, Application, End User, and Region, 2026-2034

Australia Car Rental Market Size and Share:

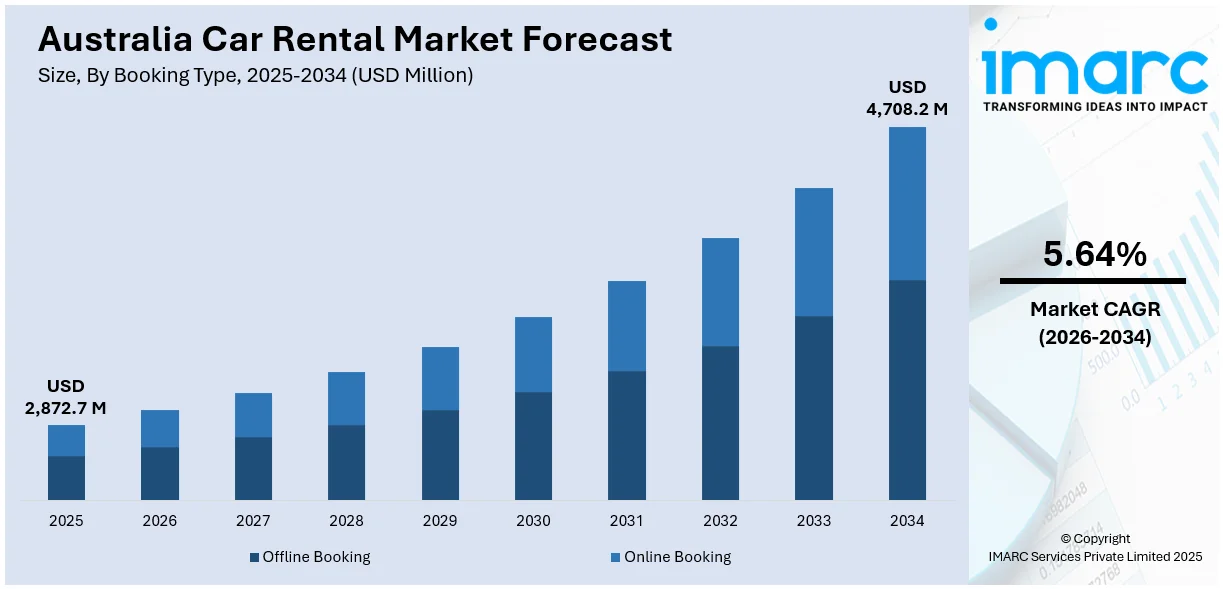

The Australia car rental market size was valued at USD 2,872.7 Million in 2025. Looking forward, the market is expected to reach USD 4,708.2 Million by 2034, exhibiting a CAGR of 5.64% from 2026-2034. The Australia car rental market share is expanding, driven by a recovering tourism sector, increased business travel, digital adoption of booking platforms, growing demand for sustainable vehicle options, and a shift towards flexible mobility solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034 |

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2,872.7 Million |

| Market Forecast in 2034 | USD 4,708.2 Million |

| Market Growth Rate (2026-2034) | 5.64% |

Australia is a popular tourist destination that has been attracting millions of visitors every year. This influx of both international and domestic tourists significantly boosts the demand for car rentals. A total of 630,700 short-term trips were recorded in September 2024, which is an increase of 46,070 compared with the corresponding month of the previous year. Tourists who come to explore Australia’s vast landscapes often prefer renting cars due to the country's large size and the freedom it offers in terms of travel. In this regard, rental cars provide a flexible and convenient way to travel across long distances, especially in regions where public transport may be less frequent or efficient.

To get more information on this market Request Sample

The modern consumer values flexibility more than ever before, and this has contributed to the popularity of car rentals in Australia. Renting a car provides a sense of independence, allowing individuals to choose their travel schedules without being reliant on public transport timetables or taxi availability. In an industry survey, it was found that almost one in four (23%) Aussies do not want to use their own car for road trips while one in five (19%) want to splurge on something different. This is especially true for people who need a vehicle for a short-term purpose, like business trips, vacations, or even just a day trip around the city.

Key Trends of Australia Car Rental Market:

Rise of the Sharing Economy and Peer-to-Peer Rentals

A major factor affecting the growth of Australia’s car rental market is the rise of the sharing economy, where individuals rent out their personal vehicles to others through peer-to-peer rental platforms. Companies like Car Next Door, DriveMyCar, and Turo have revolutionized the way people think about car rentals, giving consumers the option to rent a car directly from an individual owner rather than a traditional rental agency. According to a recent report by the Australian Bureau of Statistics, 65% of Australian households own at least one car, which is widening the scope of car renting. Peer-to-peer rentals also cater to niche markets, such as renting electric vehicles (EVs), luxury cars, or specialty vehicles that are not always available at traditional rental services. As per the Australia car rental market forecast, this shift towards peer-to-peer rentals offers more variety and can be more cost-effective, further driving the Australia car rental market demand.

Business Travel Demand

Business travel is a significant driver of the car rental market in Australia. As businesses continue to expand, more professionals are traveling for meetings, conferences, or site visits. In the ending June 2024, business travel accounted for 777,000 international trips to Australia, representing 78% of June 2019 levels, with expenditures reaching $2.3 billion, a 1% increase from June 2019. Renting a car provides a practical solution for professionals who need to travel between meetings, especially in cities with sprawling suburbs or locations that are not easily accessible via public transport. The flexibility of having a rental car at one’s disposal means that business travelers can adjust their schedules as needed without worrying about the limitations of taxis or buses. This demand has been further amplified as hybrid work models and global business expansion continue to grow. Car rental services cater to business needs by offering fleet options, premium vehicles, and even tailored corporate rental packages, which provide convenience and efficiency for companies and their employees, thereby expanding the Australia car rental market share.

Cost-Effectiveness Compared to Car Ownership

Owning a car in Australia can be expensive, especially when considering ongoing costs like insurance, registration, maintenance, and fuel. As per an industry study, 673,969 households in Australia do not own a car. For people who do not require a car on a daily basis or those living in urban areas where public transport options are plentiful, renting a car can be a more cost-effective solution. This factor is especially relevant for people who only need a vehicle for occasional use, such as weekend trips or short-term needs, rather than for daily commuting. In the year 2024, short-term arrivals accounted for 630,700 visits. Car rental provides access to vehicles without the long-term financial commitment associated with ownership, making it a popular choice for many Australians, particularly younger people, students, or those who are more environmentally conscious and prefer to avoid the costs and responsibilities of owning a vehicle.

Growth Drivers of Australia Car Rental Market:

Tourism Growth and Regional Access

The major impetus for the growth of the car rental industry in Australia comes from its thriving tourism market, which continues to draw local and foreign tourists to the country. The immense geographical spread of Australia, with a treasure trove of natural attractions including the Great Barrier Reef, Uluru, and the Great Ocean Road, prompts travelers to choose self-driven holiday experiences. The scattered nature of these attractions means that car rentals are not merely convenient but often essential. With some nations boasting closely packed urban cores, much of Australia's best is beyond the radius of primary public transportation networks. This leaves one in need of car hire facilities, particularly in rural districts where bus and rail services are sparse or non-existent. Moreover, Australia's high-quality road infrastructure and right-hand driving culture (like most tourists' native countries, e.g., the UK or Japan) lower the barriers for tourists to rent cars. These special geographical and infrastructure conditions position Australia as a very suitable place for car rental services to prosper.

Increasing Demand from Domestic Tourists and Lifestyle Changes

According to the Australia car rental market analysis, the region’s car rental business is also supported by growing domestic travel as well as changes in the lifestyle of its population. As city residents in Sydney, Melbourne, and Brisbane increasingly adopt minimalist and eco-friendly lifestyles, they are opting to forego vehicle ownership, especially due to high vehicle costs of ownership, parking, and congestion within high-density cities. Instead, more people are renting cars for weekend breaks, road trips, or short-term requirements like home moving. This is facilitated by the convenience provided by car rental companies and the availability of online platforms that enable one to book and access the vehicle easily. In addition, post-pandemic Australians have been more willing to discover their own backyard than venture elsewhere, driving demand for car rentals as a safer, more individualized alternative to public transport shared among strangers. This at-home exploration trend is particularly marked in a nation where open roads and scenic routes are part of the country's travel ethos.

Mining, Agriculture, and Corporate Mobility Needs

Australia's economy is dominated by industries such as mining, agriculture, and construction—industries that need strong mobility solutions in inaccessible and sometimes extreme terrain. Car rental businesses that service these industries have seen steady demand, particularly for utility vehicles, four-wheel drives, and commercial vans. For instance, in Western Australia and Queensland, where there are massive mining activities, firms tend to lease or rent fleets to facilitate effective employee transport to far-flung sites. Likewise, farming activities in rural Victoria or New South Wales depend on temporary access by vehicles during peak seasons. This is industrial demand specific to the economic profile and geography of Australia, distinguishing it from car rental markets in more urbanized countries. Furthermore, with companies increasingly adopting asset-light business models, leasing cars rather than maintaining large fleets is a cost-efficient move. This reliance on rentals for both logistical and operational purposes further deepen the market’s resilience and contributes significantly to its growth trajectory.

Opportunities of Australia Car Rental Market:

Expansion to Underserved Regional and Remote Regions

Australia's large landmass and sparse population outside the central metropolitan zones present very special opportunities for car hire companies to break into regional and remote regions. Numerous smaller towns and rural communities throughout states such as Northern Territory, South Australia, and Western Australia have poor access to dependable public transport, and private car rental is a necessary service. Travelers in search of off-the-beaten-path natural wonders like Kakadu National Park, the Nullarbor Plain, or back-of-beyond coastal drives may need rental cars to make the journey worthwhile. Yet existing rental infrastructure remains focused around metropolitan centers and airports. By expanding networks to regional airports, remote tourist destinations, and mining centers, operators can access latent demand. Additionally, these places generally have little competition, so new entrants or growing brands can establish local loyalty and develop sustainable operations with less pressure on pricing. The government's increasing investment in regional tourism also assists long-term sustainability in such places.

Development of Eco-Friendly and Electric Vehicle Rental Fleet

Australia's growing emphasis on environmental sustainability and changing consumer trends create a compelling proposition for car rental companies to be at the forefront of electric vehicle (EV) take-up. Although the nation has been behind some regions in adopting EVs, policy realignments at both state and federal levels are steering investment in charging infrastructure and incentives supporting cleaner transport. For rental companies, this provides an opportunity to stake a claim as green transport leaders by providing EV and hybrid fleets, particularly in environmentally aware markets like Tasmania and the ACT. Travelers visiting destinations like the Blue Mountains or Byron Bay tend to look for environmentally friendly alternatives, and EV rentals can provide exactly that. Additionally, Australia’s solar energy potential offers a compelling angle for companies to integrate renewable charging solutions into their operations. By aligning with national sustainability goals and leveraging regional green energy strengths, car rental companies can carve a niche and differentiate themselves in a competitive space.

Integration of Technology and Mobility-as-a-Service Platforms

The increasing demand for digital solutions and frictionless customer experiences presents huge opportunities within Australia's car rental industry through technology adoption and Mobility-as-a-Service (MaaS) platforms. Australian consumers are extremely mobile-aware, and cities such as Sydney and Melbourne have witnessed a sudden increase in ride-sharing and digital public transit solutions. The development shows willingness to adopt car rental systems based on the app, subscription, and fully automated forms. Car rental businesses can take advantage by using smart vehicle access technologies, touchless renting, and AI-based fleet management. There is also scope for collaboration with local councils and transport operators in bundling rental services within public transport planning, offering multi-modal trips for residents and visitors alike. For example, providing easy availability of rentals at railway stations or ferry ports could enhance regional mobility and alleviate urban traffic. With Australia's sprawling urban planning and restricted late-night public transport networks, online and adaptable car rental arrangements stand to be a big winner.

Challenges of Australia Car Rental Market:

Geographical Restraints and High Operating Costs

High operating cost is one of the most serious challenges in the car rental business in Australia, compounded by the country's enormous and diverse geography. Keeping vehicles in check and transporting them over long distances, particularly between outback areas, presents huge logistical challenges. In jurisdictions such as Western Australia or the Northern Territory, where town-to-town distances span several hundred kilometers, moving cars or offering roadside service is a prohibitively expensive exercise. Additionally, the unforgiving climate consisting of high temperatures, dust, and off-road terrain, causes rapid deterioration of cars, necessitating more frequent servicing. Insurance costs in isolated or high-risk areas also tend to be significantly higher, adding further financial strain on providers. Australia's vast landmass, although being an opportunity, ensures fleet management and asset utilization much more challenging than in more geographically condensed markets. This dimensional scale along with climatic extremities renders cost-effectiveness and operational planning major challenges for rental companies with countrywide operations.

Disruptions to Vehicle Supply Chain and Fleet Availability

Australia's reliance on imported vehicles is another significant issue faced by car rental companies, particularly ensuring fleet availability and diversity. With minimal domestic motor vehicle production, the sector is susceptible to global supply chain disruptions, including shipping delays, factory backlogs, and geopolitical problems impacting worldwide automobile production. Disruptions like natural disasters in the exporting nations or worldwide semiconductor shortages can seriously impede motor vehicle acquisition. This sets rental operators up for older fleets or even a lack of cars to address peak seasonal demand, especially during holidays when tourism surges. Furthermore, Australia's stringent import and road regulations can also delay the availability of new models or new technologies such as electric cars. The significant lead times for delivery and the significant expense of obtaining newer, lower-emission vehicles complicate efforts by firms to update their fleets. These supply chain constraints restrict growth and impact customer satisfaction because rental options might be low or varied geographically.

Price Sensitivity and Market Fragmentation

The Australian car rental market is extremely fragmented, with large multinational operators, mid-sized regional players, and small local companies competing for market share. This leads to fierce price competition, especially in capital cities and high-traffic tourist destinations where there are several rental brands shoulder to shoulder. Customers, particularly budget-sensitive native tourists, tend to book rentals strictly on price alone, so it becomes challenging for operators to realize healthy margins. To make matters worse, widespread online comparison sites have made consumers aware of price disparities, forcing firms to reduce rates or provide frequent discounts. While good for the ultimate consumer, this squeezes profit margins and deters long-term investment in fleet innovation or service enhancements. The matter is compounded by volatile cycles of demand, where seasonal peaks may be preceded by long stretches of low utilization, thereby decoupling pricing strategies from operational viability. The price-sensitive environment calls for prudent positioning and incessant value innovation in order to remain competitive.

Australia Car Rental Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia car rental market, along with forecasts at the country and regional levels from 2026-2034. The market has been categorized based on booking type, rental length, vehicle type, application, and end user.

Analysis by Booking Type:

- Offline Booking

- Online Booking

According to the Australian car rental market statistics, sizeable section of the Australian car rental industry continues to be served by the offline booking sector, particularly among clients who lack access to digital platforms or want individualized assistance. Many tourists, especially those in distant locations and elderly populations, rely on offline channels including travel agencies, rental shops, and phone bookings. As clients speak with employees directly to discuss to clarify terms, haggle over prices, or request certain services, offline reservations frequently provide a feeling of dependability and flexibility.

The popularity of smartphones and internet penetration are the main drivers of the online booking market. Because digital platforms make it easier for customers to compare costs, peruse car selections, and make fast reservations, they are becoming increasingly popular. The rise of mobile apps and user-friendly websites, integrated with features like real-time availability, discount codes, and loyalty programs, is enhancing the appeal of this segment.

Analysis by Rental Length:

- Short Term

- Long Term

Tourists, business travelers, and locals who want cars for a few hours to a few days are all served by short-term rentals. This market niche flourishes in places where convenience and adaptability are valued, such as cities, airports, and popular tourist destinations. Short-term rentals are preferred by customers for last-minute mobility requirements, business meetings, and weekend vacations. Businesses in this market category concentrate on offering a wide range of car alternatives at low prices, frequently with supplementary services like insurance plans and GPS systems.

Due to the rising demand from temporary workers, overseas residents, and businesses needing cars for lengthy periods of time, long-term rentals are becoming a growing trend in Australia. Businesses wishing to offer dependable staff transportation without the expense and commitment of fleet ownership are drawn to this market. Long-term rentals typically range from a few weeks to several months and often come with attractive pricing models, including discounted rates and flexible terms.

Analysis by Vehicle Type:

- Luxury

- Executive

- Economy

- SUVs

- Others

The luxury car rental industry in Australia serves visitors looking for first-rate experiences, high-income individuals, and business professionals. This market is also popular for events where comfort and luxury are important, such as weddings, business gatherings, and vacations. High-end amenities like chauffeur services, leather interiors, and cutting-edge safety systems are frequently included with luxury rentals.

Professionals and businesses needing mid-range cars for work are the target audience for executive rentals. Sedans and crossovers in this market sector combine cost, performance, and comfort. These cars are frequently utilized for client meetings, airport transfers, and business travel. For continuous and dependable staff mobility, businesses often reserve executive cars on long-term rental contracts.

Economy vehicles form the backbone of Australia’s car rental market, catering to budget-conscious customers, including tourists, students, and small business owners. Compact cars dominate this segment, offering fuel efficiency, affordability, and practicality for city and short-distance travel. The economy segment thrives due to its accessibility and widespread availability, making it the go-to choice for most domestic travelers. Discounts, promotional deals, and the rising trend of online booking further bolster demand, ensuring this segment remains the largest by volume.

The SUV segment is increasingly popular in Australia, driven by its versatility and suitability for family trips, off-road adventures, and regional travel. They offer ample space, safety features, and powerful performance. This segment is especially attractive to tourists exploring Australia’s diverse terrain, from coastal roads to the rugged outback. The growing preference for SUVs among locals for group travel and road trips further boosts this segment.

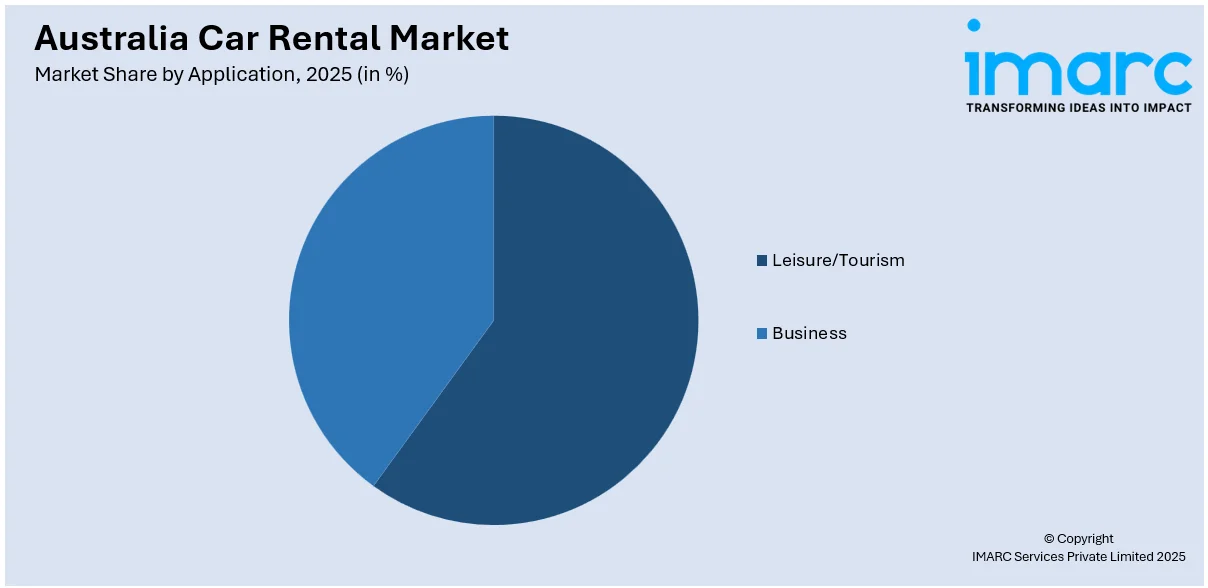

Analysis by Application:

Access the comprehensive market breakdown Request Sample

- Leisure/Tourism

- Business

The nation's appeal as a tourist destination propels the leisure and tourism sector. Both domestic and foreign visitors commonly rent cars to tour Australia's beautiful highways, national parks, and historical sites. This market is defined by short-term rentals, and clients frequently choose SUVs or economical cars to meet their travel requirements. As rental firms provide package offers and discounts catered to leisure tourists, partnerships with hotels, airlines, and travel agents further increase the demand.

The business category serves professionals and corporate clients that need dependable transportation for work-related events including conferences, meetings, and site visits. Executive and long-term rentals are in high demand in this segment as businesses value their workers' comfort and productivity. With the rise in business travel following the easing of pandemic restrictions, the segment has witnessed steady growth.

Analysis by End User:

- Self-Driven

- Chauffeur-Driven

Self-driven rentals constitute the majority of the car rental market in Australia, which attracts customers preferring independence and flexibility in traveling. Tourists, business travelers, and locals usually use self-driven rentals to visit places at their own pace without having to depend on others. This segment is driven by the wide range of vehicle choices, from economy cars to SUVs, catering to various travel needs and budgets. This convenience is further enhanced with features of real-time availability, with GPS-enabled vehicles.

Chauffeur-driven rentals are a niche segment and mainly cater to the clients consisting of business executives, luxury travelers, and event organizers. Mostly, these services are used for convenience and luxury so that the client is allowed time either to work or sleep while a professional deals with the transportation issues. This category comprises luxury sedans and SUVs, which are often associated with meet-and-greet services and multilingual drivers. Chauffeur-driven rentals are especially popular for airport transfers, weddings, and corporate events. Rental companies offer packages tailored to specific client requirements.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

One of the most significant regions for car rental in Australia is the Australian Capital Territory (ACT) & New South Wales (NSW). This region is a prominent tourist and business hub with iconic landmarks such as the Sydney Opera House and Blue Mountains that attract a large number of both local and international tourists who use rented cars for convenience. Business travel is also an important factor, as Canberra, the national capital, hosts government-related activities. This region has well-developed road infrastructure and is close to popular destinations, making it a critical market for rental companies, offering diverse options from economy cars to luxury vehicles.

Victoria and Tasmania provide a strong car rental market given the tourism appeal of Melbourne and Tasmania's scenic landscapes. Melbourne is known as an arts and cultural hub. It is also a gateway destination for the Great Ocean Road and the Yarra Valley, ensuring constant car rental demand. Tasmania ensues a strong demand for road trips, national parks, and wilderness, making car rental a must for visitors around the island. SUV and self-driven options are in higher demand among tourists.

Due to its status as a top leisure destination with attractions including the Great Barrier Reef, Gold Coast, and Daintree Rainforest, Queensland has a thriving car rental industry. Both local and foreign vacationers have a strong demand for rentals in the area, especially during the busiest travel seasons. SUVs and other family-friendly cars are well-liked for traveling through national parks and along the coast. Brisbane is a major city in the region that attracts more business travelers. Car rentals are essential for efficient travel due to the state's vast geographic area and dispersed attractions, which guarantees the region's continued expansion.

Due to its untamed landscapes and distinctive cultural attractions, the Northern Territory and South Australia serve a minor but important portion of the car rental industry. In the Northern Territory, adventurous travelers frequently choose 4WD cars for off-road driving to places like Uluru, Kakadu National Park, and Alice Springs. The coastline and wine areas of South Australia create demand for luxury and leisure rentals. Because of the distances and terrain involved, long-term rentals and SUVs are very common in these areas, and rental firms provide customized vehicles to satisfy these needs.

Western Australia's enormous expanse and varied attractions, including the Pinnacles, Ningaloo Reef, and Margaret River, have contributed to the state's booming car rental industry. For both business and pleasure tourists, the capital of the area is a crucial starting place. Strong demand for SUVs and long-term rentals is driven by the state's isolated and off-the-beaten-path locations, especially among adventure seekers and foreign visitors. Rental providers often include specialized services like additional luggage racks and off-road capabilities to cater to the unique travel needs of this expansive region.

Competitive Landscape:

In order to stay competitive, major players in the market are concentrating on sustainability, technological innovation, and customer-centric services. Numerous businesses are adding electric and hybrid vehicles to their fleets in response to the growing demand from consumers for eco-friendly options. They are also using sophisticated digital platforms to ease the booking process, which allows customers to compare prices, choose vehicles, and complete transactions with ease. Moreover, companies have modified mobile applications with features like real-time tracking and personalized recommendations. Partnerships with travel and tourism platforms are also being reinforced in order to draw in both domestic and foreign tourists and efforts are also being focused on flexible rental options, such as car-sharing models and subscription plans to meet the varied needs and preferences of customers.

The report provides a comprehensive analysis of the competitive landscape in the Australia car rental market with detailed profiles of all major companies.

Latest News and Developments:

- In September 2024, the CARWIZ brand announced that they have brought their rental business to the online realm. CARWIZ's Australian website promises to transform the way Aussies approach car rentals by offering a fresh and streamlined experience. The website's allows customers to browse through available vehicles, choose rental periods, and make reservations with a few clicks.

- In June 2024, VroomVroomVroom unveiled that it has incorporated its market-leading car rental reservation website into the official site of Sydney Airport. Under this agreement, which officially came into effect on May 1, 2024, Sydney airport customers will be able to more easily search, compare and book competitively-priced rentals from a vast selection through the airport's website available both for Sydney Airport customers and for international locations.

- In July 2024, Uber launched certain new features for its Australian users with its Uber Rent. This app enables people to rent a car directly via the Uber application.

- In November 2024, Turo entered into a partnership with The General Store to launch a brand new platform, Way To Go. This platform provides a smarter alternative to traditional car rental services, portraying its market-leading features.

Australia Car Rental Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Booking Types Covered | Offline Booking, Online Booking |

| Rental Lengths Covered | Short Term, Long Term |

| Vehicle Types Covered | Luxury, Executive, Economy, SUVs, Others |

| Applications Covered | Leisure/Tourism, Business |

| End Users Covered | Self-Driven, Chauffeur-Driven |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia car rental market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia car rental market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia car rental industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Car rental refers to the short-term or long-term leasing of vehicles by individuals or organizations for personal, business, or leisure purposes. It provides flexible transportation solutions, commonly used for travel, commuting, road trips, corporate needs, or temporary replacement of personal vehicles during repairs or maintenance.

The Australia car rental market was valued at USD 2,872.7 Million in 2025.

IMARC estimates the Australia car rental market to exhibit a CAGR of 5.64% during 2026-2034.

The Australia car rental market is expected to reach a value of USD 4,708.2 Million by 2034.

The major key trends of the Australia car rental market include rising demand for electric and hybrid vehicles, and cost effectiveness compared to car ownership. Partnerships with mobility platforms are also shaping a more flexible, tech-driven, and sustainable rental landscape.

The Australian car rental market is driven by a recovering tourism sector, increasing business travel and growing digital adoption for online bookings. Business travel is a significant driver of the car rental market in Australia.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)