Australia Carbon Black Market Size, Share, Trends and Forecast by Type, Grade, Application, and Region, 2025-2033

Australia Carbon Black Market Overview:

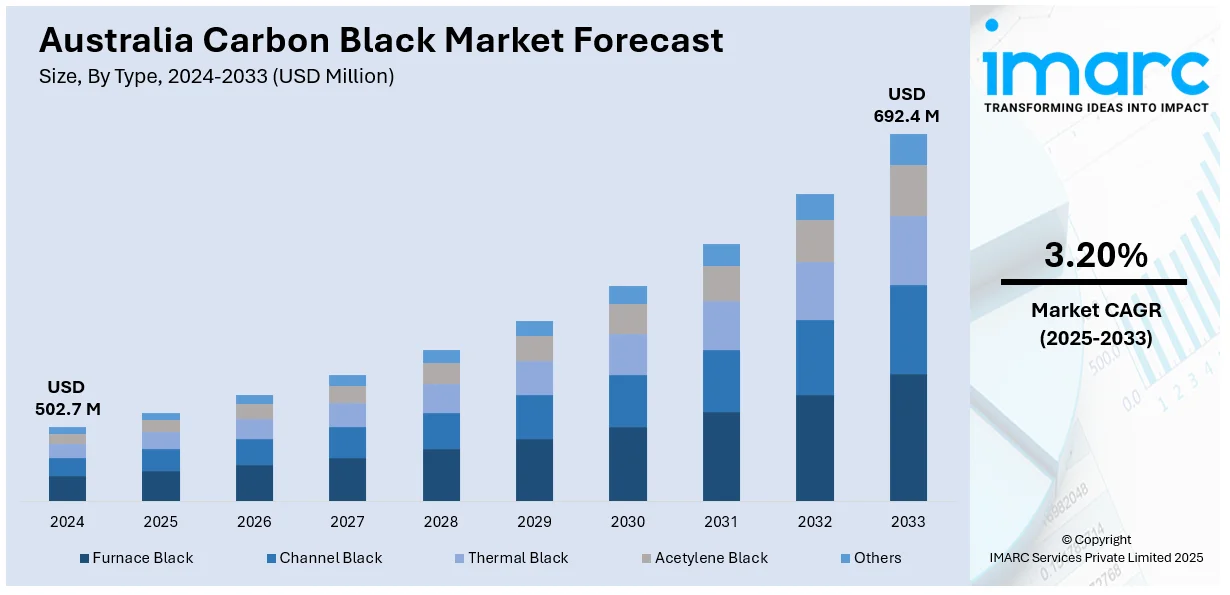

The Australia carbon black market size reached USD 502.7 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 692.4 Million by 2033, exhibiting a growth rate (CAGR) of 3.20% during 2025-2033. The market is witnessing steady growth due to rising demand from tire manufacturing, expanding automotive and industrial activities, and increased usage of plastics and coatings. Supportive infrastructure development and growing construction output are also contributing to sustained consumption.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 502.7 Million |

| Market Forecast in 2033 | USD 692.4 Million |

| Market Growth Rate 2025-2033 | 3.20% |

Australia Carbon Black Market Trends:

Rising Demand from the Automotive Sector

The use of carbon black in tire production continues to support market expansion across Australia. This material enhances strength and durability, making it essential for both commercial and passenger vehicles. As vehicle ownership increases, especially in suburban and remote areas, tire manufacturing plants are scaling up output to meet the growing replacement and OEM demand. Carbon black is also gaining traction in the non-tire rubber segment, including hoses, belts, and gaskets, which are vital for the upkeep of both industrial and agricultural vehicles. Strong trade flows and consistent imports are ensuring a stable raw material supply chain. In recent years, several local manufacturers have focused on upgrading facilities to maintain quality and environmental compliance. Ongoing upgrades and increasing capital investments by mid-size players indicate long-term confidence in the sector. Developments such as emission control upgrades in production sites and collaborations with automotive firms for product customization are shaping future trends.

To get more information on this market, Request Sample

Construction and Coatings Usage Rising

The steady increase in urban development and infrastructure activity is driving carbon black consumption in plastics and coatings. It serves as a key additive for pigmenting, UV resistance, and conductivity. The product’s role in building materials, including pipes, films, and insulation components, is becoming more critical with the push for energy-efficient structures. Demand from plastic compounding units and protective coatings manufacturers is pushing suppliers to expand their regional footprint. Many producers are adopting cleaner and more efficient furnace black production methods to align with tightening regulations. These changes are also helping meet the preferences of industries focused on low-emission inputs. The expansion of industrial coatings applications in warehouses, logistics centers, and manufacturing facilities is another contributing factor. Over the past year, a few suppliers have introduced high-dispersion grades and strengthened partnerships with local distributors to ensure faster deliveries. This is enhancing supply responsiveness and supporting product availability in key urban centers like Sydney and Melbourne.

Australia Carbon Black Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on type, grade, and application.

Type Insights:

- Furnace Black

- Channel Black

- Thermal Black

- Acetylene Black

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes furnace black, channel black, thermal black, acetylene black, and others.

Grade Insights:

- Standard Grade

- Specialty Grade

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes standard grade and specialty grade.

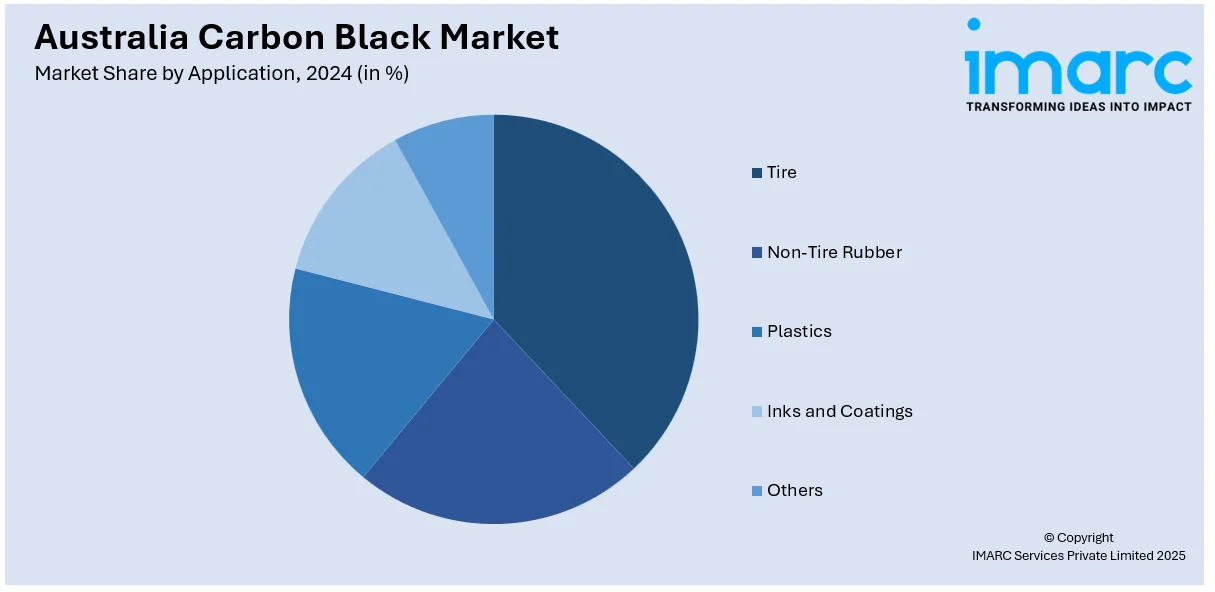

Application Insights:

- Tire

- Non-Tire Rubber

- Plastics

- Inks and Coatings

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes tire, non-tire rubber, plastics, inks and coatings, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Carbon Black Market News:

- December 2024: Epsilon Carbon’s Karnataka plant received ISCC PLUS certification, validating its sustainable Carbon Black production. This milestone boosted supply of certified low-emission carbon black to global markets, including Australia, supporting demand for eco-friendly materials and advancing circular economy goals in industrial applications.

- September 2024: Australia proposed packaging regulation reforms, including EPR fees based on material composition. This impacted the carbon black market by incentivizing recycled content use, discouraging virgin carbon black in packaging, and promoting sustainable alternatives, influencing demand patterns across packaging and industrial applications.

Australia Carbon Black Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Furnace Black, Channel Black, Thermal Black, Acetylene Black, Others |

| Grades Covered | Standard Grade, Specialty Grade |

| Applications Covered | Tire, Non-Tire Rubber, Plastics, Inks and Coatings, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia carbon black market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia carbon black market on the basis of type?

- What is the breakup of the Australia carbon black market on the basis of grade?

- What is the breakup of the Australia carbon black market on the basis of application?

- What are the various stages in the value chain of the Australia carbon black market?

- What are the key driving factors and challenges in the Australia carbon black market?

- What is the structure of the Australia carbon black market and who are the key players?

- What is the degree of competition in the Australia carbon black market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia carbon black market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia carbon black market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia carbon black industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)