Australia Carbon Capture and Storage Market Size, Share, Trends and Forecast by Service, Technology, End Use Industry, and Region, 2025-2033

Australia Carbon Capture and Storage Market Size and Share:

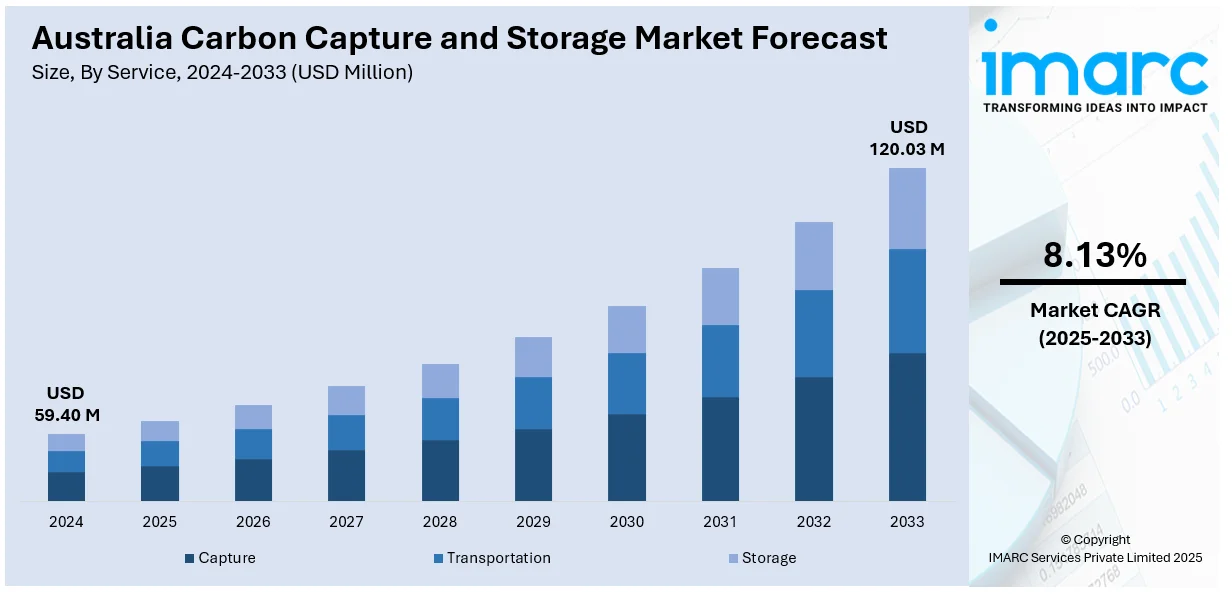

The Australia carbon capture and storage market size reached USD 59.40 Million in 2024. The market is projected to reach USD 120.03 Million by 2033, exhibiting a growth rate (CAGR) of 8.13% during 2025-2033. The government support, environmental policy commitments, and technological advancements are augmenting the market growth. Furthermore, energy sector investment, private sector engagement, industrial decarbonization needs, and growing carbon markets are stimulating the market growth. Apart from this, surging export opportunities, and increasing demand for sustainable solutions are contributing to the market growth. The country’s abundant storage capacity and commitment to net-zero emissions further support the widespread adoption and development of CCS technologies across various sectors, boosting the Australia carbon capture and storage (CCS) market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 59.40 Million |

| Market Forecast in 2033 | USD 120.03 Million |

| Market Growth Rate 2025-2033 | 8.13% |

Key Trends of Australia Carbon Capture and Storage Market:

Government Support

Government assistance is leading the carbon capture and storage (CCS) sector in Australia. Australia has recognized CCS as a significant technology that will enable it to meet its climate change goals. The government's aspiration to be net-zero by 2050 has spurred policy responses aimed at assisting the development of CCS implementation. The government has also made concerted efforts to provide a regulatory environment conducive to CCS development, including permitting guidelines, environmental monitoring guidelines, and safety guidelines. Regulatory certainty enhances investor confidence and brings both domestic and international investors to invest in CCS ventures. For example, CCS has been encouraged by the government as one of the most high-profile technologies in the "Technology Investment Roadmap," which highlights several pathways for emissions reductions in hard-to-abate industries. In line with this commitment, the Australian Federal Budget 2024–25 allocated $556.1 million over ten years to the 'Resourcing Australia’s Prosperity' program, which includes mapping geological storage potential for CCS, and an additional $32.6 million over four years to support regional cooperation on carbon sequestration, thereby reinforcing the government's dedication to advancing CCS initiatives.

To get more information on this market, Request Sample

Environmental Policy Commitments

Australia’s environmental policy commitments significantly contribute to the acceleration of the CCS market. As part of its international obligations under the Paris Agreement, Australia has set ambitious carbon reduction targets to achieve net-zero emissions by 2050. To meet these targets, Australia has emphasized the need for technological innovations, including CCS, to reduce the carbon footprint of industries with high emissions. This ambitious goal has created a clear incentive for industries and stakeholders to invest in and adopt CCS technologies as an essential tool in meeting their emission reduction obligations. With the goal to produce 500,000 tons of clean hydrogen annually by 2030, CCS is central to ensuring that hydrogen production is both economically viable and environmentally sustainable. In support of this, the Australian government announced in May 2024 a significant investment of AU$566 million to enhance offshore mapping programs aimed at identifying new carbon capture and storage locations and potential sites for clean hydrogen projects. This initiative is part of the broader "Future Made in Australia" agenda, underscoring the nation's commitment to developing a robust CCS infrastructure to meet its climate objectives .

Technological Advancements

Technological advancements in carbon capture and storage (CCS) are significantly driving the market growth. These innovations are addressing key challenges related to the efficiency and cost-effectiveness of CCS, making the technology more accessible for industries to adopt. Over the past decade, advancements in CO2 capture technologies, such as solvent-based absorption and membrane separation techniques, have improved the overall efficiency of carbon capture, reducing the energy required to capture CO2 emissions. For instance, the development of direct air capture (DAC) systems has expanded the range of CCS applications, allowing CO2 to be captured directly from ambient air, not just from industrial flue gases. This development is important as it opens up new opportunities for industries that do not have direct emissions sources, such as agriculture, to utilize CCS. Furthermore, improvements in CO2 storage methods have reduced the risks associated with long-term storage, such as leakage, through advanced monitoring and verification technologies. These advancements not only lower the costs of CCS but also enhance its overall feasibility for widespread adoption, further accelerating the Australia carbon capture and storage market growth.

Growth Drivers of Australia Carbon Capture and Storage Market:

Government Policies and Incentives

Australia's commitment to reducing carbon emissions has driven the adoption of Carbon Capture and Storage (CCS) technologies. The Australian government has introduced policies that support CCS as part of its broader climate change and net-zero emissions goals. Initiatives like the Emissions Reduction Fund provide financial incentives to industries adopting carbon capture technologies. Additionally, funding programs for CCS research and pilot projects help mitigate the cost burden on businesses. This proactive approach is necessary for Australia to achieve global climate targets, such as those under the Paris Agreement, which has further accelerated the growth of the CCS market. As regulatory frameworks become more stringent, companies are ramping up their investments in CCS technologies, leading to a positive impact on Australia carbon capture and storage market demand.

Technological Advancements and Innovation

Continuous advancements in CCS technology are crucial to the market's growth in Australia. Research into more efficient, cost-effective methods for capturing, transporting, and storing carbon dioxide (CO2) has significantly enhanced the feasibility of large-scale CCS projects. Innovation such as direct air capture and the advancement of geological storage technology would make CCS a feasible option for several industries which are difficult to decarbonize through other forms, like mining, making steel, and cement manufacture. In addition, the continual technological progress made in monitoring and verification technologies establishes confidence that CO2 would be secure and long-term, reducing significant concerns on leakage and environmental risks. According to Australia carbon capture and storage market analysis, these technological advancements are expected to accelerate market adoption, with a projected increase in investment from both public and private sectors.

Industry and Commercial Partnerships

The formation of strategic partnerships between government bodies, private companies, and research organizations is a major driver of growth in Australia’s CCS market. Collaborative efforts ensure the sharing of expertise, resources, and capital, making large-scale CCS projects more financially and technically feasible. Major industry players in the energy, mining, and manufacturing sectors are working alongside CCS technology providers and academic institutions to accelerate the development and deployment of carbon capture systems. Notably, Australia’s Cooperative Research Centres and Innovation Fund have fostered such partnerships, facilitating the scaling of CCS technologies and reducing financial risks. These collaborations are critical to advancing CCS infrastructure across Australia, positioning it as a global leader in carbon capture solutions.

Australia Carbon Capture and Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on service, technology, and end use industry.

Service Insights:

- Capture

- Transportation

- Storage

The report has provided a detailed breakup and analysis of the market based on the service. This includes capture, transportation, and storage.

Technology Insights:

- Post-combustion Capture

- Pre-combustion Capture

- Oxy-fuel Combustion Capture

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes post-combustion capture, pre-combustion capture, and oxy-fuel combustion capture.

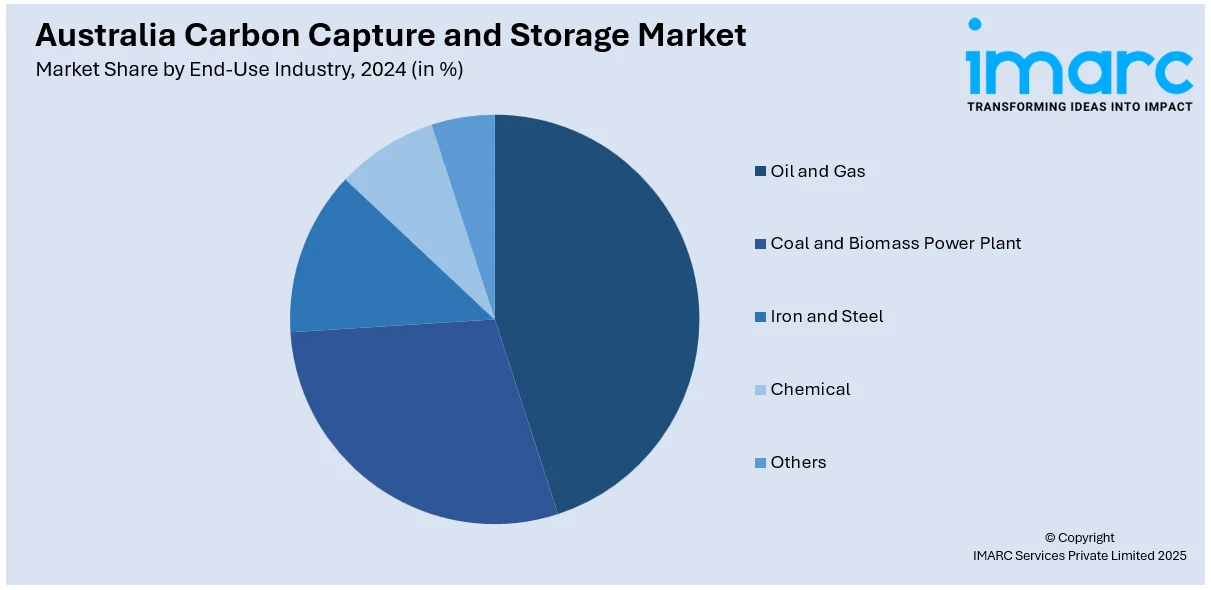

End-Use Industry Insights:

- Oil and Gas

- Coal and Biomass Power Plant

- Iron and Steel

- Chemical

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes oil and gas, coal and biomass power plants, iron and steel, chemical, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Carbon Capture and Storage Market News:

- In 2024, Santos and Beach Energy's Moomba CCS project, operational since October 2024, has stored 340,000 tons of CO₂-equivalent by year-end. The project aims to sequester 1.7 million tons annually, positioning Australia as a potential CCS hub for the Asia-Pacific region.

- In 2024, SK Earthon secured carbon storage exploration rights in Australia, aiming to address domestic storage shortages and enhance collaboration with the Australian government and industry.

Australia Carbon Capture and Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Capture, Transportation, Storage |

| Technologies Covered | Post-combustion Capture, Pre-combustion Capture, Oxy-fuel Combustion Capture |

| End-Use Industries Covered | Oil and Gas, Coal and Biomass Power Plants, Iron and Steel, Chemical, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia carbon capture and storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia carbon capture and storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia carbon capture and storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The carbon capture and storage market in the Australia was valued at USD 59.40 Million in 2024.

The Australia carbon capture and storage market is projected to exhibit a compound annual growth rate (CAGR) of 8.13% during 2025-2033.

The Australia carbon capture and storage market is expected to reach a value of USD 120.03 Million by 2033.

Key trends include increased government support through policy incentives, technological advancements improving CCS efficiency, and growing environmental policy commitments to reduce emissions, positioning CCS as a critical solution for Australia’s climate goals.

Growth drivers include government policies and incentives, technological innovations in CO2 capture and storage, and collaborations between industries and research organizations, all of which drive the adoption of CCS technologies to meet Australia's emission reduction targets.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)