Australia Cargo Handling Equipment Market Size, Share, Trends and Forecast by Equipment Type, Propulsion Type, Application, and Region, 2025-2033

Australia Cargo Handling Equipment Market Overview:

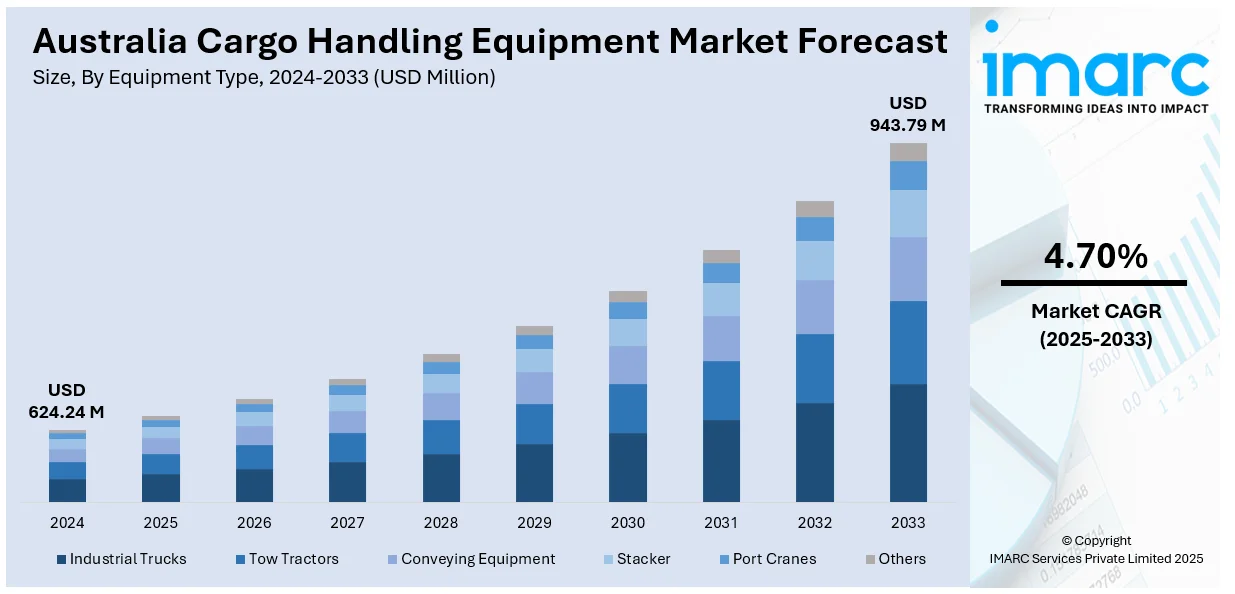

The Australia cargo handling equipment market size reached USD 624.24 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 943.79 Million by 2033, exhibiting a growth rate (CAGR) of 4.70% during 2025-2033. The growth of e-commerce, continuous port upgrades, and growing automation fuel the market demand. With the need for effective logistics options on the rise, companies are embracing cutting-edge technologies to maximize productivity and optimize operations, boosting Australia cargo handling equipment market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 624.24 Million |

| Market Forecast in 2033 | USD 943.79 Million |

| Market Growth Rate 2025-2033 | 4.70% |

Australia Cargo Handling Equipment Market Trends:

Growth in E-commerce Boosting Cargo Handling Demand

The market is witnessing rapid growth as the demand for effective logistics and supply chain solutions fueled by the e-commerce industry is on the rise. As online shopping is growing with rapid speed, there is mounting pressure for quicker and more efficient transportation services, thus boosting the demand for sophisticated cargo handling systems. Distribution centers and warehouses are being equipped with automated machinery to accelerate sorting, packaging, and delivery operations. In addition, the ongoing investments by the Australian government in infrastructure expansion to facilitate the logistics industry are giving an added stimulus to the demand for cargo handling equipment with superior performance. Installation of technologies like robotics and automated guided vehicles (AGVs) is becoming widespread in ports and warehouses, enhancing effectiveness in operations and minimizing the element of human error. The technologies enable firms to move more volume of cargo with less operational expenditure, improving profit margins and contributing to the overall Australia cargo handling equipment market growth. The emphasis on automation is expected to continue driving market growth in the coming years, as businesses seek to enhance productivity and meet customer demands for quicker delivery times.

To get more information on this market, Request Sample

Port Expansion and Infrastructure Development Driving Growth

In the past few years, Australia's cargo handling equipment market has gained from huge investments in port expansion and infrastructure renewal. The country's key ports, such as those in Sydney, Melbourne, and Brisbane, have seen large-scale expansions to accommodate growing trade volumes and boost operational efficiency. The renewal of these facilities has been instrumental in increasing the capacity for handling both domestic and overseas cargo, leading to the high demand for advanced handling equipment. As the contribution of Australia to world trade keeps on increasing, particularly in the Asia-Pacific region, there is an ever-increasing requirement for modern equipment to handle greater quantities of bulk and containerized freight. This development does not remain restricted to major ports alone but has been seen across regional smaller ports too, with various projects looking at enhancing docking facilities and cargo movement. These infrastructural investments are likely to spur market growth by offering additional capacity for cargo movement, for the demand for technology-driven equipment that is capable of managing the intricacies of contemporary cargo handling processes efficiently. With port authorities giving priority to optimizing operational workflows, the implementation of new cargo handling technologies is also expected to expand very quickly.

Australia Cargo Handling Equipment Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional level for 2025-2033. Our report has categorized the market based on equipment type, propulsion type, and application.

Equipment Type Insights:

- Industrial Trucks

- Tow Tractors

- Conveying Equipment

- Stacker

- Port Cranes

- Others

The report has provided a detailed breakup and analysis of the market based on the equipment type. This includes industrial trucks, tow tractors, conveying equipment, stacker, port cranes, and others.

Propulsion Type Insights:

- IC Engine

- Electric

A detailed breakup and analysis of the market based on the propulsion type have also been provided in the report. This includes IC Engine, Electric.

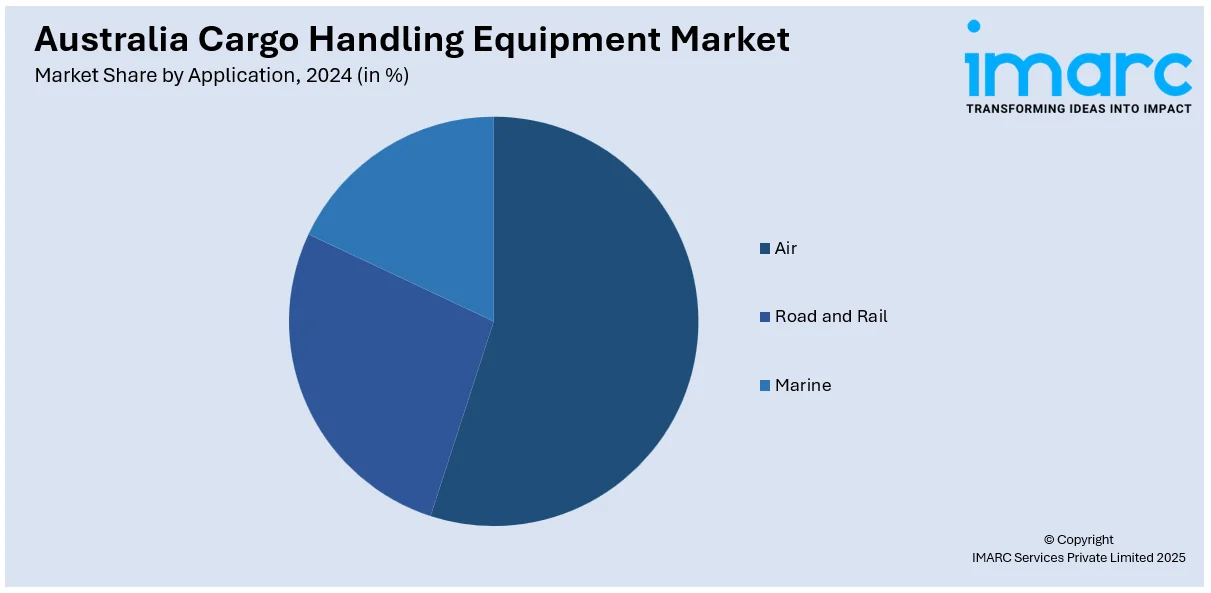

Application Insights:

- Air

- Road and Rail

- Marine

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes air, road and rail, and marine.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cargo Handling Equipment Market News:

- May 2025: Mobicon Systems launched its first battery-powered container handler, the 2HLe, addressing customer demand for zero-emission, low-cost solutions. The new handler combines efficiency, reduced noise, and lower operating costs, positioning it as a key development in the Australian cargo handling equipment sector.

- April 2025: Kalmar signed an agreement to supply four hybrid automated straddle carriers to Victoria International Container Terminal. The straddle carriers, designed to enhance productivity, and improve loading efficiency at Australia’s only fully automated container terminal.

Australia Cargo Handling Equipment Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Equipment Types Covered | Industrial Trucks, Tow Tractors, Conveying Equipment, Stacker, Port Cranes, Others |

| Propulsion Types Covered | IC Engine, Electric |

| Applications Covered | Air, Road and Rail, Marine |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cargo handling equipment market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cargo handling equipment market on the basis of equipment type?

- What is the breakup of the Australia cargo handling equipment market on the basis of propulsion type?

- What is the breakup of the Australia cargo handling equipment market on the basis of application?

- What is the breakup of the Australia cargo handling equipment market on the basis of region?

- What are the various stages in the value chain of the Australia cargo handling equipment market?

- What are the key driving factors and challenges in the Australia cargo handling equipment market?

- What is the structure of the Australia cargo handling equipment market and who are the key players?

- What is the degree of competition in the Australia cargo handling equipment market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cargo handling equipment market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cargo handling equipment market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cargo handling equipment industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)