Australia Cargo Insurance Market Size, Share, Trends and Forecast by Insurance Type, Distribution Channel, End User, and Region, 2025-2033

Australia Cargo Insurance Market Overview:

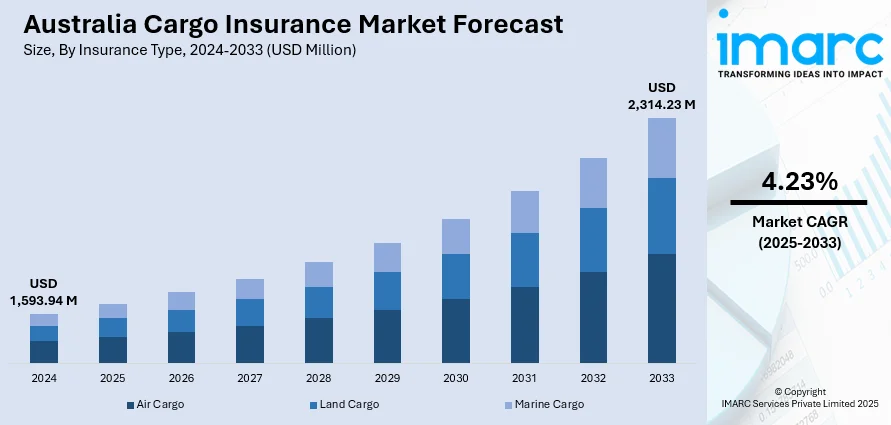

The Australia cargo insurance market size reached USD 1,593.94 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,314.23 Million by 2033, exhibiting a growth rate (CAGR) of 4.23% during 2025-2033. The market is fueled by shifting trade flows, technology, and an increased emphasis on supply chain resilience. Most significant of these are the rising trend towards bespoke insurance solutions, the further growth in the use of digital channels to distribute insurance products, and the incorporation of advanced risk tools covering climate and geopolitical risks. These developments together enable more effective and nimble coverage for stakeholders in the freight operations, further leading to the growth of Australia cargo insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,593.94 Million |

| Market Forecast in 2033 | USD 2,314.23 Million |

| Market Growth Rate 2025-2033 | 4.23% |

Australia Cargo Insurance Market Trends:

Increased Demand for Customized Policies Due to Supply Chain Diversification

The Australia cargo insurance market is experiencing a significant trend towards the tailoring of insurance policies to accommodate more diversified and intricate supply chains. As Australian importers and exporters increase their networks of trade throughout Asia-Pacific and other parts of the world, there has been increasing demand for more flexible cargo insurance cover. Companies are increasingly wanting policies that give fine-grained protection customised to the mode of transport, goods type, and local risk profile. It is especially keenly felt in industries handling high-value or sensitive cargo, like technology and agricultural products. Insurers are meeting this by rolling out modular policy constructs and adjustable terms that enable clarity in alignment with clients' business needs. For instance, in March 2024, 360 Underwriting Solutions released a new Marine, Cargo & Transit insurance policy with extensive cover, competitive premium, and experienced underwriting capability to meet vibrant market demands. Moreover, this change highlights the position of cargo insurance not only as a safeguard, but as a strategic element in logistics strategy. Australia cargo insurance expansion is thus highly correlated with the flexibility of products that mirror changing trade conditions.

To get more information on this market, Request Sample

Widening of Digital Platforms to Improve Policy Accessibility

One of the most important trends driving Australia's cargo insurance industry is the digitalization of insurance services, which is increasing accessibility and ease of use. The blending of cutting-edge digital platforms enables end users—traders, cargo owners, and logistics operators—to seek quotes, buy coverage, and handle claims more easily than with conventional means. Such platforms use real-time information, risk analysis, and automation to streamline decision-making and cut down on administrative work. In addition, increases in direct-to-consumer digital distribution are eliminating reliance on middlemen, facilitating affordable access to policies in both urban and outlying areas. This development promotes increasing customer demand for transparency, speed, and convenience, placing the insurance market in line with wider digital advances in logistics and freight management. Through enhancing reach and responsiveness, the shift to digital has a crucial role in underpinning Australia cargo insurance market growth, as it makes the market accessible to more types of users and shipments.

Integration of Climate and Geopolitical Risk Assessment Tools

The second characteristic trend of Australia's cargo insurance market is the integration of sophisticated risk-assessment tools taking into account climate variability and geopolitics. Increased occurrences of weather-related catastrophes—such as floods, cyclones, and bushfires—have necessitated that insurers improve their underwriting models using climate data in order to effectively evaluate transit risk. Likewise, geopolitical events such as changes in trade policy and maritime security concerns are necessitating a re-examination of exposures by route. These technologies allow premiums, exclusions, and zones of risk coverage to be dynamically adjusted, creating a more predictive and responsive environment for insureds. For example, in October 2024, Marinex Underwriting has ventured into the Australian market with marine insurance products, such as cargo and liability, to address increased demand for specialty coverage within the Australia cargo insurance market. Furthermore, for shipping owners and logisticians, such functionality is critical to managing resilience and continuity in turbulent commerce. Risk embedding risk intelligence in coverage solutions extends risk mitigation as well as operations planning. These developments play a major role in Australia cargo insurance expansion since they enhance trust in protection and consolidate confidence despite world uncertainties.

Australia Cargo Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on insurance type, distribution channel, and end user.

Insurance Type Insights:

- Air Cargo

- Land Cargo

- Marine Cargo

The report has provided a detailed breakup and analysis of the market based on the insurance type. This includes air cargo, land cargo, and marine cargo.

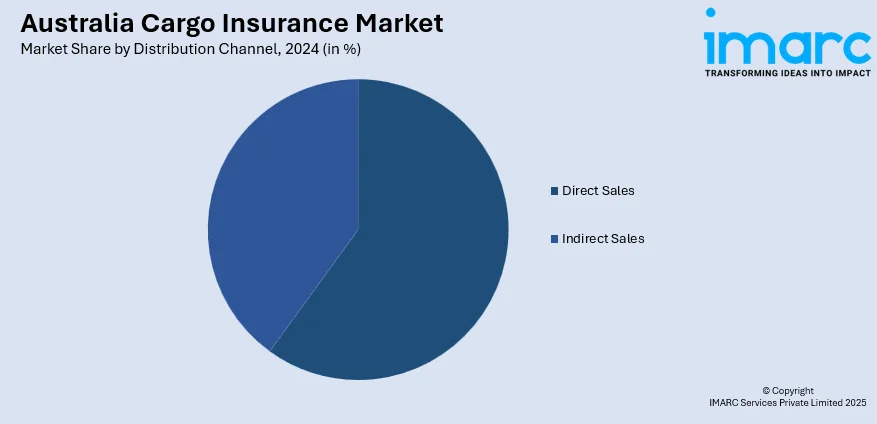

Distribution Channel Insights:

- Direct Sales

- Indirect Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales and indirect sales.

End User Insights:

- Traders

- Cargo Owners

- Ship Owners

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes traders, cargo owners, ship owners, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cargo Insurance Market News:

- In 2024, Rhodian Group expanded its portfolio by launching Marinex Underwriting, a marine-focused agency offering products such as Cargo, Carriers, Commercial Hull, and Marine Liability. Backed by global specialty insurer Amwins and Lloyd’s, Marinex aims to deliver specialized underwriting solutions to the Australian market.

Australia Cargo Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Insurance Types Covered | Air Cargo, Land Cargo, Marine Cargo |

| Distribution Channels Covered | Direct Sales, Indirect Sales |

| End Users Covered | Traders, Cargo Owners, Ship Owners, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cargo insurance market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cargo insurance market on the basis of insurance type?

- What is the breakup of the Australia cargo insurance market on the basis of distribution channel?

- What is the breakup of the Australia cargo insurance market on the basis of end user?

- What is the breakup of the Australia cargo insurance market on the basis of region?

- What are the various stages in the value chain of the Australia cargo insurance market?

- What are the key driving factors and challenges in the Australia cargo insurance?

- What is the structure of the Australia cargo insurance market and who are the key players?

- What is the degree of competition in the Australia cargo insurance market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cargo insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cargo insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cargo insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)