Australia Cargo Security and Surveillance Market Size, Share, Trends and Forecast by Security Type, Mode of Transport, Technology, End-User Industry, and Region, 2026-2034

Australia Cargo Security and Surveillance Market Summary:

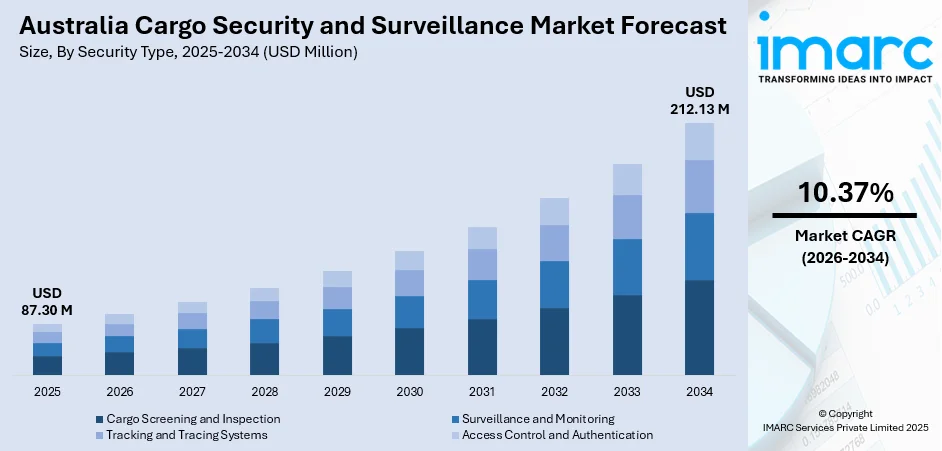

The Australia cargo security and surveillance market size was valued at USD 87.30 Million in 2025 and is projected to reach USD 212.13 Million by 2034, growing at a compound annual growth rate of 10.37% from 2026-2034.

The market is driven by escalating security threats across supply chains, mandatory regulatory compliance frameworks demanding enhanced screening protocols, rapid expansion of international trade volumes through air and maritime gateways and increasing adoption of intelligent surveillance technologies integrating artificial intelligence (AI) capabilities. These factors collectively strengthen cargo protection infrastructure while enabling real-time visibility across transportation networks, ultimately supporting the Australia cargo security and surveillance market share.

Key Takeaways and Insights:

-

By Security Type: Cargo screening and inspection dominates the market with a share of 32.15% in 2025, driven by stringent border mandates, advanced imaging detection capabilities, and high-throughput inspection processes at major freight terminals nationwide.

-

By Mode of Transport: Air cargo security leads the market with a share of 33.09% in 2025, owing to stringent aviation safety regulations, higher cargo value density, time-sensitive delivery requirements, and passenger-to-cargo conversion trends.

-

By Technology: X-ray scanners represent the largest segment with a market share of 35.17% in 2025, driven by proven effectiveness, container versatility, international compliance standards alignment, superior imaging resolution, and non-intrusive inspection capabilities.

-

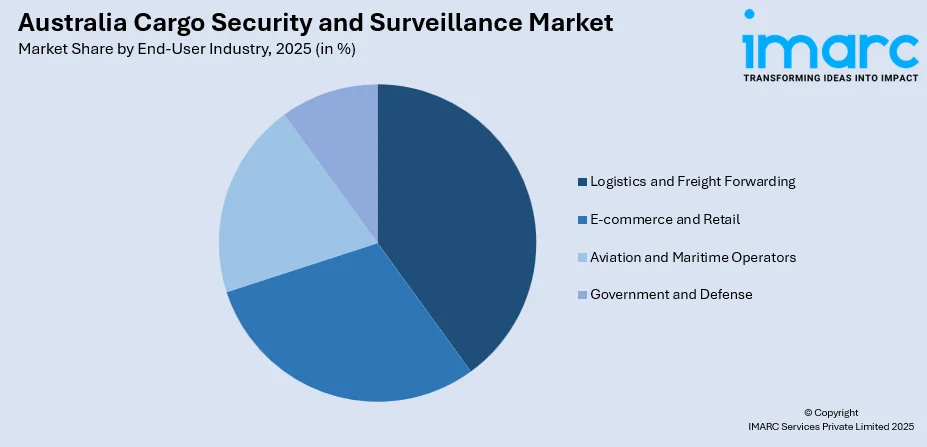

By End-User Industry: Logistics and freight forwarding dominates the market with a share of 30.09% in 2025, owing to e-commerce growth, insurance obligations, competitive security differentiation, and operational imperatives minimizing loss-related multi-modal transportation disruptions.

-

By Region: Australia Capital Territory & New South Wales leads the market with a share of 33% in 2025, driven by gateway concentration, federal oversight, advanced infrastructure, population density, and cargo volumes requiring comprehensive multi-modal screening.

-

Key Players: The competitive landscape includes multinational security technology leaders and regional surveillance specialists, differentiated by proprietary detection algorithms, integration strength, support networks, and compliance certifications, while partnerships with freight operators enhance penetration and accelerate deployments globally.

To get more information on this market Request Sample

The Australia cargo security and surveillance market experiences robust expansion propelled by convergence of regulatory imperatives, technological advancement, and evolving threat landscapes. Government authorities enforce stringent screening mandates protecting national borders from contraband infiltration and terrorism-related threats, compelling cargo handlers to deploy sophisticated detection infrastructure. Moreover, expanding international trade relationships generate unprecedented freight volumes requiring scalable security solutions maintaining operational efficiency without compromising thoroughness. Rising e-commerce penetration intensifies demand for secure last-mile logistics protecting consumer goods against theft and tampering throughout distribution networks. Integration AI, ML, and automated threat recognition capabilities transforms traditional surveillance approaches into proactive risk mitigation systems. Geographic concentration of population centers along coastal regions creates critical infrastructure requiring comprehensive protection against supply chain vulnerabilities.

Australia Cargo Security and Surveillance Market Trends:

Integration of Artificial Intelligence-Powered Threat Detection Systems

Traditional cargo screening approaches relying on manual operator interpretation face scalability limitations amid surging freight volumes. Modern surveillance infrastructure incorporates AI algorithms automatically analyzing scan imagery to identify anomalous patterns suggesting concealed threats. ML models trained on extensive databases of prohibited items enable real-time flagging of suspicious cargo without human intervention, significantly accelerating inspection throughput while maintaining detection accuracy. As per sources, in December 2025, 91 percent of Australian organisations reported integrating AI into cybersecurity, enhancing threat detection, incident response, and operational management, reflecting widespread adoption of intelligent systems in security infrastructure. Moreover, these intelligent systems reduce false-positive rates that previously disrupted supply chain flow, allowing legitimate shipments expedited clearance while focusing intensive examination on genuinely suspicious consignments.

Adoption of End-to-End Supply Chain Visibility Platforms

Contemporary cargo security transcends isolated inspection checkpoints, embracing comprehensive monitoring across entire transportation journeys. As per sources, in August 2025, 80 % of Australian logistics firms considered technology critical for competitive advantage, while 94 % planned to maintain or increase investments to enhance end-to-end supply chain visibility. Moreover, Internet of Things (IoT) sensor networks embedded within containers transmit real-time telemetry data tracking location, temperature, shock events, and unauthorized access attempts throughout multi-modal journeys. Blockchain-enabled documentation systems create immutable chain-of-custody records ensuring cargo integrity verification at every transfer point between carriers, warehouses, and customs authorities. Cloud-based analytics platforms aggregate disparate data streams from GPS trackers, door sensors, and environmental monitors, providing shippers comprehensive visibility into shipment status while automatically alerting stakeholders to security anomalies.

Expansion of Biometric Authentication and Access Control Systems

Physical security perimeters surrounding cargo facilities increasingly incorporate advanced authentication technologies preventing unauthorized personnel access to restricted zones. Biometric verification systems utilizing facial recognition, fingerprint scanning, and iris identification replace traditional credential-based entry controls vulnerable to theft or duplication. In October 2025, IDEMIA Public Security’s NAFIS NextGen biometric system went live in Australia, supporting law enforcement with fingerprint and palmprint identification, processing over 12,000 daily searches. Furthermore, multi-factor authentication protocols combining biological markers with proximity cards and personal identification numbers establish robust identity verification preventing facility infiltration by malicious actors. These systems maintain comprehensive access logs documenting personnel movements throughout sensitive areas, enabling forensic investigation following security incidents while deterring insider threats through visible monitoring presence.

Market Outlook 2026-2034:

The market trajectory demonstrates sustained expansion driven by persistent security imperatives, technological innovation cycles, and infrastructure modernization initiatives. Regulatory frameworks increasingly mandate comprehensive screening protocols across all transportation modalities, compelling operators to upgrade legacy systems with contemporary detection capabilities. Revenue growth reflects capital investments in sophisticated surveillance architectures supporting expanding freight volumes while maintaining stringent security standards. Integration of AI, automation, and interconnected monitoring platforms positions the sector for continued evolution beyond traditional inspection paradigms toward predictive threat intelligence ecosystems supporting Australia's role within global supply chain networks. The market generated a revenue of USD 87.30 Million in 2025 and is projected to reach a revenue of USD 212.13 Million by 2034, growing at a compound annual growth rate of 10.37% from 2026-2034.

Australia Cargo Security and Surveillance Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Security Type | Cargo Screening and Inspection | 32.15% |

| Mode of Transport | Air Cargo Security | 33.09% |

| Technology | X-ray Scanners | 35.17% |

| End-User Industry | Logistics and Freight Forwarding | 30.09% |

| Region | Australia Capital Territory & New South Wales | 33% |

Security Type Insights:

- Cargo Screening and Inspection

- Surveillance and Monitoring

- Tracking and Tracing Systems

- Access Control and Authentication

Cargo screening and inspection dominates with a market share of 32.15% of the total Australia cargo security and surveillance market in 2025.

Cargo screening and inspection leads the market, driven by rigorous safeguards to counter concealed threats and mitigate severe aviation safety and operational risks. Multi-layered screening mandates require inspection of all cargo and mail transported aboard passenger aircraft, with cargo-only flights subject to risk-based measures proportional to threat assessments. Known shipper programs establish trusted participants whose cargo receives expedited screening based on compliance histories and facility certifications. Advanced technologies designed for aviation applications detect threats within complex configurations while processing high volumes maintaining aircraft departure schedules.

Cargo screening and inspection implements specialized handling procedures governing dangerous goods transportation requiring compatible screening methodologies avoiding triggering reactive substances during examination. Chain-of-custody documentation tracks screened cargo throughout airport facilities preventing post-inspection tampering. Canine detection teams supplement technological screening providing biological threat identification capabilities effective against novel explosive compositions evading equipment detection. Insider threat mitigation programs including background checks, access controls, and behavioural monitoring protect against security compromise by personnel with legitimate facility access ensuring comprehensive aviation freight protection standards.

Mode of Transport Insights:

- Air Cargo Security

- Maritime Cargo Security

- Rail Cargo Security

- Road Cargo Security

Air cargo security leads with a share of 33.09% of the total Australia cargo security and surveillance market in 2025.

Air cargo security fulfils stringent freight security protocols due to aircraft vulnerability to explosive devices and the severe, potentially catastrophic consequences of in-flight security breaches. Multi-layered screening mandates require inspection of all cargo and mail transported aboard passenger aircraft, with cargo-only flights subject to risk-based measures proportional to threat assessments. As per sources, in April 2024, Operation AMBROSIA at Sydney Airport saw ABF inspect 37 flights, 25 aircraft hold, and x-ray 164 cargo pieces, deterring insider threats and securing aviation supply chains. Moreover, known shipper programs establish trusted participants whose cargo receives expedited screening based on compliance histories and facility certifications. Advanced technologies designed for aviation applications detect threats within complex configurations while processing high volumes maintaining departure schedules.

Specialized handling procedures govern dangerous goods transportation requiring compatible screening methodologies that avoid triggering reactive substances during examination. Chain-of-custody documentation tracks screened cargo throughout airport facilities preventing post-inspection tampering. Canine detection teams supplement technological screening providing biological threat identification capabilities effective against novel explosive compositions evading equipment detection. Insider threat mitigation programs including background checks, access controls, and behavioral monitoring protect against security compromise by personnel with legitimate facility access. International harmonization of aviation security standards ensures consistent protection levels across global networks, facilitating trade while preventing security gap exploitation.

Technology Insights:

- X-ray Scanners

- Explosive Detection Systems (EDS)

- Video Surveillance Systems

- RFID & GPS-based Tracking

X-ray scanners exhibit a clear dominance with a 35.17% share of the total Australia cargo security and surveillance market in 2025.

X-ray scanners dominated the market segment, representing the most widely deployed cargo inspection technology given versatility across diverse container sizes, mature reliability, and operator familiarity developed through decades of aviation security application. Systems range from compact cabinet configurations examining small parcels to massive tunnel installations accommodating entire cargo containers and loaded vehicles. Dual-energy imaging techniques analyze material atomic composition differentiating organic materials like explosives from inorganic substances including metals and ceramics. Automated threat recognition software applies pattern-matching algorithms flagging anomalous shapes.

These scanners utilize advanced scatter imaging techniques revealing contents of cargo regions appearing solid in traditional transmission X-rays, penetrating concealment methods exploiting material density. Three-dimensional reconstruction algorithms transform multiple two-dimensional scans passes into volumetric imagery enabling virtual cargo unpacking without physical container opening. Integration with conveyance systems creates continuous automated inspection lines processing containers at speeds matching logistics handling requirements. Portable and mobile X-ray systems extend inspection capabilities beyond fixed installations, enabling security operations at temporary facilities, remote border crossings, and special event venues requiring screening. In May 2024, the Australian Border Force deployed a new mobile Xray unit in Hobart, Tasmania, enhancing inspection of sea, air, and land cargo to detect narcotics, firearms, and contraband.

End-User Industry Insights:

Access the comprehensive market breakdown Request Sample

- Logistics and Freight Forwarding

- E-commerce and Retail

- Aviation and Maritime Operators

- Government and Defense

Logistics and freight forwarding leads with a market share of 30.09% of the total Australia cargo security and surveillance market in 2025.

Logistics and freight forwarding dominated the market segment, constituting primary market participants deploying cargo security infrastructure given operational responsibility for shipment protection throughout complex multi-modal journeys. These entities manage cargo movements across international borders, coordinating transportation between various carriers while ensuring compliance with diverse national security regulations. Contractual obligations with shippers include cargo protection guarantees requiring documentation of security measures implemented throughout supply chains. Insurance requirements mandate certified secure handling facilities and equipment driving surveillance technology investments.

Logistics and freight forwarding operations integrate security systems with warehouse management platforms enabling comprehensive cargo monitoring throughout storage periods, tracking internal movements and identifying unauthorized access attempts. According to sources, in November 2025, ORCA Opti, DNH Logistics, and Aurora Materials launched a 360-degree, zero-trust supply chain model for defence and pharmaceutical logistics, enhancing tracking, authentication, and secure monitoring across sensitive operations. Further, loading dock surveillance prevents legitimate cargo substitution with contraband during transfer operations between carriers. Vehicle tracking systems monitor freight movements providing real-time location data alerting operators to route deviations suggesting hijacking attempts. Employee background screening and access control protocols address insider threat risks from personnel with legitimate facility access and cargo handling responsibilities establishing comprehensive protection frameworks.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales dominates with a market share of 33% of the total Australia cargo security and surveillance market in 2025.

Australia Capital Territory & New South Wales captured the leads through geographic concentration of major international gateways establishing dominance in cargo security infrastructure deployment and operational activity. Sydney's container terminals process substantial import-export volumes connecting Australian commerce with global markets, requiring comprehensive screening capabilities meeting international security standards. Aviation freight operations through Sydney Airport implement sophisticated multi-layered security protocols protecting domestic and international cargo movements. Canberra's federal capital role concentrates government regulatory agencies establishing security policies and compliance frameworks applicable nationwide.

The region benefits from federal law enforcement presence including border protection agencies operating advanced detection technologies at gateway facilities, collaborating with commercial operators implementing coordinated security frameworks. Counter-terrorism imperatives following global security incidents have driven sustained investment in state-of-the-art surveillance and screening infrastructure protecting critical transportation assets. Educational institutions and technology development clusters foster innovation in security technologies creating pipelines between research capabilities and operational deployment. Transportation network connectivity linking maritime ports, airports, and inland distribution centers creates complex cargo flows requiring integrated security monitoring.

Market Dynamics:

Growth Drivers:

Why is the Australia Cargo Security and Surveillance Market Growing?

Stringent Regulatory Mandates Enforcing Comprehensive Security Protocols

Government authorities continuously strengthen cargo security regulations responding to evolving threat intelligence and international security coordination efforts. Aviation security frameworks mandate screening of all cargo transported aboard aircraft requiring operators to deploy certified detection equipment meeting rigorous performance standards. Maritime security regulations enforce container scanning protocols at major ports identifying high-risk shipments for intensive examination. Land-based border crossings implement vehicle and cargo inspection requirements detecting contraband and prohibited goods infiltration. As per sources, in July 2024, Australia passed the Australian Postal Corporation and Other Legislation Amendment Bill, modernising mail screening and inspection at the border, enhancing security, regulatory clarity, and risk-based interventions. Furthermore, regulatory harmonization through international bodies establishes consistent security baselines facilitating global trade while preventing regulatory arbitrage.

Technological Innovation Enhancing Detection Capabilities and Operational Efficiency

Continuous advancement in screening technologies expands threat detection capabilities while simultaneously accelerating inspection throughput reconciling security imperatives with commercial time pressures. AI algorithms analyzing scan imagery automate threat identification reducing operator workload and accelerating cargo clearance for legitimate shipments. According to sources, Trellis Data and Australia’s Department of Agriculture piloted the AI-powered BATDS at Brisbane’s DP World, scanning over 48,000 containers and detecting 63% of soil-related biosecurity threats. Moreover, enhanced imaging resolution reveals smaller prohibited items within dense cargo configurations expanding detection capabilities against sophisticated concealment techniques. Material discrimination technologies differentiate explosive substances from benign materials reducing false-positive alerts disrupting supply chain flow. Networked surveillance platforms aggregate data from multiple inspection points creating comprehensive cargo monitoring throughout transportation journeys.

Expanding International Trade Volumes Generating Proportional Security Requirements

Australia's economic integration within global supply chains generates substantial import-export freight volumes requiring comprehensive security screening protecting national interests. According to reports, Australia’s air cargo imports reached 424,000 tonnes, projected to grow 80% by 2049–50, prompting airport and port upgrades to enhance handling, efficiency, and global trade competitiveness. Furthermore, trade agreements with major economic partners increase cargo flows through gateway facilities necessitating scalable security infrastructure processing expanded volumes without creating bottlenecks compromising supply chain velocity. E-commerce growth dramatically increases parcel volumes entering distribution networks requiring inspection capabilities scaling from traditional containerized freight to accommodate vast quantities of small packages from diverse international origins. High-value cargo movements including electronics and pharmaceuticals attract sophisticated criminal enterprises necessitating robust protection throughout supply chains preventing theft and counterfeiting.

Market Restraints:

What Challenges the Australia Cargo Security and Surveillance Market is Facing?

High Capital Investment Barriers

Advanced cargo security systems demand significant upfront capital expenditures creating financial barriers for small and mid-sized logistics operators. Sophisticated screening equipment represents multi-million-dollar investments exceeding budgetary capacity. Installation requirements including facility modifications add substantial costs. Operational expenditures including trained personnel and maintenance contracts create ongoing obligations. Technology obsolescence risks necessitate periodic equipment replacement as authorities mandate upgraded capabilities addressing evolving threats.

Legacy Infrastructure Integration Challenges

Cargo security technologies must integrate seamlessly with existing operations creating technical challenges for operators with legacy infrastructure. Older facilities lack physical space accommodating modern equipment without expensive expansions disrupting workflows. Incompatible data formats require costly middleware development. Training requirements create temporary productivity reductions. Varied international security standards create equipment compatibility challenges for operators serving multiple jurisdictions with divergent regulatory requirements extending implementation timelines.

Data Privacy and Regulatory Constraints

Comprehensive cargo surveillance generating extensive data raises privacy considerations requiring careful regulatory navigation. Data protection legislation governs collection, storage, and sharing of commercial information constraining intelligence sharing between operators and authorities. Shippers express concerns about competitive intelligence exposure revealing proprietary information. Biometric authentication systems face privacy advocacy opposition and regulatory restrictions. Cloud-based surveillance platforms create cybersecurity vulnerabilities exposing commercial information to unauthorized access complicating coordination.

Competitive Landscape:

The market exhibits fragmentation across technology specializations with established multinational corporations competing alongside nimble regional innovators. Participants differentiate through proprietary algorithms, detection performance certifications, and integration capabilities with diverse logistics infrastructure configurations. Strategic positioning emphasizes comprehensive solution portfolios spanning multiple screening modalities rather than point products addressing isolated requirements. After-sales support networks providing maintenance, calibration, and operator training establish long-term customer relationships extending beyond initial equipment sales. Technology licensing partnerships enable smaller operators to access advanced capabilities without internal research investments. Innovation cycles focus on AI integration, automated threat recognition, and reduced operational footprints addressing space-constrained deployment environments.

Australia Cargo Security and Surveillance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Security Types Covered | Cargo Screening and Inspection, Surveillance and Monitoring, Tracking and Tracing Systems, Access Control and Authentication |

| Mode of Transports Covered | Air Cargo Security, Maritime Cargo Security, Rail Cargo Security, Road Cargo Security |

| Technologies Covered | X-ray Scanners, Explosive Detection Systems (EDS), Video Surveillance Systems, RFID & GPS-based Tracking |

| End-User Industries Covered | Logistics and Freight Forwarding, E-commerce and Retail, Aviation and Maritime Operators, Government and Defense |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia cargo security and surveillance market size was valued at USD 87.30 Million in 2025.

The Australia cargo security and surveillance market is expected to grow at a compound annual growth rate of 10.37% from 2026-2034 to reach USD 212.13 Million by 2034.

Cargo screening and inspection held the largest market share owing to stringent border control mandates requiring comprehensive cargo examination, advanced imaging detection capabilities for prohibited materials, high-throughput inspection processes at freight terminals, and regulatory compliance requirements maintaining supply chain efficiency nationwide.

Key factors driving the Australia cargo security and surveillance market include stringent regulatory mandates enforcing screening protocols, technological innovation integrating AI capabilities, expanding international trade volumes through air and maritime gateways, rising e-commerce penetration, and escalating security threats necessitating enhanced protection infrastructure.

Major challenges include substantial capital investment requirements limiting adoption, integration complexity with legacy logistics infrastructure, privacy concerns constraining surveillance deployment, technology obsolescence risks necessitating periodic replacement, and coordination difficulties between multiple stakeholders.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)