Australia Casting and Forging Market Size, Share, Trends and Forecast by Component Type, Material Type, Manufacturing Process, Sales Channel, and Region, 2025-2033

Australia Casting and Forging Market Size and Share:

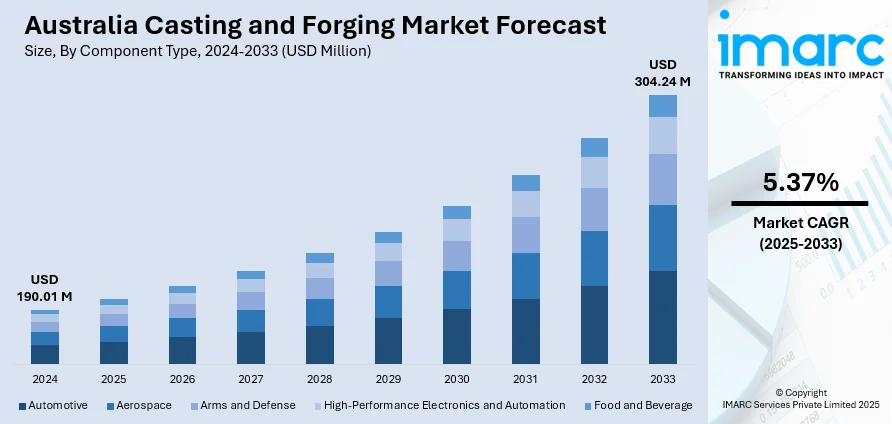

The Australia casting and forging market size reached USD 190.01 Million in 2024. Looking forward, the market is expected to reach USD 304.24 Million by 2033, exhibiting a growth rate (CAGR) of 5.37% during 2025-2033. The market is driven by rising demand across automotive, aerospace, and defense sectors, fueled by infrastructure upgrades, industrial automation, and localized manufacturing strategies. Supportive government initiatives and export-oriented policies also contribute to expansion. These factors collectively enhance the Australia casting and forging market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 190.01 Million |

| Market Forecast in 2033 | USD 304.24 Million |

| Market Growth Rate 2025-2033 | 5.37% |

Key Trends of Australia Casting and Forging Market:

Localization of Supply Chains and Sovereign Capability Development

A significant trend in the Australia casting and forging market growth is the emphasis on domestic production capabilities to reduce reliance on international supply chains. Geopolitical uncertainties and global disruptions have compelled both public and private sectors to invest in sovereign manufacturing infrastructure. The defense and aerospace industries, in particular, are prioritizing locally sourced components to align with national security and procurement frameworks. Strategic partnerships between government agencies and manufacturers are fostering innovation and expanding production capacity. Moreover, incentives promoting local supplier engagement are encouraging small and medium enterprises to enter the casting and forging value chain. This shift toward localized sourcing enhances resilience and also stimulates the domestic economy, ensuring long-term competitiveness, along with Australia casting and forging market demand. For instance, in March 2025, Airbus and Australian start-up Drone Forge signed a Letter of Intent to deploy the Flexrotor uncrewed aerial system (UAS) in the Asia-Pacific region. The Flexrotor, a VTOL UAV suited for defence, surveillance, and harsh environments, will be supported by a new service centre in Perth. This partnership aims to commercialize advanced UAV technologies across commercial, government, and defence sectors. With proven performance and versatile payload capabilities, the Flexrotor is positioned as a key asset in evolving uncrewed aviation operations.

To get more information on this market, Request Sample

Digitization and Process Automation in Foundries and Forging Units

The Australia casting and forging market growth is being accelerated by rapid digital transformation as manufacturers are increasingly integrating automation and smart technologies into their operations. The use of computer-aided engineering (CAE), robotics, and real-time data monitoring is revolutionizing traditional processes, resulting in higher precision, reduced cycle times, and enhanced product quality. Predictive maintenance powered by IoT sensors and AI-driven process control systems are also becoming mainstream, minimizing unplanned downtime and maximizing throughput. Moreover, digital twins are being employed to simulate casting and forging workflows before physical implementation, ensuring cost-efficiency and design optimization. This shift toward Industry 4.0 practices enhances traceability and regulatory compliance, positioning local manufacturers to compete globally. For instance, in April 2025, the ARM Institute launched a new Project Call focused on robotic inspection for casting and forging. It seeks solutions for automated, scalable dimensional and thermal inspection of high-mix, low-volume components at both hot and ambient temperatures. The initiative also aims to evolve from manual to autonomous mobile inspection platforms. The project addresses challenges in legacy component production, workforce shortages, and the need for advanced, real-time quality control in casting and forging industries.

Growth Drivers of Australia Casting and Forging Market:

High Demand from Mining and Resource Sectors

In Australia, the casting and forging industry is largely influenced by the nation's strong mining, oil, and gas industries. Heavy equipment and industrial components needed to undertake mining activities like drill components, heavy-duty structural components, and equipment housings, rely on tough, precision-forged and cast metal components. Australian manufacturers meet such specialized requirements by creating products designed specifically to suit local conditions of mineral extraction such as high abrasion, corrosive soil, and harsh temperatures. Local foundries and forging plants cooperate closely with the mining industry, frequently designing tailor-made solutions that comply with strict local safety and reliability standards. The cyclical pattern of mining investment does not diminish the overall upward trend due to developments toward industrial modernization and ongoing replacement of old infrastructure, strengthening demand for superior quality casting and forging services in the area.

Regional Manufacturing Support and Infrastructure Development

Development projects of infrastructure across Australia like roads, railways, ports, and urban building renovations, are key growth drivers for the casting and forging industry. Parts utilized in infrastructure equipment, transport, and heavy construction machinery need regional certification and precision forging and casting, which Australian suppliers can provide. Investment in local capability is driven by government initiatives to bolster local manufacturing and cut dependence on imports which is also enhancing capacity. This enables foundries and forging facilities beyond Perth, Adelaide, and Brisbane to increase production, perform advanced fabrication, and customize metallurgy for compliance with Australian material specifications. Regional sidebar of manufacturing clusters ensures that supply chains are shorter, turnaround is quicker, and quality assurance is higher than foreign suppliers, significantly adding to industry growth.

Technological Advancement and Skilled Workforce Development

According to the Australia casting and forging market analysis, technological advancement and human skills form the foundation of the development of the sector. To enhance casting molds and forging dies, domestic companies are using more complex techniques such computer-aided design (CAD), computer numerical control (CNC) machining, and simulation-based metal flow analysis. Such capabilities find specific value in industries like defense and renewable energy, where accuracy and material performance matter most. At the same time, Australia's technical training facilities and apprenticeship programs are graduating highly competent metallurgists, pattern makers, and machine operators skilled in both ancient methods and computer integration. This synergy of human talent and technology allows local producers to deliver high-value components with superior traceability, environmental compliance, and quality control. In pursuit of self-sufficiency and innovation in metal production, Australian companies continue to focus on these for ongoing growth within the casting and forging industry.

Application of Australia Casting and Forging Market:

Mining and Resource Extraction

One of the most important areas of application for casting and forging in Australia is mining, due to the nation's extensive deposits of iron ore, coal, gold, and rare earth minerals. The mining sector demands very resilient parts for drilling, crushing, haulage, and processing machinery, most of which depend on cast and forged components for withstanding the severe operating conditions. Forged products like shafts, gears, and brackets are necessary to keep the heavy machinery employed in underground and open-cut mines operational. Similarly, cast products such as pump casings, mill liners, and parts of crushers find extensive applications for their resistance to wear and capacity for high impact. A large number of these parts are specially designed to fit the local geological and environmental conditions of the Australian mine fields. Local casting and forging suppliers usually collaborate directly with mining operators in creating parts to precise performance requirements, enabling effective operation in remote and large-scale projects throughout Western Australia, Queensland, and the Northern Territory.

Construction and Infrastructure Equipment

Casting and forging are important in Australia's infrastructure construction and construction industry. The demand for strong, dependable equipment components like those used in cranes, bulldozers, concrete mixers, and hydraulic systems positions forged and cast pieces as an integral part of large-scale civil engineering construction projects. When governments are investing in transport infrastructure, energy plants, and urban development, the demand increases for heavy equipment constructed using robust pieces that can withstand Australia's variable climates, ranging from harsh desert environments to coastal areas. Locally made components guarantee conformity with Australian safety standards and performance requirements. Custom forging is also applied to structural components such as beams, joints, and brackets needed for bridges, tunnels, and ports. Australian forging firms, particularly in states such as Victoria and South Australia, are increasing capacity to make components appropriate for extended use in harsh environments and under severe loads. This application segment is expanding with the government's continuing support for infrastructure revitalization and economic stability through public works.

Defense, Rail, and Renewable Energy Sectors

The Australian defense and railway industries are new but increasingly key application fields for casting and forging. In the defense sector, cast and forged metal parts are needed for military equipment, naval vessels, and weapons systems, where strength, accuracy, and dependability are essential. With increased focus on sovereign defense manufacturing capacity, domestic foundries are machining parts that satisfy strict defense-grade quality. Likewise, in rail business, forged wheels, axles, and couplers are critical to safety and performance in freight and passenger trains. The modernization of the Australian rail network continues to fuel demand for specialized parts that can be sourced and maintained locally. Another expanding use is for renewable energy, notably wind and hydroelectric power, where forged and cast parts are utilized in turbines, generators, and structural components. These industries depend on locally manufactured parts for economic and strategic purposes, and indigenous manufacturers are making technology and capability investments to address these expanding high-performance markets.

Australia Casting and Forging Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on component type, material type, manufacturing process, and sales channel.

Component Type Insights:

- Automotive

- Engine Components

- Transmission Components

- Structural Components

- Suspension Components

- Exhaust System Components

- Powertrain Components

- Interior Components

- Exterior Components

- Others

- Aerospace

- Safety Critical Structural Parts

- Non-Safety Critical Parts

- Arms and Defense

- Mobility

- Arms and Gear

- High-Performance Electronics and Automation

- Heat Management

- Electronic-Housings

- Automation Structural Parts

- Food and Beverage

- Structural Components

- Functional Components

The report has provided a detailed breakup and analysis of the market based on the component type. This includes automotive (engine components, transmission components, structural components, suspension components, exhaust system components, powertrain components, interior components, exterior components, and others), aerospace (safety critical structural parts and non-safety critical parts), arms and defense (mobility and arms and gear), high-performance electronics and automation (heat management, electronic housings, and automation structural parts), and food and beverage (structural and functional components).

Material Type Insights:

- Aluminum Alloy 2xxx Series

- Aluminum Alloy 3xxx Series

- Aluminum Alloy 5xxx Series

- Aluminum Alloy 6xxx Series

- Aluminum Alloy 7xxx Series

The report has provided a detailed breakup and analysis of the market based on the material type. This includes aluminum alloy 2xxx series, 3xxx series, 5xxx series, 6xxx series, and 7xxx series.

Manufacturing Process Insights:

- Casting Process

- Sand Casting

- Die Casting

- High Pressure Die Casting

- Others

- Forging Process

- Open Die Forging

- Closed Die Forging

- Upset Forging

- Precision Forging

- Rheocasting Process

- Others

The report has provided a detailed breakup and analysis of the market based on the manufacturing process. This includes casting process (sand casting, die casting, high pressure die casting, and others), forging process (open die forging, closed die forging, upset forging, and precision forging), rheocasting process, and others.

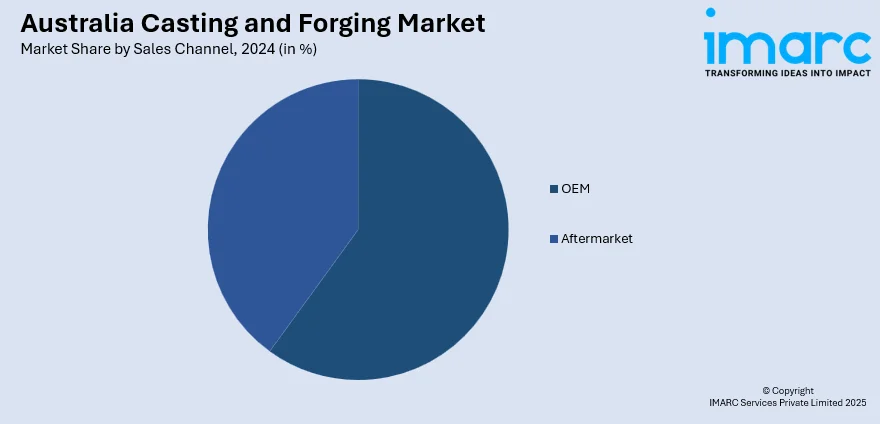

Sales Channel Insights:

- OEM

- Aftermarket

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes OEM and aftermarket.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Adarsh Australia

- Adelaide Brass Castings Pty Ltd

- Beckwith Group

- Bradken

- CR Mining

- Greg Sewell Forgings Pty Ltd

- Intercast & Forge

- White Industries

Australia Casting and Forging Market News:

- In January 2024, Bradken, an Australian company and subsidiary of Hitachi Construction Machinery, acquired a foundry in Chilca, Peru, from Funtec to locally produce mill liners for the South American mining market. This strategic move supports Bradken’s global expansion from its Australian base, enabling faster product delivery and reduced reliance on imports from India and Canada. Backed by hydroelectric power, the facility will cut CO₂ emissions by 95%. Production is set to begin in 2026, strengthening Bradken’s presence and capabilities across the Americas.

Australia Casting and Forging Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Component Types Covered |

|

| Material Types Covered | Aluminium Alloy 2xxx Series, Aluminium Alloy 3xxx Series, Aluminium Alloy 5xxx Series, Aluminium Alloy 6xxx Series, Aluminium Alloy 7xxx Series |

| Manufacturing Processes Covered |

|

| Sales Channels Covered | OEM, Aftermarket |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Adarsh Australia, Adelaide Brass Castings Pty Ltd, Beckwith Group, Bradken, CR Mining, Greg Sewell Forgings Pty Ltd, Intercast & Forge, White Industries, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia casting and forging market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia casting and forging market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia casting and forging industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia casting and forging market was valued at USD 190.01 Million in 2024.

The Australia casting and forging market is projected to exhibit a CAGR of 5.37% during 2025-2033.

The Australia casting and forging market is expected to reach a value of USD 304.24 Million by 2033.

The key trends of the Australia casting and forging market are advanced manufacturing techniques, increased demand from mining and infrastructure, and growing focus on domestic production. Some of the other trends include adoption of automation, precision engineering, and sustainable practices, with rising applications in defense, renewable energy, and transport supporting long-term industry growth and self-sufficiency.

Key drivers of Australia casting and forging market include strong demand from the mining and construction sectors, infrastructure development, and government support for domestic manufacturing. Technological advancements, skilled labor, and the push for sovereign capabilities in defense and transport also fuel growth, reinforcing the need for high-quality forged and cast components.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)