Australia Caustic Soda Market Size, Share, Trends and Forecast by Product Type, Manufacturing Process, Grade, Application, and Region, 2026-2034

Australia Caustic Soda Market Size and Share:

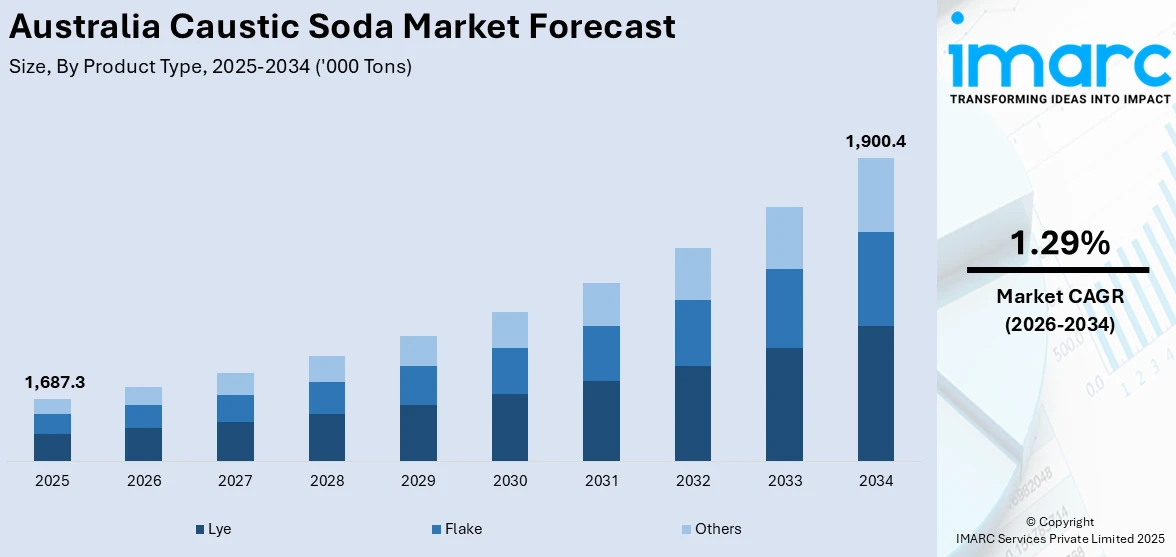

The Australia caustic soda market size reached 1,687.3 Thousand Tons in 2025. Looking forward, the market is projected to reach 1,900.4 Thousand Tons by 2034, exhibiting a growth rate (CAGR) of 1.29% during 2026-2034. Australia’s market is shaped by expanding local production, increasing demand from alumina refineries, and a growing focus on supply chain stability. Infrastructure upgrades and energy-linked disruptions continue to influence operations, driving efforts to boost domestic output and improve handling systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | 1,687.3 Thousand Tons |

| Market Forecast in 2034 | 1,900.4 Thousand Tons |

| Market Growth Rate 2026-2034 | 1.29% |

Australia Caustic Soda Market Trends:

Rising Local Production Capacity

Australia’s industry is seeing a gradual shift toward self-reliance as domestic producers expand to meet regional industrial demand. One key driver is the growing need for caustic soda in sectors such as alumina refining, water treatment, and chemical manufacturing. As Australia continues to push for greater industrial efficiency and supply security, investments in expanding local infrastructure have become more common. These moves aim to reduce dependence on international suppliers and avoid price fluctuations tied to global trade dynamics. In February 2024, Coogee Chemicals completed a significant expansion of its Chlor Alkali Plant located in Kemerton, Western Australia. As part of this project, Fusion executed the installation of CPVC piping systems to improve chemical processing reliability and output. This expansion boosted domestic caustic soda production and supported rising demand from downstream users, including alumina refineries and mining operations. By increasing capacity, the plant contributed to a stronger domestic supply chain and provided local industries with a more stable source of this essential input. The development reflects a broader trend of prioritizing internal growth to enhance supply consistency and reduce logistical risks in the Australian caustic soda segment.

To get more information on this market Request Sample

Rising Demand from Chemical Industry

Caustic soda serves as an essential raw material in a variety of chemical processes contributing to its ongoing demand in Australia. The chemical sector heavily relies on it in alumina refining facilitating the extraction of aluminum from bauxite. It also plays an essential role in the pulp and paper sector by assisting in the breakdown of wood fibers and the elimination of impurities. Additionally, it is vital in the production of chemicals like chlorine, sodium compounds, and various derivatives utilized across a broad spectrum of industrial applications. The growing industrialization and the development of chemical manufacturing facilities in Australia are further enhancing consumption levels. As businesses strive for improved operational efficiency and product quality, the usage of caustic soda continues to increase meeting consistent industrial needs. This ongoing industrial dependency is driving Australia caustic soda market demand across different sectors.

Growth in End-Use Sectors

In addition to its role in industrial chemical processes, caustic soda is experiencing heightened demand across several end-use sectors in Australia. It is utilized in water treatment to adjust pH levels and purify water, ensuring safety for both residential and industrial purposes. The textile sector employs caustic soda in processes like bleaching, dyeing, and fiber treatment. Furthermore, manufacturers of soap, detergents, and personal care products depend on caustic soda for saponification and cleaning formulations. The growth of these industries, along with increasing urban populations and heightened awareness about hygiene, is leading to sustained consumption. Companies are also prioritizing production efficiency and sustainability, which indirectly enhances the use of caustic soda. Together, these factors are bolstering the Australia caustic soda market share across various end-use applications.

Growth Drivers of Australia Caustic Soda Market:

Urbanization and Infrastructure Development

The swift expansion of urban regions and the advancement of infrastructure in Australia are leading to a substantial increase in the demand for industrial chemicals such as caustic soda. In the construction industry, caustic soda is utilized to produce essential materials such as cement, glass, and aluminum derivatives, which are vital for contemporary buildings and infrastructure projects. At the same time, the increasing industrial activities in manufacturing, chemicals, and water treatment facilities are leading to consistent use of this adaptable compound. Factors such as a rising population, urban migration, and government-supported infrastructure initiatives are further boosting the long-term demand for construction materials and chemical inputs. Companies are progressively incorporating caustic soda into their supply chains to satisfy growing needs, ensuring efficiency and quality. This ongoing industrial dependency and infrastructure expansion are key contributors to Australia caustic soda market growth.

Technological Advancements

Innovations in the production of caustic soda are greatly improving efficiency, output, and overall market sustainability. The implementation of cutting-edge membrane cell electrolysis and automation technologies enables manufacturers to create high-purity caustic soda while lowering energy use and operational expenses. Digital monitoring, process control systems, and predictive maintenance enhance production efficiency, decrease downtime, and ensure safety. Furthermore, advancements in managing by-products, such as the recovery of chlorine and hydrogen, are leading to more sustainable and cost-effective operations. These improvements guarantee a consistent and high-quality supply and enhance the industry's capacity to meet rising industrial and end-user demands. By facilitating efficient production and reliable delivery, technological developments are a vital factor driving growth in the Australia caustic soda market.

Rising Focus on Sustainability

Sustainability is becoming a prominent factor in the Australia caustic soda market, as producers adopt energy-efficient and eco-friendly manufacturing practices. Manufacturers are emphasizing the reduction of greenhouse gas emissions, optimizing energy use, and minimizing waste during the production of caustic soda. The use of advanced membrane cell technology and the recycling of by-products like chlorine and hydrogen further improve environmental compliance. Additionally, regulatory pressures and heightened consumer awareness regarding sustainable industrial practices are prompting producers to establish greener operations. These environmentally conscious initiatives help companies cut operational costs while enhancing their reputation and competitiveness in the market. According to Australia caustic soda market analysis, such responsible practices are significantly impacting growth.

Australia Caustic Soda Market Dynamics:

Supply and Demand Balance

The balance between supply and demand significantly affects the caustic soda market in Australia. Domestic production, shaped by factors like plant capacity, maintenance schedules, and energy availability, establishes the fundamental supply of caustic soda. Concurrently, import and export trends greatly influence overall availability and pricing, particularly when international trade routes or global demand shift. Restrictions in supply can trigger price increases, while oversupply may lessen profitability for manufacturers. Additionally, demand fluctuations from key sectors such as alumina refining, chemicals, textiles, and water treatment impact market stability. To ensure timely supply, manufacturers and distributors must carefully track production schedules and trade dynamics. Effective planning and forecasting are crucial for maintaining market equilibrium and adapting to shifts in industrial needs.

Regulatory Environment

The caustic soda market in Australia operates under rigorous environmental and safety regulations that influence production methods. Rules regarding emissions, effluent management, handling of hazardous substances, and workplace safety impose extra operational demands on manufacturers. Compliance often requires investment in pollution control technologies, monitoring systems, and employee training, thereby increasing production expenses. Furthermore, non-compliance can lead to penalties, operational setbacks, or damage to reputation. While these regulations promote safe and sustainable production, they also affect pricing and supply chain strategies. Companies are increasingly adopting environmental management systems and safety protocols to meet regulatory requirements. Balancing compliance with operational efficiency is essential for fostering growth and sustainability in the Australian caustic soda market.

Price Volatility

Price volatility poses a continual challenge for Australia's caustic soda market, influenced by changes in energy prices, raw materials, and international trade factors. Given the energy-intensive nature of caustic soda production, fluctuations in electricity costs have a significant impact on operational expenses. Additionally, changes in the prices of salt, chlorine, and other raw materials directly affect production costs. International trade factors, including export demand, competition from imports, and currency variations, further exacerbate price instability. These elements render market pricing unpredictable, affecting profitability for producers and complicating cost management for end-use industries. To mitigate the consequences of volatility, companies must pursue strategic sourcing, long-term supply agreements, and adaptable pricing models. Effective risk management is vital to uphold financial stability and ensure consistent supply across various industrial sectors.

Australia Caustic Soda Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2026-2034. Our report has categorized the market based on product type, manufacturing process, grade, and application.

Product Type Insights:

- Lye

- Flake

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes lye, flake, and others.

Manufacturing Process Insights:

- Membrane Cell

- Diaphragm Cell

- Others

A detailed breakup and analysis of the market based on the manufacturing process have also been provided in the report. This includes membrane cell, diaphragm cell, and others.

Grade Insights:

- Reagent Grade

- Industrial Grade

- Pharmaceutical Grade

- Others

A detailed breakup and analysis of the market based on the grade have also been provided in the report. This includes reagent grade, industrial grade, pharmaceutical grade, and others.

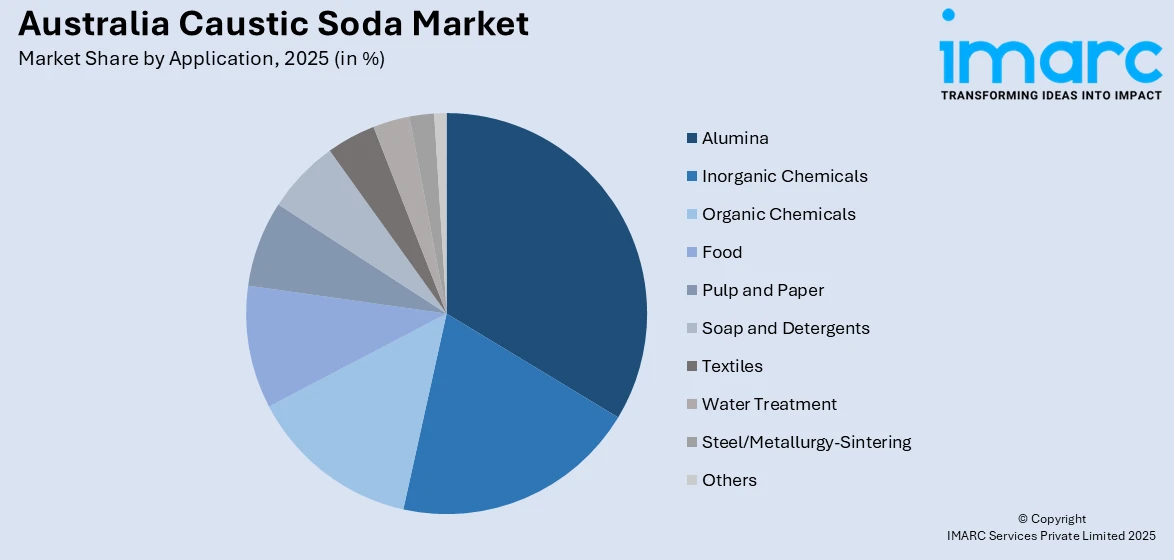

Application Insights:

Access the comprehensive market breakdown Request Sample

- Alumina

- Inorganic Chemicals

- Organic Chemicals

- Food, Pulp and Paper

- Soap and Detergents

- Textiles

- Water Treatment

- Steel/Metallurgy-Sintering

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes alumina, inorganic chemicals, organic chemicals, food, pulp and paper, soap and detergents, textiles, water treatment, steel/metallurgy-sintering, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Caustic Soda Market News:

- October 2024: Impact Minerals, CPC Engineering, and ECU received a USD 2.87 Million grant to develop a pilot plant using a low-carbon HPA process that avoided traditional caustic soda leaching. This innovation reduced hazardous waste generation, signaling a shift in Australia's caustic soda demand.

- September 2024: De Nora launched the CECHLO-MS 200 electrolyzer in the Americas, following successful deployments in Australia. The system produced caustic soda on-site using salt, water, and electricity, reducing dependency on chemical supply chains and strengthening localized production, positively impacting Australia's caustic soda sector resilience.

Australia Caustic Soda Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Lye, Flake, Others |

| Manufacturing Processes Covered | Membrane Cell, Diaphragm Cell, Others |

| Grades Covered | Reagent Grade, Industrial Grade, Pharmaceutical Grade, Others |

| Applications Covered | Alumina, Inorganic Chemicals, Organic Chemicals, Food, Pulp and Paper, Soap and Detergents, Textiles, Water Treatment, Steel/Metallurgy-Sintering, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia caustic soda market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia caustic soda market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia caustic soda industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The caustic soda market in Australia reached 1,687.3 Thousand Tons in 2025.

The Australia caustic soda market is projected to exhibit a compound annual growth rate (CAGR) of 1.29% during 2026-2034.

The Australia caustic soda market is expected to reach 1,900.4 Thousand Tons by 2034.

The market is witnessing increasing adoption of green production methods and membrane cell technologies. Rising use in end-use industries like alumina refining, water treatment, and soaps, along with digitalized process monitoring and sustainable by-product management, are also shaping market trends.

Growth is driven by expanding industrial chemical demand, increasing consumption in water treatment, textiles, and detergent industries, and rising urbanization and infrastructure development. Technological advancements, focus on sustainability, and favorable export opportunities further support the long-term expansion of the Australia caustic soda market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)