Australia Ceiling Light Market Size, Share, Trends and Forecast by Light Source, Mounting Type, Application, Smart Features, Style, and Region, 2026-2034

Australia Ceiling Light Market Summary:

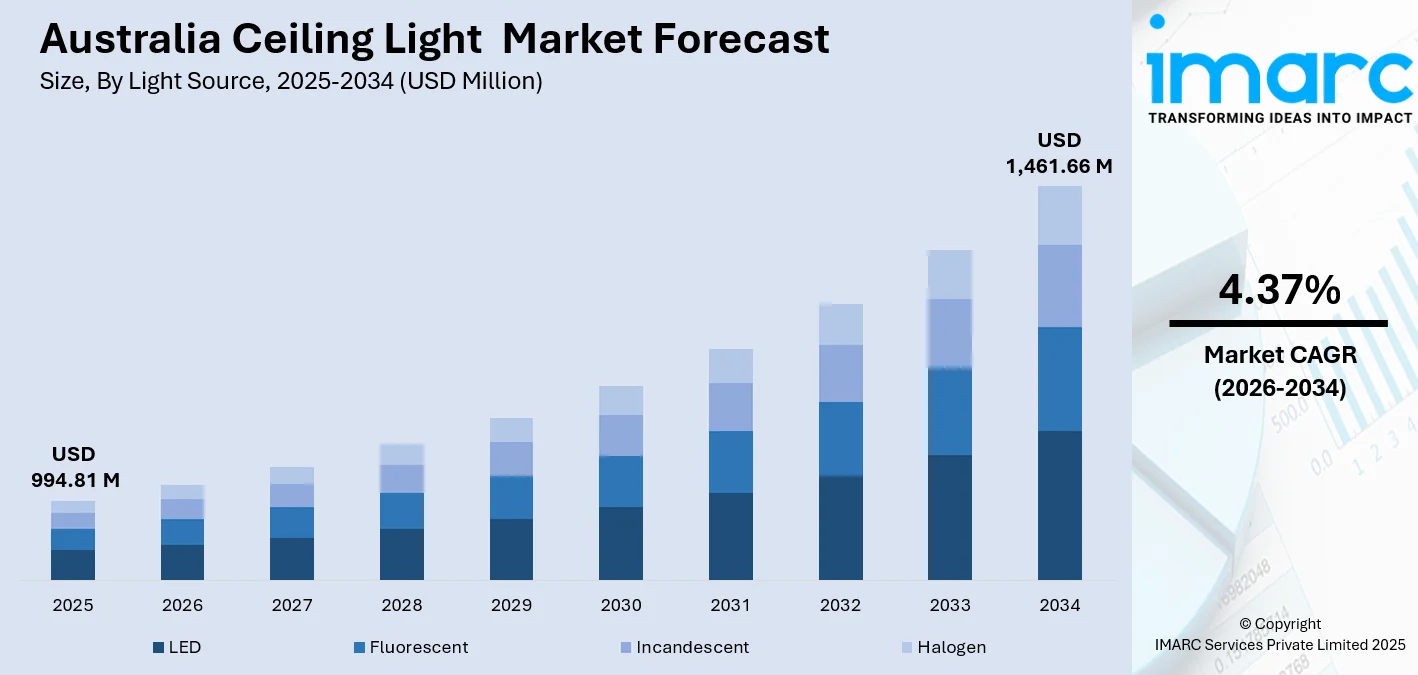

The Australia ceiling light market size was valued at USD 994.81 Million in 2025 and is projected to reach USD 1,461.66 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034.

The market is experiencing robust expansion driven by accelerating adoption of energy-efficient LED technology, heightened preference for smart home integration features, and sustained growth in residential and commercial construction activities across major Australian metropolitan areas. Government initiatives promoting energy conservation, combined with declining LED component costs and enhanced product functionality, are propelling widespread ceiling light replacements and new installations. The convergence of sustainability mandates, design innovation, and technological advancement is fundamentally reshaping lighting procurement decisions across both residential and commercial segments, thereby expanding the Australia ceiling light market share.

Key Takeaways and Insights:

-

By Light Source: LED dominates the market with a share of 56% in 2025, driven by superior energy efficiency, extended lifespan, and declining costs that make it the preferred choice across all applications.

-

By Mounting Type: Recessed leads the market with a share of 31% in 2025, favored for its sleek integration into ceilings and widespread use in modern commercial and residential construction projects.

-

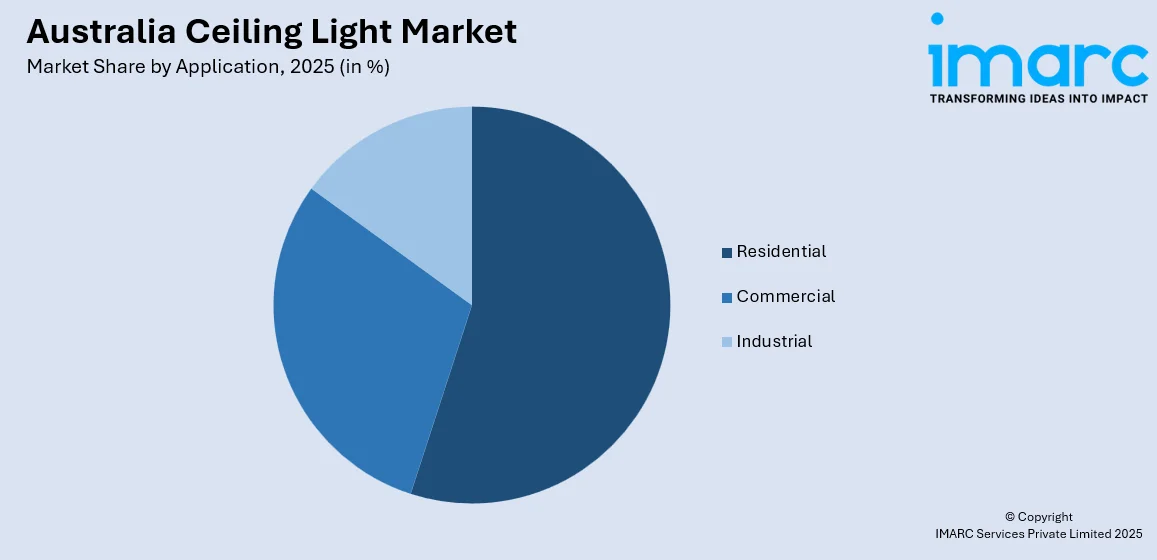

By Application: Residential represents the largest segment with a market share of 55% in 2025, reflecting substantial investment in office buildings, retail spaces, and hospitality venues requiring professional lighting solutions.

-

By Smart Features: Dimmable leads the market with a share of 40% in 2025, offering practical energy management and ambiance control without requiring complex smart home infrastructure.

-

By Style: Modern represents the largest segment with a market share of 33% in 2025, aligning with contemporary architectural preferences and minimalist interior design trends prevalent across Australian homes and businesses.

-

By Region: Australia Capital Territory & New South Wales lead the market with a share of 26% in 2025, driven by Sydney's substantial commercial property sector and robust residential construction activity across the state.

-

Key Players: The Australia ceiling light market features a competitive landscape comprising multinational lighting corporations and established regional manufacturers competing through product innovation, energy efficiency improvements, design differentiation, and expanding distribution networks to capture growing consumer demand.

To get more information on this market Request Sample

The Australia ceiling light market is advancing as both residential and commercial sectors embrace modern lighting technologies that combine aesthetic appeal with functional efficiency. Growing emphasis on sustainable building practices and green certifications is driving architects and developers to specify high-performance ceiling fixtures that meet stringent energy standards established under the National Construction Code. The expansion of smart home ecosystems is creating opportunities for connected lighting solutions that integrate seamlessly with broader automation platforms, enabling voice control, scheduling, and energy monitoring capabilities. Rising construction activity across major metropolitan areas including Sydney, Melbourne, and Brisbane is generating consistent demand for quality ceiling lighting products. For instance, in August 2024, Haneco Specialised Solutions launched its exclusive range of professional luminaires and control systems at the Adelaide Marriott Hotel, demonstrating the industry's commitment to delivering innovative commercial lighting solutions that balance design excellence with operational efficiency and sustainability requirements.

Australia Ceiling Light Market Trends:

Integration of Smart Home Technologies with Ceiling Lights

Smart lighting is emerging as a transformative trend in the Australian ceiling light market, reflecting the broader adoption of connected home technologies across residential and commercial sectors. Consumers and businesses are increasingly investing in Internet of Things (IoT)-enabled lighting solutions that provide remote operation, automation capabilities, and seamless integration with building management systems. Voice control compatibility with platforms is becoming a standard expectation among technology-conscious consumers seeking convenience and energy optimization. In 2024, Amazon launched the new Alexa experience in Australia named Spicy Alexa. The connectivity standard is removing proprietary barriers, enabling devices from different manufacturers to communicate through unified applications and enhancing interoperability across smart home ecosystems. Commercial facilities are deploying intelligent lighting networks that enable centralized monitoring, occupancy-based controls, and data-driven energy management.

Accelerated Shift to Energy-Efficient LED Lighting

The transition from traditional incandescent and halogen lighting to LED technology continues to accelerate across Australia, driven by sustainability concerns, cost-effectiveness imperatives, and regulatory mandates. LED ceiling lights consume less electricity than conventional alternatives while delivering superior illumination quality, enhanced color rendering capabilities, and extended operational lifespans exceeding 50,000 hours. Government policies mandating minimum energy performance standards are reinforcing this shift by restricting the availability of inefficient lighting products in Australian markets. The declining cost of LED components has improved affordability across all market segments, making energy-efficient lighting accessible to price-sensitive residential consumers and budget-constrained commercial projects alike. Technological advancements enable modern LED fixtures to offer adjustable color temperatures ranging from warm to cool white, supporting human-centric lighting applications. In 2024, the Energy and Climate Change Ministerial Council agreed to phase out inefficient halogen lamps where LED equivalents are available, with new Greenhouse and Energy Minimum Standards expected to take effect by March 2026.

Rising Demand for Human-Centric and Wellness Lighting Solutions

Human-centric lighting that supports health, productivity, and natural circadian rhythms is gaining significant traction across commercial and residential applications throughout Australia. Tunable white LED fixtures capable of adjusting color temperature throughout the day are becoming increasingly popular in offices, healthcare facilities, educational institutions, and residential spaces where occupant wellbeing is prioritized. These advanced solutions help optimize productivity during working hours while supporting relaxation and healthy sleep patterns during evening periods. Research demonstrating the positive effects of appropriate lighting on cognitive performance, mood regulation, and overall wellness is driving specification decisions among facility managers and homeowners seeking enhanced living and working environments. Corporate wellness initiatives are incorporating lighting design as a key element of employee health programs, recognizing its impact on staff satisfaction and performance. One of the prominent Australian companies, Galactic Night Co. combines advanced lighting technology with curated aesthetics that support relaxation and decor. Using exclusive diffusion methods, every lamp produces uniform, glare-free lighting that calms the senses and enhances the style of the room. Clients enjoy sleep-friendly wavelengths and stylish finishes that complement any modern décor.

Market Outlook 2026-2034:

The Australia ceiling light market is poised for sustained expansion as construction activity strengthens and consumer preferences continue evolving toward intelligent, energy-efficient solutions. Infrastructure investments, residential housing initiatives, and commercial renovation projects will drive demand across all product categories. The market generated a revenue of USD 994.81 Million in 2025 and is projected to reach a revenue of USD 1,461.66 Million by 2034, growing at a compound annual growth rate of 4.37% from 2026-2034. Green building certifications including NABERS ratings will influence specification decisions toward high-performance LED solutions with advanced control capabilities. The convergence of smart technologies, sustainable design principles, and aesthetic innovation will shape product development strategies among leading manufacturers.

Australia Ceiling Light Market Report Segmentation:

| Segment Category | Leading Segment | Market Share |

|---|---|---|

| Light Source | LED | 56% |

| Mounting Type | Recessed | 31% |

| Application | Residential | 55% |

| Smart Features | Dimmable | 40% |

| Style | Modern | 33% |

| Region | Australia Capital Territory & New South Wales | 26% |

Light Source Insights:

- LED

- Fluorescent

- Incandescent

- Halogen

LED dominates with a market share of 56% of the total Australia ceiling light market in 2025.

The LED segment's commanding market position reflects the technology's compelling value proposition combining energy efficiency, longevity, and design flexibility. LED ceiling lights consume up to 75% less energy than traditional incandescent alternatives while delivering superior illumination quality and color rendering capabilities. The extended operational lifespan exceeding 50,000 hours significantly reduces maintenance requirements and replacement costs for commercial property managers and homeowners alike. Declining LED component prices have improved affordability, accelerating adoption across price-sensitive market segments.

The segment's dominance extends across application categories, with residential users prioritizing long-term cost savings and environmental sustainability, while commercial property managers value reduced maintenance disruption and electricity expenses. Technological maturation has eliminated early concerns regarding light quality, with contemporary LED products delivering superior color rendering that rivals traditional sources. Manufacturing scale economies continue compressing retail prices, expanding addressable markets into value-conscious segments previously reliant on cheaper conventional alternatives. The trajectory remains favorable as incremental innovations in chip efficiency, thermal management, and optical design further enhance LED performance advantages over remaining traditional technologies.

Mounting Type Insights:

- Recessed

- Surface-Mounted

- Pendant

- Chandelier

Recessed leads with a share of 31% of the total Australia ceiling light market in 2025.

Recessed ceiling lights maintain market leadership through architectural compatibility with contemporary design aesthetics emphasizing clean lines, uncluttered ceiling planes, and maximized visual space perception. The mounting approach proves particularly advantageous in residential settings with lower ceiling heights, where protruding fixtures compromise headroom clearance. Commercial environments favor recessed installations for their professional appearance, even light distribution across workspaces, and reduced cleaning maintenance compared to surface-mounted alternatives accumulating dust on exposed surfaces.

Installation considerations increasingly favor recessed fixtures in new construction projects, where electrical rough-in occurs during framing stages, eliminating retrofit complications associated with ceiling penetration in finished spaces. The format accommodates diverse lighting technologies, wattages, and beam patterns, enabling specification flexibility across functional requirements from general ambient illumination to focused task lighting. Architectural trends toward integrated ceiling systems incorporating HVAC components, sprinkler heads, and acoustic treatments position recessed lighting as the preferred mounting approach maintaining aesthetic coherence. Energy codes mandating airtight construction techniques have driven innovation in recessed fixture designs addressing thermal performance and preventing conditioned air leakage through ceiling penetrations.

Application Insights:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Industrial

Residential exhibits a clear dominance with a 55% share of the total Australia ceiling light market in 2025.

Residential applications form the largest segment of the Australia ceiling light market, driven by steady housing demand and high replacement cycles. Urban population growth, ongoing apartment construction, and frequent interior upgrades keep residential lighting purchases consistent throughout the year. Homeowners show strong preference for ceiling-mounted fixtures due to space efficiency, ease of installation, and suitability across living rooms, bedrooms, kitchens, and hallways. LED ceiling lights dominate this segment as energy efficiency standards tighten and electricity costs remain a concern. Government incentives supporting energy-saving products further encourage adoption. Design preferences also play a role, with demand rising for slim panels, smart lighting options, and fixtures that blend with modern interiors, making residential buyers the most active contributors to overall market volumes.

Within the residential segment, renovation and replacement demand outweighs new construction, reinforcing its market leadership. Australian households regularly update lighting to improve aesthetics, functionality, and energy performance, creating recurring sales opportunities. Ceiling lights are often the first upgrade during home improvement projects because of their immediate visual and efficiency benefits. Growing interest in smart homes has accelerated the uptake of connected ceiling lights that offer dimming, color control, and remote operation. Price sensitivity remains moderate, as consumers balance design appeal with long-term energy savings. Wide availability through retail stores, online platforms, and electrical distributors also supports high penetration levels, keeping residential applications firmly positioned as the dominant end-use segment in the Australia ceiling light market.

Smart Features Insights:

- Dimmable

- Color-Changing

- Voice-Controlled

- Smart Home Integration

Dimmable leads with a share of 40% of the total Australia ceiling light market in 2025.

Dimmable ceiling lights represent the most accessible entry into smart lighting functionality, offering tangible benefits without requiring comprehensive home automation infrastructure investment. The capability addresses fundamental consumer desires for lighting customization across different activities, times of day, and mood preferences while delivering measurable energy savings through reduced power consumption during dimmed operation. Compatibility with existing wall switches and straightforward installation procedures minimize adoption barriers compared to more sophisticated smart features requiring dedicated hubs or network configuration.

Commercial applications increasingly specify dimmable fixtures to comply with energy codes mandating automatic lighting controls in commercial spaces, while restaurants, bars, and entertainment venues leverage dimming capabilities as essential ambiance control tools directly impacting customer experiences. The technology accommodates various control methodologies spanning traditional rotary dimmers, wireless remotes, smartphone applications, and voice commands, enabling progressive feature adoption as consumers expand their smart home ecosystems. Dimming compatibility has evolved from premium feature to baseline expectation, with manufacturers standardizing the functionality across product portfolios as incremental cost premiums compress through technological maturation and competitive market dynamics.

Style Insights:

- Modern

- Traditional

- Contemporary

- Industrial

- Coastal

Modern exhibits a clear dominance with a 33% share of the total Australia ceiling light market in 2025.

Modern styling maintains market leadership, aligned with prevailing architectural trends emphasizing geometric simplicity, minimalist aesthetics, and integration with contemporary interior design philosophies dominating Australian urban residential developments. The style encompasses clean lines, neutral finishes, and understated profiles that complement rather than compete with surrounding decor elements. Property developers targeting younger demographic cohorts specify modern ceiling lights as standard fixtures appealing to millennial and Generation Z homebuyers whose aesthetic preferences favor streamlined contemporary design over ornate traditional alternatives.

The style's versatility accommodates diverse application contexts from sophisticated urban apartments to suburban family homes, offering universal appeal across regional markets and socioeconomic segments. Modern ceiling lights integrate seamlessly with open floor plan layouts prevalent in contemporary residential construction, providing ambient illumination without visual clutter. Commercial spaces including corporate offices, boutique retail stores, and modern hospitality venues favor the style for its professional appearance and timeless aesthetic resilience to shifting design trends. Manufacturing efficiencies associated with simpler geometries and standardized finishes enable competitive pricing, expanding modern style accessibility across value-oriented market segments while premium design houses offer elevated interpretations commanding higher price points.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

Australia Capital Territory & New South Wales with a share of 26% of the total Australia ceiling light market in 2025.

The combined Australia Capital Territory and New South Wales region maintains its position as the largest regional market due to the concentration of Australia's most populous metropolitan area alongside the national capital's significant government and institutional building requirements. Sydney's extensive office building stock, retail developments, hospitality venues, and healthcare facilities generate consistent requirements for professional ceiling lighting installations and upgrades. Canberra's federal government buildings, diplomatic precincts, and educational institutions contribute additional demand for high-quality commercial lighting solutions meeting stringent performance specifications. The region's diverse residential construction activity spanning high-rise apartments, medium-density developments, and detached housing creates demand across all product categories and price segments.

The region's commitment to sustainability and energy efficiency is accelerating adoption of LED ceiling lighting across both new construction and retrofit applications. The Australian Capital Territory's focus on achieving net-zero emissions targets is driving government agencies to upgrade lighting systems in public buildings, with energy-efficient LED fixtures and smart controls becoming standard specifications. Commercial property owners pursuing NABERS energy ratings are specifying high-efficiency lighting systems, while residential builders incorporate modern LED fixtures to meet National Construction Code energy requirements established under federal and state building regulations.

Market Dynamics:

Growth Drivers:

Why is the Australia Ceiling Light Market Growing?

Stringent Government Energy Efficiency Standards

Government policies promoting energy efficiency are fundamentally reshaping the Australia ceiling light market by mandating performance standards and phasing out inefficient lighting technologies. The Equipment Energy Efficiency program administered by the Department of Climate Change, Energy, the Environment and Water establishes Greenhouse and Energy Minimum Standards that lighting products must meet for sale in Australian markets. These regulations compel both manufacturers and consumers to transition toward LED and other high-efficiency lighting solutions. The National Construction Code incorporates progressively stringent energy requirements for building lighting systems, influencing specification decisions during design and construction phases. In 2024, the Australian Government arranged 2 public webinars in November comprising crucial lighting upgradation from the Equipment Energy Efficiency (E3) Program.

Expanding Construction Sector Activity

Australia's construction sector expansion is generating sustained demand for ceiling lighting across residential, commercial, and infrastructure projects. The federal government's housing target of 1.2 million new homes by 2029 requires annual completions to increase substantially from current levels, creating visibility for lighting suppliers serving residential builders. Commercial construction including office buildings, retail developments, and hospitality projects continues across major metropolitan areas despite economic headwinds. Infrastructure investments in transport corridors, educational facilities, and healthcare buildings incorporate professional lighting requirements that support market growth. According to IMARC Group, Australia's construction market was valued at USD 420.5 Billion in 2025, projected to reach USD 603.0 Billion by 2034, exhibiting a CAGR of 4.09% from 2026-2034.

Growing Adoption of Smart Building Technologies

The integration of smart technologies into building management systems is driving demand for connected ceiling lighting solutions that support automation, monitoring, and optimization capabilities. Commercial property owners recognize that intelligent lighting systems deliver operational cost savings through occupancy-based controls, daylight harvesting, and centralized management. Building automation platforms increasingly incorporate lighting as a core component alongside HVAC, security, and access control systems. The residential smart home market is stimulating consumer interest in voice-controlled and app-managed ceiling fixtures that integrate with broader home automation ecosystems. In 2025, the federal government plans to allocate $225 million for its own AI usage over the next four years, primarily through the GovAI service and support functions. The Australian Public Service Commission and the DTA will get $22.1 million over four years, plus $400,000 annually afterward, to implement essential AI capability development activities and a unified workforce planning effort to assist agencies in navigating AI-driven changes in job design, skills, and mobility.

Market Restraints:

What Challenges the Australia Ceiling Light Market is Facing?

Extended Product Lifespans Reducing Replacement Frequency

LED technology's exceptional operational longevity substantially extends replacement cycles compared to traditional lighting alternatives, compressing addressable market opportunities within existing building stock. Manufacturers face strategic tensions balancing durability quality supporting brand reputations against commercial implications of reduced repeat purchase frequency. The dynamics particularly impact replacement market segments where installations previously requiring periodic bulb changes now function for years without maintenance intervention. Distributor and retailer business models optimized for consumable product turnover adapt to inventory strategies emphasizing new construction and renovation project cycles rather than routine replacement sales.

Price Sensitivity Constraining Premium Product Penetration

Consumer perception of ceiling lights as commodity products creates resistance toward premium pricing despite superior performance attributes. Value-oriented purchasing behavior particularly prevails across residential replacement markets where functional illumination requirements outweigh aesthetic considerations. Price comparison transparency through online retail channels intensifies competitive pricing pressures compressing manufacturer margins. Import competition from low-cost manufacturing regions establishes aggressive pricing benchmarks challenging domestically-produced alternatives. Economic uncertainty periods amplify consumer cost consciousness, deferring discretionary lighting upgrades and favoring minimum-specification products meeting basic functional requirements.

Installation Complexity Deterring Residential Retrofit Activity

Recessed ceiling light installations require ceiling cavity access, electrical rough-in modifications, and potential structural considerations complicating residential retrofit projects. Homeowner concerns regarding installation costs, drywall repair requirements, and renovation disruption create adoption friction particularly in older housing stock lacking existing recessed fixture infrastructure. The complexity favors surface-mounted alternatives in retrofit scenarios despite consumer aesthetic preferences for recessed installations. Professional installation requirements add labor costs to project budgets, deterring price-sensitive consumers considering do-it-yourself approaches feasible with simpler fixture types.

Competitive Landscape:

The Australia ceiling light market exhibits moderate fragmentation with multinational lighting corporations competing alongside established domestic retailers and regional manufacturers. Major international players leverage global technology development, extensive product portfolios, and brand recognition to serve commercial and premium residential segments. Australian companies maintain strong positions through retail distribution networks, local market knowledge, and responsive customer service capabilities. Competition centers on product innovation, energy efficiency performance, design differentiation, and value-added services including lighting design consultation and project support. Strategic partnerships between manufacturers and distributors strengthen market access while enabling specialized capabilities in commercial project delivery.

Australia Ceiling Light Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Light Sources Covered | LED, Fluorescent, Incandescent, Halogen |

| Mounting Types Covered | Recessed, Surface-Mounted, Pendant, Chandelier |

| Applications Covered | Residential, Commercial, Industrial |

| Smart Features Covered | Dimmable, Color-Changing, Voice-Controlled, Smart Home Integration |

| Styles Covered | Modern, Traditional, Contemporary, Industrial, Coastal |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report

The Australia ceiling light market size was valued at USD 994.81 Million in 2025.

The Australia ceiling light market is expected to grow at a compound annual growth rate of 4.37% from 2026-2034 to reach USD 1,461.66 Million by 2034.

LED holds the largest share of 56%, dominates the Australia ceiling light market due to its superior energy efficiency, extended lifespan exceeding 50,000 hours, declining component costs, and versatile design applications across residential and commercial sectors.

Key factors driving the Australia ceiling light market include stringent government energy efficiency standards, expanding construction sector activity across residential and commercial segments, growing adoption of smart building technologies, increasing consumer preference for sustainable lighting, and rising demand for aesthetically appealing modern fixtures.

Major challenges include high initial costs of premium LED and smart fixtures, supply chain vulnerabilities and import dependencies affecting product availability, skilled labor shortages impacting installation capacity, and the need for consumer education regarding smart lighting benefits and operation.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)