Australia Cement Additives Market Size, Share, Trends and Forecast by Type, Function, and Region, 2025-2033

Australia Cement Additives Market Overview:

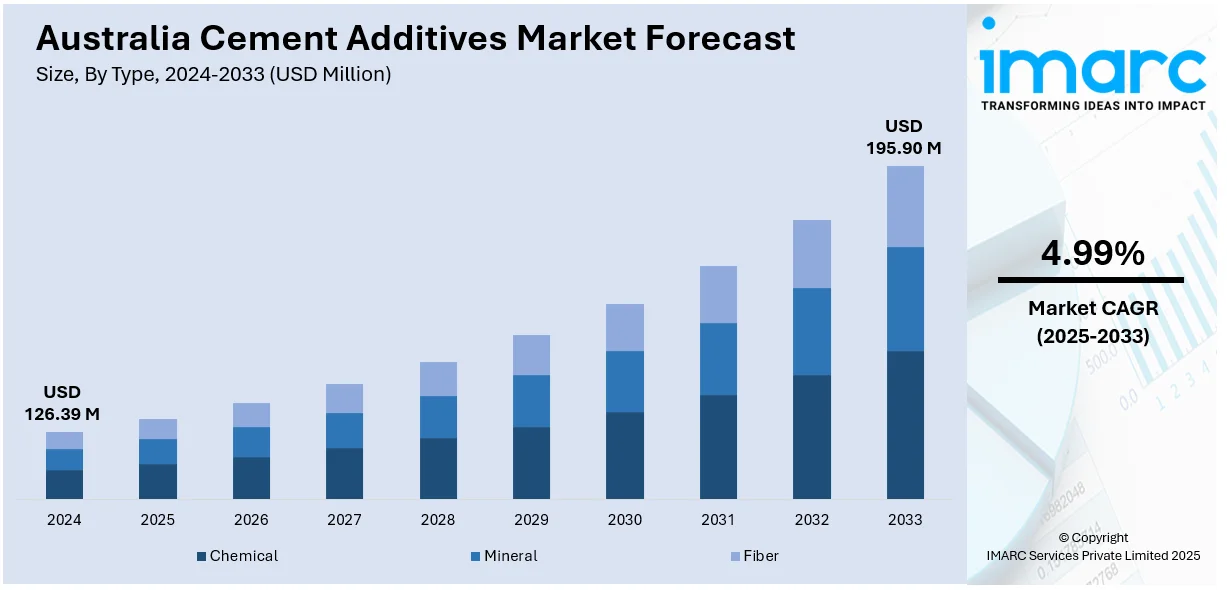

The Australia cement additives market size reached USD 126.39 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 195.90 Million by2033, exhibiting a growth rate (CAGR) of 4.99% during 2025-2033. At present, rising investments in infrastructure activities are driving the demand for high-performance building materials that enhance the efficiency and quality of construction. Besides this, the growing focus on safety and efficiency in mining activities is contributing to the expansion of the Australia cement additives market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 126.39 Million |

| Market Forecast in 2033 | USD 195.90 Million |

| Market Growth Rate 2025-2033 | 4.99% |

Australia Cement Additives Market Trends:

Growing investments in construction activities

Rising investments in construction activities are positively influencing the market in Australia. As both public and private sectors are wagering on infrastructure development, including roads, bridges, commercial complexes, and residential buildings, the need for advanced cement products is growing steadily. Cement additives play an important role in improving the properties of cement, such as strength, durability, and workability, which are crucial for large-scale construction projects. These additives help reduce water usage, speed up construction timelines, and offer better resistance to environmental stress. As modern construction practices are shifting towards sustainability and energy efficiency, there is a greater adoption of additives that lower the carbon footprint of cement production. Government initiatives aimed at upgrading transportation networks, healthcare infrastructure, and educational facilities are further supporting market expansion. Real estate development in urban and regional areas is also boosting cement usage, making performance additives increasingly important. Investors and developers prefer materials that offer long-term durability and cost savings, which is encouraging the employment of chemical and mineral additives in cement. Additionally, technological advancements in construction techniques are creating more opportunities for the application of specialized additives. Overall, increasing investments in construction are contributing to the growth of the market across Australia by ensuring sustained demand and innovation. According to the IMARC Group, the Australia construction market is set to attain USD 588 Billion by 2033, exhibiting a CAGR of 4.30% from 2025-2033.

To get more information on this market, Request Sample

Increasing mining activities

Rising mining activities are impelling the Australia cement additives market growth. As per the Australian Bureau of Statistics, spending on mineral exploration increased by 1.3% in December 2024. Mining operations often require robust structures, such as tunnels, shafts, foundations, and processing facilities, which rely heavily on cement-based components. Cement additives help enhance the strength, setting time, and durability of cement used in these applications, making them highly suitable for challenging mining environments. The harsh conditions and heavy loads in mining areas require concrete with superior resistance to pressure, moisture, and chemical exposure, which cement additives provide. As the mining sector is expanding to meet worldwide demand for minerals and metals, more construction projects are emerging in remote and geologically complex regions, further creating the need for specialized cement mixtures. Additionally, mining companies are prioritizing safety and long-term performance, leading to a higher preference for quality cement formulations. The use of additives is also supporting faster construction schedules and reduced maintenance costs, which are important in time-sensitive mining operations. Growing investments in mining infrastructure and exploration activities continue to drive the demand for advanced construction materials, thereby strengthening the market.

Australia Cement Additives Market Segmentation:

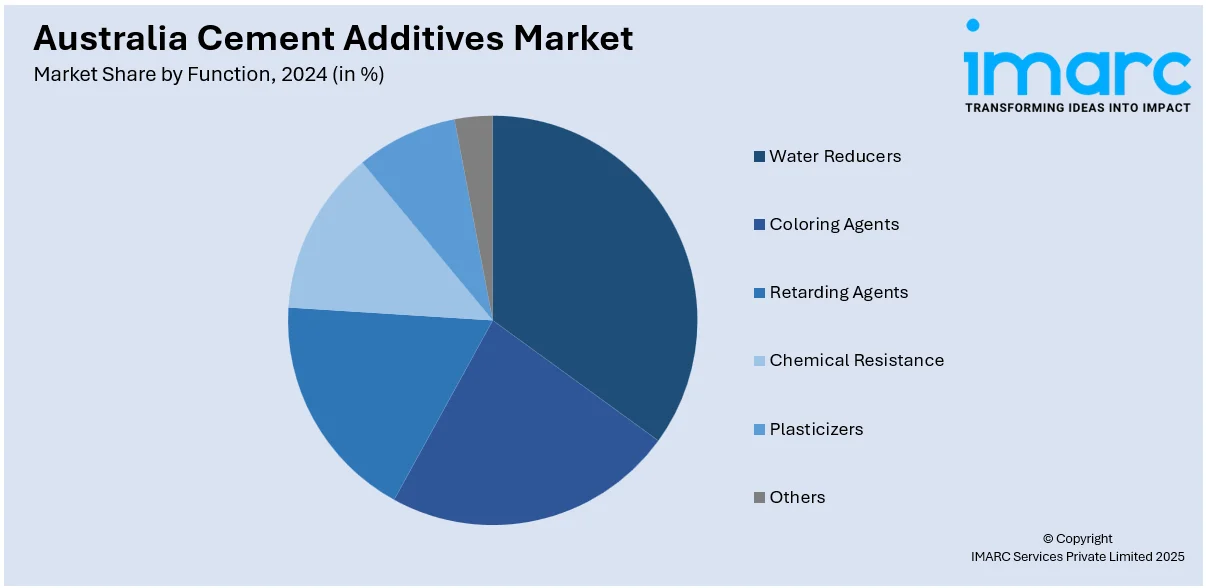

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the countr and regional levels for 2025-2033. Our report has categorized the market based on type and function.

Type Insights:

-

Chemical

-

Mineral

-

Fiber

- Water Reducers

- Coloring Agents

- Retarding Agents

- Chemical Resistance

- Plasticizers

- Others

A detailed breakup and analysis of the market based on the function have also been provided in the report. This includes water reducers, coloring agents, retarding agents, chemical resistance, plasticizers, and others.

Regional Insights:

-

Australia Capital Territory & New South Wales

-

Victoria & Tasmania

-

Queensland

-

Northern Territory & Southern Australia

-

Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cement Additives Market News:

- In April 2025, Mapei Australia introduced the CUBE system, featuring the locally devised Mapecube 70, to the Australian market. Launched at a specialized industry event in mid-March, the Mapecube series of concrete additives facilitated the creation of low carbon concrete (LCC) by decreasing clinker levels and using increased amounts of supplementary cementitious materials (SCMs). These liquid additives aimed to enhance concrete durability while reducing CO₂ emissions.

- In April 2024, CRDC Global Ltd. launched its inaugural RESIN8 construction materials manufacturing plant in Australia. The company's patented eco-friendly technology incorporated shredded and mixed plastic waste to produce more sustainable concrete additives. The firm employed a method that processed all kinds of plastic waste including resins 1 through 7, and transformed it into various climate-adaptive concrete additives and sustainable aggregates, sold and manufactured under the RESIN8 brand.

Australia Cement Additives Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Chemical, Mineral, Fiber |

| Functions Covered | Water Reducers, Coloring Agents, Retarding Agents, Chemical Resistance, Plasticizers, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

-

How has the Australia cement additives market performed so far and how will it perform in the coming years?

-

What is the breakup of the Australia cement additives market on the basis of type?

-

What is the breakup of the Australia cement additives market on the basis of function?

-

What is the breakup of the Australia cement additives market on the basis of region?

-

What are the various stages in the value chain of the Australia cement additives market?

-

What are the key driving factors and challenges in the Australia cement additives market?

-

What is the structure of the Australia cement additives market and who are the key players?

-

What is the degree of competition in the Australia cement additives market?

Key Benefits for Stakeholders:

-

IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cement additives market from 2019-2033.

-

The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cement additives market.

-

Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cement additives industry and its attractiveness.

-

Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)