Australia Cement Admixtures Market Size, Share, Trends and Forecast by Product Type, End User, and Region, 2025-2033

Australia Cement Admixtures Market Overview:

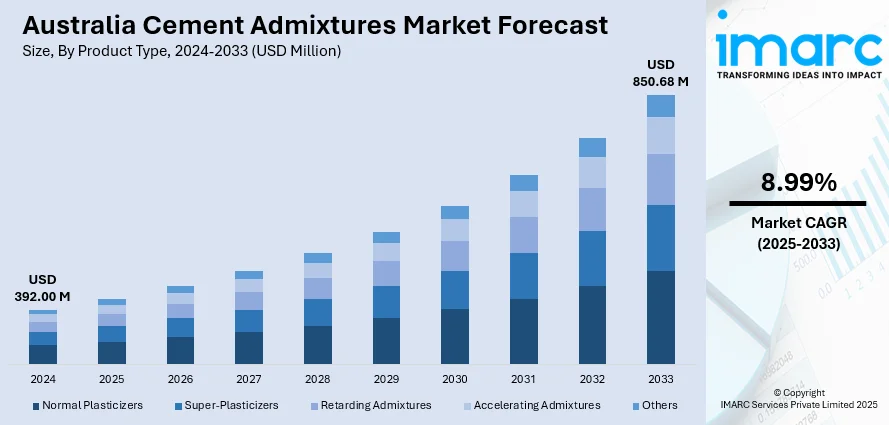

The Australia cement admixtures market size reached USD 392.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 850.68 Million by 2033, exhibiting a growth rate (CAGR) of 8.99% during 2025-2033. The market is driven by strong growth in Australia’s construction and infrastructure projects, where admixtures are vital for enhancing concrete's performance and meeting the evolving needs of the industry. Technological innovations in concrete production processes, including advanced admixture formulations, support the construction of high-performance concrete suited to complex projects. The increasing emphasis on sustainability and the adoption of eco-friendly building standards further strengthen the Australian admixtures market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 392.00 Million |

| Market Forecast in 2033 | USD 850.68 Million |

| Market Growth Rate 2025-2033 | 8.99% |

Australia Cement Admixtures Market Trends:

Strong Growth in Construction and Infrastructure Projects

Significant growth in construction and infrastructure industries across Australia are the main drivers of the market for admixtures. With its strong pipeline of big-ticket infrastructure projects, such as transport networks, residential real estate, and commercial office buildings, demand for high-quality construction products, including concrete admixtures, has increased significantly. Admixtures are essential in optimizing the performance of concrete, for example, in increasing workability, durability, and resistance to harsh weather conditions. The growing demand for new, high-strength concrete products that are compliant with both local building regulations and global standards is driving the market. Additionally, continued investments by the Australian government in infrastructure development, including roads, bridges, and airports, has supported this expansion. On January 2023, the M4-M5 Link Tunnels, part of Sydney's WestConnex highway project, were opened to traffic, utilizing PENETRON ADMIX, a crystalline concrete waterproofing admixture, to ensure the tunnels' durability and impermeability. The USD 16.8 billion project, Australia's largest road infrastructure undertaking, spans 33 km (21 miles) of highway, with the M4-M5 tunnels being 7.5 km (4.65 miles) long. The use of PENETRON ADMIX improved the concrete's resistance to corrosion and hydrostatic pressure, enhancing its longevity and reducing the need for future maintenance. As construction projects become more complex, the role of concrete admixtures in ensuring optimal concrete performance in varying environmental conditions becomes even more critical. Additionally, the rise of urbanization and housing projects, particularly in major cities like Sydney and Melbourne, necessitates the use of high-quality, durable concrete, which drives further adoption of advanced admixtures. These factors together contribute to the sustained Australia admixtures market growth, with demand set to increase alongside the country's infrastructure expansion and urban development plans.

To get more information on this market, Request Sample

Technological Advancements and Innovations in Concrete Production

Technological advancements in concrete production play a pivotal role in driving the demand for admixtures in Australia. The continuous development of new admixture formulations that improve concrete's performance in terms of strength, durability, and sustainability has significantly expanded the range of options available to the construction industry. Innovations such as self-compacting concrete, which uses specific admixtures for enhanced workability without requiring mechanical compaction, are becoming increasingly popular for high-rise buildings and large infrastructure projects. These innovations help reduce labor costs and improve the overall quality of concrete used in construction, which in turn benefits the entire construction value chain. On March 21, 2025, Mapei launched Mapecube, a groundbreaking liquid admixture designed to reduce CO₂ emissions and strengthen concrete. This product enables concrete producers to enhance durability while reducing the amount of cement used, resulting in a lower environmental impact. By incorporating increased volumes of alternative binders, Mapecube supports the global cement and concrete industry in achieving sustainability goals, including Australia's target of net-zero emissions by 2050. Moreover, there is a growing trend toward incorporating sustainable practices in construction, and admixtures play an essential role in facilitating these efforts. Admixtures that allow for the use of alternative materials, such as recycled aggregates or industrial by-products, in concrete production are gaining traction. As research and development efforts continue to drive new and improved admixture solutions, these technological advancements are expected to support the growth of the market. The adoption of cutting-edge admixture technologies will continue to be a crucial factor in shaping the Australian admixtures market, contributing to its long-term expansion.

Australia Cement Admixtures Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type and end user.

Product Type Insights:

- Normal Plasticizers

- Super-Plasticizers

- Retarding Admixtures

- Accelerating Admixtures

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes normal plasticizers, super-plasticizers, retarding admixtures, accelerating admixtures, and others.

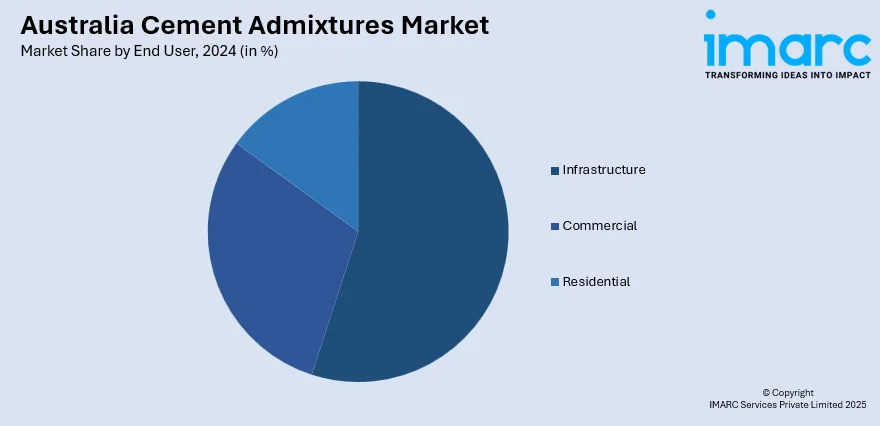

End User Insights:

- Infrastructure

- Commercial

- Residential

The report has provided a detailed breakup and analysis of the market based on the end user. This includes infrastructure, commercial, and residential.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all major regional markets. This includes Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cement Admixtures Market News:

- On December 19, 2023, MC-Bauchemie Australia, a newly established subsidiary of MC-Bauchemie Group, acquired the construction chemical trading business of Building Chemical Supplies (BCS). This acquisition includes BCS’s assets in Sydney and Melbourne, and MC-Bauchemie Australia will leverage these to expand its presence in the Australian market.

Australia Cement Admixtures Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Normal Plasticizers, Super-Plasticizers, Retarding Admixtures, Accelerating Admixtures, Others |

| End Users Covered | Infrastructure, Commercial, Residential |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cement admixtures market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cement admixtures market on the basis of product type?

- • What is the breakup of the Australia cement admixtures market on the basis of end user?

- What is the breakup of the Australia cement admixtures market on the basis of region?

- What are the various stages in the value chain of the Australia cement admixtures market?

- What are the key driving factors and challenges in the Australia cement admixtures market?

- What is the structure of the Australia cement admixtures market and who are the key players?

- What is the degree of competition in the Australia cement admixtures market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cement admixtures market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cement admixtures market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cement admixtures industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)