Australia Cement Clinker Market Size, Share, Trends and Forecast by Type, Distribution Channel, Application, End-Use Industry, and Region, 2025-2033

Australia Cement Clinker Market Overview:

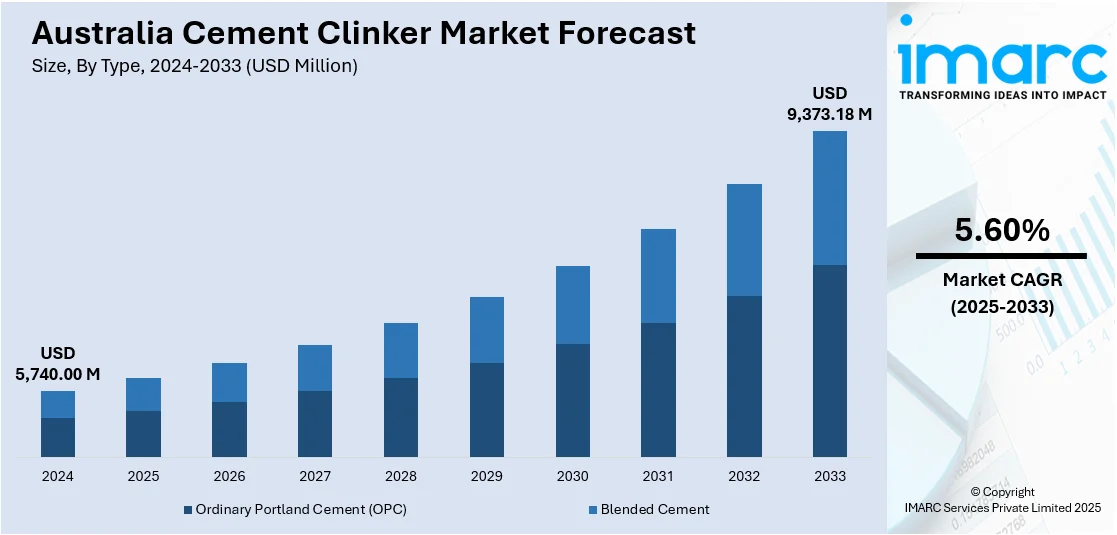

The Australia cement clinker market size reached USD 5,740.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 9,373.18 Million by 2033, exhibiting a growth rate (CAGR) of 5.60% during 2025-2033. A number of factors are fueling the market, such as rising demand from the construction sector, particularly for residential and infrastructure development. The demand for green construction solutions and urbanization also favorably contribute to this market growth. All these factors are poised to boost the Australia cement clinker market share in the future.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 5,740.00 Million |

| Market Forecast in 2033 | USD 9,373.18 Million |

| Market Growth Rate 2025-2033 | 5.60% |

Australia Cement Clinker Market Trends:

Shift Towards Sustainable Construction Materials

Sustainability is a growing priority in the Australian construction sector, fueling market demands for greener and more environmentally sustainable materials. Cement clinker manufacturers are responding by using alternative raw materials and fuels, including fly ash and slag, to minimize the carbon intensity of production. For instance, in April 2025, Boral secured a significant investment of USD 15 Million from the Australian government for decarbonisation at its Berrima cement plant. This will help the company increase alternative raw material (ARM) use, reduce limestone consumption, and reduce energy intensity. By 2028, Boral aims to raise ARM use to 23%, contributing to the company’s sustainability and decarbonisation goals. The market for low-carbon or carbon-neutral cement clinker will increase as Australia moves towards its sustainability objectives, bolstered by policies promoting eco-friendly building solutions. With increasing numbers of building initiatives prioritizing energy efficiency and lower emissions, the transition towards green cement clinker solutions is anticipated to lead to the growth of the Australia cement clinker market.

To get more information on this market, Request Sample

Technological Advancements in Cement Production

Technological advancements in cement manufacturing processes have enhanced the cost and efficiency of cement clinker production in Australia. Improved kiln technologies and automation have generated energy savings, lessened emissions, and reduced the cost of production. For instance, in March 2024, Etex expanded its presence in Australia by acquiring BGC’s plasterboard and fibre cement businesses. This acquisition adds advanced cement grinding facilities and cutting-edge fibre cement products to Etex’s portfolio. Additionally, advancements in clinker quality control ensure that cement produced meets stringent standards, which is critical for construction projects requiring durable and high-strength concrete. As Australian cement manufacturers continue to invest in research and development, these technologies are expected to further fuel the Australia cement clinker market growth, allowing it to meet the evolving needs of the construction industry.

Australia Cement Clinker Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region/country level for 2025-2033. Our report has categorized the market based on type, distribution channel, application, and end-use industry.

Type Insights:

- Ordinary Portland Cement (OPC)

- Blended Cement

The report has provided a detailed breakup and analysis of the market based on the type. This includes ordinary Portland cement (OPC) and blended cement.

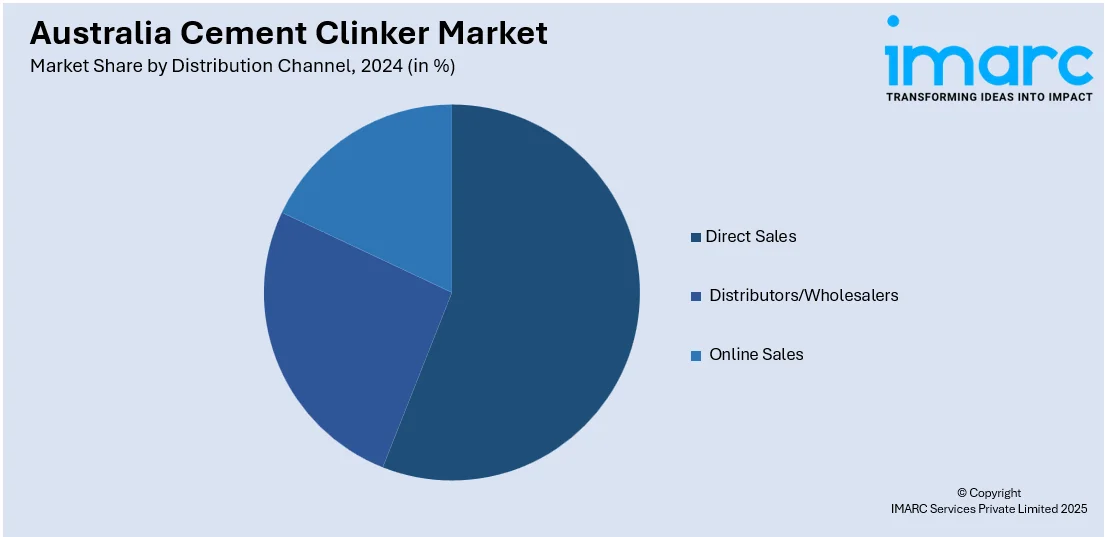

Distribution Channel Insights:

- Direct Sales

- Distributors/Wholesalers

- Online Sales

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes direct sales, distributors/wholesalers, and online sales.

Application Insights:

- Residential

- Commercial

- Infrastructure

The report has provided a detailed breakup and analysis of the market based on the application. This includes residential, commercial, and infrastructure.

End-Use Industry Insights:

- Construction

- Manufacturing

The report has provided a detailed breakup and analysis of the market based on the end-use industry. This includes construction and manufacturing.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cement Clinker Market News:

- In September 2024, Boral Australia invested $170 million in a clinker grinding and cement storage facility at GeelongPort, boosting its cement supply for Victoria, South Australia, and Tasmania. The facility can process 1.3 million tonnes of clinker and slag annually, supporting infrastructure projects and contributing to sustainability by utilizing steel slag to reduce landfill waste.

- In April 2024, Cement Australia’s Railton kiln facility received AUD 52.9 Million (USD 34.4 Million) in government funding to upgrade its operations, allowing the use of biomass instead of coal for clinker and cement production. This project, part of Australia's federal push to reduce carbon emissions, is expected to create 10 permanent jobs and 230 temporary positions, further contributing to the country's low-carbon manufacturing efforts.

Australia Cement Clinker Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Ordinary Portland Cement (OPC), Blended Cement |

| Distribution Channels Covered | Direct Sales, Distributors/Wholesalers, Online Sales |

| Applications Covered | Residential, Commercial, Infrastructure |

| End-Use Industries Covered | Construction, Manufacturing |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cement clinker market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cement clinker market on the basis of type?

- What is the breakup of the Australia cement clinker market on the basis of distribution channel?

- What is the breakup of the Australia cement clinker market on the basis of application?

- What is the breakup of the Australia cement clinker market on the basis of end-use industry?

- What is the breakup of the Australia cement clinker market on the basis of region?

- What are the various stages in the value chain of the Australia cement clinker market?

- What are the key driving factors and challenges in the Australia cement clinker market?

- What is the structure of the Australia cement clinker market and who are the key players?

- What is the degree of competition in the Australia cement clinker market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cement clinker market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cement clinker market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cement clinker industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)