Australia Cement Market Size, Share, Trends and Forecast by Type, End Use, and Region, 2026-2034

Australia Cement Market Size and Share:

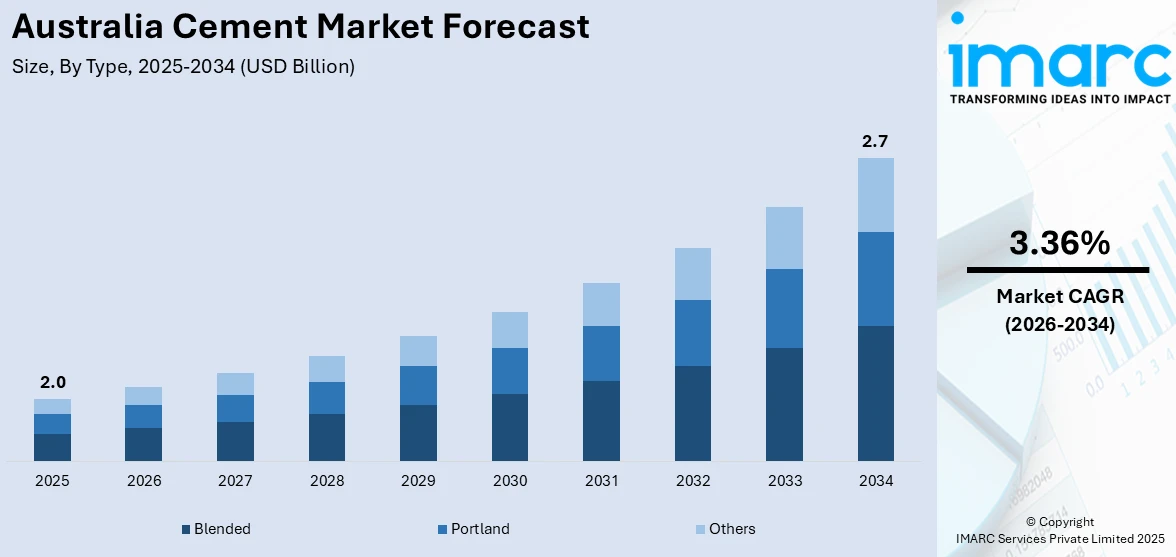

The Australia cement market size was valued at USD 2.0 Billion in 2025. Looking forward, the market is projected to reach USD 2.7 Billion by 2034, exhibiting a CAGR of 3.36% from 2026-2034. The Australia cement market share is expanding, driven by growing construction and infrastructure projects, urbanization, government investments in housing and transport and the demand for sustainable building materials. Rising industrialization and technological advancements in cement production also contribute to market growth addressing environmental concerns and enhancing product performance.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025 |

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

| Market Size in 2025 | USD 2.0 Billion |

| Market Forecast in 2034 | USD 2.7 Billion |

| Market Growth Rate (2026-2034) | 3.36% |

The Australian cement market is significantly driven by robust infrastructure development and a booming construction sector. Government investments in large-scale projects, such as highways, railways, and urban housing initiatives, fuel the Australia cement demand. According to industry reports, the Australian Government is investing over $120 billion in a 10-year infrastructure program with $96.5 billion allocated for the Infrastructure Investment Program by the 2024-25 Budget. Additionally, the growth in residential and commercial construction driven by urbanization and population growth further propels market expansion. Economic stability and increased private sector investments also play crucial roles in sustaining the demand for cement across various construction applications.

To get more information on this market Request Sample

The Australian cement market is also driven by the rising emphasis on sustainability and environmentally friendly building practices. The industry is adopting advanced technologies to reduce carbon emissions and enhance energy efficiency in cement production. For instance, in November 2024, Cement Australia in partnership with Holcim launched GreenCem low-carbon cement technology for the Yitpi Yartapuultiku Cultural Centre in Adelaide. This innovation uses up to 80% fly ash and slag reducing carbon emissions by 30% and supporting South Australia's carbon reduction goals. Regulatory policies promoting green construction materials and sustainable development initiatives encourage the use of eco-friendly cement products. Furthermore, innovations in cement formulations and the increasing preference for high-performance materials to meet modern construction standards are essential factors driving the Australian cement market forward.

Key Trends of Australia Cement Market:

Technological Advancements

The Australian cement industry is driving technological innovations to enhance product performance and operational efficiency. For instance, in November 2024, Smartcrete CRC allocated $3.2 million to six industry-led projects focused on sustainable concrete research totaling a $14 million investment. These initiatives aim to develop innovative materials and technologies to enhance the sustainability of Australia’s concrete infrastructure supporting the goal of achieving net zero emissions by 2050. Companies nowadays are developing high-performance and specialized cement products tailored for specific applications, such as ultra-high-strength concrete, rapid-setting formulations, and environmentally friendly options. These advanced materials meet the evolving demands of modern construction projects offering superior durability and sustainability. Additionally, the adoption of cutting-edge manufacturing technologies, including automation, robotics, and artificial intelligence (AI), is streamlining production processes. These technologies improve product quality, reduce waste and lower production costs enabling manufacturers to remain competitive and responsive to market needs while fostering continuous improvement and innovation in the sector.

Rising Focus on Sustainability

The growing focus on sustainability by aggressively targeting carbon emission reductions is offering a favorable Australian cement market outlook. Companies are developing and adopting low-carbon cementitious materials, such as blended cements with fly ash or slag, and exploring alternative binders like geopolymers. For instance, in April 2024, Cement Australia received a grant of US$34.4 million for a kiln upgrade at its Railton cement plant in Tasmania. This project is part of a larger US$215 million investment under the Powering the Regions initiative aimed at increasing the use of alternative fuels. The upgrade will enhance low-emissions manufacturing and support regional employment. Additionally, the implementation of carbon capture and storage (CCS) technologies is gaining traction enabling the capture of CO₂ emissions directly from production processes for underground storage. These initiatives not only align with global environmental goals but also enhance the sector’s resilience and competitiveness by mitigating its environmental impact and fostering innovation in sustainable construction practices.

Government Investments

Government infrastructure investments are significantly driving the Australian cement market by increasing the product demand through large-scale projects, such as highways, bridges, railways, and public buildings. Substantial public spending ensures a steady flow of construction activities directly boosting cement consumption. For instance, in November 2024, the Australian government updated the Future Fund's mandate to prioritize investments in domestic infrastructure energy transition and housing. The fund will appoint a new executive director for energy transition and aims to maintain strong returns while addressing national priorities. Additionally, supportive policies and funding initiatives from the government create a favorable environment for infrastructure development. These policies may include grants, tax incentives and streamlined regulatory approvals which encourage private and public sector participation in construction projects. These investments and supportive measures enhance market stability, stimulate economic growth, and ensure sustained demand for cement within the construction industry.

Growth Drivers of Australia Cement Market:

Infrastructure Development

Infrastructure development continues to be a major contributor to cement demand in Australia. The construction of roads, bridges, ports, railways, and urban facilities necessitates large amounts of cement to ensure structural integrity and support. Projects backed by the government and public-private partnerships aimed at upgrading transportation networks and urban amenities further drive consumption. The demand is also fueled by the construction of industrial facilities, stadiums, and large-scale energy projects. As these infrastructure initiatives progress, cement manufacturers are witnessing consistent orders, leading to capacity expansions and investments in advanced production technologies. Moreover, these projects often require high-quality, durable cement to adhere to safety and longevity standards. Overall, the sustained focus on strong national infrastructure significantly enhances the Australian cement market, boosting both domestic production and strategic investments within the construction sector.

Residential and Commercial Construction

Residential and commercial construction serves as a major growth engine for the Australian cement market. Increasing population, household formation, and urban development initiatives are generating substantial demand for new homes, apartments, office complexes, and commercial buildings. The intersection of real estate development and private investment in residential and commercial properties fuels steady cement consumption. Builders are increasingly turning to high-strength and specialized cement formulations to provide durability, energy efficiency, and sustainability. The rise of mixed-use developments and progressive urban planning additionally contributes to heightened cement usage. Furthermore, the growing consumer preference for modern and appealing architectural designs promotes innovation in cement products. Together, the growth in residential and commercial construction secures continued demand and positions the Australian cement market for long-term advancement.

Rising Urbanization

Rising urbanization in Australia is having a profound impact on cement demand, as more individuals relocate to cities for job opportunities, education, and improved living conditions. Urban expansion results in increased construction of housing complexes, commercial buildings, and public facilities, all of which necessitate considerable cement usage. Furthermore, urbanization incentivizes the development of essential infrastructure such as roads, drainage systems, and bridges, further enhancing consumption. High-density projects, contemporary architectural designs, and multi-story structures require high-performance cement products that guarantee structural stability and longevity. As cities expand and urban planning efforts broaden, cement consumption is likely to rise, creating ongoing opportunities for manufacturers. Thus, rising urbanization plays a crucial role in sustaining growth within the Australian cement market.

Opportunities of Australia Cement Market:

Public-Private Partnerships (PPPs)

Public-Private Partnerships (PPPs) are becoming a vital opportunity for the Australian cement sector. These collaborative frameworks between governmental bodies and private firms facilitate the implementation of large infrastructure projects, such as roads, bridges, ports, and transportation hubs. PPPs ensure stable, long-term demand for construction materials, including cement, by guaranteeing project financing, timely completion, and operational efficiency. Involvement from the private sector often accelerates project timelines, introduces innovative construction methods, and promotes the adoption of advanced, high-performance cement products. Furthermore, PPPs bolster urban and regional development by incorporating modern design and sustainability standards. For cement producers, this results in predictable consumption patterns, contract-based supply agreements, and chances to invest in production capacity and technological advancements to fulfill the quality demands of significant infrastructure projects.

Urban Redevelopment and Smart Cities

Urban redevelopment projects and smart city developments offer considerable opportunities for the Australian cement industry. As cities evolve, older infrastructures are replaced with energy-efficient, resilient, and technologically integrated constructions. Smart city initiatives involve the construction of residential complexes, commercial areas, public facilities, and advanced transportation systems, all necessitating large quantities of cement. Additionally, developers are increasingly utilizing specialized cement solutions for durability, sustainability, and aesthetic enhancement to satisfy modern architectural requirements. Redevelopment efforts frequently include retrofitting and reinforcing existing structures, further driving demand. By aligning product offerings with these initiatives, manufacturers can deliver high-performance and eco-friendly cement solutions. Overall, urban redevelopment and smart city development foster a dynamic market environment with long-term growth prospects for cement producers in Australia.

Export Potential

The Australian cement industry holds promising export opportunities due to rising demand in nearby regions and international markets. The geographic proximity to emerging economies in the Asia-Pacific area allows Australian manufacturers to deliver high-quality cement efficiently. Increased infrastructure investments in developing nations, along with regional construction booms, create a consistent demand for imported cement. Export activities provide domestic producers with a means to diversify their revenue sources, lessen reliance on local market unpredictability, and utilize excess production capacity. Additionally, international trade fosters the adoption of standardized, high-performance, and environmentally compliant cement products to meet global quality standards. By enhancing logistics, distribution networks, and trade partnerships, Australian cement manufacturers can exploit cross-border opportunities, boost market presence, and improve overall competitiveness in the regional and global construction industry.

Challenges of Australia Cement Market:

High Production Costs

High production costs continue to be a major hurdle for the Australia cement sector. The manufacturing of cement is an energy-intensive process, demanding significant electricity and fuel for operations such as clinker production and grinding. The escalating prices of raw materials like limestone, gypsum, and additives further inflate the operational costs. Simultaneously, ensuring high quality while enhancing production efficiency necessitates ongoing investments in technology, equipment, and skilled labor. These factors can squeeze profit margins, especially in a competitive landscape where there's little room for pricing adjustments. Companies must find a balance between managing costs and meeting quality and sustainability goals, which can be quite challenging. Thus, effectively managing energy consumption, sourcing raw materials efficiently, and implementing process optimization techniques are crucial strategies for alleviating the financial strain caused by high production costs in the Australia cement industry.

Environmental Regulations

Stringent environmental regulations present a significant obstacle for cement manufacturers in Australia. Emission controls aimed at reducing carbon dioxide, particulate matter, and other pollutants compel companies to heavily invest in pollution control technologies and monitoring systems. Furthermore, sustainability mandates require manufacturers to use low-carbon production techniques, alternative fuels, and robust waste management solutions. Complying with these regulations raises both operational and administrative costs and necessitates frequent audits and reporting. Non-compliance can lead to fines, legal repercussions, or operational limitations, impacting financial performance and corporate reputation. Although these regulations promote long-term sustainability, they impose immediate financial and logistical pressures on manufacturers. Adapting production processes to meet environmental standards is thus a vital operational challenge within the Australia cement market.

Market Competition

The Australia cement market is characterized by fierce competition from both local producers and imported products, creating significant challenges for pricing and profitability. Well-established domestic manufacturers are in competition with lower-cost imported cement that often has pricing advantages, particularly in regions close to ports. This competitive landscape restricts pricing flexibility and compresses margins for local suppliers. Additionally, a multitude of players encourages frequent promotional tactics and discounts, which intensifies market rivalry. In order to stand out, manufacturers must invest in product quality, customer service, and technological advancements, which can increase operational costs. While market competition fosters continuous innovation and efficiency improvements, it also complicates the ability to maintain long-term profitability. Successfully navigating these dynamics requires strategic planning, brand differentiation, and prudent supply chain management to stay competitive in the Australia cement market.

Australia Cement Industry Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the Australia cement market, along with forecasts at the regional and country levels from 2026-2034. The market has been categorized based on type, and end use.

Analysis by Type:

- Blended

- Portland

- Others

Blended cement holds a notable Australia cement market share due to its environmental benefits and enhanced performance characteristics. It combines Portland cement with supplementary materials like fly ash, slag or silica fume which reduce carbon emissions and improve durability. This type of cement is increasingly used in infrastructure projects and commercial construction due to its resistance to chemical attacks and reduced heat of hydration. The growing focus on sustainability in construction and government initiatives to reduce carbon footprints are key drivers for blended cement's popularity. Additionally, its cost-effectiveness and superior long-term strength make it a preferred choice in Australia's cement market.

Portland cement remains a cornerstone of the Australian cement market widely used for its versatility and strength in various construction applications. It is the primary choice for residential buildings, bridges and pavements due to its quick-setting properties and consistent performance. Despite the rising demand for sustainable alternatives Portland cement's availability and compatibility with different construction needs keep it relevant. Its adaptability to harsh Australian climates and ease of production further solidify its position.

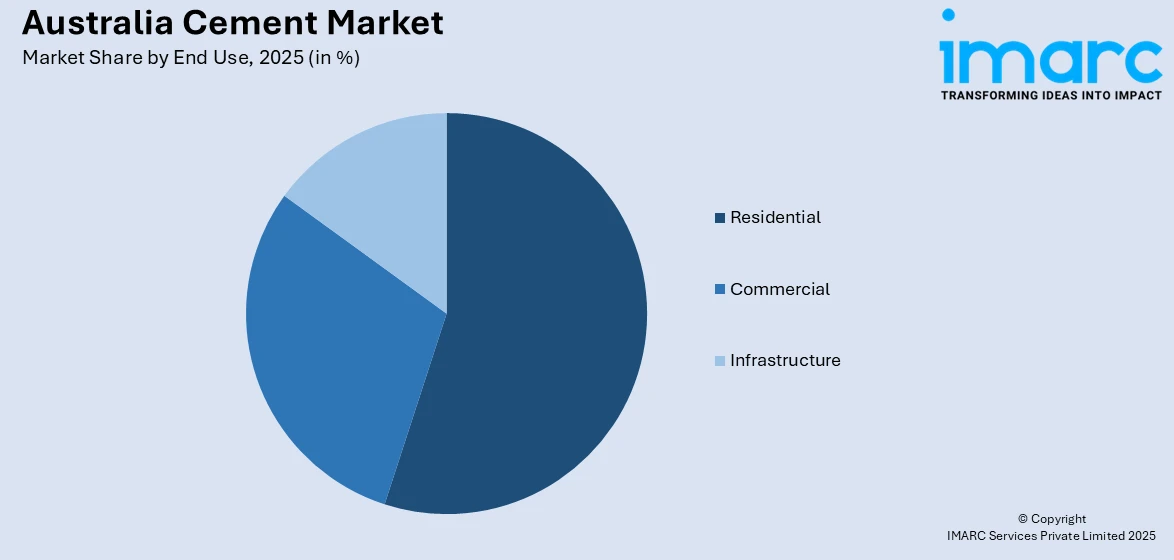

Analysis by End Use:

Access the comprehensive market breakdown Request Sample

- Residential

- Commercial

- Infrastructure

The residential sector in Australia drives significant demand for cement primarily for building homes and small-scale renovations. Portland cement is widely used in foundations, walls and floors due to its strength and affordability. Additionally, the rising adoption of sustainable construction practices is boosting the use of blended cement in residential projects. As housing demand continues to grow, especially in urban areas the residential sector remains a key contributor to the overall cement market supported by favorable government housing initiatives. The Australia cement market forecast suggests continued growth, particularly influenced by the expanding residential sector and the adoption of sustainable construction materials.

The commercial sector is a major end-use segment in Australia’s cement market driven by large-scale projects such as office buildings, retail spaces and industrial facilities. Blended cement is increasingly preferred in commercial construction for its durability and reduced environmental impact. High-strength cement solutions are essential to meet structural and aesthetic requirements in this sector. Continued urbanization and expansion of business hubs across Australian cities are fueling the demand for cement in commercial applications making this segment pivotal to market growth.

The infrastructure sector dominates the Australian cement market driven by ongoing investments in roads, bridges and public facilities. Blended cement is widely used for its superior durability and lower carbon footprint aligning with sustainable infrastructure goals. Large-scale government projects including transport networks and energy facilities are key drivers of demand. The sector benefits from Australia's emphasis on improving connectivity and resilience to climate challenges making infrastructure a crucial pillar for the cement market’s expansion.

Regional Analysis:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The cement market in ACT and New South Wales thrives on infrastructure projects and urban development. Major metropolitan cities like Sydney demand significant cement for residential and commercial construction. Public infrastructure projects, including rail networks and highways, further drive growth. Blended cement is increasingly popular due to its sustainability and cost-effectiveness. Leading manufacturers focus on catering to the region's diverse construction needs, supported by government investments in housing and public infrastructure.

Victoria and Tasmania’s cement markets are bolstered by residential and infrastructure developments. Melbourne, as a growing urban hub, drives significant demand for cement in high-rise buildings and housing projects. Tasmania’s focus on sustainable construction and renewable energy infrastructure also fuels demand for blended cement. Investments in regional connectivity, such as roads and bridges, further support growth. Cement producers in this region emphasize innovation to align with environmental regulations and sustainable building practices.

Queensland’s cement market is driven by strong demand from its booming residential and commercial construction sectors especially in cities like Brisbane and the Gold Coast. Infrastructure projects including transport and renewable energy initiatives also contribute significantly to the Australia cement market growth. The tropical climate necessitates high-quality and durable cement with blended types gaining traction for their sustainability. Cement manufacturers in Queensland are expanding capacity and focusing on innovative solutions to meet the growing demands of this rapidly developing region.

The Northern Territory and South Australia rely on cement for infrastructure projects and mining-related construction. Remote areas require durable cement solutions suitable for harsh conditions. Blended cement is increasingly adopted due to environmental considerations. Government investment in transport, energy and housing projects drives the market. South Australia’s industrial base also contributes to demand with cement producers focusing on efficient logistics to serve these dispersed regions effectively.

Western Australia’s cement market is primarily driven by its thriving mining industry and urban development in Perth. Infrastructure investments such as transport corridors and port facilities fuel steady demand. The region also sees growth in residential construction due to expanding suburban developments. Blended cement is gaining popularity for sustainability reasons while manufacturers invest in technology to optimize production. Western Australia’s vast area necessitates efficient distribution networks to ensure market growth across urban and remote regions.

Competitive Landscape:

The Australian cement market is characterized by intense competition driven by factors such as pricing, product innovation and sustainability efforts. Key players vie for market share by offering a diverse range of high-performance and specialized cement products to meet varied construction needs. Sustainability initiatives including the adoption of low-carbon technologies and alternative fuels are crucial differentiators in the market. For instance, in July 2024, Climate Tech Cement and Polevine announced their plans to launch a reduced-CO2 geopolymer concrete in a significant infrastructure project in Western Australia. The collaboration aims to develop varied strength formulations assessing their performance and costs. Additionally, firms leverage extensive distribution networks and invest in advanced manufacturing processes to enhance efficiency and reduce costs. Mergers and acquisitions (M&As) are common strategies to achieve economies of scale and expand market presence. Continuous innovations and responsiveness to regulatory changes further heighten competitive dynamics ensuring a dynamic and evolving market landscape.

The report provides a comprehensive analysis of the competitive landscape in the Australia cement market with detailed profiles of all major companies.

Latest News and Developments:

- October 2024: Heidelberg Materials' subsidiary Hanson Australia announced its plans to acquire the Elvin Group's concrete business the largest in the Australian Capital Territory. The deal includes two concrete plants and a sand blending facility enhancing Hanson's market position and bringing sustainability and digitalisation expertise to a significant regional market.

- August 2024: Australia's new Geelong grinding plant located near Lascelles Wharf in Victoria began operations. Capable of grinding 1.3Mt/yr of granulated blast furnace slag and clinker the facility aims to minimize landfill waste and replace cement in concrete while creating job opportunities to boost the local economy.

- April 2024: Australian startup MCi Carbon held a foundation ceremony in Newcastle for a carbon capture facility capable of storing 1,000 to 3,000 tonnes of CO2 annually. Backed by Japan's Itochu and others, the plant aims to produce cement materials from captured carbon, with commercialization targeted for 2026. The project highlights efforts to advance decarbonization technologies in construction.

- December 2024: Boral revealed an upgraded carbon reducing technology in its Berrima Cement Works in the Southern highlands region of New South Wales (NSW). The facility gives a new chlorine bypass, which cuts the buildup of chlorides and other byproducts of fuel.

- December 2024: Cement Australia, a partnership between Heidelberg Materials Australia and Holcim Australia, is set to purchase the cement division of the Buckeridge Group of Companies (BGC) based in Perth for US$800 million. The purchase encompasses a cement grinding setup with 'substantial' capabilities, in addition to procedures in cement, concrete, quarrying, asphalt, transportation, and a materials technology center.

Australia Cement Market Report Scope:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Blended, Portland, Others |

| End Uses Covered | Residential, Commercial, Infrastructure |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format |

PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cement market from 2020-2034.

- The research study provides the latest information on the market drivers, challenges, and opportunities in the Australia cement market.

- Porter's Five Forces analysis assists stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cement industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

Cement is a versatile binding material used in construction, formed by heating limestone and other minerals to produce clinker, which is then ground into a fine powder. It is essential for making concrete and mortar, serving applications in buildings, infrastructure projects, roads, bridges, and various other construction works.

The Australia cement market was valued at USD 2.0 Billion in 2025.

IMARC estimates the Australia cement market to exhibit a CAGR of 3.36% during 2026-2034.

The Australian cement market is driven by robust construction and infrastructure projects, urbanization, significant government investments in housing and transport, and the rising demand for sustainable building materials. Additionally, technological advancements and increasing industrialization contribute to market growth.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)