Australia Chocolate Market Size, Share, Trends and Forecast by Product Type, Product Form, Application, Pricing, Distribution, and Region, 2025-2033

Australia Chocolate Market Size and Share:

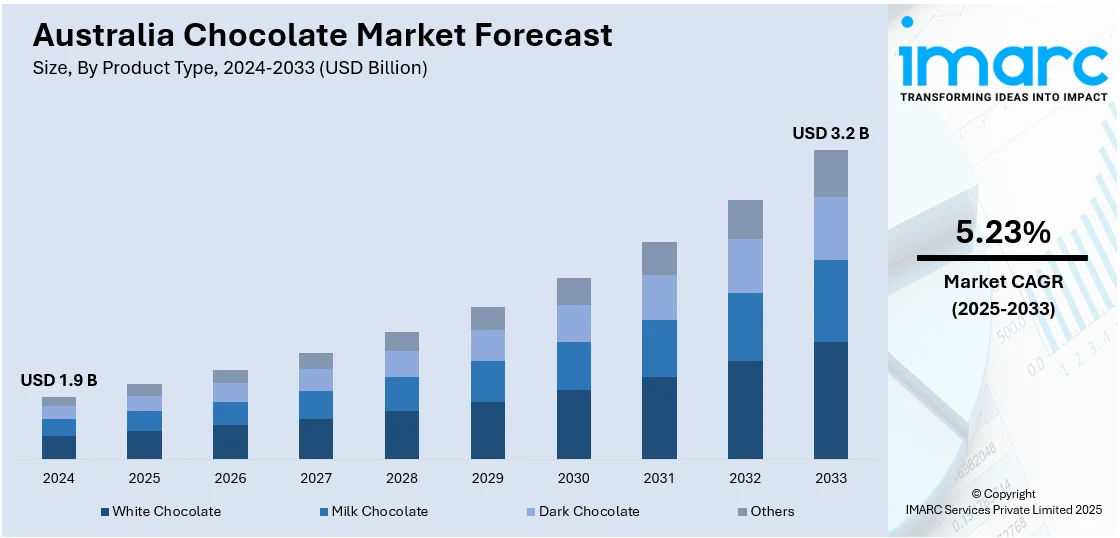

The Australia chocolate market size reached USD 1.9 Billion in 2024. Looking forward, the market is expected to reach USD 3.2 Billion by 2033, exhibiting a growth rate (CAGR) of 5.23% during 2025-2033. The market is witnessing steady growth, led by strong consumer demand, product availability, growing retail distribution, and differentiated offerings across formats and price segments, with rising presence in supermarkets, convenience stores, specialty shops, and online channels across the country.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1.9 Billion |

| Market Forecast in 2033 | USD 3.2 Billion |

| Market Growth Rate 2025-2033 | 5.23% |

Key Trends of Australia Chocolate Market:

Rising Preference for Premium and Artisan Chocolate

Australian shoppers are highly seeking out high-quality, small-batch, and artisanal chocolate. The move is fuelled by a rise in interest for genuine ingredients, unique flavour profiles, and sustainable sourcing. For example, in October 2024, Aldi became the first supermarket in Australia to join Tony's Open Chain, introducing three Choceur CHOCO CHANGER chocolate bars with Dark Salty Fudge Almond, Milk Honeycomb Nougat, and Milk Salted Caramel Brownie flavours. Furthermore, bean-to-bar products, single-origin cocoa, and low-sugar options have risen to the top among health-orientated and quality-driven consumers. The change is part of a larger movement away from mass-produced chocolate and towards curated experiences and open sourcing. Specialty food stores and gourmet outlets have experienced mounting foot traffic as consumers look for novelty and handcraft. Limited edition seasonal offerings and collaborations with local chefs are also increasingly prevalent. Australia chocolate market outlook shows that premium segments will continue to influence purchase behavior and pricing trends, especially among younger consumers with disposable income. With the distinction between indulgence and well-being diminishing, brands are innovating through formulation and packaging to satisfy elevated expectations and remain pertinent in an increasingly taste-driven competitive environment.

To get more information on this market, Request Sample

Plant-Based Chocolate Gaining Mainstream Momentum

The demand for dairy-free and plant-based chocolate is accelerating in Australia, reflecting the broader shift toward vegan and flexitarian lifestyles. Oat milk, almond milk, and coconut milk alternatives have expanded chocolate formulation options, enabling new textures and tastes that resonate with a wider audience. These products are no longer confined to niche shelves but are increasingly found in mainstream supermarkets and convenience stores. The appeal extends beyond dietary restrictions—consumers are driven by environmental and health considerations, contributing to sustained uptake. Texture innovations, cleaner labels, and certifications such as organic or non-GMO further strengthen consumer confidence. Australia chocolate market share of plant-based segments is expanding, prompting manufacturers to diversify portfolios and enhance visibility across digital and retail platforms. As consumer literacy around ingredients and sustainability rises, demand for inclusive chocolate products will likely deepen, signaling a more permanent shift in how Australians define quality and value in their chocolate choices.

Seasonal and Gifting Segments Driving Volume Growth

Seasonal purchases of chocolates linked to festivals, cultural events, and gift-giving occasions are recording consistent Australia chocolate market growth. Christmas and Easter continue to be the strongest peak seasons, while emerging trends, such as Valentine's Day, Mother's Day, and corporate gifts fuel wider calendar-driven demand. Decorative packaging, thematic assortment, and limited-edition product launches are central to drawing this attention. For instance, in June 2024, Cadbury announced the launch of Dairy Milk Velvet in Australia, with 40% more cocoa and 25% more milk content, and with country-wide release starting 29 July to celebrate World Chocolate Day festivities. Moreover, consumers are also spending more on presentation, with personalized choices and high-end wrapping driving last-minute purchase decisions. Online channels and click-and-collect options have increased convenience and accessibility, driving impulse and bulk purchases. Australia chocolate growth within the gifting category highlights the emotional and experiential status of chocolate within the consumer psyche, transcending a treat to become an expression of connection and concern. While digital marketing and influencer-driven campaigns heighten seasonal fervor, the market shall gain from elevated order values and diversified purchase occasions during the course of the year.

Growth Drivers of Australia Chocolate Market:

Health-Conscious Product Innovation

Australian consumers are becoming increasingly health-aware, prompting chocolate manufacturers to develop better-for-you offerings. Innovations such as sugar-free, keto-friendly, high-protein, or antioxidant-rich chocolates are catering to fitness and wellness-focused individuals. Consumers are also seeking clean-label ingredients, reduced artificial additives, and transparency in nutritional content. This shift is encouraging brands to explore natural sweeteners like stevia or monk fruit and include functional ingredients such as probiotics or adaptogens. Health-focused chocolates not only appeal to the regular market but also attract niche segments like diabetics or individuals with dietary restrictions. This evolving preference toward mindful indulgence is creating substantial demand for alternative formulations, enabling chocolate brands to diversify portfolios and build loyalty among health-oriented consumers.

Expansion of E-Commerce and Direct-to-Consumer Sales

The rapid digitalization of retail in Australia has transformed chocolate purchasing behavior, which is driving the Australia chocolate market demand. With rising internet penetration and consumer comfort with online shopping, brands are investing in robust e-commerce platforms and direct-to-consumer (DTC) models. Online-exclusive collections, limited-edition launches, and curated chocolate subscription boxes are becoming increasingly popular. These digital channels allow brands to engage directly with consumers, personalize offerings, and gather valuable purchasing data for better targeting. Social media marketing, influencer collaborations, and seasonal online campaigns further enhance visibility and conversion rates. This digital momentum is especially effective for boutique brands and startups that lack shelf space in physical retail, making e-commerce a key enabler of growth across all market tiers.

Multicultural Influence and Flavor Diversification

Australia’s rich cultural diversity is significantly influencing the local chocolate landscape, which is fueling the Australia chocolate market share. As consumers show interest in global cuisines, chocolate manufacturers are exploring unique and culturally inspired flavor profiles. Offerings such as Japanese matcha truffles, Indian chai-infused bars, or Middle Eastern pistachio and rose blends are gaining popularity. This trend allows brands to innovate beyond conventional milk and dark chocolates, appealing to adventurous palates. Additionally, limited-edition, regionally themed collections tap into consumer curiosity and encourage trial. By embracing multiculturalism and incorporating international ingredients and culinary inspiration, chocolate brands are better positioned to differentiate in a competitive market. Flavor innovation thus plays a crucial role in attracting new consumer segments and driving repeat purchases.

Opportunities of Australia Chocolate Market:

Functional and Fortified Chocolate Products

An emerging opportunity in Australia’s chocolate market lies in developing chocolates with added health and wellness benefits. Consumers are increasingly seeking products that deliver more than just taste, such as enhanced mood, stress relief, energy boosts, or beauty benefits. This trend supports innovation in chocolates fortified with ingredients like collagen, magnesium, CBD (where legal), adaptogens, or nootropics. Brands can market these as guilt-free indulgences that align with wellness routines, particularly among younger, health-conscious demographics. Functional chocolates blur the lines between confectionery and supplements, opening new shelf space in pharmacies, health stores, and fitness centers. With growing consumer interest in holistic health, fortified chocolates offer a differentiated value proposition that could lead to premium pricing and repeat purchases.

Growth of Experiential and On-Site Chocolate Tourism

Australia presents strong potential for chocolate tourism and experiential marketing. As consumers increasingly value immersive and interactive experiences, chocolate brands can create destination-based experiences such as factory tours, chocolate-making workshops, tasting rooms, and interactive brand museums. According to the Australia chocolate market analysis, these offerings not only generate additional revenue but also deepen emotional brand connections and loyalty. Regional chocolate producers, particularly in Tasmania, Victoria, and Western Australia, can capitalize on growing domestic travel trends by tying their facilities to local food tourism. Seasonal events, festivals, and pop-up chocolate experiences also attract curious consumers and influencers, generating social media buzz. This strategy is especially effective in premium positioning and story-driven branding, giving chocolate companies a unique edge in customer engagement.

Personalized and Customizable Chocolate Offerings

The desire for individuality is driving consumer interest in personalized chocolate products. Customization—from choosing ingredients and flavors to personalized packaging or engraved messages—offers a unique gifting and self-indulgence proposition. Brands can implement digital tools on e-commerce platforms that allow users to design their own bars or assortments. This appeals to both mass-market consumers looking for meaningful gifts and niche audiences seeking exclusive, made-to-order experiences. Corporate gifting and event-based personalization (e.g., weddings, birthdays, holidays) present additional avenues for expansion. Retailers that adopt in-store customization stations or seasonal personalization kiosks can create memorable shopping experiences. As consumers increasingly seek products that reflect their identity or sentiments, personalized chocolate presents a scalable and emotionally resonant market opportunity.

Challenges of Australia Chocolate Market:

Increasing Consumer Awareness about Sugar and Calorie Intake

Growing public awareness around sugar consumption and its link to obesity, diabetes, and other health issues poses a significant challenge for chocolate manufacturers in Australia. Government campaigns and nutritional education have made consumers more cautious about indulging in traditional chocolate, particularly among parents purchasing for children. Health advocacy groups and media coverage further amplify concerns over high-calorie snacks. As a result, standard chocolate offerings may face reduced demand, especially in the mass-market segment. While healthier options are gaining traction, reformulating without compromising taste and texture remains complex and costly. Balancing indulgence with health consciousness requires ongoing R&D investment, transparent labeling, and new marketing strategies to maintain consumer trust and ensure continued product relevance.

Intense Market Competition and Price Pressure

Australia’s chocolate market is highly competitive, with established global players, private labels, boutique brands, and new health-oriented entrants all vying for shelf space and consumer attention. This crowded landscape leads to price pressure and challenges in maintaining brand loyalty. Supermarket chains increasingly favor private-label chocolates, often priced lower, which further squeezes margins for premium or mid-tier brands. Smaller artisanal makers struggle to match the promotional budgets and distribution networks of multinationals, limiting their scalability. Additionally, continuous innovation from competitors forces brands to invest in new product development to stay relevant. This dynamic requires constant differentiation and marketing spend, making it difficult for many players to achieve consistent profitability in a saturated and price-sensitive environment.

Environmental Concerns and Packaging Sustainability Demands

As sustainability becomes a central consumer value, chocolate manufacturers face growing pressure to reduce their environmental footprint, especially in packaging. Single-use plastics, non-recyclable foil wrappers, and excessive packaging are increasingly scrutinized by environmentally conscious shoppers. Retailers and regulators alike are pushing for eco-friendly alternatives, including compostable, biodegradable, or recyclable materials. However, transitioning to sustainable packaging can be cost-prohibitive, particularly for smaller brands, and may affect shelf appeal or product freshness. Meeting sustainability standards while ensuring packaging remains functional and attractive is a complex challenge. Failure to address environmental expectations can lead to reputational damage, loss of consumer trust, and decreased brand competitiveness in an era where eco-responsibility influences purchase decisions.

Australia Chocolate Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, product form, application, pricing, and distribution.

Product Type Insights:

- White Chocolate

- Milk Chocolate

- Dark Chocolate

- Others

The report has provided a detailed breakup and analysis of the market based on the product type. This includes white chocolate, milk chocolate, dark chocolate, and others.

Product Form Insights:

- Molded

- Countlines

- Others

A detailed breakup and analysis of the market based on the product form have also been provided in the report. This includes molded, countlines, and others.

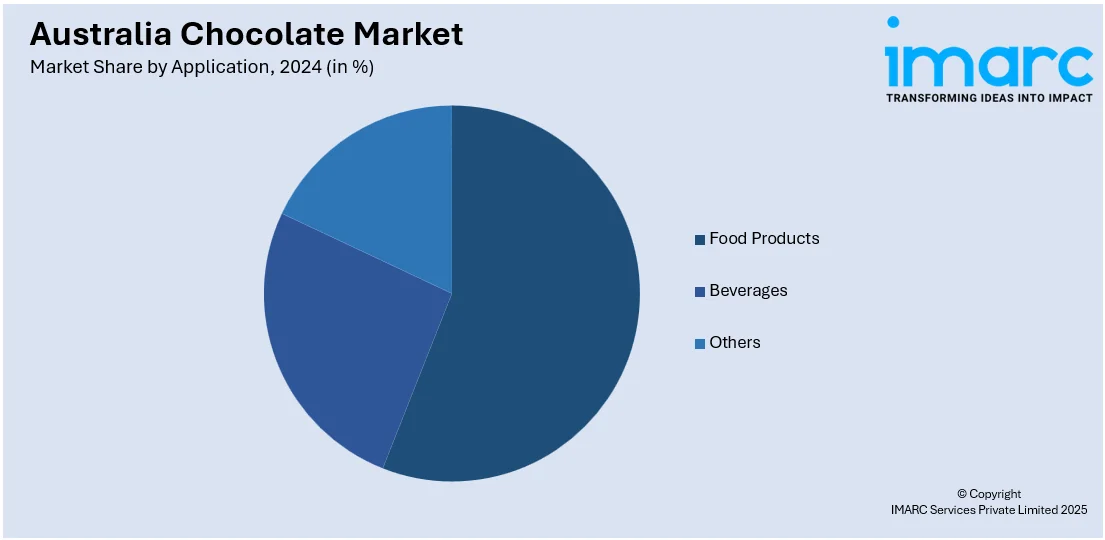

Application Insights:

- Food Products

- Bakery Products

- Sugar Confectionery

- Desserts

- Others

- Beverages

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food products (bakery products, sugar confectionery, desserts, and others), beverages, and others.

Pricing Insights:

- Everyday Chocolate

- Premium Chocolate

- Seasonal Chocolate

A detailed breakup and analysis of the market based on the pricing have also been provided in the report. This includes everyday chocolate, premium chocolate, and seasonal chocolate.

Distribution Insights:

- Direct Sales (B2B)

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

The report has provided a detailed breakup and analysis of the market based on the distribution. This includes direct sales (B2B), supermarkets and hypermarkets, convenience stores, online stores, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- CACAO Chocolates & Macarons

- Charley's

- Chocolatier Australia

- Darrell Lea

- Haigh's Chocolates

- Lindt & Sprüngli (Australia) PTY LTD

- Margaret River Chocolate Company

- Melbourne Cocoa

- Mondelez Australia Pty Ltd

- Nestle S.A

Australia Chocolate Market News:

- In February 2025, Noosa Chocolate Factory opened its new expanded Adelaide Street shop in Brisbane, with a bigger retail space and dine-in café. The expansion supports growing demand for craft products and enhances the company's foothold in the expanding Australia chocolate market, giving customers greater access to fresh, handcrafted chocolate experiences.

- In February 2024, Cadbury launched its Easter chocolate portfolio in Australia with new additions such as the Bubbly Mint Bunny and Pascall Clinkers Easter Bunny, alongside traditional lines, with a focus on minimizing packaging waste in its seasonal chocolate portfolio.

Australia Chocolate Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | White Chocolate, Milk Chocolate, Dark Chocolate, Others |

| Product Forms Covered | Molded, Countlines, Others |

| Applications Covered |

|

| Pricings Covered | Everyday Chocolate, Premium Chocolate, Seasonal Chocolate |

| Distributions Covered | Direct Sales (B2B), Supermarkets and Hypermarkets, Convenience Stores, Online Stores, Others |

| Regions Covered | Australian Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & South Australia, Western Australia |

| Companies Covered | CACAO Chocolates & Macarons, Charley's, Chocolatier Australia, Darrell Lea, Haigh's Chocolates, Lindt & Sprüngli (Australia) PTY LTD, Margaret River Chocolate Company, Melbourne Cocoa, Mondelez Australia Pty Ltd, Nestle S.A, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia chocolate market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia chocolate market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia chocolate industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The chocolate market in Australia was valued at USD 1.9 Billion in 2024.

The Australia chocolate market is projected to exhibit a CAGR of 5.23% during 2025-2033.

The Australia chocolate market is projected to reach a value of USD 3.2 Billion by 2033.

The Australia chocolate market is evolving with trends like ethical sourcing, adventurous flavor combinations, and local ingredient use. Consumers seek immersive brand experiences, nostalgic varieties, and limited-edition releases. Digital engagement, influencer marketing, and visual storytelling are also shaping purchasing behavior, making storytelling and innovation essential for capturing modern chocolate buyers.

The market growth is fueled by rising discretionary spending, growing snack culture, and expanding retail presence in both urban and regional areas. Strong tourism recovery, improved supply chain efficiency, and support for domestic food production drive volume. Increased demand for convenience, novelty, and emotional comfort also supports consistent chocolate consumption.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)