Australia Citric Acid Market Size, Share, Trends and Forecast by Application, Form, and Region, 2025-2033

Australia Citric Acid Market Overview:

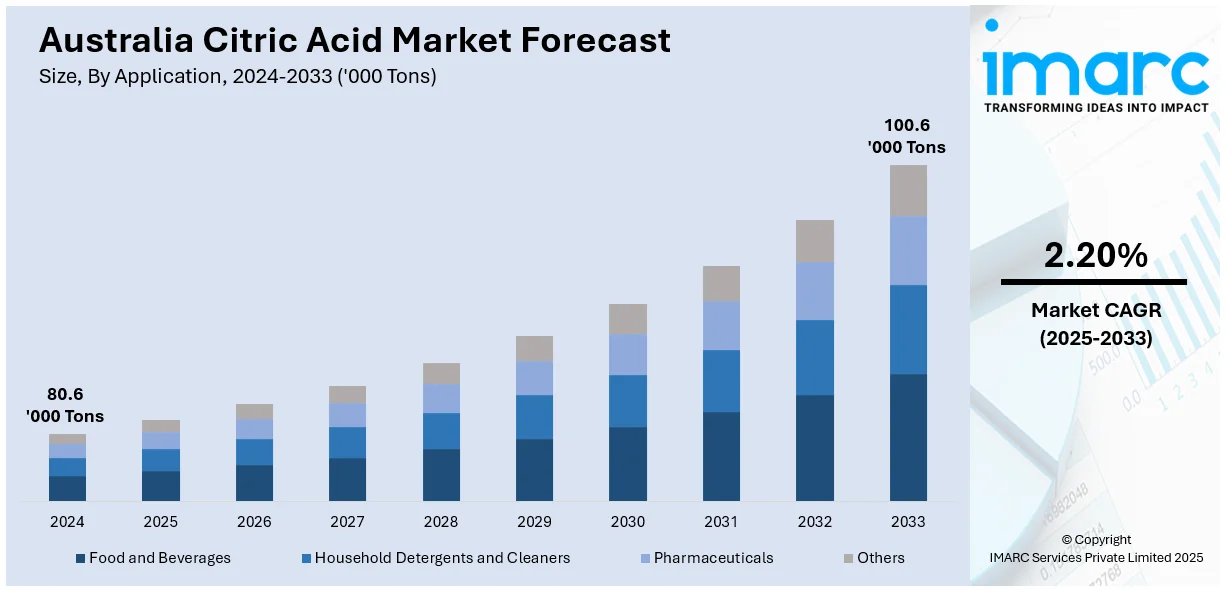

The Australia citric acid market size reached 80.6 Thousand Tons in 2024. Looking forward, IMARC Group expects the market to reach 100.6 Thousand Tons by 2033, exhibiting a growth rate (CAGR) of 2.20% during 2025-2033. The market is driven by rising demand in food and beverages, increased use in pharmaceuticals, growing applications in cleaning products, and a shift toward natural preservatives. Expanding health-conscious consumer trends and industrial uses further boost Australia citric acid market growth and sustainability efforts.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | 80.6 Thousand Tons |

| Market Forecast in 2033 | 100.6 Thousand Tons |

| Market Growth Rate 2025-2033 | 2.20% |

Australia Citric Acid Market Trends:

Growing Demand in the Food and Beverage Industry

The citric acid market in Australia is primarily driven by its widespread use as a food additive and preservative. It enhances flavors, extends shelf life, and regulates acidity in beverages, processed foods, and confectionery. Food manufacturers transform their products by substituting synthetic additives with citric acid due to the growing market demand for natural ingredients. The market demand is fueling as consumers increasingly focus on health along with their commitment to clean-label products. Food manufacturers rely on citric acid as a primary ingredient because the rising beverage industry demands not only energy drinks and fruit juice products but also retains its dominance in manufactured soft drinks.

To get more information on this market, Request Sample

Rising Applications in Pharmaceuticals and Healthcare

Citric acid plays a crucial role in pharmaceuticals, where it is used as an acidity regulator, stabilizer, and anticoagulant in medicines and dietary supplements. The growing demand for vitamin C-based health products, effervescent tablets, and medical formulations has significantly boosted the Australia citric acid market share. Additionally, the expanding healthcare sector in Australia, with an increased focus on preventive health and wellness, supports this growth. The increasing pharmaceutical demand for citric acid, together with its function as a medical chelating agent, increases its market volume. As consumers prioritize immunity-boosting and wellness products, the pharmaceutical applications of citric acid continue to expand.

Increasing Use in Cleaning and Personal Care Products

The shift toward eco-friendly and biodegradable cleaning solutions has increased citric acid’s usage in household and industrial cleaning products. It acts as a natural descaler, pH adjuster, and disinfectant in detergents, surface cleaners, and dishwashing liquids. With stringent environmental regulations in Australia promoting sustainable cleaning solutions, the demand for citric acid as a safer alternative to harsh chemicals is growing. Additionally, in personal care products such as shampoos, skincare items, and bath products, citric acid is used to balance pH and improve product stability. This rising awareness of green formulations is further creating a positive impact on the Australia citric acid market outlook.

Australia Citric Acid Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the regional level for 2025-2033. Our report has categorized the market based on application and form.

Application Insights:

- Food and Beverages

- Household Detergents and Cleaners

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes food and beverages, household detergents and cleaners, pharmaceuticals, and others.

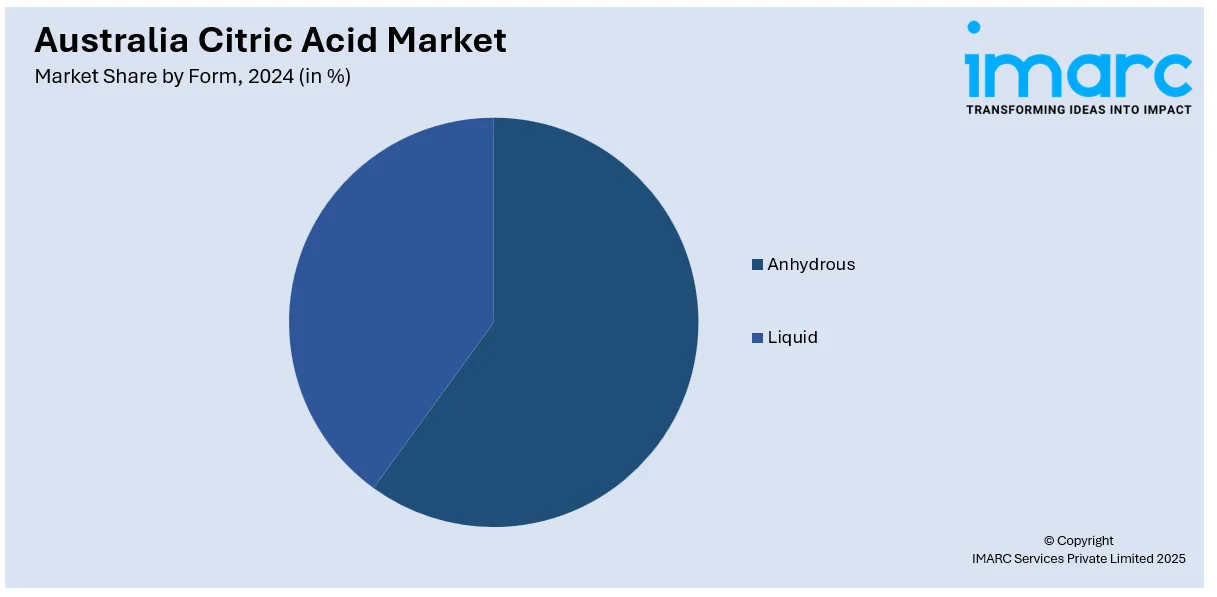

Form Insights:

- Anhydrous

- Liquid

A detailed breakup and analysis of the market based on the form have also been provided in the report. This includes anhydrous and liquid.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Citric Acid Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Thousand Tons |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Applications Covered | Food and Beverages, Household Detergents and Cleaners, Pharmaceuticals, Others |

| Forms Covered | Anhydrous, Liquid |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia citric acid market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia citric acid market on the basis of application?

- What is the breakup of the Australia citric acid market on the basis of form?

- What is the breakup of the Australia citric acid market on the basis of region?

- What are the various stages in the value chain of the Australia citric acid market?

- What are the key driving factors and challenges in the Australia citric acid market?

- What is the structure of the Australia citric acid market and who are the key players?

- What is the degree of competition in the Australia citric acid market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia citric acid market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia citric acid market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia citric acid industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)