Australia Clinical Nutrition Market Size, Share, Trends and Forecast by Product, Route of Administration, Application, End User, and Region, 2025-2033

Australia Clinical Nutrition Market Overview:

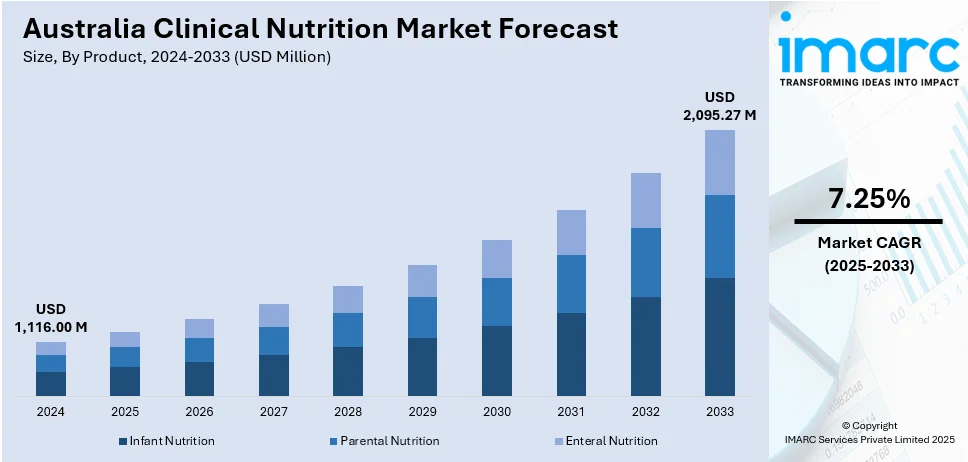

The Australia clinical nutrition market size reached USD 1,116.00 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,095.27 Million by 2033, exhibiting a growth rate (CAGR) of 7.25% during 2025-2033. The market is driven by an aging population, rising prevalence of chronic diseases, growing demand for personalized nutrition, and advancements in formulation technologies. Moreover, increased health awareness and government support for nutritional care, especially in hospitals, aged care, and home healthcare settings, are some of the other factors contributing to the Australia clinical nutrition market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,116.00 Million |

| Market Forecast in 2033 | USD 2,095.27 Million |

| Market Growth Rate 2025-2033 | 7.25% |

Australia Clinical Nutrition Market Trends:

Rising Prevalence of Chronic Diseases

Australia is witnessing a steady rise in chronic diseases like cardiovascular disorders, diabetes, cancer, and gastrointestinal conditions. Long-term dietary management, together with specific nutrient support, becomes vital for patient care because these illnesses need it. Nutrient-dense supplements and therapeutic diets become essential for patients with chronic illnesses because malnutrition remains a serious problem in this population. Clinical nutrition plays a key role in recovery, symptom control, and quality of life, particularly for hospitalized or home-bound individuals. The increasing integration of medical nutrition into clinical guidelines and hospital protocols reinforces market demand. Public and private healthcare initiatives aimed at managing chronic diseases have further highlighted the essential role of tailored nutritional support.

To get more information on this market, Request Sample

Increasing Demand for Personalized Nutrition

The demand for personalized nutrition is rising rapidly in Australia, fueled by a shift toward proactive health management and prevention. Consumers and healthcare providers are increasingly interested in dietary strategies tailored to individual health profiles, including genetic predispositions, microbiome composition, allergies, and lifestyle factors. Personalized clinical nutrition helps manage conditions such as obesity, metabolic syndrome, and autoimmune disorders more effectively. Innovations in diagnostics, such as DNA testing and wearable health monitors, enable deeper insights into nutritional needs. Startups and established brands are offering customized supplements and nutrition plans, meeting the growing demand. This trend is especially strong among health-conscious younger populations and patients seeking holistic, long-term wellness solutions, making personalized nutrition a significant driver of the Australia clinical nutrition market growth.

Technological Advancements

Technological innovation is significantly shaping Australia’s clinical nutrition landscape. Advances in biotechnology and food science have led to the development of targeted, nutrient-specific products designed to support disease management and recovery. Digital health tools, including AI-driven dietary planning apps and telehealth services, enable tailored nutrition guidance and real-time monitoring, improving patient adherence and outcomes. Clinical decision support systems help dietitians and physicians recommend precise nutrition protocols based on individual patient data. Furthermore, novel delivery formats such as ready-to-drink formulas, microencapsulation, and time-release supplements improve convenience and efficacy. These innovations make nutrition therapy more accessible and effective, particularly in hospital settings and aged care, accelerating the market’s expansion and elevating the standard of care.

Australia Clinical Nutrition Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product, route of administration, application, and end user.

Product Insights:

- Infant Nutrition

- Parental Nutrition

- Enteral Nutrition

The report has provided a detailed breakup and analysis of the market based on the product. This includes infant nutrition, parental nutrition, and enteral nutrition.

Route of Administration Insights:

- Oral

- Enteral

- Parenteral

A detailed breakup and analysis of the market based on the route of administration have also been provided in the report. This includes oral, enteral, and parenteral.

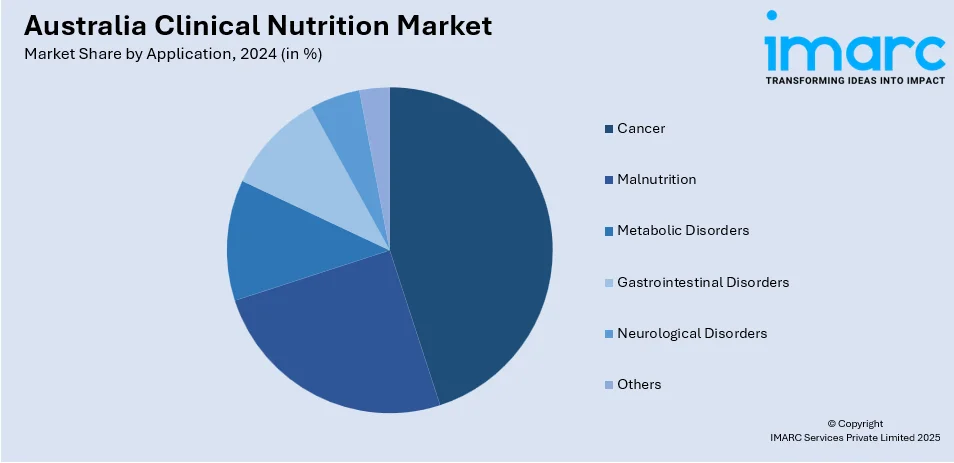

Application Insights:

- Cancer

- Malnutrition

- Metabolic Disorders

- Gastrointestinal Disorders

- Neurological Disorders

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes cancer, malnutrition, metabolic disorders, gastrointestinal disorders, neurological disorders, and others.

End User Insights:

- Pediatric

- Adults

- Geriatric

A detailed breakup and analysis of the market based on the end user have also been provided in the report. This includes pediatric, adults, and geriatric.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Clinical Nutrition Market News:

- In July 2024, NGS signed an exclusive Intellectual Property License Agreement for the production and distribution of The Healthy Chef products in both the United States and Canada. The Healthy Chef is an Australian high-end lifestyle brand providing wholefood nutrition for women's health, inner beauty, and wellness.

Australia Clinical Nutrition Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Products Covered | Infant Nutrition, Parental Nutrition, Enteral Nutrition |

| Route of Administrations Covered | Oral, Enteral, Parenteral |

| Applications Covered | Cancer, Malnutrition, Metabolic Disorders, Gastrointestinal Disorders, Neurological Disorders, Others |

| End Users Covered | Pediatric, Adults, Geriatric |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia clinical nutrition market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia clinical nutrition market on the basis of product?

- What is the breakup of the Australia clinical nutrition market on the basis of route of administration?

- What is the breakup of the Australia clinical nutrition market on the basis of application?

- What is the breakup of the Australia clinical nutrition market on the basis of end user?

- What is the breakup of the Australia clinical nutrition market on the basis of region?

- What are the various stages in the value chain of the Australia clinical nutrition market?

- What are the key driving factors and challenges in the Australia clinical nutrition market?

- What is the structure of the Australia clinical nutrition market and who are the key players?

- What is the degree of competition in the Australia clinical nutrition market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia clinical nutrition market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia clinical nutrition market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia clinical nutrition industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)