Australia Cloud Computing Market Report by Service (Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS)), Deployment (Public, Private, Hybrid), Workload (Application Development and Testing, Data Storage and Backup, Resource Management, Orchestration Services, and Others), Enterprise Size (Large Enterprises, Small and Medium Enterprises), End-Use (BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, and Others), and Region 2025-2033

Australia Cloud Computing Market Size and Share:

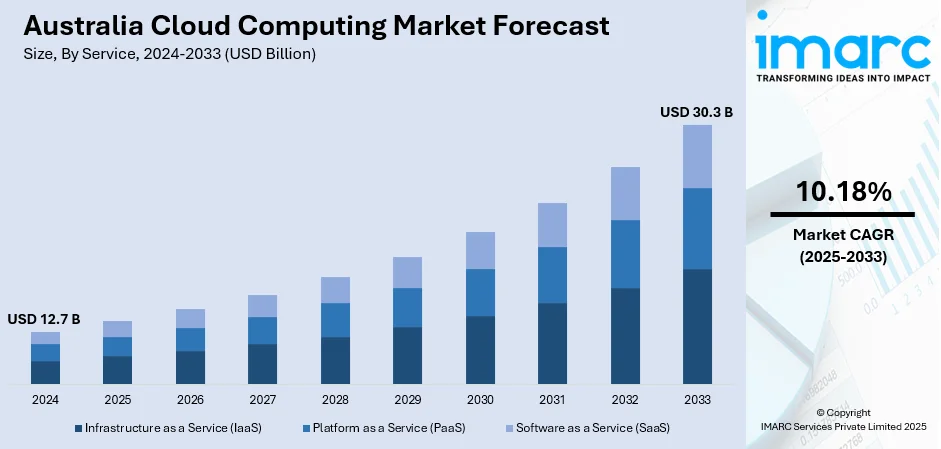

The Australia cloud computing market size reached USD 12.7 Billion in 2024. Looking forward, the market is projected to reach USD 30.3 Billion by 2033, exhibiting a growth rate (CAGR) of 10.18% during 2025-2033. The market is driven by increasing digital transformation, the demand for scalable IT infrastructure, the widespread adoption of cloud-based solutions in businesses, rising government initiatives supporting cloud technology, and growing needs for data security, storage, and remote work solutions.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 12.7 Billion |

| Market Forecast in 2033 | USD 30.3 Billion |

| Market Growth Rate 2025-2033 | 10.18% |

Key Trends of Australia Cloud Computing Market:

Digital Transformation Initiatives

Australia's cloud computing market is experiencing rapid growth, driven by widespread digital transformation initiatives across industries. Businesses in sectors such as finance, healthcare, and retail are adopting cloud-based services to enhance operational efficiency, improve customer experience, and streamline processes. The shift to remote work culture, accelerated by the pandemic, has further increased the demand for cloud infrastructure. Companies are leveraging cloud platforms to support scalable, flexible, and secure environments, allowing for the seamless integration of new technologies like artificial intelligence (AI) and big data analytics. This shift is enabling organizations to innovate and remain competitive in an increasingly digital landscape, positioning cloud computing as a key driver of technological advancement in Australia. For instance, in October 2023, Microsoft announced a AUS$ 5 billion investment to expand cloud computing and AI infrastructure in Australia by 2025. The initiative is expected to expand the nation’s technology landscape by 250%, create thousands of jobs, and protect against cyberattacks. Microsoft is also establishing a data center academy with TAFE NSW to train technicians and IT personnel.

To get more information on this market, Request Sample

Government Support and Policies

Government support and favorable policies are playing a critical role in driving the cloud computing market in Australia. The Australian government is actively promoting cloud adoption through initiatives aimed at modernizing public sector IT infrastructure. This includes investments in cloud technologies to enhance cybersecurity, improve data management, and foster innovation. Additionally, policies focusing on data sovereignty and privacy protection are fostering trust in cloud services, particularly for sensitive data. These initiatives are boosting cloud adoption, both in the public and private sectors, and fueling market growth. For instance, in July 2024, the Australian government announced a $2 Billion partnership with Amazon to develop a secure intelligence cloud for its security agencies. This project aims to enhance information sharing and improve the resilience of the country's defense system, with the construction of three data centers to handle top-secret intelligence. The collaboration will provide access to top private-sector talent and cutting-edge technology, including artificial intelligence, to improve data collection and analysis.

Growing Demand for Data Storage and Security

The increasing need for robust data storage and enhanced security solutions is a major driver of the Australian cloud computing market growth. As businesses generate massive amounts of data, the demand for scalable, secure cloud storage solutions has surged. For instance, according to industry reports, public cloud spending in Australia is forecasted to reach A$23.2 billion in 2024, reflecting a 19.3% increase from 2023. This growth will mark the first-time public cloud services represent 50% of the total addressable market in the country. Cloud computing offers enterprises the ability to store, manage, and analyze vast amounts of data with high levels of security and compliance. Rising concerns over data breaches, along with strict regulatory requirements such as the Notifiable Data Breaches (NDB) scheme, have pushed organizations toward cloud providers offering advanced security features. This growing focus on data protection and storage scalability is propelling cloud adoption across various industries in Australia.

Growth Drivers of Australia Cloud Computing Market:

Rising Data Volumes

The rapid pace of digital transformation across various sectors has resulted in an unprecedented increase in data creation, particularly within e-commerce, financial services, and online platforms. Organizations now require a highly scalable and dependable infrastructure to effectively store, process, and manage these enormous datasets. Cloud solutions offer the adaptability to scale resources as needed while ensuring smooth data access across multiple devices and locations. Moreover, the growth of digital payments, online shopping, and content streaming services further amplifies the need for sophisticated storage and analytics capabilities. By utilizing cloud infrastructure, businesses can achieve enhanced performance, security, and scalability. This swift proliferation of data remains a crucial element propelling the expansion of the Australia cloud computing market growth.

Adoption of Emerging Technologies

The swift adoption of technologies such as artificial intelligence (AI), Internet of Things (IoT), and big data analytics is driving the demand for cloud computing in Australia. These cutting-edge technologies produce and manage vast amounts of data, necessitating a robust and scalable infrastructure to effectively process workloads. Cloud platforms empower organizations to implement complex applications, deploy machine learning models, and manage interconnected IoT devices without substantial initial investments. The adaptability of cloud solutions also enables businesses to innovate rapidly, boosting productivity and competitiveness across various sectors. Additionally, the increasing focus on digital-first approaches ensures that cloud adoption remains pivotal to operational strategies. This strong dependency on cloud infrastructure to support emerging technologies significantly drives the growth of the Australia cloud computing market share.

Cost Efficiency and Flexibility

Businesses in Australia are increasingly attracted to cloud computing due to its potential to minimize capital expenditures while providing flexible payment options. Instead of making significant investments in on-premises IT infrastructure, organizations can adjust resources on-demand and pay solely for what they consume. This pay-as-you-go model improves budget management and enables quick adaptations to market changes. For startups and smaller companies, cloud platforms give access to enterprise-level technology at more affordable rates, creating a more level competitive environment with larger firms. Additionally, the flexibility in deployment whether public, private, or hybrid cloud presents customized solutions for various business requirements. By facilitating cost savings, scalability, and operational flexibility, cloud adoption continues to rise, boosting the Australia cloud computing market demand.

Government Initiatives of Australia Cloud Computing Market:

Digital Transformation Programs

The Australian government is proactively advancing digital transformation through the integration of cloud-based platforms within public services. These initiatives aim to enhance service delivery, optimize administrative workflows, and improve citizen interaction by providing accessible and efficient digital solutions. By transitioning healthcare, education, and governmental documentation systems to digital formats, authorities are fostering a strong demand for cloud solutions across various sectors. This strategy increases efficiency and encourages businesses to align with government standards, thereby hastening the adoption of cloud technologies in the private sector. Prioritizing the modernization of public infrastructure with cloud innovations ensures both scalability and interoperability in the long run. Such initiatives significantly enrich the overall ecosystem, establishing cloud computing as a fundamental element in Australia’s digital future.

Cybersecurity and Data Protection Policies

To bolster confidence in cloud adoption, the Australian government has implemented strict regulations surrounding cybersecurity and data protection. These frameworks are designed to protect sensitive data while promoting the use of cloud technologies among businesses without compromising security. Rigorous compliance requirements, data sovereignty regulations, and risk management protocols enable enterprises to fortify their defenses against cyber threats. According to Australia cloud computing market analysis, robust data protection policies enhance market confidence and attract more investments in cloud solutions from enterprises. Additionally, these regulations set a standard for cloud service providers to maintain elevated levels of encryption, monitoring, and transparency. Consequently, regulatory clarity is a crucial factor in promoting the safe and secure growth of the cloud computing industry.

Smart Infrastructure Development

Government investments aimed at building smart infrastructure such as high-speed 5G networks, broadband enhancements, and modern data centers are establishing a strong foundation for cloud computing adoption in Australia. These infrastructure improvements provide quicker connectivity, lower latency, and seamless integration of digital services for both consumers and enterprises. Advanced infrastructure additionally facilitates the use of emerging technologies like IoT, AI, and big data, which depend on scalable and high-performance cloud platforms. Through infrastructure investment, Australia is positioning itself for regional and global competitiveness within the digital economy. These advancements benefit not just large corporations but also empower small and medium-sized enterprises to engage in digital innovation, fostering a sustainable environment for accelerated cloud adoption across various industries.

Opportunities of Australia Cloud Computing Market:

Rising SME Adoption

Small and medium enterprises (SMEs) in Australia are increasingly utilizing cloud platforms to enhance scalability, minimize infrastructure expenses, and boost efficiency. Unlike conventional IT models that necessitate significant upfront investments, cloud solutions offer SMEs economical, pay-as-you-go options, enabling them to compete with larger companies. Cloud adoption allows SMEs to streamline operations, incorporate modern business tools, and facilitate seamless collaboration among distributed teams. Moreover, the growth of e-commerce and digital-first businesses is encouraging SMEs to tap into cloud-based applications for customer engagement, data analytics, and supply chain management. This transition enhances competitiveness and paves the way for long-term growth, establishing SMEs as a vital part of Australia's cloud computing market expansion.

AI and IoT Integration

The combination of artificial intelligence (AI), Internet of Things (IoT), and big data analytics is revolutionizing industries across Australia, with cloud platforms at the heart of this change. AI and IoT produce substantial amounts of real-time data, which necessitate robust computing capabilities for storage, analysis, and scalability—requirements efficiently fulfilled by cloud infrastructure. Organizations in healthcare, manufacturing, and retail are increasingly adopting AI- and IoT-integrated cloud solutions for predictive analytics, automation, and improved decision-making. The interplay between emerging technologies and cloud platforms fosters innovation and propels digital transformation across various sectors. This technological convergence is unlocking new opportunities for providers and significantly enhancing Australia's cloud computing market share by expanding adoption beyond traditional IT applications.

Hybrid and Multi-Cloud Growth

Businesses in Australia are progressively embracing hybrid and multi-cloud strategies to achieve a balance of flexibility, performance, and cost-effectiveness. Hybrid cloud models enable organizations to merge private and public cloud infrastructures, optimizing the management of sensitive data while taking advantage of the scalable resources offered by public clouds. Multi-cloud adoption also allows companies to distribute workloads across different providers, reducing vendor lock-in and increasing resilience. This adaptability is particularly crucial for sectors like finance, healthcare, and government, where compliance and data sovereignty are paramount. Additionally, hybrid and multi-cloud strategies enhance disaster recovery capabilities and enable better workload optimization. As organizations emphasize adaptability and risk management, reliance on these models is anticipated to drive growth in Australia's cloud computing market in the years ahead.

Challenges of Australia Cloud Computing Market:

Data Security Concerns

Data security is a significant issue in the Australian cloud computing sector. Organizations frequently hesitate to embrace cloud platforms due to potential risks such as breaches, unauthorized access, and the loss of confidential information. Data sovereignty adds further complexity; many companies prefer their data to be stored and managed within Australia to comply with local regulations. Prominent cyberattacks have heightened awareness about these dangers, causing businesses to be wary about moving critical operations to the cloud. Although cloud providers are pouring resources into advanced encryption and security protocols, customer apprehensions remain. Establishing trust through transparency, adherence to standards, and robust disaster recovery plans is crucial for overcoming these obstacles and promoting wider cloud adoption.

High Implementation Costs

While cloud adoption offers long-term cost-saving advantages, the initial expenses related to migration and integration can be a significant hurdle, especially for small and medium enterprises (SMEs). Moving from legacy systems to cloud solutions incurs costs like software licensing, customization, employee training, and consulting. For SMEs with tight budgets, these financial demands can deter cloud adoption. Additionally, unexpected costs such as bandwidth enhancements, cybersecurity investments, and ongoing subscription fees further strain financial resources. Larger organizations may have the financial capacity to manage these costs, but SMEs often experience slower adoption as a result. Lowering financial barriers through adaptable pricing structures and government incentives could greatly boost growth in the Australian cloud computing landscape.

Regulatory Compliance Complexity

Another key challenge in cloud adoption within Australia is managing compliance requirements. Industries like finance, healthcare, and government adhere to stringent regulatory frameworks regarding data privacy, security, and sovereignty. Companies must verify that their cloud providers comply with regulations such as the Australian Privacy Act and specific compliance standards, which can be complicated and require substantial resources. Non-compliance can lead to legal consequences and harm to reputation, heightening the stakes for companies considering migration. Additionally, international cloud service providers may struggle to align with local compliance standards, creating further concerns for customers. Tackling these issues necessitates strong collaboration between regulators, businesses, and cloud providers to simplify processes and enable secure, compliant cloud adoption.

Australia Cloud Computing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on service, deployment, workload, enterprise size, and end-use.

Service Insights:

- Infrastructure as a Service (IaaS)

- Platform as a Service (PaaS)

- Software as a Service (SaaS)

The report has provided a detailed breakup and analysis of the market based on the service. This includes infrastructure as a service (IaaS), platform as a service (PaaS), and software as a service (SaaS).

Deployment Insights:

- Public

- Private

- Hybrid

A detailed breakup and analysis of the market based on the deployment have also been provided in the report. This includes public, private, and hybrid.

Workload Insights:

- Application Development and Testing

- Data Storage and Backup

- Resource Management

- Orchestration Services

- Others

The report has provided a detailed breakup and analysis of the market based on the workload. This includes application development and testing, data storage and backup, resource management, orchestration services, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium enterprises.

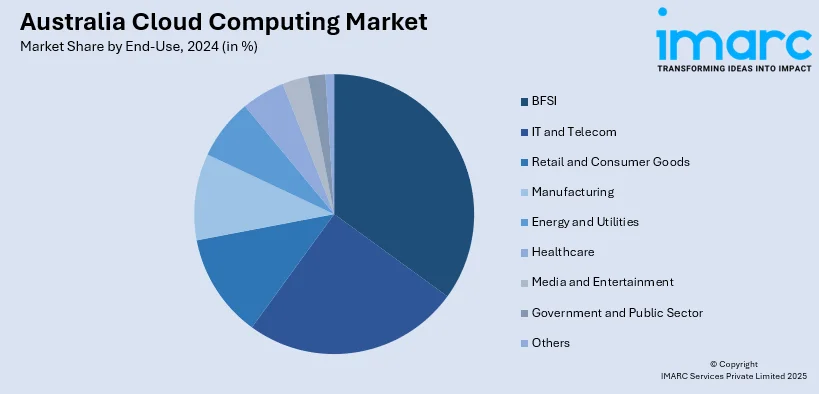

End-Use Insights:

- BFSI

- IT and Telecom

- Retail and Consumer Goods

- Manufacturing

- Energy and Utilities

- Healthcare

- Media and Entertainment

- Government and Public Sector

- Others

The report has provided a detailed breakup and analysis of the market based on the end-use. This includes BFSI, IT and telecom, retail and consumer goods, manufacturing, energy and utilities, healthcare, media and entertainment, government and public sector, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape in the market. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cloud Computing Market News:

- In June 2025, Amazon announced a historic AU$20 Billion investment to expand its data center infrastructure in Australia by 2029, enhancing cloud computing and AI capabilities. This initiative includes new solar farms and aims to bolster local innovation while supporting the Australian government’s economic growth plans through AI and cloud advancements.

- In June 2025, AWS partnered with Datacom to enhance cloud migration and modernization in Australia and New Zealand using generative AI tools like Amazon Q Developer. This collaboration aims to improve developer productivity, reduce coding time by up to 70%, and streamline processes while minimizing risks and costs for organizations.

- In May 2025, Komatsu Australia partnered with Macquarie Cloud Services to enhance its cloud computing infrastructure through a multimillion-dollar agreement. This initiative, part of a digital transformation strategy, aims to improve disaster recovery, data protection, and operational performance while enabling scalability and innovation in a secure, local cloud environment.

- In June 2024, Macquarie Cloud Services launched Macquarie Flex, a hybrid cloud solution powered by Microsoft Azure Stack HCI and Dell Technologies APEX. This offering provides Australian businesses with flexible, secure, and compliant cloud services, combining the benefits of both public and private clouds. By simplifying hybrid cloud management, it allows organizations to handle sensitive workloads while leveraging Azure’s capabilities. The collaboration with Microsoft and Dell aims to support businesses on their cloud journey, enhance IT investments, and drive innovation across various industries in Australia.

- In July 2024, LexisNexis Risk Solutions launched its first cloud hosting facility in Australia to provide localized risk orchestration services, improving data security and compliance. The cloud platform integrates risk management tools such as Know Your Customer (KYC), Know Your Business (KYB), and anti-money laundering (AML) solutions. This new service aims to enhance decision-making processes for businesses while ensuring high standards of data privacy and governance. The platform is built to meet strict regulatory requirements and certifications, reinforcing the company's commitment to providing secure, innovative solutions to Australian businesses.

Australia Cloud Computing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Services Covered | Infrastructure as a Service (IaaS), Platform as a Service (PaaS), Software as a Service (SaaS) |

| Deployments Covered | Public, Private, Hybrid |

| Workloads Covered | Application Development and Testing, Data Storage and Backup, Resource Management, Orchestration Services, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium Enterprises |

| End-Uses Covered | BFSI, IT and Telecom, Retail and Consumer Goods, Manufacturing, Energy and Utilities, Healthcare, Media and Entertainment, Government and Public Sector, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cloud computing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cloud computing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cloud computing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The cloud computing market in Australia was valued at USD 12.7 Billion in 2024.

The Australia cloud computing market is projected to exhibit a compound annual growth rate (CAGR) of 10.18% during 2025-2033.

The Australia cloud computing market is expected to reach a value of USD 30.3 Billion by 2033.

The major key trends of the Australia cloud computing market include the growing adoption of hybrid and multi-cloud models, alongside rapid integration of AI, IoT, and big data. Rising demand for industry-specific cloud solutions, expansion of edge computing, and focus on sustainability in data centers are also shaping the evolving market landscape.

The Australia cloud computing market is driven by digital transformation initiatives across enterprises, government investments in smart infrastructure, and rising adoption by SMEs. Increasing demand for cost-efficient IT scalability, improved data security frameworks, and the need for remote workforce enablement further accelerate market growth across diverse sectors.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)