Australia Cloud Storage Market Size, Share, Trends and Forecast by Component, Deployment Type, User Type, Industry Vertical, and Region, 2025-2033

Australia Cloud Storage Market Overview:

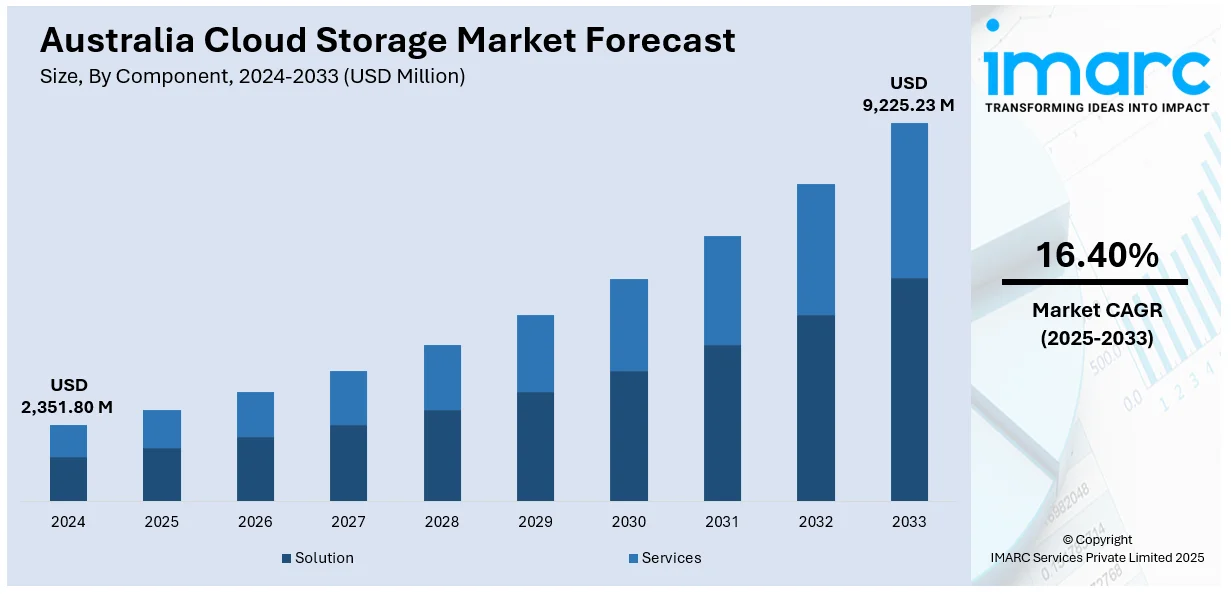

The Australia cloud storage market size reached USD 2,351.80 Million in 2024. Looking forward, the market is expected to reach USD 9,225.23 Million by 2033, exhibiting a growth rate (CAGR) of 16.40% during 2025-2033. Enterprise digital transformation, cloud-first public sector policies, investments in local data centers, and high-speed internet infrastructure improvements are major market contributors. Rising focus on data sovereignty, cybersecurity mandates, demand for localized storage facilities, and sector-specific compliance needs are additional factors. Consumer privacy awareness, encryption technologies, and hybrid storage model adoption are some of the factors positively impacting the Australia cloud storage market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 2,351.80 Million |

| Market Forecast in 2033 | USD 9,225.23 Million |

| Market Growth Rate 2025-2033 | 16.40% |

Key Trends of Australia Cloud Storage Market:

Expansion of Digital Transformation Initiatives Across Enterprises

A primary driver influencing the market is the widespread expansion of digital transformation initiatives across industries. Australian businesses, from small enterprises to large corporations, are aggressively migrating to cloud-based solutions to enhance operational efficiency, scalability, and data security. On July 4, 2024, Amazon Web Services (AWS) announced a USD 2 Billion partnership with the Australian Government to deliver "Top Secret" AWS Cloud (TS Cloud) services, aimed at enhancing defense and intelligence capabilities. AWS has already invested over USD 9.1 Billion into Australia’s economy since 2012, with plans to invest an additional USD 13.2 Billion by 2027, while contributing AUD 467 Million (USD 302 Million) to the local economy through renewable energy projects. Public sector organizations are also adopting cloud-first policies, prompting significant demand for reliable and compliant storage services. Major global cloud providers, in collaboration with local technology firms, are investing heavily in building new data centers across Australia to meet this rising need. Improved high-speed internet infrastructure, driven by projects such as the National Broadband Network (NBN), is further facilitating seamless cloud adoption even in remote regions. Furthermore, Australian regulatory frameworks such as the Privacy Act and the Notifiable Data Breaches scheme are compelling organizations to choose cloud storage solutions that guarantee compliance with strict data protection standards. In this environment, Australia cloud storage market growth is being supported by enterprises seeking hybrid and multi-cloud storage models to ensure business continuity and disaster recovery readiness. The demand for customizable, pay-as-you-go storage solutions continues to rise as companies aim to optimize IT spending. Collectively, these developments are embedding cloud storage as a core component of Australia's national digital economy agenda.

To get more information on this market, Request Sample

Growing Focus on Data Sovereignty and Cybersecurity Compliance

A second significant driver fueling the market is the growing national focus on data sovereignty and cybersecurity compliance. Australian companies and government agencies are increasingly prioritizing the localization of data storage within national borders to safeguard sensitive information and adhere to regulatory obligations. This trend is accelerating investment in domestic data center facilities by both international cloud service providers and local operators. The emergence of cybersecurity mandates, including the Critical Infrastructure Act and the Australian Cyber Security Strategy, is compelling organizations to evaluate and strengthen their cloud storage arrangements. As observed in the Australia cloud storage market trends, enterprises are showing a preference for vendors who offer end-to-end encryption, robust access controls, and transparent compliance certifications. On January 30, 2024, Quantum Corporation announced that Amidata, a leading managed services provider in Australia, has launched its new Amidata Secure Cloud Storage Service, built on Quantum’s ActiveScale™ object storage. This service is designed to support both active and cold data use cases, offering scalable, cost-effective solutions for fast-growing data volumes while enhancing protection against ransomware attacks. ActiveScale’s integration with Quantum’s Scalar tape libraries for cold storage enables efficient and low-cost data archiving, crucial for AI-driven analytics and long-term data retention. The financial services, healthcare, and education sectors are adopting highly secure, industry-specific cloud storage solutions to protect critical data assets. Additionally, rising consumer awareness about data privacy rights is influencing corporate IT strategies, pushing storage providers to maintain high standards of security transparency. These converging factors are reinforcing the necessity for secure, localized, and scalable cloud storage options, cementing Australia’s position as one of the leading markets in the Asia-Pacific region for trusted cloud infrastructure services.

Growth Drivers of Australia Cloud Storage Market:

Government Digitization Programs and Cloud-First Policies

The government's high momentum toward digitalization of all public sector functions is among the main drivers of growth in the cloud storage market in Australia. The Australian government has embraced a cloud-first policy for its agencies, promoting the migration of data storage and IT infrastructure into secure, scalable cloud ecosystems. This has generated enormous need for cloud storage providers that are compliant with national data sovereignty and cybersecurity needs. The Digital Transformation Agency (DTA) actively encourages these endeavors, advocating collaborations with approved cloud providers able to provide services in accordance with rigid local rules. This change is occurring in federal departments, while state governments such as New South Wales and Victoria are also implementing digitization programs across transportation, education, and healthcare. These efforts are providing long-term opportunities for cloud storage vendors that can handle large amounts of structured and unstructured data with solutions that are highly available, have local data residency, and highly secure controls specific to the Australia regulatory environment.

Increased Use of Hybrid Work and Remote Teams

According to the Australia cloud storage market analysis, the widespread use of hybrid work and remote collaboration solutions has been a strong driver of growth for the industry. In the wake of changed work habits driven by the pandemic, companies across industries are increasingly making investments in cloud platforms to enable smooth access to data, safe file sharing, and real-time collaboration among dispersed teams. Australian businesses, particularly in major cities such as Sydney, Melbourne, and Brisbane, are depending more and more on scalable cloud storage technologies to ensure business resilience, cater to workforce mobility, and diminish reliance on physical infrastructure. The education industry has also been a driving force behind this trend, with educational institutions and universities employing cloud infrastructures to facilitate distance learning and delivery of digital content. This development has encouraged cloud service providers to fine-tune services that provide rapid local access, multi-device support, and greater user control. The demand for data agility and location-based collaboration is driving businesses further into rich, adaptable cloud storage environments.

Data-Driven Business Models and Growing Utilization of Big Data

Australia's developing digital economy and increased dependence on data analytics are propelling demand for flexible and secure cloud storage infrastructure. As companies from sectors such as retail and logistics to agriculture and financial services have adopted data-driven decision-making, the amount of data generated, processed, and stored has grown significantly. In areas like Western Australia, where mining and energy businesses manage large amounts of sensor and IoT data, cloud storage remains pivotal to support real-time analytics and data storage over the long term. At the same time, start-ups and medium-sized businesses are embracing AI and machine learning technologies that need flexible, high-capacity storage environments. With greater recognition of requirements for secure backups, disaster recovery, and regulations for data privacy legislation, cloud storage has become a strategic investment. Companies that provide localized infrastructure, low access times, and integration with analytics platforms are well placed to gain from the changing needs of Australia's data-intensive business environment.

Government Initiatives of Australia Cloud Storage Market:

National Cloud Strategy and Digital Transformation Framework

The Australian government has played a key role in promoting cloud storage adoption with its overarching national cloud strategy, which focuses on digital transformation at federal and state government agencies. This strategy enforces a "cloud-first" policy, urging government departments to adopt cloud solutions for storing and managing data to improve operational efficiency, security, and scalability. The Digital Transformation Agency (DTA) is at the forefront of deploying this framework, with agencies being led to transition legacy systems into cloud environments and align with robust Australian data sovereignty regulations. The program also entails forging partnerships with trusted local and international cloud providers that are qualified to adhere to Australia's high expectations of cybersecurity and privacy measures. The government's emphasis on keeping data within Australian borders has encouraged investment in domestic data centers, allowing government institutions to utilize cloud storage solutions without jeopardizing control or security. This mass movement speeds up cloud adoption and also serves as a model for private sector organizations, establishing a secure market environment for the growth of Australia cloud storage market demand.

State-Level Cloud Adoption Programs and Regional Focus

Aside from the national initiatives, Australia's individual states have also initiated their own cloud adoption programs to transform public services and facilitate regional economic development. For instance, states such as New South Wales, Victoria, and Queensland have undertaken targeted initiatives in migrating health records, educational material, and transport data onto cloud-based systems. These government-initiated initiatives acknowledge the distinct requirements of their populations, such as facilitating far-flung and rural communities where conventional IT infrastructure can be scarce. Through using cloud storage, such areas are looking to enhance data accessibility, service continuity, and disaster recovery facilities. Additionally, regional governments are investing more in cloud infrastructure to fund smart city initiatives, which are dependent on real-time data analytics and IoT connectivity. This regional emphasis assists in bridging digital divides in the nation and keeping public services robust and scalable against varying geographic and demographic conditions. These state initiatives complement federal efforts and together drive demand for high-end cloud storage solutions specific to Australia's diverse environments.

Focus on Cybersecurity and Data Sovereignty in Cloud Initiatives

Australia's cloud initiatives by the government have a special focus on cybersecurity and data sovereignty, considering these two as key drivers for cloud storage adoption. With rising fears about cyber-attacks and data exposure across the world, Australian government agencies have devised strict policies and frameworks that can protect sensitive government data in the cloud. The Australian Signals Directorate (ASD) advises on the safe use of cloud technology via the Cloud Security Principles and the Certified Cloud Services List, enabling government agencies to find compliant cloud service providers. This means that any cloud storage solution employed by public bodies must adhere to high standards of encryption, access management, and incident response. In addition, data sovereignty regulations mandate that government data stay in Australian jurisdiction, which also stimulates investment in local data centers and cloud infrastructure. This prioritization ensures that agencies and citizens have added confidence in cloud technology, thereby increasing trust in cloud technologies. The government's strategy for balancing innovation and security is thus influencing market expectations and motivating cloud storage companies to innovate in hybrid cloud and private cloud solutions that are now evolving to complement Australia's regulatory environment.

Australia Cloud Storage Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on component, deployment type, user type, and industry vertical.

Component Insights:

- Solution

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes solution and services.

Deployment Type Insights:

- Private

- Public

- Hybrid

The report has provided a detailed breakup and analysis of the market based on the deployment type. This includes private, public, and hybrid.

User Type Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

The report has provided a detailed breakup and analysis of the market based on the user type. This includes large enterprises and small and medium-sized enterprises.

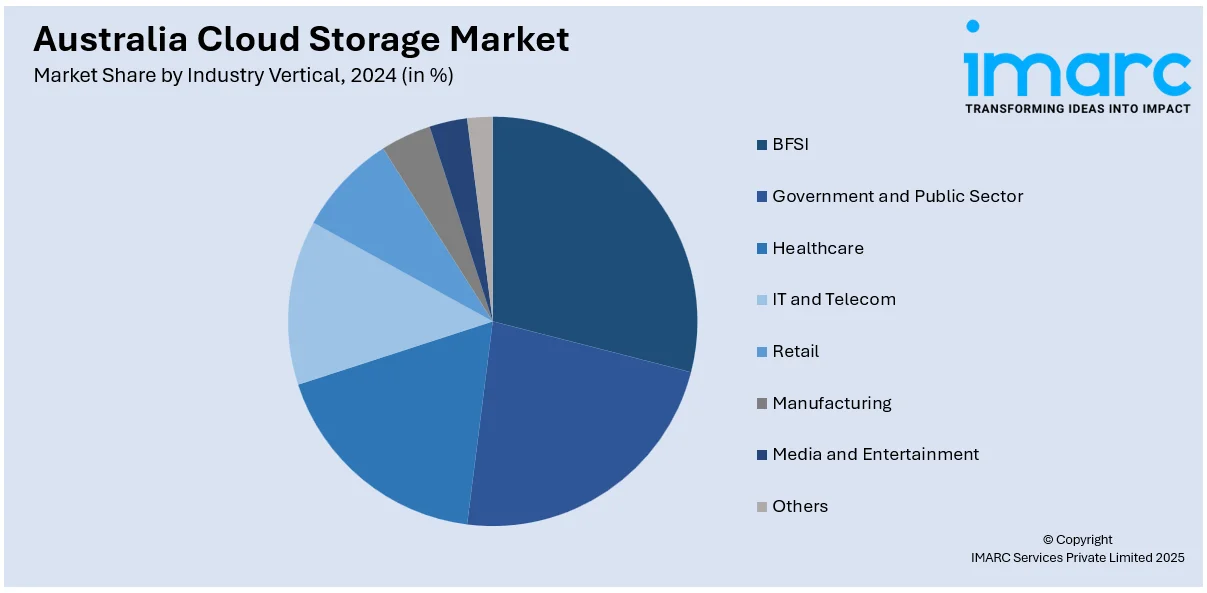

Industry Vertical Insights:

- BFSI

- Government and Public Sector

- Healthcare

- IT and Telecom

- Retail

- Manufacturing

- Media and Entertainment

- Others

The report has provided a detailed breakup and analysis of the market based on the industry vertical. This includes BFSI, government and public sector, healthcare, IT and telecom, retail, manufacturing, media and entertainment, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided, including:

- Iron Mountain, Inc.

- iseek Pty Ltd

- Macquarie Technology Group

- Oracle Corporation

- OrionVM

- OVHcloud

- Servers Australia

- Vault Cloud

Australia Cloud Storage Market News:

- On November 14, 2024, Australia-based Arcitecta announced a partnership with Wasabi Technologies to integrate Wasabi’s cloud storage into data workflows via Arcitecta’s Mediaflux platform, providing a unified view of all data, regardless of its location. This collaboration enables organizations to seamlessly store, manage, and access data from Wasabi’s cloud storage, enhancing scalability, security, and performance while optimizing costs through predictable and transparent pricing.

Australia Cloud Storage Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Components Covered | Solution, Services |

| Deployment Types Covered | Private, Public, Hybrid |

| User Types Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Industry Verticals Covered | BFSI, Government and Public Sector, Healthcare, IT and Telecom, Retail, Manufacturing, Media and Entertainment, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Companies Covered | Iron Mountain, Inc., iseek Pty Ltd, Macquarie Technology Group, Oracle Corporation, OrionVM, OVHcloud, Servers Australia, Vault Cloud, etc. |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cloud storage market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cloud storage market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cloud storage industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia cloud storage market was valued at USD 2,351.80 Million in 2024.

The Australia cloud storage market is projected to exhibit a CAGR of 16.40% during 2025-2033.

The Australia cloud storage market is expected to reach a value of USD 9,225.23 Million by 2033.

The Australia cloud storage market trends include rising adoption of hybrid and multi-cloud strategies, increased focus on data security and compliance, and growth in local data center investments. Businesses are also leveraging cloud for remote collaboration, AI integration, and scalable storage, while government policies continue to drive cloud-first digital transformation across sectors.

The Australia cloud storage market is driven by strong government digitization initiatives, increased remote work adoption, and growing demand for data-driven business solutions. Strict data sovereignty laws and expanding local data centers also support market growth by ensuring security and compliance, making cloud storage a vital part of Australia’s digital infrastructure evolution.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)