Australia CNC Grinding Machines Market Size, Share, Trends and Forecast by Type, Application, Distribution Channel, and Region, 2025-2033

Australia CNC Grinding Machines Market Overview:

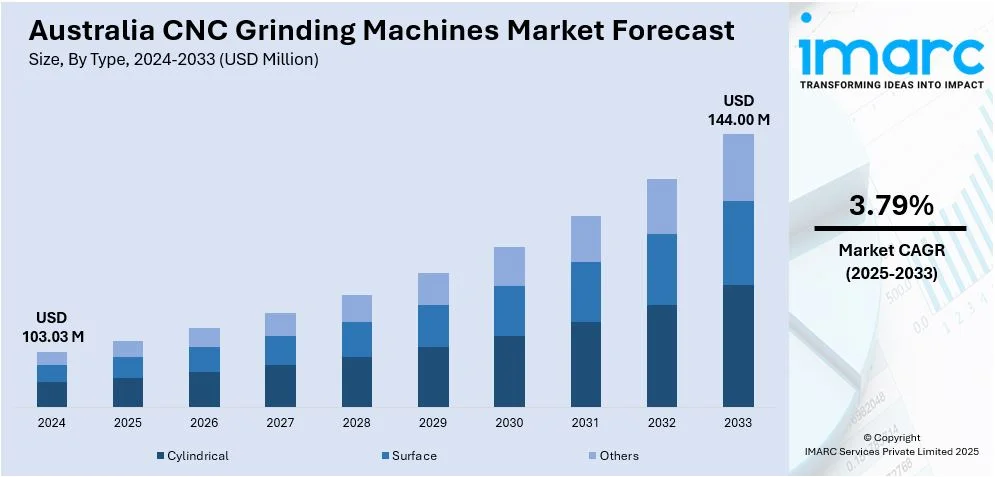

The Australia CNC grinding machines market size reached USD 103.03 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 144.00 Million by 2033, exhibiting a growth rate (CAGR) of 3.79% during 2025-2033. Rising demand for precision components in automotive, aerospace, and medical sectors, along with increased automation and Industry 4.0 adoption, is fueling market expansion. Growth is further supported by the need for tighter metal tolerances, surging defense and mining equipment output, and the booming electronics industry. Labor shortages and government backing for advanced manufacturing also contribute, as does the move toward high-performance alloys and replacement of outdated manual systems—all of which are boosting the Australia CNC grinding machines market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 103.03 Million |

| Market Forecast in 2033 | USD 144.00 Million |

| Market Growth Rate 2025-2033 | 3.79% |

Australia CNC Grinding Machines Market Trends:

Rise in Automotive Component Production

Australia’s automotive industry maintains a strong presence in parts manufacturing and specialty vehicle production. Local companies are increasingly supplying components like engine parts, braking systems, and drivetrains to both domestic and international markets. This growth is closely tied to the rising demand for CNC grinding machines, which are essential for producing high-precision components needed in engines and transmissions. CNC grinders help achieve the tight tolerances required for parts such as camshafts, crankshafts, and gears. Moreover, Australia's reputation for high-quality, niche automotive solutions, such as in performance tuning, motorsport, and four-wheel drive (4WD) custom builds, has added momentum to the demand for reliable grinding technologies. As workshops and component makers aim to reduce error margins, CNC grinding becomes a key part of their toolset, particularly for hard metals and complex geometries, which is fostering the market growth.

To get more information on this market, Request Sample

Expanding Aerospace Manufacturing Base

Australia’s aerospace industry is evolving into a strategic sector, particularly through government and private sector collaboration on defense and aviation programs. Queensland is a notable center of this growth, with over 300 aerospace-related businesses and 31% of the country’s total maintenance, repair, and overhaul (MRO) activities concentrated there. As domestic defense projects ramp up, such as the modernization of the Royal Australian Air Force’s fleet and drone systems, demand for high-precision components has surged. These include jet engine parts, structural elements, and landing gear components, all of which require surface accuracy and geometric consistency that CNC grinding machines can deliver. Moreover, the need for ultra-reliable parts in aerospace settings pushes manufacturers to adopt precision grinding processes that reduce material stress and meet rigorous safety standards. CNC grinders, especially multi-axis variants, are ideal for fabricating parts with curved surfaces, fine tolerances, and hard-to-machine alloys like titanium and Inconel. Furthermore, Australia's focus on growing sovereign industrial capacity in aerospace, particularly for critical components and assemblies, is also contributing to the market growth. In April 2024, Boeing Australia announced the expansion of its Brisbane manufacturing site to support increased local production of advanced components for defense aircraft, reinforcing the country’s ambition to become a key regional hub for aerospace manufacturing.

Growth in Medical Device Precision Tooling

Australia’s medical technology industry is closely aligned with advanced manufacturing trends, particularly in the production of high-precision surgical instruments, implants, and diagnostic equipment. As the sector expands to serve aging populations and chronic disease management, the need for finely machined components has grown sharply. This includes orthopedic screws, dental implants, catheter tips, and laparoscopic tools, which must meet stringent hygiene and dimensional standards. CNC grinding machines are central to manufacturing these tools, offering micro-level accuracy and consistent surface finishes. Australian firms are increasingly investing in these machines to stay competitive in global supply chains and meet local demand for tailored medical solutions. The Medical Research Future Fund (MRFF) and other national programs support technological upgrades and encourage advanced manufacturing adoption in health-related industries. CNC grinding ensures compatibility with a range of biomaterials, from surgical-grade stainless steel to titanium alloys and high-performance polymers, which is further propelling the Australia CNC grinding machines market growth.

Australia CNC Grinding Machines Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and distribution channel.

Type Insights:

- Cylindrical

- Surface

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes cylindrical, surface, and others.

Application Insights:

.webp)

- Automotive

- Aerospace and Defense

- Medical

- Electrical and Electronics

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes automotive, aerospace and defense, medical, electrical and electronics, and others.

Distribution Channel Insights:

- Online

- Company Websites

- E-commerce Websites

- Offline

- Direct Sales

- Indirect Sales

The report has provided a detailed breakup and analysis of the market based on the distribution channel. This includes online, company websites, e-commerce websites, offline, direct sales, and indirect sales.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia CNC Grinding Machines Market News:

- In 2024, UNITED GRINDING Group announced its acquisition of GF Machining Solutions from Georg Fischer AG. Valued between CHF 630–650 million, the deal aims to bolster UNITED GRINDING's position in ultra-precision machining.

Australia CNC Grinding Machines Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Cylindrical, Surface, Others |

| Applications Covered | Automotive, Aerospace and Defense, Medical, Electrical and Electronics, Others |

| Distribution Channels Covered | Online, Company Websites, E-commerce Websites, Offline, Direct Sales, Indirect Sales |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia CNC grinding machines market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia CNC grinding machines market on the basis of type?

- What is the breakup of the Australia CNC grinding machines market on the basis of application?

- What is the breakup of the Australia CNC grinding machines market on the basis of distribution channel?

- What is the breakup of the Australia CNC grinding machines market on the basis of region?

- What are the various stages in the value chain of the Australia CNC grinding machines market?

- What are the key driving factors and challenges in the Australia CNC grinding machines market?

- What is the structure of the Australia CNC grinding machines market and who are the key players?

- What is the degree of competition in the Australia CNC grinding machines market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia CNC grinding machines market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia CNC grinding machines market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia CNC grinding machines industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)