Australia Co-Working Office Space Market Size, Share, Trends and Forecast by Type, Application, End User, and Region, 2026-2034

Australia Co-Working Office Space Market Overview:

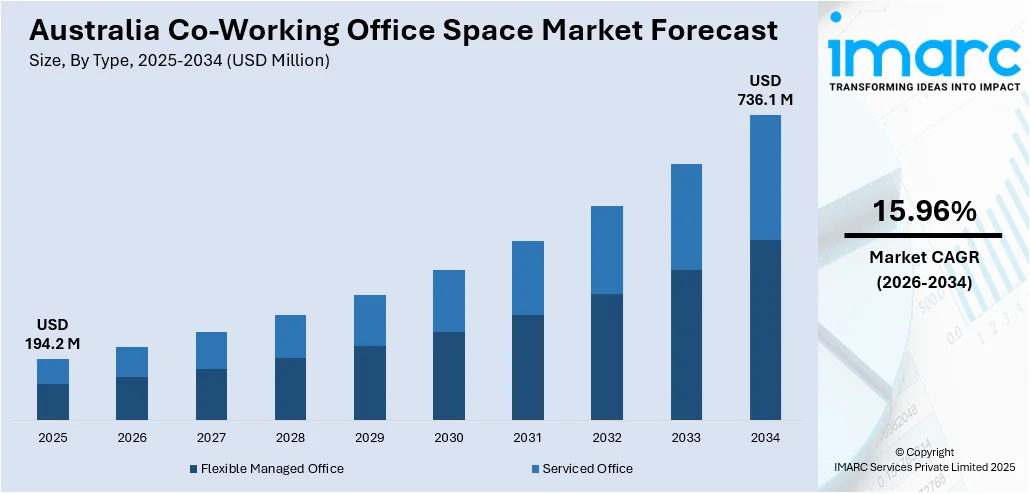

The Australia co-working office space market size reached USD 194.2 Million in 2025. Looking forward, IMARC Group expects the market to reach USD 736.1 Million by 2034, exhibiting a growth rate (CAGR) of 15.96% during 2026-2034. At present, with an increasing number of entrepreneurs starting new businesses and more people opting for freelancing instead of conventional employment, the demand for office spaces that provide affordability and convenience is rising. Besides this, the growing adoption of remote work culture, which is motivating firms to design adaptive and inclusive environments, is contributing to the expansion of the Australia co-working office space market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2025

|

|

Forecast Years

|

2026-2034

|

|

Historical Years

|

2020-2025

|

|

Market Size in 2025

|

USD 194.2 Million |

|

Market Forecast in 2034

|

USD 736.1 Million |

| Market Growth Rate 2026-2034 | 15.96% |

Key Trends of Australia Co-Working Office Space Market:

Increasing number of startups and freelancers

Rising number of startups and freelancers is positively influencing the market in Australia. As more entrepreneurs are launching new ventures and individuals are choosing freelancing over traditional jobs, the need for office spaces that offer cost-efficiency and convenience is increasing. According to industry reports, as of March 2025, registrations of freelancers increased by 122% in Australia. Co-working spaces provide ideal environments for these professionals, offering shared infrastructure, modern amenities, and short-term lease options that reduce operational costs and long-term commitments. Startups prefer such spaces to scale gradually without the burden of maintaining a private office. Co-working providers are responding by offering tailored packages, niche communities, and industry-specific setups. Locations in central business districts and suburban hubs make these spaces easily accessible. As innovation-based workforces are expanding, the demand for such dynamic and community-oriented environments is rising. The result is a thriving co-working office space market in Australia, supported by the continuous influx of small businesses and self-employed professionals.

To get more information on this market, Request Sample

Rising adoption of remote work culture

The growing adoption of remote work culture is impelling the Australia co-working office space market growth. As more professionals are employing remote work arrangements, they are seeking environments that support productivity without the isolation of working from home. According to industry reports, as of August 2024, 14.3% of Australian job listings on Indeed explicitly incorporated phrases like ‘work from home’ (WFH) or ‘work remotely’ in their descriptions, nearing an all-time high. Australia's share of remote postings rose by 12.2% from 2023. Co-working spaces offer a professional setting with necessary facilities, such as fast internet and conference rooms, which appeal to gig workers and remote employees. These spaces also foster community and collaboration, which helps reduce the sense of disconnection often associated with remote work. Companies with remote teams also prefer co-working spaces as satellite offices or occasional meeting venues. The flexibility in leasing terms, combined with the ability to work from various locations, attracts independent workers, startups, and corporate employees. This shift in work culture is motivating co-working space providers to design adaptive and inclusive environments. As the remote work trend continues to grow, the demand for co-working spaces in both urban and regional areas is strengthening, making it a key driver of market expansion in Australia.

Growth Drivers of Australia Co-Working Office Space Market:

Cost Efficiency and Scalability for Businesses

Co-working spaces are increasingly favored by businesses in Australia due to their cost-effective and scalable nature. Unlike conventional office leases, co-working models allow companies to pay only for the space they need, making it easier to control operational expenses. This flexible arrangement is especially beneficial for businesses navigating fluctuating workforce demands or uncertain market conditions. The inclusion of shared amenities such as meeting rooms, internet, and office equipment further reduces overhead costs. Whether for small enterprises or growing companies, co-working spaces eliminate the burden of long-term commitments while enabling quick expansion or downsizing as needed. As a result, these dynamic office solutions provide a strategic alternative for organizations seeking to maximize value, boost efficiency, and maintain a professional environment without the high fixed costs of traditional offices.

Corporate Demand for Satellite Offices

The rising preference for hybrid and decentralized work models has led large corporations in Australia to adopt co-working spaces as satellite offices, a major factor driving the Australia co-working office space market demand. These flexible environments allow companies to set up smaller, strategically located hubs near residential areas, enabling employees to work closer to home while maintaining access to essential office infrastructure. Co-working spaces offer a fully equipped setting with modern technology, meeting rooms, and collaborative zones, helping organizations support remote teams without compromising productivity or brand professionalism. This decentralized approach also enhances employee satisfaction and reduces commuting time, promoting a better work-life balance. As businesses aim to create more adaptive workplace strategies, co-working spaces serve as practical and cost-effective alternatives to traditional branch offices, helping corporations stay agile and responsive in a rapidly evolving work landscape.

Government and Institutional Support

The Australian government, along with various regional authorities and institutions, has played a pivotal role in supporting the co-working office space market. Through initiatives aimed at fostering innovation, entrepreneurship, and digital transformation, these entities have promoted the development of flexible work environments. Programs supporting tech hubs, startup accelerators, and small business development often include funding or incentives for co-working providers, encouraging the creation of collaborative ecosystems. These efforts align with broader workforce modernization strategies, aiming to equip professionals and entrepreneurs with access to affordable, well-connected, and resource-rich spaces. Additionally, public sector engagement helps increase the credibility and visibility of co-working spaces, attracting diverse tenants from across industries. Such institutional backing is not only boosting supply but also shaping long-term demand for flexible, future-ready office solutions.

Opportunities of Australia Co-Working Office Space Market:

Regional and Suburban Expansion

The ongoing improvement of digital infrastructure across Australia, combined with the spread of urban populations into surrounding suburbs and regional towns, is creating new growth opportunities for the co-working office space market. As more professionals choose to live and work outside traditional city centers, the demand for quality, flexible workspaces in these areas is increasing. Co-working providers have a unique chance to meet this demand by offering professionally equipped environments closer to home, reducing the need for lengthy commutes. These locations often have less competition and lower operational costs, making them appealing for both operators and users. By tapping into underserved markets with tailored offerings, co-working companies can expand their reach while supporting the growing trend of decentralized work and regional workforce development.

Rise of Niche and Industry-Specific Spaces

The Australian co-working sector is witnessing a rise in demand for niche, industry-focused workspaces designed to cater to specific professional communities. Unlike general-purpose offices, these tailored environments offer specialized infrastructure, curated programming, and industry-relevant resources that better support collaboration and productivity. Spaces designed for sectors such as legal services, design, technology, health, or media are attracting like-minded professionals who benefit from working in a community with shared goals, values, and networking potential. These hubs also create a stronger sense of identity and belonging, which traditional office environments often lack. As businesses and individuals seek more than just a desk, the appeal of co-working spaces with industry-specific amenities and services continues to grow, offering providers a competitive edge and a deeper connection with their target markets.

Integration of Advanced Technology

Technological innovation is a key opportunity area for co-working operators in Australia seeking to stand out in a competitive market. Integrating smart technologies such as AI-driven room booking platforms, contactless entry systems, biometric authentication, and real-time occupancy tracking can significantly enhance the user experience. These innovations not only improve operational efficiency but also offer greater convenience, security, and adaptability for tenants. As digital-first work habits become the norm, professionals increasingly expect seamless connectivity and automation in their workspaces. Furthermore, tech-enabled spaces allow for better space management, energy optimization, and personalized service delivery. By adopting these advanced tools, co-working providers can attract tech-savvy users, differentiate their offerings, and future-proof their facilities in an evolving workplace landscape driven by innovation and digital transformation.

Challenges of Australia Co-Working Office Space Market

High Competition and Market Saturation

Australia’s co-working office space market is experiencing intense competition due to a surge in new entrants and expanding operations by established providers, particularly in major metropolitan areas. This rapid growth has led to market saturation in certain regions, making it increasingly difficult for operators to differentiate their services and maintain strong occupancy rates. Pricing pressure is another key challenge, as many players attempt to attract clients through aggressive discounts and promotions, often at the expense of profitability. To remain viable, co-working providers must innovate with unique offerings such as value-added services, tailored amenities, or niche community focus. Strategic branding, partnerships, and targeted marketing are essential for standing out in a crowded landscape where customer loyalty is hard-won and competition is constantly evolving.

Managing Occupancy Fluctuations

One of the major operational challenges for co-working space providers in Australia is managing unpredictable occupancy rates. Unlike traditional commercial leases, co-working memberships typically run on flexible, short-term agreements that can change month to month. According to the Australia co-working office space market analysis, this model, while attractive to tenants, exposes operators to frequent fluctuations in revenue and space utilization. External factors such as economic downturns, seasonal demand shifts, or evolving workplace trends can lead to abrupt changes in tenant volume. Such inconsistency can complicate financial forecasting, disrupt resource allocation, and impact long-term sustainability. To address this, providers must adopt dynamic pricing strategies, diversify tenant types, and implement data-driven space management tools that help anticipate demand and improve retention, ensuring greater resilience and adaptability in a volatile market environment.

Balancing Community with Privacy Needs

Creating a balanced environment that caters to both community engagement and individual privacy remains a delicate challenge for co-working operators. While open layouts, shared lounges, and social events foster collaboration and networking—key selling points of co-working spaces—not all tenants prioritize interaction. Professionals handling confidential tasks or requiring deep focus often seek private offices or designated quiet zones. Failing to accommodate these needs can lead to dissatisfaction and higher turnover. To overcome this, operators must design adaptable spaces that integrate private offices, soundproof pods, and quiet zones alongside communal areas. Clearly defined usage policies, flexible layouts, and noise control measures are essential to meet the diverse expectations of members. A thoughtful approach to space planning ensures tenant satisfaction, improved productivity, and stronger long-term client relationships.

Australia Co-Working Office Space Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2026-2034. Our report has categorized the market based on type, application, and end user.

Type Insights:

- Flexible Managed Office

- Serviced Office

The report has provided a detailed breakup and analysis of the market based on the type. This includes flexible managed office and serviced office.

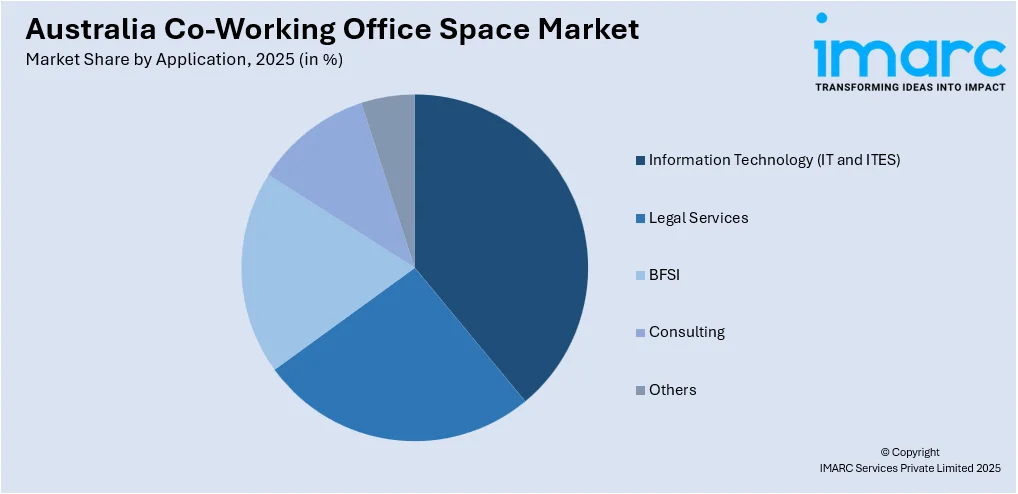

Application Insights:

Access the Comprehensive Market Breakdown, Request Sample

- Information Technology (IT and ITES)

- Legal Services

- BFSI

- Consulting

- Others

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes information technology (IT and ITES), legal services, BFSI, consulting, and others.

End User Insights:

- Personal User

- Small Scale Company

- Large Scale Company

- Others

The report has provided a detailed breakup and analysis of the market based on the end user. This includes personal user, small scale company, large scale company, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Co-Working Office Space Market News:

- In July 2024, JustCo, the top co-working workspace provider in Asia, revealed the opening of JustCo Emporium Melbourne in Australia. This new versatile area included private office suites, hot desk areas, meeting rooms equipped with video conferencing, and custom-designed micro-spaces for concentrated work and collaborations. This achievement highlighted JustCo's commitment to providing professionals with sustainable and flexible workspace options that could encourage a balance between work and life, while also reaffirming its goal to grow its existing network of more than 40 centers in the area.

Australia Co-Working Office Space Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2025 |

| Historical Period | 2020-2025 |

| Forecast Period | 2026-2034 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Flexible Managed Office, Serviced Office |

| Applications Covered | Information Technology (IT and ITES), Legal Services, BFSI, Consulting, Others |

| End Users Covered | Personal User, Small Scale Company, Large Scale Company, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia co-working office space market from 2020-2034.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia co-working office space market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia co-working office space industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The Australia co-working office space market is projected to exhibit a CAGR of 15.96% during 2026-2034.

Australia’s co-working office space market is evolving with rising demand for hybrid work setups, tech-enabled workspaces, and sustainability-focused designs. Other trends include smart access systems, industry-specific coworking hubs, and expansion into suburban and regional areas to meet the needs of a flexible, mobile workforce.

Australia’s co-working office space market growth is fueled by widespread adoption of hybrid work models, demand for flexible and cost-effective office solutions, rising numbers of startups and freelancers, strategic corporate satellite offices, and supportive government policies encouraging digital transformation and startup ecosystems.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)