Australia Cognitive Health Supplements Market Size, Share, Trends and Forecast by Product Type, Form, Sales Channel, Functionality, and Region, 2025-2033

Australia Cognitive Health Supplements Market Overview:

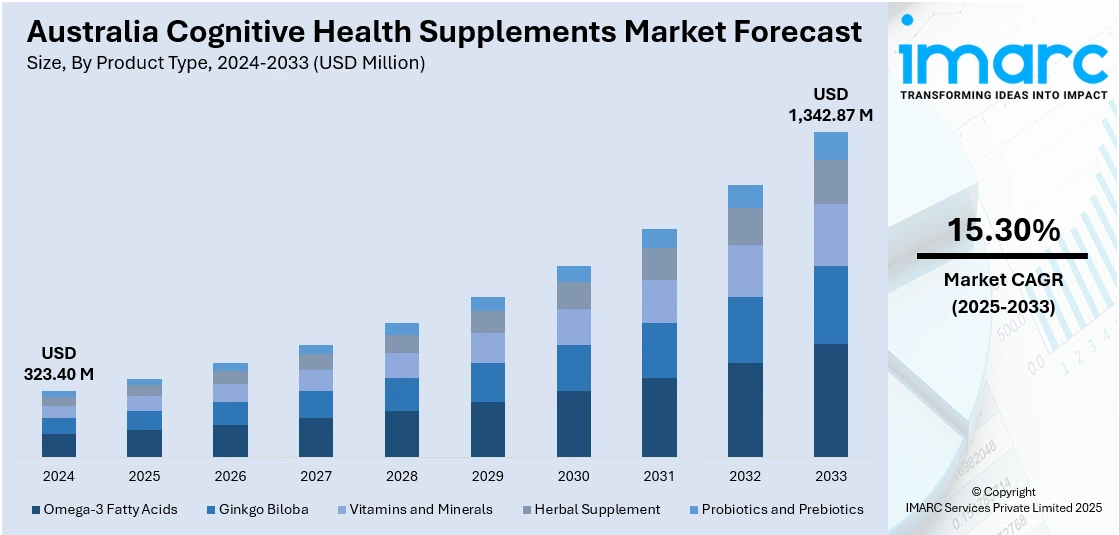

The Australia Cognitive Health Supplements Market size reached USD 323.40 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,342.87 Million by 2033, exhibiting a growth rate (CAGR) of 15.30% during 2025-2033. Increased consumer awareness about mental health conditions has led consumers to seek out natural and holistic means of boosting cognitive wellness, further propelling market growth. The rising incidence of neurological diseases like Alzheimer's disease and dementia has helped in increasing popularity of cognitive health supplements as consumers seek preventative measures to maintain brain function while also expanding the Australia cognitive health supplements market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 323.40 Million |

| Market Forecast in 2033 | USD 1,342.87 Million |

| Market Growth Rate 2025-2033 | 15.30% |

Australia Cognitive Health Supplements Market Trends:

Emergence of Natural and Herbal Ingredients

In Australia, there is also a strong demand for cognitive health supplements that use natural and herbal substances. Consumers are now looking for products that make use of plant-derived compounds with proven cognitive effects. Herbal extracts like Ginkgo Biloba, Bacopa Monnieri, and Rhodiola Rosea are also becoming increasingly popular because of their long history of use in improving memory, concentration, and mental acuity. This move toward natural ingredients is part of a wider trend toward health-conscious consumers choosing supplements that resonate with their own sustainability and overall wellness values. As a response, manufacturers are creating products that emphasize these natural ingredients in order to capture the demand for clean-label and transparent products. The focus on herbal ingredients satisfies the demand for efficacy along with the increasing anxiety about side effects of synthetic compounds.

To get more information on this market, Request Sample

Incorporation of Cognitive Support as Part of Daily Wellness Routine

Australia cognitive health supplements market growth is fueled by the incorporation of regular wellness practices as a shift toward preventive care. Consumers are becoming aware of the need to keep their minds in good working order and are actively adopting supplements in their lives. This is prominent especially among millennials and working adults who look for solutions that enhance mental acuity, concentration, and stress management. Supplements that couple cognitive advantages with other aspects of wellness, including mood support and energy enhancement, are increasing in popularity. The convenience of these multi-purpose supplements appeals to busy lifestyles of today's consumer, which makes them an appealing choice for individuals wishing to maximize their overall health. As more and more people become aware of the connection between cognitive health and total well-being, demand for balanced supplements that treat multiple areas of concern should increase.

Regulatory Scrutiny and Consumer Education

The Australian market for cognitive health supplements is facing greater regulatory pressure and consumer education efforts. With the rise of supplements purporting to promote cognition, there is greater focus on proving product safety, effectiveness, and transparency. The regulatory agencies are strengthening guidelines to prove that the claims put forward by supplement companies are supported with scientific proof. Such an environment is typically causing businesses to spend on research and development to confirm the efficacy of their products. At the same time, customers are becoming increasingly sophisticated, demanding products that offer transparent and transparent communications about ingredients sourcing, manufacturing processes, and clinical trials substantiating efficacy across the board. Brands offering transparency and adhering to regulation standards are winning consumer trust and loyalty. This shift highlights the need for upholding high-quality standards and developing an educated consumer base in the developing cognitive health supplements industry.

Australia Cognitive Health Supplements Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on product type, form, sales channel, and functionality.

Product Type Insights:

- Omega-3 Fatty Acids

- Ginkgo Biloba

- Vitamins and Minerals

- Herbal Supplement

- Probiotics and Prebiotics

The report has provided a detailed breakup and analysis of the market based on the product type. This includes omega-3 fatty acids, ginkgo biloba, vitamins and minerals, herbal supplement, and probiotics and prebiotics.

Form Insights:

- Chewable

- Capsule

- Tablet

- Powder

- Liquid

A detailed breakup and analysis of the market based on the form has also been provided in the report. This includes chewable, capsule, tablet, powder, and liquid.

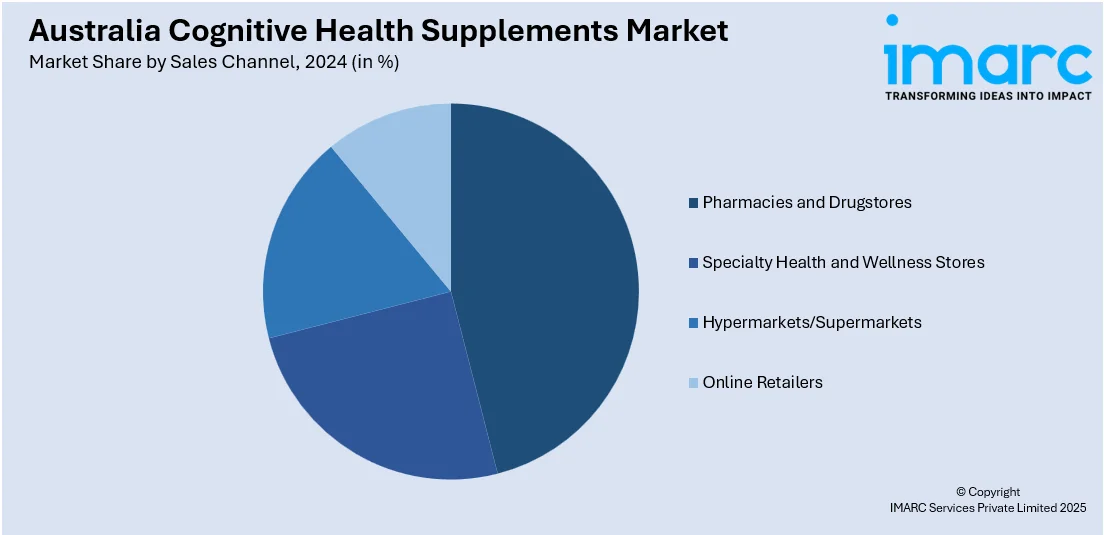

Sales Channel Insights:

- Pharmacies and Drugstores

- Specialty Health and Wellness Stores

- Hypermarkets/Supermarkets

- Online Retailers

The report has provided a detailed breakup and analysis of the market based on the sales channel. This includes pharmacies and drugstores, specialty health and wellness stores, hypermarkets/supermarkets, and online retailers.

Functionality Insights:

- Memory Support

- Focus and Concentration Improvement

- Boosting Cognitive Performance

- Stress and Anxiety Management

- Mood Enhancement

A detailed breakup and analysis of the market based on the functionality has also been provided in the report. This includes memory support, focus and concentration improvement, boosting cognitive performance, stress and anxiety management, and mood enhancement.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cognitive Health Supplements Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Omega-3 Fatty Acids, Ginkgo Biloba, Vitamins and Minerals, Herbal Supplement, Probiotics and Prebiotics |

| Forms Covered | Chewable, Capsule, Tablet, Powder, Liquid |

| Sales Channels Covered | Pharmacies and Drugstores, Specialty Health and Wellness Stores, Hypermarkets/Supermarkets, Online Retailers |

| Functionalities Covered | Memory Support, Focus and Concentration Improvement, Boosting Cognitive Performance, Stress and Anxiety Management, Mood Enhancement |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cognitive health supplements market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cognitive health supplements market on the basis of product type?

- What is the breakup of the Australia cognitive health supplements market on the basis of form?

- What is the breakup of the Australia cognitive health supplements market on the basis of sales channel?

- What is the breakup of the Australia cognitive health supplements market on the basis of functionality?

- What is the breakup of the Australia cognitive health supplements market on the basis of region?

- What are the various stages in the value chain of the Australia cognitive health supplements market?

- What are the key driving factors and challenges in the Australia cognitive health supplements market?

- What is the structure of the Australia cognitive health supplements market and who are the key players?

- What is the degree of competition in the Australia cognitive health supplements market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cognitive health supplements market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cognitive health supplements market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cognitive health supplements industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)