Australia Cold Chain Transport Market Size, Share, Trends and Forecast by Type, Application, Equipment, and Region, 2025-2033

Australia Cold Chain Transport Market Overview:

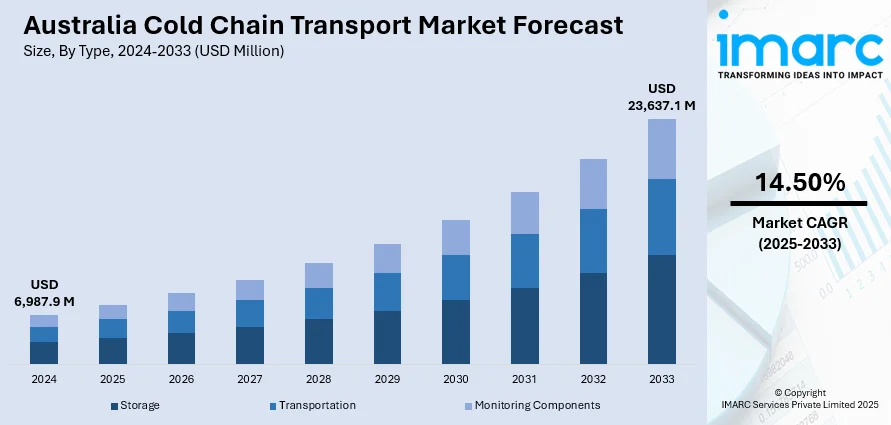

The Australia cold chain transport market size reached USD 6,987.9 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 23,637.1 Million by 2033, exhibiting a growth rate (CAGR) of 14.50% during 2025-2033. The increasing demand for perishable goods, including fresh produce, dairy, and meat products, is impelling the growth of the market. This, along with technology and automation integration into cold chain shipping, is contributing to the market growth. Apart from this, the Australian government is introducing and enforcing more stringent rules and regulations related to food safety and product quality, which is expanding the Australia cold chain transport market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024

|

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

|

Market Size in 2024

|

USD 6,987.9 Million |

|

Market Forecast in 2033

|

USD 23,637.1 Million |

| Market Growth Rate 2025-2033 | 14.50% |

Australia Cold Chain Transport Market Trends:

Advancements in Technology and Automation

Technology and automation integration into cold chain shipping is contributing to the market growth. Businesses are using Internet of Things (IoT) devices, temperature monitoring sensors, and real-time location systems to track and optimize shipment of temperature-controlled products. All these developments make it possible for improved visibility and management of shipments, with goods staying within designated temperatures during transit throughout the supply chain. Automation is also enhancing the efficiency of cold storage and transportation logistics, minimizing human error and maximizing productivity. Moreover, machine learning (ML) and artificial intelligence (AI) are utilized to forecast demand patterns and optimize routes for delivery to minimize operational cost while maximizing delivery time. Through investments in such technology advancements, Australian cold chain transport companies are raising the reliability and efficiency of their services, thereby winning more customers and creating market growth. In 2024, Merck, a science and technology company, declared its agenda to shift from conventional expanded polystyrene (EPS) cold-chain padding to wool-pack insulation for shipments in Australia. This shift will be implemented on September 1. The company expects it will replace 300m3 or 3.6 tons of non-recyclable EPS annually. The packaging solution using wool is tested for one-day shipments of drug products in Australian summertime conditions.

To get more information on this market, Request Sample

Rising Demand for Perishable Goods and Pharmaceuticals

The Australia cold chain transport industry is experiencing significant growth due to the increasing demand for perishable goods, including fresh produce, dairy, and meat products. As people are becoming more health-conscious and seeking fresh, organic, and high-quality food products, the need for efficient cold chain logistics is intensifying. Additionally, the growing innovation in the pharmaceutical sector is driving the demand for temperature-sensitive medicines, including vaccines and biologics, which require stringent cold chain management to maintain their efficacy. Companies in Australia are expanding their cold chain networks, enhancing transportation technology, and adopting more robust storage solutions to meet this demand. By implementing advanced refrigeration systems and monitoring technologies, the industry is ensuring that perishable goods are transported under optimal conditions, preserving quality and minimizing spoilage. As these trends continue, cold chain transport operators are adapting their infrastructure and capabilities to cater to the high volumes of sensitive goods. The IMARC Group predicts that the Australia pharmaceutical market is projected to attain USD 31.1 Billion by 2033.

Stringent Government Regulations and Standards

The Australian government is introducing and enforcing more stringent rules and regulations related to food safety and product quality, which are catalyzing the demand for trustworthy cold chain transport solutions. In 2025, Food Standards Australia New Zealand (FSANZ) established new food safety laws for fruit and vegetables, implementing tighter primary production and processing standards for berries, leafy greens and melons. The Australian Food Safety Standards, for example, mandate food suppliers to store food within particular temperature ranges during transportation to avoid contamination and spoilage. Cold chain shipping providers are thus looking to improve their regulatory compliance with these measures by implementing more advanced tracking and monitoring solutions. Beyond food safety, the government is also imposing more stringent standards on shipping pharmaceuticals, calling for the industry to uphold persistent and accurate temperature conditions along the supply chain. Therefore, businesses are investing in new refrigeration technologies, staff training, and quality management practices to guarantee complete regulatory compliance. These regulations are driving improvements in the sector and propelling the Australia cold chain transport market growth.

Australia Cold Chain Transport Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type, application, and equipment.

Type Insights:

- Storage

- Transportation

- Monitoring Components

The report has provided a detailed breakup and analysis of the market based on the type. This includes storage, transportation, and monitoring components.

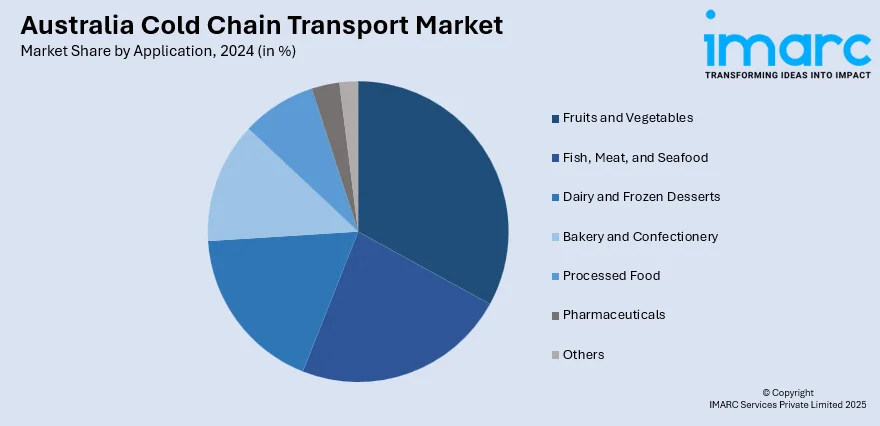

Application Insights:

- Fruits and Vegetables

- Fish, Meat, and Seafood

- Dairy and Frozen Desserts

- Bakery and Confectionery

- Processed Food

- Pharmaceuticals

- Others

The report has provided a detailed breakup and analysis of the market based on the application. This includes fruits and vegetables; fish, meat, and seafood; dairy and frozen desserts; bakery and confectionery; processed food; pharmaceuticals; and others.

Equipment Insights:

- Storage Equipment

- Transportation Equipment

A detailed breakup and analysis of the market based on the equipment have also been provided in the report. This includes storage equipment and transportation equipment.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cold Chain Transport Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Storage, Transportation, Monitoring Components |

| Applications Covered | Fruits and Vegetables, Fish, Meat, and Seafood, Dairy and Frozen Desserts, Bakery and Confectionery, Processed Food, Pharmaceuticals, Others |

| Equipments Covered | Storage Equipment, Transportation Equipment |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cold chain transport market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cold chain transport market on the basis of type?

- What is the breakup of the Australia cold chain transport market on the basis of application?

- What is the breakup of the Australia cold chain transport market on the basis of equipment?

- What is the breakup of the Australia cold chain transport market on the basis of region?

- What are the various stages in the value chain of the Australia cold chain transport market?

- What are the key driving factors and challenges in the Australia cold chain transport?

- What is the structure of the Australia cold chain transport market and who are the key players?

- What is the degree of competition in the Australia cold chain transport market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cold chain transport market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cold chain transport market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cold chain transport industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)