Australia Cold Chain Warehousing Market Size, Share, Trends and Forecast by Type of Storage, Temperature Range, Ownership, End Use Industry, and Region, 2025-2033

Australia Cold Chain Warehousing Market Overview:

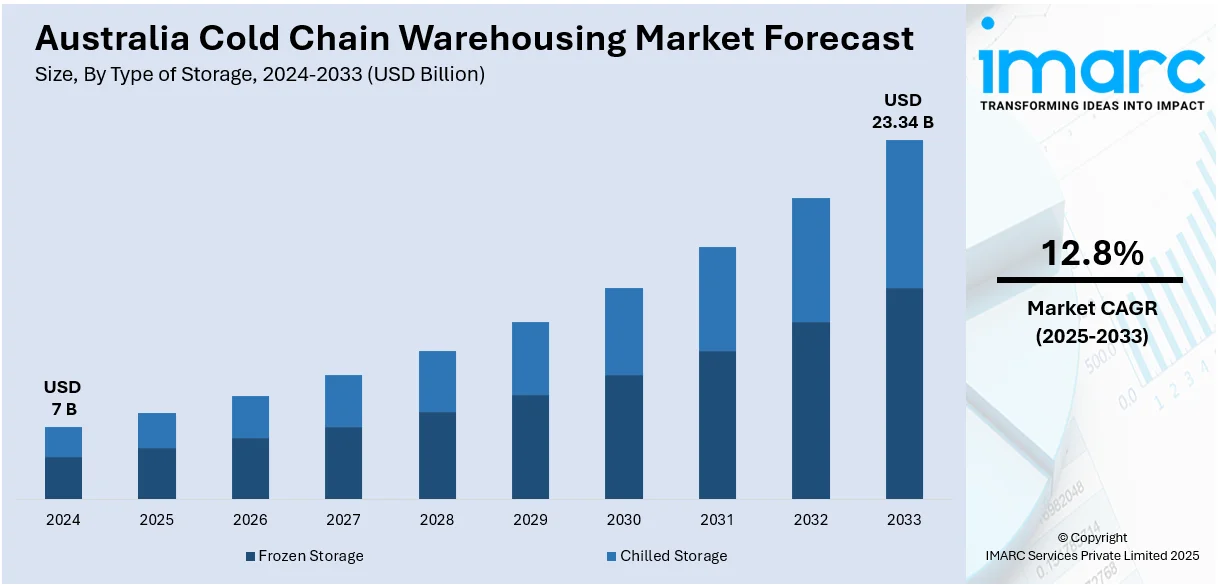

The Australia cold chain warehousing market size reached USD 7 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 23.34 Billion by 2033, exhibiting a growth rate (CAGR) of 12.8% during 2025-2033. Growing demand for perishable food products, increased e-commerce, rising consumer preferences for fresh and frozen goods, stricter food safety regulations, and technological advancements in temperature-controlled logistics and warehouse management systems are some of the factors contributing to Australia cold chain warehousing market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 7 Billion |

| Market Forecast in 2033 | USD 23.34 Billion |

| Market Growth Rate 2025-2033 | 12.8% |

Australia Cold Chain Warehousing Market Trends:

Growth in Cold Chain Warehousing Capacity

The cold chain warehousing industry in Australia is growing rapidly, owing to increased demand for refrigerated storage solutions. The growing requirement to handle temperature-sensitive products, such as perishable commodities and medicines, is driving the industry to expand its capacity. With the advent of e-commerce and a rising desire for frozen and chilled items, the need for efficient and dependable cold storage facilities is expected to expand. Businesses are investing in cutting-edge warehouses outfitted with sophisticated technology such as computerized inventory systems and high-capacity racking. This growth is critical for maintaining supply chain stability and catering to businesses that require specialized storage and handling. The cold chain sector is becoming increasingly important in ensuring product integrity and safety, especially as customer demands for quality and freshness grow. These factors are intensifying the Australia cold chain warehousing market growth. For example, as per industry reports, in 2024, Australia's refrigerated warehouse capacity was approximately 10.2 Million Cubic Meters. It is projected that the country will expand its refrigerated warehouse space to around 0.6 Cubic Meters per resident in the following years.

To get more information on this market, Request Sample

Growth in Demand for Cold Chain Warehousing

Australia's food retail sector is expanding rapidly, with consumer spending continuing to climb. As the demand for fresh, frozen, and chilled items grows, the requirement for dependable cold chain warehousing solutions becomes more pressing. The food retail business, with its expected rise in spending, is driving the construction of refrigerated storage capacity to ensure the safe handling and preservation of temperature-sensitive commodities. As food expenditure grows, merchants and distributors are concentrating on developing modern cold storage facilities with automated systems, improved inventory management, and expanded storage capacity. This change focuses not only on fulfilling rising demand, but also on maintaining product quality, safety, and freshness across the supply chain. The continued increase in food retail spending is contributing to the construction of infrastructure capable of handling larger volumes of perishable commodities. Cold chain solutions are becoming increasingly important in maintaining product integrity, improving delivery speed, and reducing waste, particularly as customer tastes shift toward higher-quality, fresher food alternatives. This changing market scenario is establishing cold chain storage as a critical driver in Australia's transportation and retail sectors. For instance, in 2023, Australia's food retail expenditure totaled around AUD 170 Billion, and it is forecasted to exceed AUD 200 Billion by 2028.

Australia Cold Chain Warehousing Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on type of storage, temperature range, ownership, and end use industry.

Type of Storage Insights:

- Frozen Storage

- Chilled Storage

The report has provided a detailed breakup and analysis of the market based on the type of storage. This includes frozen storage and chilled storage.

Temperature Range Insights:

- Ambient

- Refrigerated

- Frozen

- Deep-Frozen

A detailed breakup and analysis of the market based on the temperature range have also been provided in the report. This includes ambient, refrigerated, frozen, and deep-frozen.

Ownership Insights:

- Private Warehouses

- Public Warehouses

- Bonded Warehouses

The report has provided a detailed breakup and analysis of the market based on the ownership. This includes private warehouses, public warehouses, and bonded warehouses.

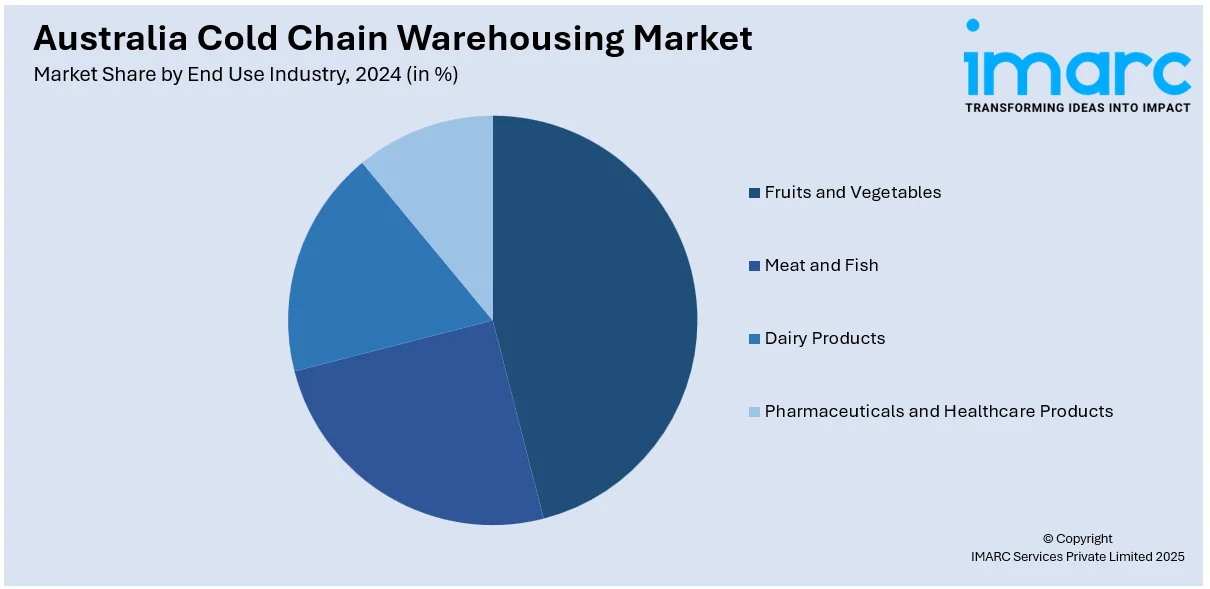

End Use Industry Insights:

- Fruits and Vegetables

- Meat and Fish

- Dairy Products

- Pharmaceuticals and Healthcare Products

A detailed breakup and analysis of the market based on the end use industry have also been provided in the report. This includes fruits and vegetables, meat and fish, dairy products, and pharmaceuticals and healthcare products.

Regional Insights:

- Australia Capital Territory and New South Wales

- Victoria and Tasmania

- Queensland

- Northern Territory and Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory and New South Wales, Victoria and Tasmania, Queensland, Northern Territory and Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cold Chain Warehousing Market News:

- In March 2025, Tasman Logistics Services expanded its cold storage capacity with a new facility in Morningside, Queensland, tripling storage to 7,400 frozen pallets and 1,300 chilled pallets. Its cold chain solutions division provides advanced temperature-sensitive product handling, including packaging, transportation, and certification services. The facility includes four loading docks and cutting-edge racking systems, enhancing efficiency for high-volume clients with specialized needs. It is licensed for imports, with export and Halal approvals pending.

Australia Cold Chain Warehousing Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types of Storage Covered | Frozen Storage, Chilled Storage |

| Temperature Ranges Covered | Ambient, Refrigerated, Frozen, Deep-Frozen |

| Ownerships Covered | Private Warehouses, Public Warehouses, Bonded Warehouses |

| End Use Industries Covered | Fruits and Vegetables, Meat and Fish, Dairy Products, Pharmaceuticals and Healthcare Products |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cold chain warehousing market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cold chain warehousing market on the basis of type of storage?

- What is the breakup of the Australia cold chain warehousing market on the basis of temperature range?

- What is the breakup of the Australia cold chain warehousing market on the basis of ownership?

- What is the breakup of the Australia cold chain warehousing market on the basis of end use industry?

- What is the breakup of the Australia cold chain warehousing market on the basis of region?

- What are the various stages in the value chain of the Australia cold chain warehousing market?

- What are the key driving factors and challenges in the Australia cold chain warehousing market?

- What is the structure of the Australia cold chain warehousing market and who are the key players?

- What is the degree of competition in the Australia cold chain warehousing market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cold chain warehousing market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cold chain warehousing market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cold chain warehousing industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)