Australia Cold Pressed Juices Market Size, Share, Trends and Forecast by Category, Distribution Channel, and Region, 2025-2033

Australia Cold Pressed Juices Market Overview:

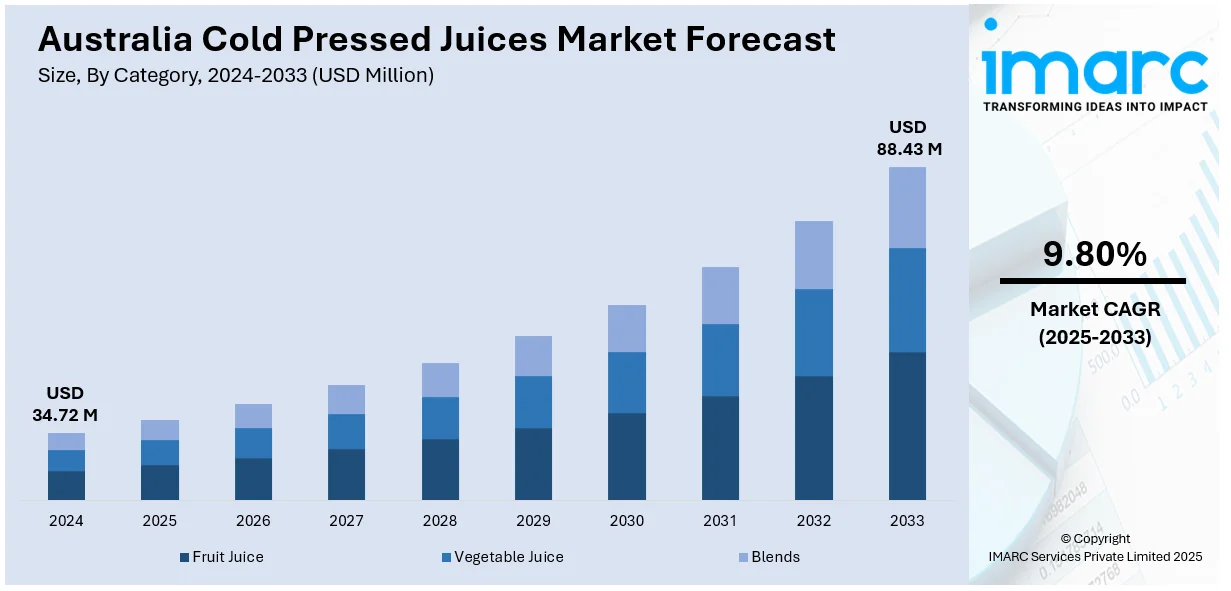

The Australia cold pressed juices market size reached USD 34.72 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 88.43 Million by 2033, exhibiting a growth rate (CAGR) of 9.80% during 2025-2033. The market includes the rising health consciousness, demand for natural and organic beverages, and the popularity of functional nutrition. Consumers are seeking clean-label drinks with no additives or preservatives, fueling interest in nutrient-rich cold-pressed options. Lifestyle trends like plant-based diets and detox routines also contribute to Australia cold pressed juices market share. Additionally, expanding availability through supermarkets, cafes, and online channels makes these juices more accessible, while innovative flavors and eco-friendly packaging enhance consumer appeal and brand differentiation.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 34.72 Million |

| Market Forecast in 2033 | USD 88.43 Million |

| Market Growth Rate 2025-2033 | 9.80% |

Australia Cold Pressed Juices Market Trends:

Health-Driven Demand for Functional and Organic Juices

Australian consumers are more concerned with wellness than ever before, pushing demand for cold-pressed juices to provide benefits beyond mere refreshment. Strong demand exists for juices that deliver immunity, digestion, and detox benefits, with particular ingredients such as ginger, turmeric, beetroot, and green leafy greens becoming popular. Organic and chemical-free products are particularly in vogue, evidence of a larger movement towards clean eating and natural living. Labels that emphasize "no added sugar," "non-genetically modified organisms (GMO)," and "preservative-free" attract health-oriented consumers. Most consumers today carefully examine ingredient lists for transparency and minimal processing. The trend is also associated with increased interest in plant-based diets and whole life living. Authenticity-led brands with wellness-oriented messages attract loyal consumers who value quality over quantity. As individuals become increasingly cognizant of what they eat, differentiation based on health is one of the primary drivers for brand selection.

To get more information on this market, Request Sample

Innovation in Flavors and Sustainable Packaging

Innovative flavor and devotion to sustainability are rebranding cold-pressed juice in Australia. Companies are expanding beyond generic apple or orange to more daring pairings like pineapple-mint, berry-beet, or citrus with cayenne. These creative blends appeal to customers wanting more variety and strong, natural taste. And at the same time, sustainability is no longer a choice—it's mandatory. Most producers are shifting towards environmentally friendly packaging such as recyclable bottles and biodegradable labels. There's also increased narrative around sourcing practices, with brands celebrating locally sourced produce and sustainable farming. This positioning of environmental values enhances consumer trust and brand identity. The two-pronged emphasis on flavor innovation and planet-friendly packaging keeps the product exciting but also speaks to the lifestyle choices of contemporary consumers. As customers seek to communicate their values through their buying habits, these aspects are allowing businesses to differentiate themselves in a competitive environment.

Expansion of Distribution Channels and E-Commerce Growth

Cold-pressed juice in Australia is no longer just a health store item it’s now found in a wide variety of places, reflecting its move into the mainstream. Beyond supermarkets and cafes, consumers are discovering these juices in vending machines, fitness centers, and airport kiosks. At the same time, e-commerce has become a key Australia cold pressed juices market growth area, with more brands offering direct-to-door delivery services. This shift allows consumers to access a wider selection of juice varieties and niche brands that may not be stocked locally. Subscription models and online bundles are also growing in popularity, catering to convenience and personalization. Social media and influencer marketing are playing a major role in brand visibility online. Altogether, this expanded reach is making it easier for busy, health-conscious Australians to integrate cold-pressed juices into their routines, whether they’re shopping in-store or browsing from their phones.

Australia Cold Pressed Juices Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country and regional levels for 2025-2033. Our report has categorized the market based on category and distribution channel.

Category Insights:

- Fruit Juice

- Vegetable Juice

- Blends

The report has provided a detailed breakup and analysis of the market based on the category. This includes fruit juice, vegetable juice, and blends.

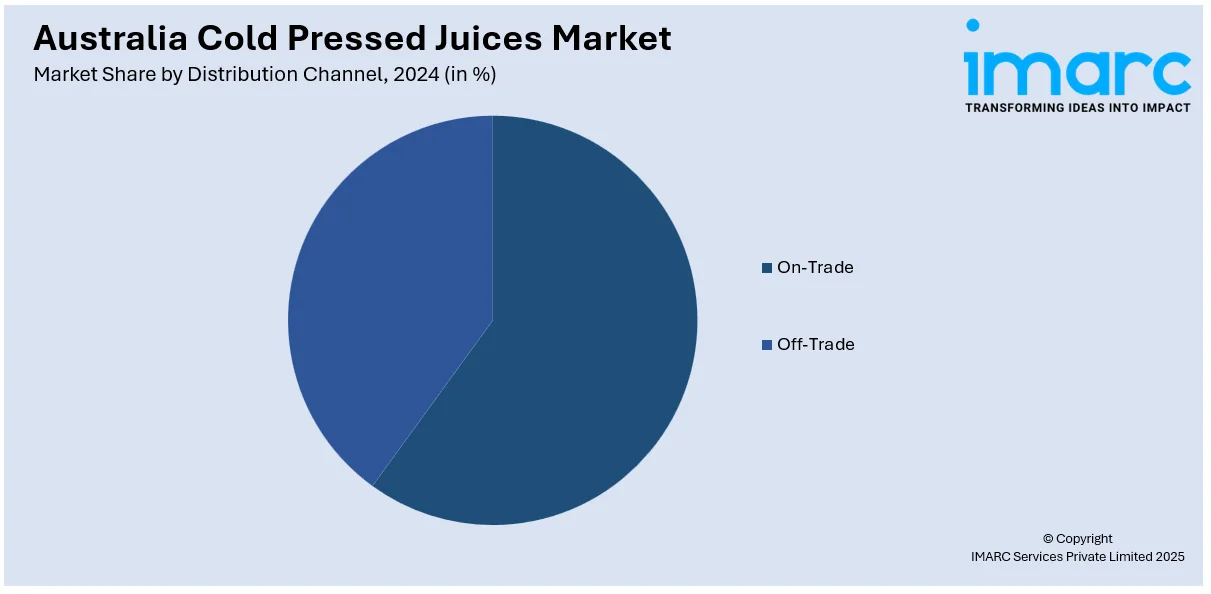

Distribution Channel Insights:

- On-Trade

- Off-Trade

- Supermarkets/Hypermarkets

- Convenience/Grocery Stores

- Online Stores

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes on-trade, off-trade (supermarkets/hypermarkets, convenience/grocery stores, online stores, and others).

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Cold Pressed Juices Market News:

- In October 2024, SPC Global is set to merge with The Original Juice Company and Nature One Dairy, forming a major Australian-owned food and beverage group. The merger, pending shareholder approval, combines SPC’s packaged foods with OJC’s premium juices and Nature One Dairy’s nutritional products. Led by Robert Iervasi, the new entity aims to boost domestic and global growth, enhance distribution, and leverage synergies across its three core divisions.

Australia Cold Pressed Juices Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Categories Covered | Fruit Juice, Vegetable Juice, Blends |

| Distribution Channels Covered |

|

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia cold pressed juices market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia cold pressed juices market on the basis of category?

- What is the breakup of the Australia cold pressed juices market on the basis of distribution channel?

- What is the breakup of the Australia cold pressed juices market on the basis of region?

- What are the various stages in the value chain of the Australia cold pressed juices market?

- What are the key driving factors and challenges in the Australia cold pressed juices market?

- What is the structure of the Australia cold pressed juices market and who are the key players?

- What is the degree of competition in the Australia cold pressed juices market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia cold pressed juices market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia cold pressed juices market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia cold pressed juices industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)