Australia Command and Control System Market Size, Share, Trends and Forecast by Platform, Solution, Application, and Region, 2025-2033

Australia Command and Control System Market Overview:

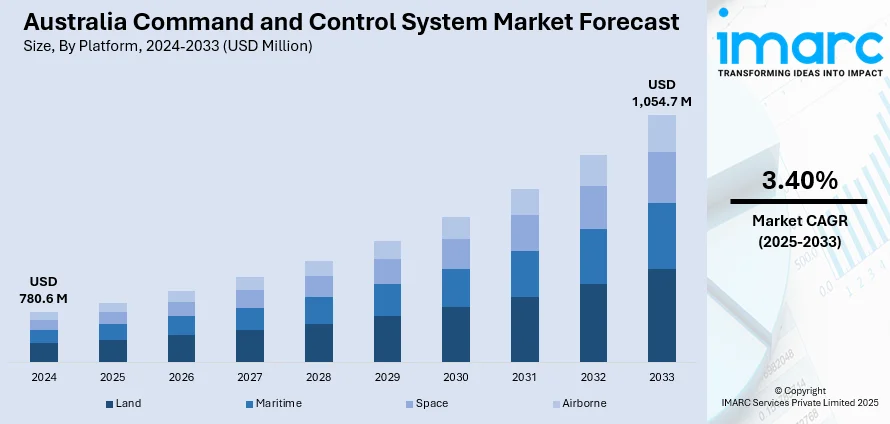

The Australia command and control system market size reached USD 780.6 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 1,054.7 Million by 2033, exhibiting a growth rate (CAGR) of 3.40% during 2025-2033. The market is driven by rising defense modernization efforts, increasing cybersecurity threats, and the need for real-time situational awareness. Government investments in smart city initiatives, disaster response technologies, and AI-driven analytics further propel demand. The shift toward cloud-based solutions and interoperability requirements also accelerates market growth, supported by advancements in IoT and autonomous systems.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 780.6 Million |

| Market Forecast in 2033 | USD 1,054.7 Million |

| Market Growth Rate 2025-2033 | 3.40% |

Australia Command and Control System Market Trends:

Increasing Adoption of Cloud-Based Command and Control Systems

The significant shift toward cloud-based solutions, driven by the need for scalability, real-time data access, and cost efficiency is favoring the Australia command and control system market growth. Cloud platforms are increasingly being used by government entities, military, and emergency response teams to enhance situational awareness and support decision-making. These cloud platforms enable seamless data integration from disparate systems, streamlining collaboration across a wide spectrum of operations critical to government missions, ranging from disaster management to national security initiatives. In addition, improved cybersecurity protocols are dispelling fears of data breaches, making the adoption of cloud solutions all the more viable. Australia witnessed 47 million data breaches in 2024, equating to one breach every second, ranking it as the 11th most affected country globally. Thus, the breach density was 1,785 incidents per 1,000 residents. Thus, this is also increasing the need for command and control systems to protect sensitive financial information. The Australian government’s push for digital transformation is further expanding the Australia command and control system market share, with investments in secure cloud infrastructure. As a result, vendors are focusing on developing AI-powered analytics and IoT-enabled cloud platforms to meet the growing demand for agile and interoperable command and control systems.

To get more information on this market, Request Sample

Integration of AI and Machine Learning for Enhanced Decision-Making

Artificial intelligence (AI) and machine learning (ML) are transforming the market by enabling predictive analytics and automated decision-making. A research report from the IMARC Group indicates that the artificial intelligence market in Australia was valued at USD 2,072.7 Million in 2024. It is projected to grow to USD 7,761.0 Million by 2033, reflecting a compound annual growth rate (CAGR) of 15.17% from 2025 to 2033. Defense and public safety organizations are employing artificial intelligence to process vast amounts of data captured from sensors, drones, and surveillance systems in real time. These innovations facilitate risk monitoring, better resource allocation, and mission planning, which in turn reduce human error and response time. For instance, artificial intelligence-based algorithms can opt for forecasting potential information security breaches or natural disasters, which can be handled proactively. As the Australian Defence Force Airlines trains up until 2023, the defense force intends to push forward the advancement of air pressure and the integration of AI, thereby collaborating with many related technology companies in order to design the newest command systems. The growth of urban security and traffic management, as well as the emergence of smart cities and IoT networks, are enhancing demands for AI-driven control centers. The transition to autonomous and intelligent command systems is marked by an increase in the market's investment in artificial intelligence technologies as they become more powerful. Therefore, this is creating a positive Australia command and control system market outlook.

Australia Command and Control System Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on platform, solution, and application.

Platform Insights:

- Land

- Maritime

- Space

- Airborne

The report has provided a detailed breakup and analysis of the market based on the platform. This includes land, maritime, space, and airborne.

Solution Insights:

- Hardware

- Software

- Services

A detailed breakup and analysis of the market based on the solution have also been provided in the report. This includes hardware, software, and services.

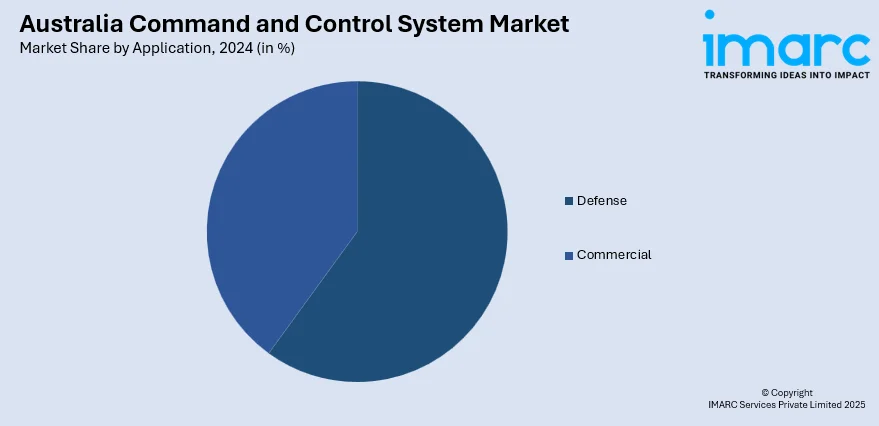

Application Insights:

- Defense

- Commercial

The report has provided a detailed breakup and analysis of the market based on the application. This includes defense and commercial.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Command and Control System Market News:

- March 14, 2025: Rheinmetall Defence Australia commenced the assembly of twelve MASS anti-ship missile defense systems under a €125 Million (USD 136 Million) contract, with the option to eventually cover the entire Australian naval fleet, worth AUD 1 Billion. MASS, an advanced subsystem of the MINIFRIGATE, is a network of connected command and control technologies that allows the MINIFRIGATE to release decoys autonomously to counter guided missile threats. The initiative is expected to reach full operational capability by 2027 and has already generated over 30 new jobs at the MILVEHCOE facility in Brisbane.

- February 18, 2025: Hanwha Systems is aiming to export its advanced C4I (Command, Control, Communications, Computers, and Intelligence) systems to the Australian military as part of its global defense expansion strategy. The company is leveraging its experience in South Korea’s defense infrastructure to offer tailored solutions for Australia’s evolving security needs. This initiative is part of Hanwha's broader effort to strengthen its presence in international markets and forge strategic defense partnerships.

Australia Command and Control System Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report | Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Platforms Covered | Land, Maritime, Space, Airborne |

| Solutions Covered | Hardware, Software, Services |

| Applications Covered | Defense, Commercial |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia command and control system market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia command and control system market on the basis of platform?

- What is the breakup of the Australia command and control system market on the basis of solution?

- What is the breakup of the Australia command and control system market on the basis of application?

- What is the breakup of the Australia command and control system market on the basis of region?

- What are the various stages in the value chain of the Australia command and control system market?

- What are the key driving factors and challenges in the Australia command and control system market?

- What is the structure of the Australia command and control system market and who are the key players?

- What is the degree of competition in the Australia command and control system market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia command and control system market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia command and control system market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia command and control system industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)