Australia Commercial Display Market Size, Share, Trends and Forecast by Product Type, Technology, Component, Panel Type, Size, Application, and Region, 2025-2033

Australia Commercial Display Market Overview:

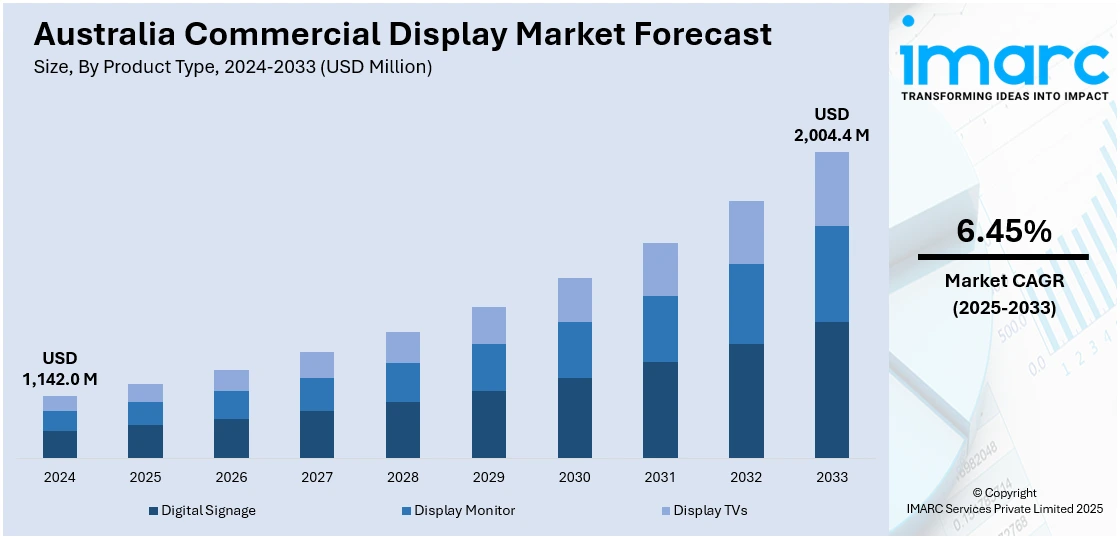

The Australia commercial display market size reached USD 1,142.0 Million in 2024. Looking forward, IMARC Group expects the market to reach USD 2,004.4 Million by 2033, exhibiting a growth rate (CAGR) of 6.45% during 2025-2033. The market is driven by increasing demand for interactive touchscreens in retail and education, alongside the shift toward energy-efficient and sustainable display solutions. Digital transformation, enhanced customer engagement, and stricter environmental regulations are expanding the Australia commercial display market share, with businesses prioritizing high-performance, eco-friendly, and long-lasting display technologies.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 1,142.0 Million |

| Market Forecast in 2033 | USD 2,004.4 Million |

| Market Growth Rate 2025-2033 | 6.45% |

Australia Commercial Display Market Trends:

Growth in Outdoor and High-Brightness Displays for Advertising

The increasing demand for outdoor and high-brightness digital signage is majorly driving the Australia commercial display market growth. This can be supported by the need for weather-resistant and sunlight-readable screens in advertising and public information displays. Businesses in transportation hubs, retail outlets, and stadiums are investing in rugged, high-nit displays to ensure visibility in direct sunlight and harsh weather conditions. These displays are also being used for dynamic advertising, real-time information updates, and wayfinding solutions in smart cities. A research report from the IMARC Group indicates that the advertising market in Australia was valued at USD 20.39 Billion in 2023. It is projected to grow to USD 27.96 Billion by 2032, reflecting a compound annual growth rate (CAGR) of 3.10% from 2024 to 2032. Recent advances in LED-backlit LCD and direct-view LED features have also improved durability and energy efficiency, making them qualified for outdoor use 24/7. Additionally, the advent of IoT and cloud content management systems also allows for remote monitoring and real-time content changes. With an explosion in digital out-of-home (DOOH) advertising, brands are turning to data-led and interactive outdoor displays to increase audience engagement. This trend is anticipated to grow further with the rise of urbanization and smart infrastructure initiatives throughout Australia.

To get more information on this market, Request Sample

Shift Toward Energy-Efficient and Sustainable Display Solutions

Sustainability is becoming a key driver in the market, with businesses prioritizing energy-efficient and eco-friendly display solutions. Therefore, this is creating a positive Australia commercial display market outlook. As organizations align with environmental regulations and corporate sustainability goals, demand for low-power LED and OLED displays is rising. These technologies reduce energy consumption and offer superior brightness and contrast, making them ideal for digital signage and outdoor advertising. For instance, micro-LED display technology continues to progress rapidly, achieving pixel densities in the 30,000 PPI range and upwards of 1,000,000 nits in brightness. It is highly efficient and durable, ideal for use in a deeper purpose. Micro-LEDs are predicted to outperform traditional LCD and OLED for both performance and longevity, placing them in a prime position to revolutionize Australia's commercial display market in areas such as high-end signage and immersive retail environments. Concurrently, innovations such as 5100 PPI arrays and 4μm chip sizes show substantial commercial potential. Moreover, manufacturers are incorporating recyclable materials and modular designs to minimize e-waste. In addition, smart displays featuring ambient light sensors and automatic brightness adjustment also help save energy. Sectors, including hospitality, healthcare, and transport, are increasingly selecting displays that provide longer life cycles and smaller carbon footprints. This trend of embracing sustainability is part of a broader industry shift toward green technology, with energy efficiency and environmental stewardship playing key roles in purchasing decisions. As a result, suppliers are developing sustainable display solutions that help them retain peak performance and visual quality.

Australia Commercial Display Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the country level for 2025-2033. Our report has categorized the market based on product type, technology, component, panel type, size, and application.

Product Type Insights:

- Digital Signage

- Display Monitor

- Display TVs

The report has provided a detailed breakup and analysis of the market based on the product type. This includes digital signage, display monitor, and display TVs.

Technology Insights:

- LCD

- LED

- Others

A detailed breakup and analysis of the market based on the technology have also been provided in the report. This includes LCD, LED, and others.

Component Insights:

- Hardware

- Software

- Services

The report has provided a detailed breakup and analysis of the market based on the component. This includes hardware, software, and services.

Panel Type Insights:

- Flat Panel

- Curved Panel

- Others

A detailed breakup and analysis of the market based on the panel type have also been provided in the report. This includes flat panel, curved panel, and others.

Size Insights:

- Below 32 inches

- 32 to 52 inches

- 52 to 75 inches

- Above 75 inches

The report has provided a detailed breakup and analysis of the market based on the size. This includes below 32 inches, 32 to 52 inches, 52 to 75 inches, and above 75 inches.

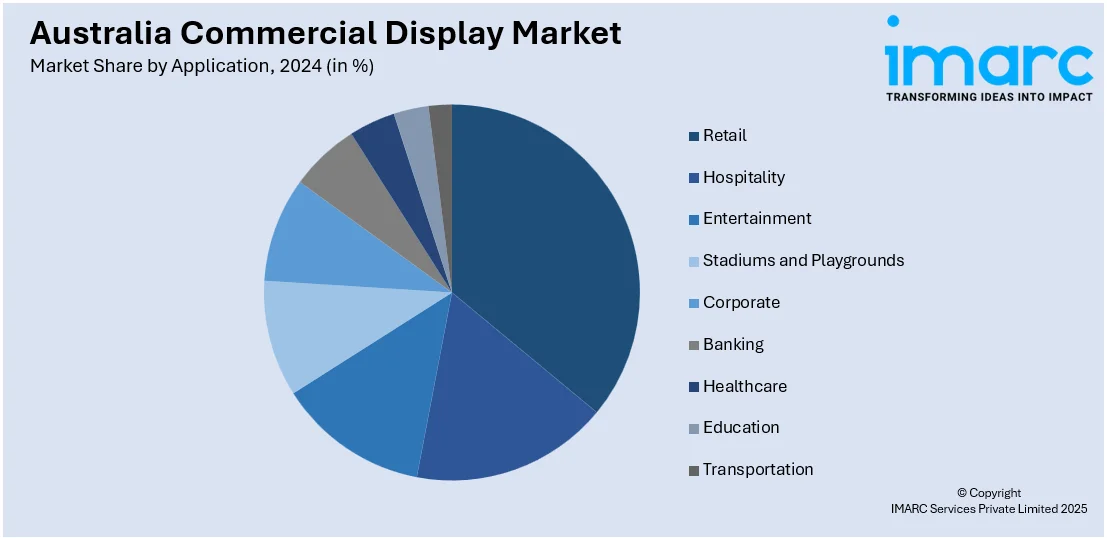

Application Insights:

- Retail

- Hospitality

- Entertainment

- Stadiums and Playgrounds

- Corporate

- Banking

- Healthcare

- Education

- Transportation

A detailed breakup and analysis of the market based on the application have also been provided in the report. This includes retail, hospitality, entertainment, stadiums and playgrounds, corporate, banking, healthcare, education, and transportation.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Display Market News:

- February 24, 2025: Entain Venues launched a big-screen commercial-grade LED solution across Australia and New Zealand, catering directly to sports-focused venues with high-end display options, including indoor, outdoor, curved, transparent, and gaming screens. The move aims to leverage using global best practices across local sports bars and venues and is part of the company's strategy to take advantage of the growing Australian commercial display market, supported by account managers with an average of 15+ years of experience in the sector.

- December 10, 2024: oOh! media launched a classic 100% digital Out of Home network comprising 230 portrait screens at 21 of Queensland's leading Retail First shopping centers, including standout locations such as Australia Fair, Toowong Village, and Mt Ommaney Centre. The initiative is set to reach over 83 million annual shoppers within a USD 2 Billion retail portfolio of more than 1,730 retailers. This announcement solidifies oOh! ’s footprint in Australia’s commercial display space, enhancing engagement in crowded retail areas.

Australia Commercial Display Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Million USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Product Types Covered | Digital Signage, Display Monitor, Display TVs |

| Technologies Covered | LCD, LED, Others |

| Components Covered | Hardware, Software, Services |

| Panel Types Covered | Flat Panel, Curved Panel, Others |

| Sizes Covered | Below 32 inches, 32 to 52 inches, 52 to 75 inches, Above 75 inches |

| Applications Covered | Retail, Hospitality, Entertainment, Stadiums and Playgrounds, Corporate, Banking, Healthcare, Education, Transportation |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Questions Answered in This Report:

- How has the Australia commercial display market performed so far and how will it perform in the coming years?

- What is the breakup of the Australia commercial display market on the basis of product type?

- What is the breakup of the Australia commercial display market on the basis of technology?

- What is the breakup of the Australia commercial display market on the basis of component?

- What is the breakup of the Australia commercial display market on the basis of panel type?

- What is the breakup of the Australia commercial display market on the basis of size?

- What is the breakup of the Australia commercial display market on the basis of application?

- What is the breakup of the Australia commercial display market on the basis of region?

- What are the various stages in the value chain of the Australia commercial display market?

- What are the key driving factors and challenges in the Australia commercial display market?

- What is the structure of the Australia commercial display market and who are the key players?

- What is the degree of competition in the Australia commercial display market?

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial display market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial display market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial display industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)