Australia Commercial Insurance Market Size, Share, Trends and Forecast by Type, Enterprise Size, Distribution Channel, Industry Vertical, and Region, 2025-2033

Australia Commercial Insurance Market Size and Share:

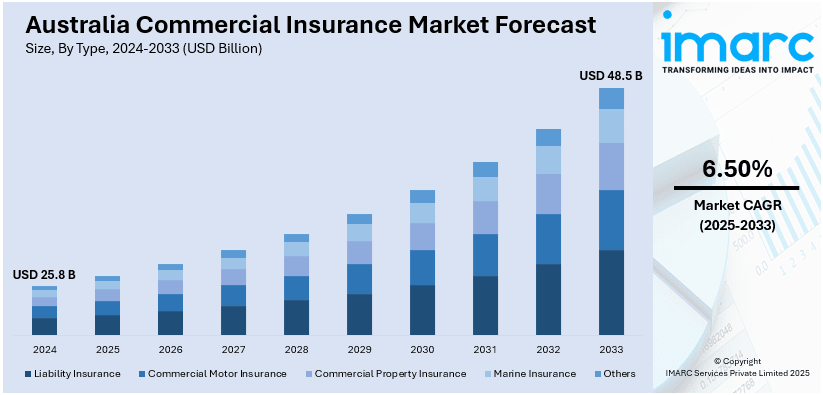

The Australia commercial insurance market size reached USD 25.8 Billion in 2024. Looking forward, IMARC Group expects the market to reach USD 48.5 Billion by 2033, exhibiting a growth rate (CAGR) of 6.50% during 2025-2033. The market is experiencing steady growth, driven by rising demand for tailored policies, regulatory compliance needs, and increasing focus on risk management across industries. Expanding SME coverage, climate risk preparedness, and digital transformation in underwriting and claims are further shaping the sector’s evolution, strengthening Australia commercial insurance market share.

|

Report Attribute

|

Key Statistics

|

|---|---|

|

Base Year

|

2024 |

|

Forecast Years

|

2025-2033

|

|

Historical Years

|

2019-2024

|

| Market Size in 2024 | USD 25.8 Billion |

| Market Forecast in 2033 | USD 48.5 Billion |

| Market Growth Rate 2025-2033 | 6.50% |

Key Trends of Australia Commercial Insurance Market:

Increased Demand for Cyber Insurance and Digital Risk Coverage

One of the most remarkable trends shifting the Australian commercial insurance arena has been an insatiable appetite for cyber insurance and digital risk coverage. With digital transformation occurring at an accelerated rate, Australian businesses are adopting cloud-based technologies in tandem with growing exposure to cyber threats like data breaches, ransom attacks, and business email compromise. Cyber incidents across high-profile sectors have spread awareness of digital vulnerabilities, with organizations of all sizes looking for solutions that back their financial loss, reputational harm, and regulatory penalty claims. Insurers have responded to this incident by rolling the development of comprehensively designed cyber insurance policies that provide higher levels of incident response coverage, covering legal costs, data recovery, and business interruption. For instance, in May 2024, Coalition entered Australia’s excess cyber insurance market, allowing brokers to offer up to AUD 20 million in additional coverage above existing cyber insurance policies. According to the Australia commercial insurance market analysis, the evolving regulatory landscape, particularly the enforcement of the Australian Privacy Act and mandatory data breach notification requirements, has further underscored the need for proactive cyber risk management. As the frequency and sophistication of cyber attacks increase, cyber insurance is becoming a critical component of enterprise risk management strategies in Australia. This trend is expected to continue driving innovation in underwriting models, risk assessment tools, and premium pricing structures within the commercial insurance sector.

To get more information on this market, Request Sample

Market Hardening and Rising Premiums Across Key Sectors

The Australian commercial insurance market is currently experiencing a phase of market hardening, characterized by rising premiums, reduced underwriting capacity, and stricter policy terms across several key sectors. This trend is largely driven by a combination of increased claims frequency and severity, climate-related risks, and global reinsurance market pressures. For instance, in 2024, for the fifth consecutive year, insured losses from natural catastrophes surpassed US$100 billion, as highlighted in the latest Allianz Risk Barometer report, underscoring increasing global climate-related risks. Industries such as construction, professional services, and property are particularly impacted, as insurers reassess risk appetites and tighten underwriting standards in response to mounting loss ratios and regulatory challenges. The growing incidence of natural catastrophes, including bushfires, floods, and storms, has also placed upward pressure on property insurance premiums and coverage limitations. Additionally, economic uncertainty and inflation have contributed to higher replacement costs and liability exposures, further influencing premium adjustments. As a result, businesses are facing increased scrutiny during the renewal process and are often required to provide more detailed risk information to secure coverage. This market hardening is prompting commercial clients to explore alternative risk transfer strategies, including self-insurance, captives, and greater reliance on risk mitigation practices. While challenging for insureds, this trend is also creating opportunities for insurers and brokers to offer value-added advisory services and tailored solutions that address emerging risks in a dynamic operating environment.

Growth Drivers of Australia Commercial Insurance Market:

Regulatory Compliance and Evolving Standards

Stricter regulatory frameworks and evolving compliance standards are driving demand for commercial insurance in Australia. Businesses across industries face complex obligations related to workplace safety, financial reporting, and liability management. Insurers offering policies that align with these legal requirements help companies mitigate risks while ensuring adherence to regulations. This trend is particularly significant for sectors such as construction, healthcare, and finance, where penalties for non-compliance can be severe. By providing tailored coverage that meets industry-specific standards, insurers not only safeguard businesses from legal exposure but also build long-term trust. As compliance rules continue to tighten, the necessity of adequate insurance coverage becomes a crucial driver of the Australia commercial insurance market growth.

SME Expansion and Tailored Insurance Solutions

Australia’s growing small and medium enterprise (SME) sector is creating substantial opportunities for commercial insurers. SMEs often require flexible, cost-effective policies to address risks such as liability, property damage, and employee protection. Unlike larger corporations, smaller businesses may lack in-house risk management expertise, increasing reliance on insurers for guidance and customized coverage. Insurers developing simplified, affordable products tailored to SMEs’ unique needs can tap into this expanding market segment. Demand is particularly strong in industries like retail, logistics, and professional services, where exposure to operational risks is high. By offering modular policies, digital onboarding, and advisory services, insurers can strengthen relationships with SMEs, fueling sustainable growth within Australia’s commercial insurance market.

Climate Risks and Catastrophe Preparedness

Increasing exposure to climate risks and natural disasters such as bushfires, floods, and storms is a major growth driver for the Australia commercial insurance market demand. Businesses are seeking comprehensive policies to protect assets, supply chains, and operations from climate-related disruptions. Insurers addressing this demand with innovative solutions, such as parametric insurance or climate-risk modeling, gain a competitive advantage. Government emphasis on disaster resilience further supports adoption of such products. For industries like agriculture, construction, and energy, climate coverage is not optional but a necessity. As extreme weather events become more frequent and severe, businesses will increasingly prioritize robust insurance protection, making climate risk coverage a key catalyst for market growth in Australia.

Australia Commercial Insurance Market Segmentation:

IMARC Group provides an analysis of the key trends in each segment of the market, along with forecasts at the region level for 2025-2033. Our report has categorized the market based on type, enterprise size, distribution channel, and industry vertical.

Type Insights:

- Liability Insurance

- Commercial Motor Insurance

- Commercial Property Insurance

- Marine Insurance

- Others

The report has provided a detailed breakup and analysis of the market based on the type. This includes liability insurance, commercial motor insurance, commercial property insurance, marine insurance, and others.

Enterprise Size Insights:

- Large Enterprises

- Small and Medium-sized Enterprises

A detailed breakup and analysis of the market based on the enterprise size have also been provided in the report. This includes large enterprises and small and medium-sized enterprises.

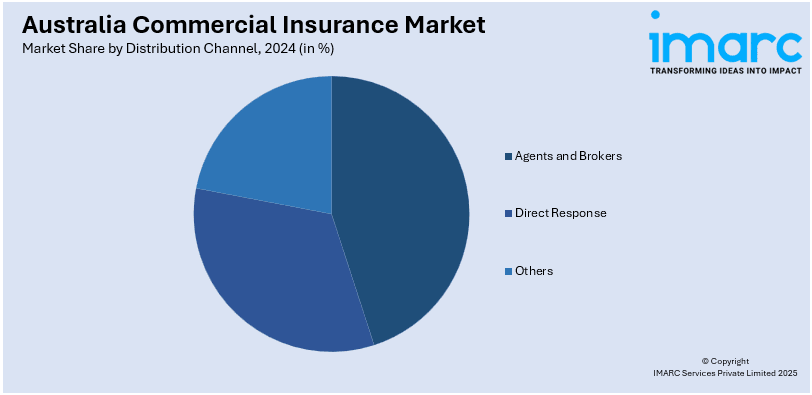

Distribution Channel Insights:

- Agents and Brokers

- Direct Response

- Others

A detailed breakup and analysis of the market based on the distribution channel have also been provided in the report. This includes agents and brokers, direct response, and others.

Industry Vertical Insights:

- Transportation and Logistics

- Manufacturing

- Construction

- IT and Telecom

- Healthcare

- Energy and Utilities

- Others

A detailed breakup and analysis of the market based on the industry vertical have also been provided in the report. This includes transportation and logistics, manufacturing, construction, it and telecom, healthcare, energy and utilities, and others.

Regional Insights:

- Australia Capital Territory & New South Wales

- Victoria & Tasmania

- Queensland

- Northern Territory & Southern Australia

- Western Australia

The report has also provided a comprehensive analysis of all the major regional markets, which include Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, and Western Australia.

Competitive Landscape:

The market research report has also provided a comprehensive analysis of the competitive landscape. Competitive analysis such as market structure, key player positioning, top winning strategies, competitive dashboard, and company evaluation quadrant has been covered in the report. Also, detailed profiles of all major companies have been provided.

Australia Commercial Insurance Market News:

- In February 2025, Upcover, Australia’s only digital-first commercial insurance broking company, raised USD 19 Million in Series A funding to grow its share in the USD 20 billion market. Despite a challenging startup climate, it doubled revenue in 2024 and will launch new digital products in 2025, expanding its services to 60,000+ businesses.

Australia Commercial Insurance Market Report Coverage:

| Report Features | Details |

|---|---|

| Base Year of the Analysis | 2024 |

| Historical Period | 2019-2024 |

| Forecast Period | 2025-2033 |

| Units | Billion USD |

| Scope of the Report |

Exploration of Historical Trends and Market Outlook, Industry Catalysts and Challenges, Segment-Wise Historical and Future Market Assessment:

|

| Types Covered | Liability Insurance, Commercial Motor Insurance, Commercial Property Insurance, Marine Insurance, Others |

| Enterprise Sizes Covered | Large Enterprises, Small and Medium-sized Enterprises |

| Distribution Channels Covered | Agents and Brokers, Direct Response, Others |

| Industry Verticals Covered | Transportation and Logistics, Manufacturing, Construction, IT and Telecom, Healthcare, Energy and Utilities, Others |

| Regions Covered | Australia Capital Territory & New South Wales, Victoria & Tasmania, Queensland, Northern Territory & Southern Australia, Western Australia |

| Customization Scope | 10% Free Customization |

| Post-Sale Analyst Support | 10-12 Weeks |

| Delivery Format | PDF and Excel through Email (We can also provide the editable version of the report in PPT/Word format on special request) |

Key Benefits for Stakeholders:

- IMARC’s industry report offers a comprehensive quantitative analysis of various market segments, historical and current market trends, market forecasts, and dynamics of the Australia commercial insurance market from 2019-2033.

- The research report provides the latest information on the market drivers, challenges, and opportunities in the Australia commercial insurance market.

- Porter's five forces analysis assist stakeholders in assessing the impact of new entrants, competitive rivalry, supplier power, buyer power, and the threat of substitution. It helps stakeholders to analyze the level of competition within the Australia commercial insurance industry and its attractiveness.

- Competitive landscape allows stakeholders to understand their competitive environment and provides an insight into the current positions of key players in the market.

Key Questions Answered in This Report

The commercial insurance market in Australia was valued at USD 25.8 Billion in 2024.

The Australia commercial insurance market is projected to exhibit a CAGR of 6.50% during 2025-2033.

The Australia commercial insurance market is projected to reach a value of USD 48.5 Billion by 2033.

The Australia commercial insurance market is witnessing trends such as rising demand for cyber insurance due to digital threats, greater adoption of tailored policies for SMEs, and increased focus on risk management solutions. Sustainability-linked insurance and technology-driven underwriting are also shaping innovation and customer engagement in the sector.

The growth in the Australia commercial insurance market is driven by rising cyber risk awareness, expanding small and medium enterprise coverage needs, and stricter regulatory compliance requirements. Increasing demand for customized policies, coupled with digital transformation in underwriting and claims, further strengthens market expansion and insurer competitiveness.

Need more help?

- Speak to our experienced analysts for insights on the current market scenarios.

- Include additional segments and countries to customize the report as per your requirement.

- Gain an unparalleled competitive advantage in your domain by understanding how to utilize the report and positively impacting your operations and revenue.

- For further assistance, please connect with our analysts.

Request Customization

Request Customization

Speak to an Analyst

Speak to an Analyst

Request Brochure

Request Brochure

Inquire Before Buying

Inquire Before Buying

.webp)

.webp)